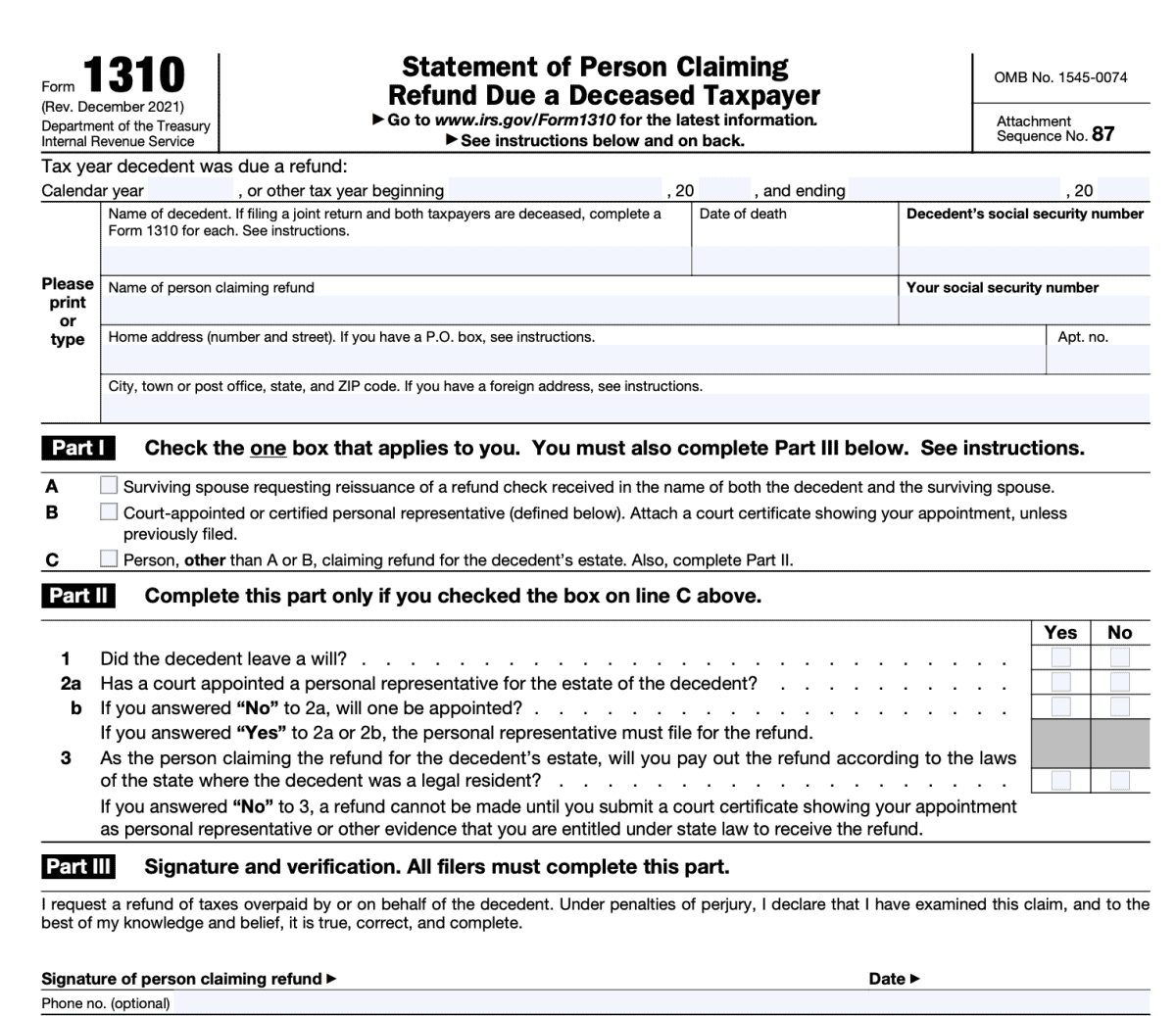

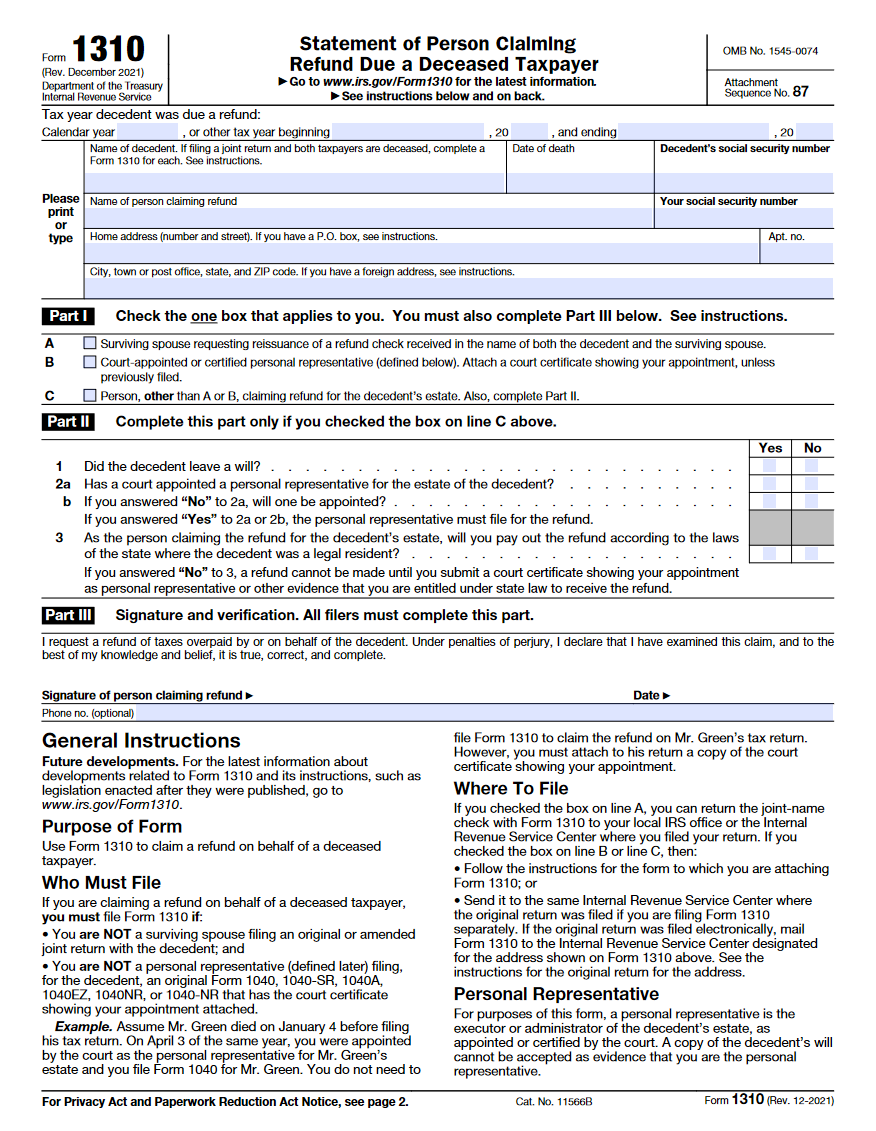

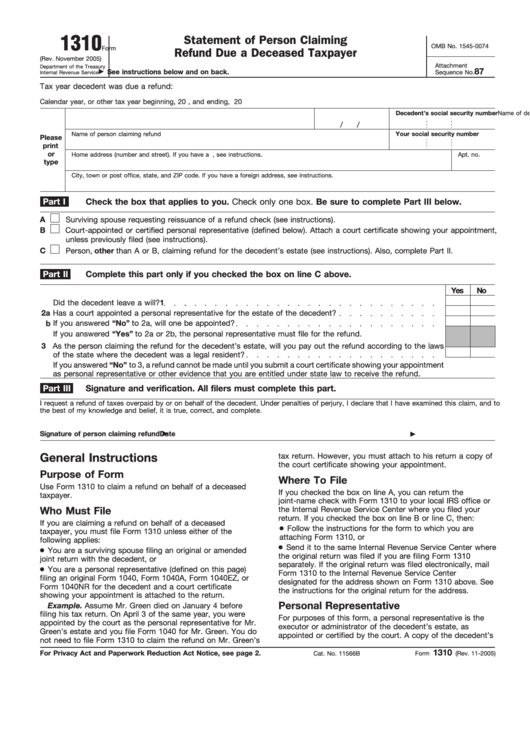

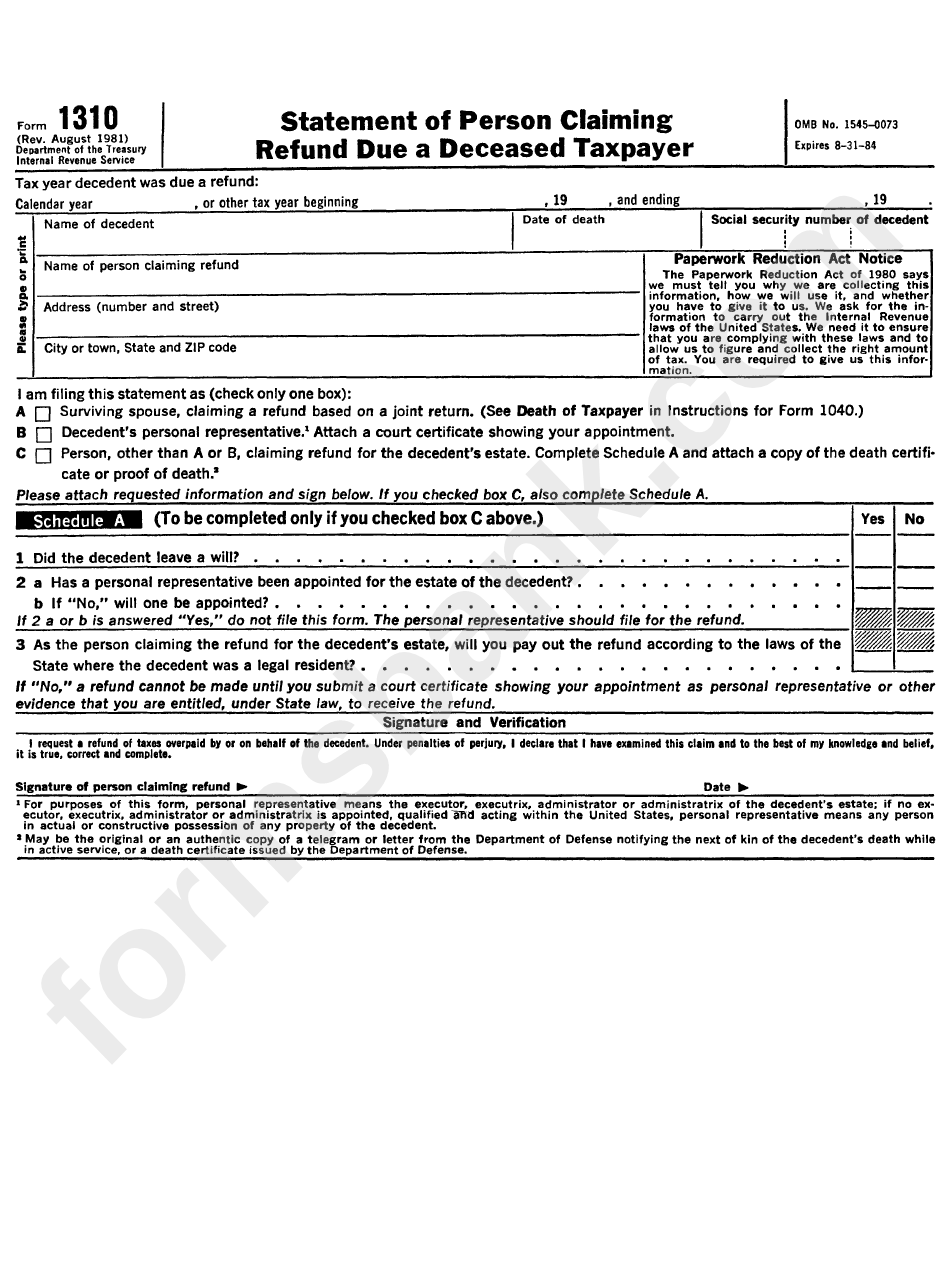

Who Files Form 1310 - When a taxpayer dies, the taxpayer’s personal. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Irs form 1310 is filed to claim a refund on behalf of a deceased taxpayer. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. You must file form 1310 if the description in line a, line b, or line c on the form.

You must file form 1310 if the description in line a, line b, or line c on the form. Irs form 1310 is filed to claim a refund on behalf of a deceased taxpayer. When a taxpayer dies, the taxpayer’s personal. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,.

Irs form 1310 is filed to claim a refund on behalf of a deceased taxpayer. You must file form 1310 if the description in line a, line b, or line c on the form. Use form 1310 to claim a refund on behalf of a deceased taxpayer. When a taxpayer dies, the taxpayer’s personal. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,.

Irs 1310 Fill out & sign online DocHub

Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. Irs form 1310 is filed to claim a refund on behalf of a deceased taxpayer. When a taxpayer dies, the taxpayer’s personal. You must file form 1310 if the description in line a, line b, or line c on the form. Use form 1310.

