Wip In Balance Sheet - Wip is capitalized on the balance sheet, deferring expense recognition until the project is completed or until certain conditions are met. Work in progress is considered as a current asset on the balance sheet, predominantly because of the fact that they are expected to be converted to. Work in progress inventory can be found in the current assets section of the balance sheet, which reflects how inventory is expected to. Depending on the manufacturing process, the.

Depending on the manufacturing process, the. Work in progress is considered as a current asset on the balance sheet, predominantly because of the fact that they are expected to be converted to. Wip is capitalized on the balance sheet, deferring expense recognition until the project is completed or until certain conditions are met. Work in progress inventory can be found in the current assets section of the balance sheet, which reflects how inventory is expected to.

Work in progress inventory can be found in the current assets section of the balance sheet, which reflects how inventory is expected to. Work in progress is considered as a current asset on the balance sheet, predominantly because of the fact that they are expected to be converted to. Depending on the manufacturing process, the. Wip is capitalized on the balance sheet, deferring expense recognition until the project is completed or until certain conditions are met.

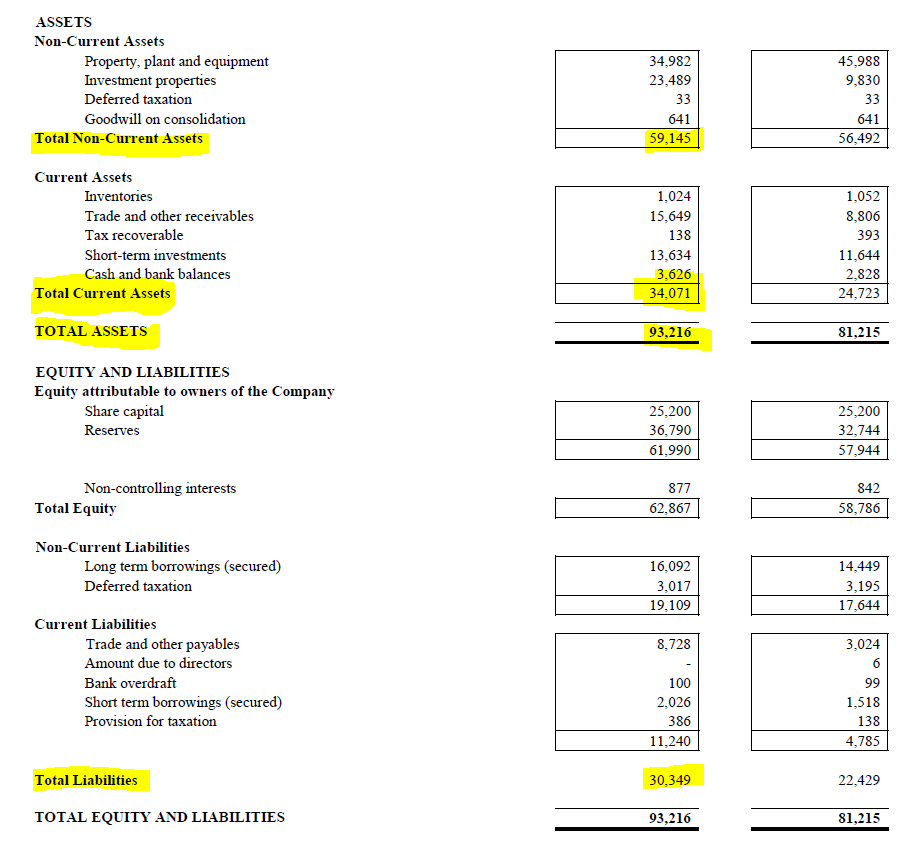

BTECH SPARKING A FRENZY UPTREND GREATWARRANTS I3investor

Work in progress is considered as a current asset on the balance sheet, predominantly because of the fact that they are expected to be converted to. Work in progress inventory can be found in the current assets section of the balance sheet, which reflects how inventory is expected to. Depending on the manufacturing process, the. Wip is capitalized on the.