Irs Form 1310 Printable

Use form 1310 to claim a refund on behalf of a deceased taxpayer. When a taxpayer dies, the taxpayer’s personal. Irs form 1310 is filed to claim a refund on behalf of a deceased taxpayer. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. You must file form 1310 if the description in.

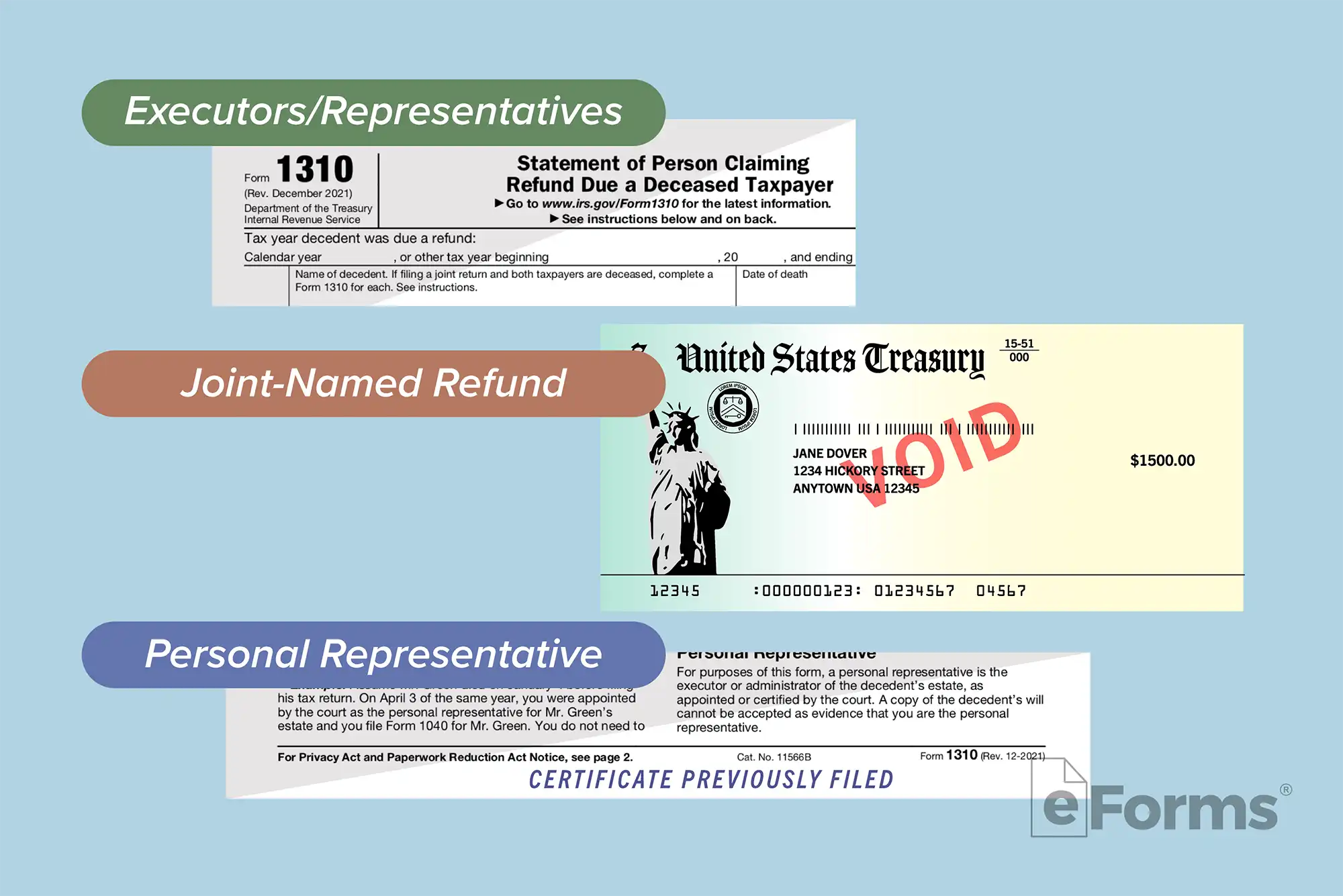

Free IRS Form 1310 PDF eForms

Irs form 1310 is filed to claim a refund on behalf of a deceased taxpayer. Use form 1310 to claim a refund on behalf of a deceased taxpayer. When a taxpayer dies, the taxpayer’s personal. You must file form 1310 if the description in line a, line b, or line c on the form. Information about form 1310, statement of.