Fun Format Of Consolidated Balance Sheet Holding Company Excel Download

Work in progress is considered as a current asset on the balance sheet, predominantly because of the fact that they are expected to be converted to. Work in progress inventory can be found in the current assets section of the balance sheet, which reflects how inventory is expected to. Wip is capitalized on the balance sheet, deferring expense recognition until.

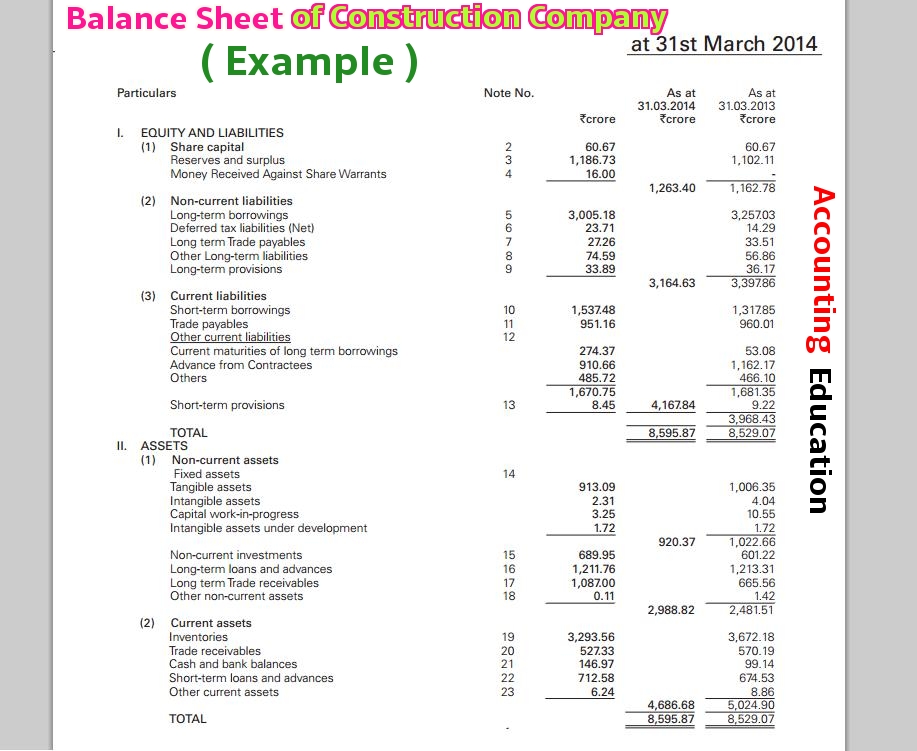

What is Construction In Progress Accounting Everything You Need To

Wip is capitalized on the balance sheet, deferring expense recognition until the project is completed or until certain conditions are met. Work in progress is considered as a current asset on the balance sheet, predominantly because of the fact that they are expected to be converted to. Work in progress inventory can be found in the current assets section of.