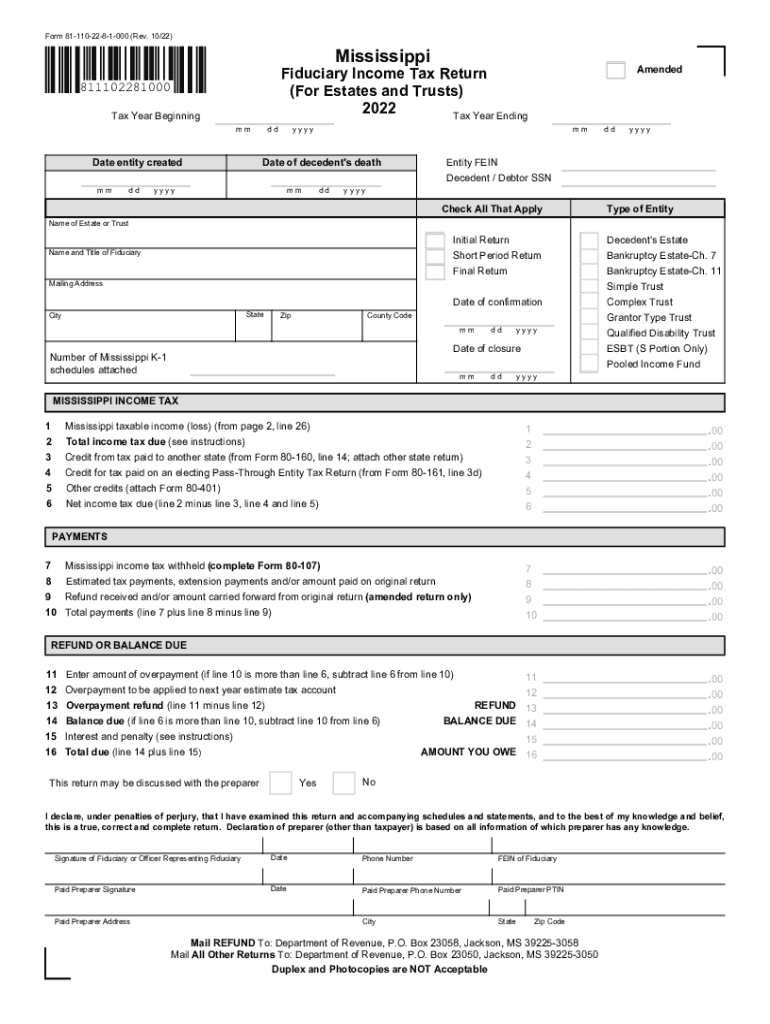

Fillable Form R 1310 Certificate Of Sales Tax Exemption Exclusion For

Use form 1310 to claim a refund on behalf of a deceased taxpayer. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. You must file form 1310 if the description in line a, line b, or line c on the form. Irs form 1310 is filed to claim a refund on behalf of.