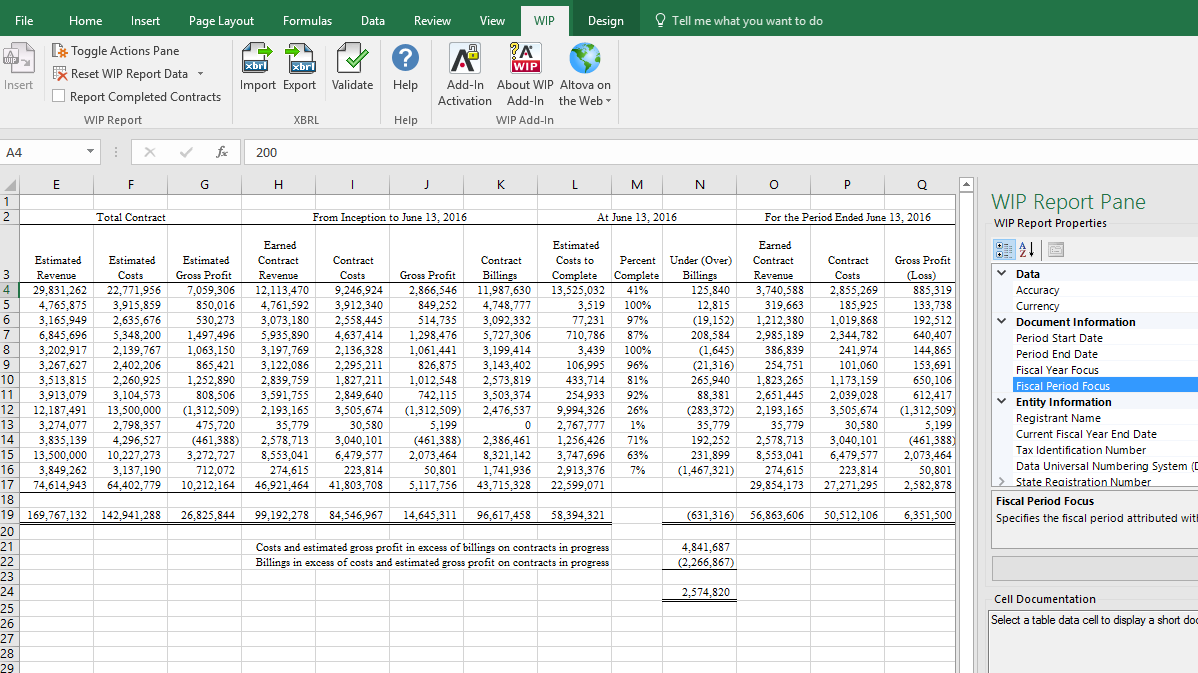

Construction Wip Report Template Excel

Work in progress is considered as a current asset on the balance sheet, predominantly because of the fact that they are expected to be converted to. Wip is capitalized on the balance sheet, deferring expense recognition until the project is completed or until certain conditions are met. Depending on the manufacturing process, the. Work in progress inventory can be found.

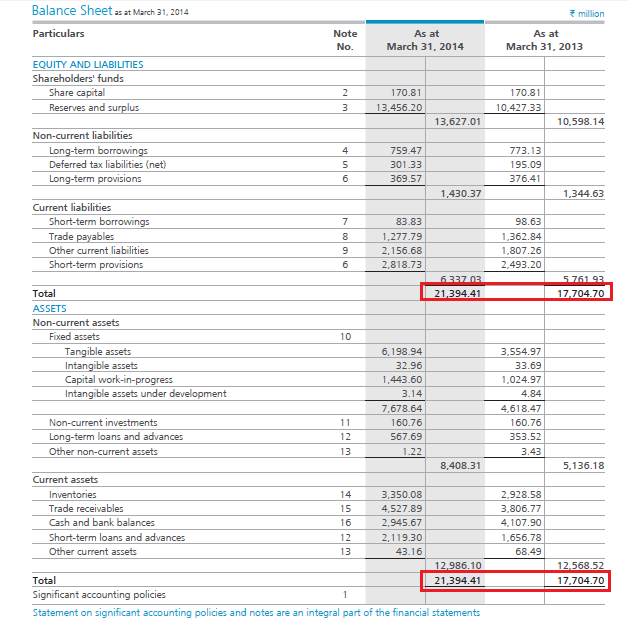

What is Work in Progress (WIP) Inventory Elite EXTRA

Work in progress is considered as a current asset on the balance sheet, predominantly because of the fact that they are expected to be converted to. Wip is capitalized on the balance sheet, deferring expense recognition until the project is completed or until certain conditions are met. Work in progress inventory can be found in the current assets section of.

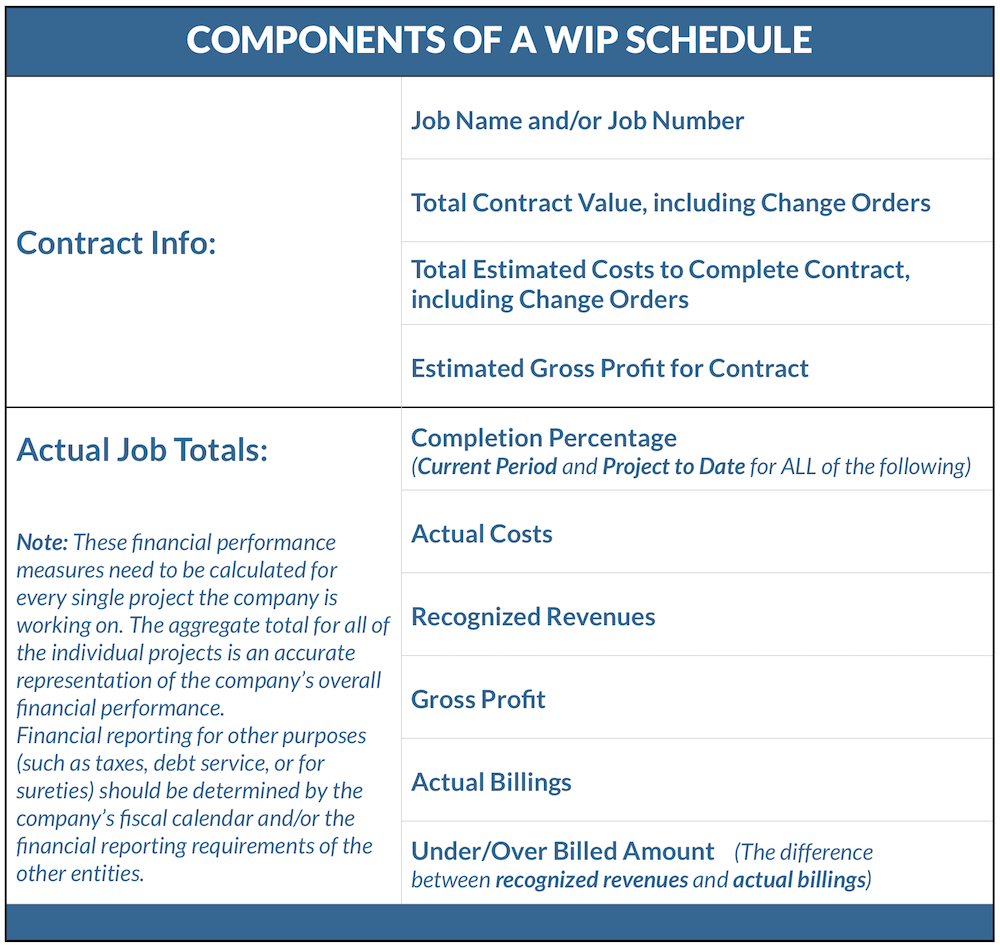

What Is a Work in Progress Schedule? Construction Accounting

Depending on the manufacturing process, the. Work in progress inventory can be found in the current assets section of the balance sheet, which reflects how inventory is expected to. Work in progress is considered as a current asset on the balance sheet, predominantly because of the fact that they are expected to be converted to. Wip is capitalized on the.

Consignment Inventory Microsoft Dynamics NAV Community

Wip is capitalized on the balance sheet, deferring expense recognition until the project is completed or until certain conditions are met. Depending on the manufacturing process, the. Work in progress inventory can be found in the current assets section of the balance sheet, which reflects how inventory is expected to. Work in progress is considered as a current asset on.

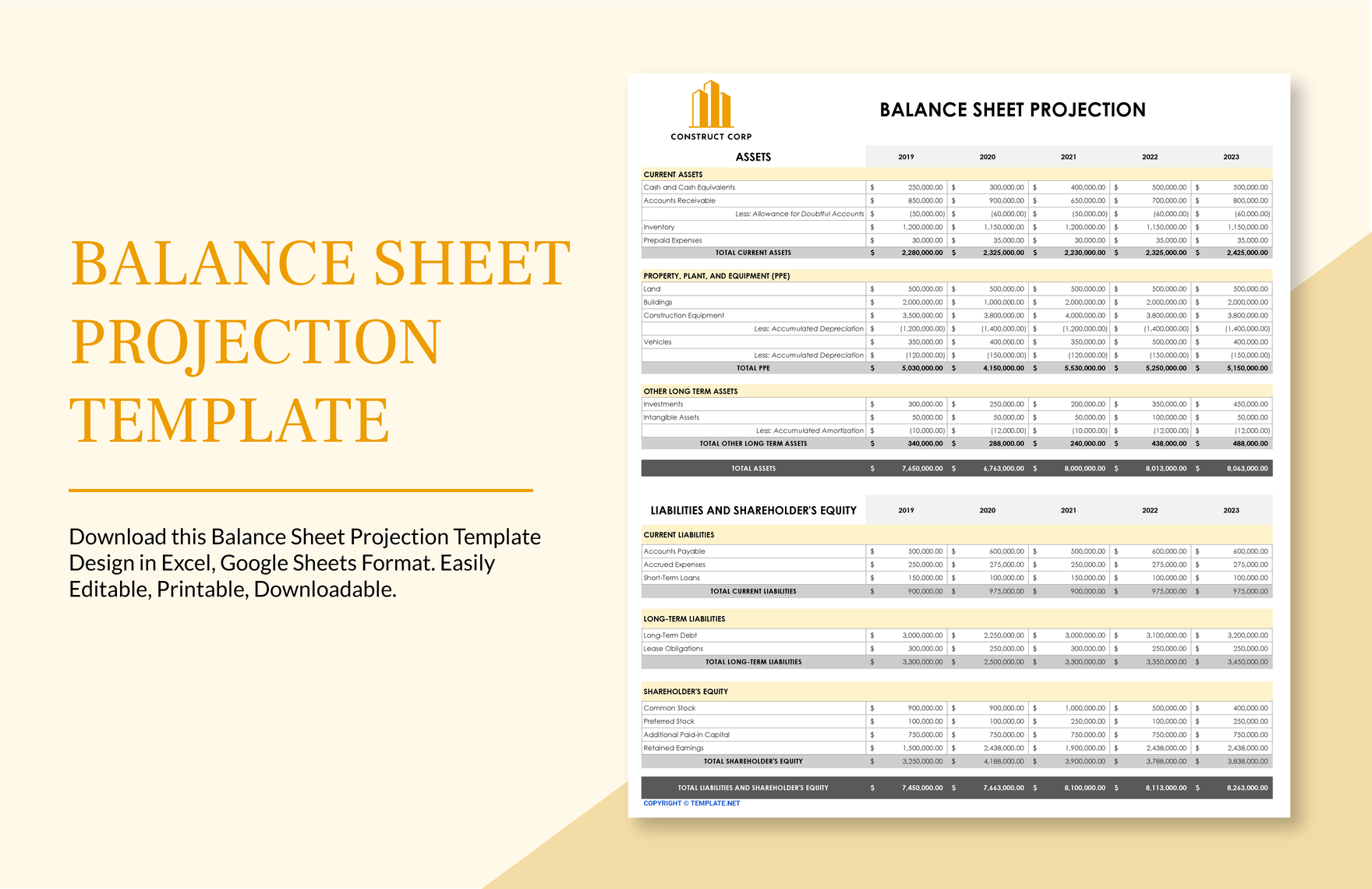

Free Balance Sheet Projection Template Download in Excel, Google

Depending on the manufacturing process, the. Wip is capitalized on the balance sheet, deferring expense recognition until the project is completed or until certain conditions are met. Work in progress inventory can be found in the current assets section of the balance sheet, which reflects how inventory is expected to. Work in progress is considered as a current asset on.

Balance Sheet Formats, Types, Uses and more

Depending on the manufacturing process, the. Work in progress is considered as a current asset on the balance sheet, predominantly because of the fact that they are expected to be converted to. Wip is capitalized on the balance sheet, deferring expense recognition until the project is completed or until certain conditions are met. Work in progress inventory can be found.

Percentage Of Completion Spreadsheet Spreadsheet Downloa construction

Work in progress inventory can be found in the current assets section of the balance sheet, which reflects how inventory is expected to. Work in progress is considered as a current asset on the balance sheet, predominantly because of the fact that they are expected to be converted to. Wip is capitalized on the balance sheet, deferring expense recognition until.

Work In Progress Is Considered As A Current Asset On The Balance Sheet, Predominantly Because Of The Fact That They Are Expected To Be Converted To.

Depending on the manufacturing process, the. Work in progress inventory can be found in the current assets section of the balance sheet, which reflects how inventory is expected to. Wip is capitalized on the balance sheet, deferring expense recognition until the project is completed or until certain conditions are met.