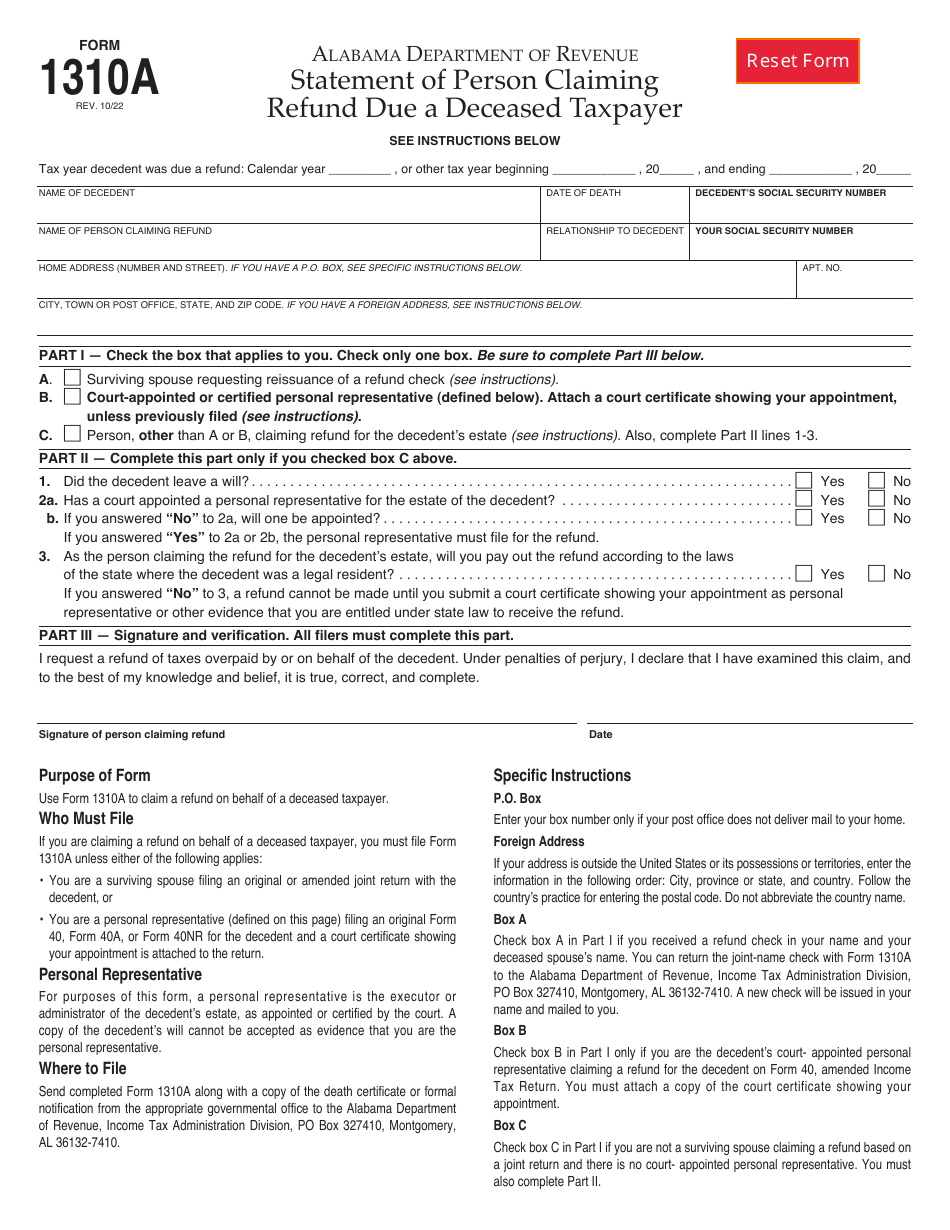

Form 1310A Fill Out, Sign Online and Download Fillable PDF, Alabama

You must file form 1310 if the description in line a, line b, or line c on the form. When a taxpayer dies, the taxpayer’s personal. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. Irs form 1310 is filed.

IRS Form 1310. Statement of Person Claiming Refund Due a Deceased

Use form 1310 to claim a refund on behalf of a deceased taxpayer. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. Irs form 1310 is filed to claim a refund on behalf of a deceased taxpayer. You must file form 1310 if the description in line a, line b, or line c.

Fillable Form 1310 Statement Of Person Claiming Refund Due A Deceased

When a taxpayer dies, the taxpayer’s personal. You must file form 1310 if the description in line a, line b, or line c on the form. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. Irs form 1310 is filed.

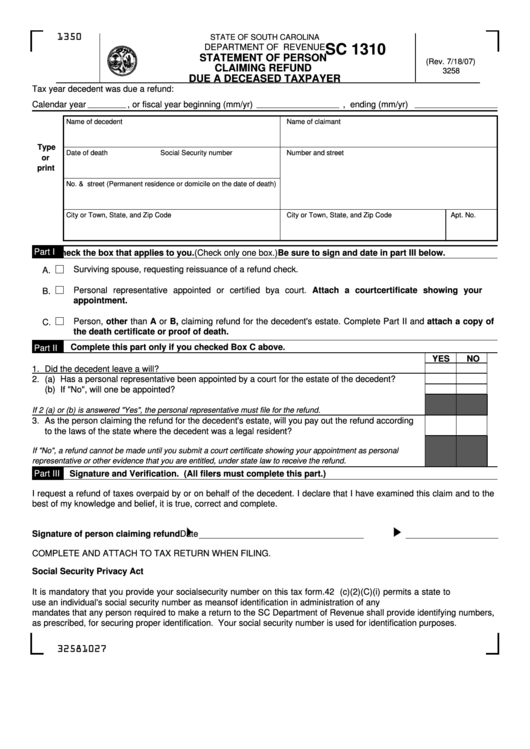

Form Sc 1310 Statement Of Person Claiming Refund Due A Deceased

You must file form 1310 if the description in line a, line b, or line c on the form. When a taxpayer dies, the taxpayer’s personal. Irs form 1310 is filed to claim a refund on behalf of a deceased taxpayer. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. Use form 1310.

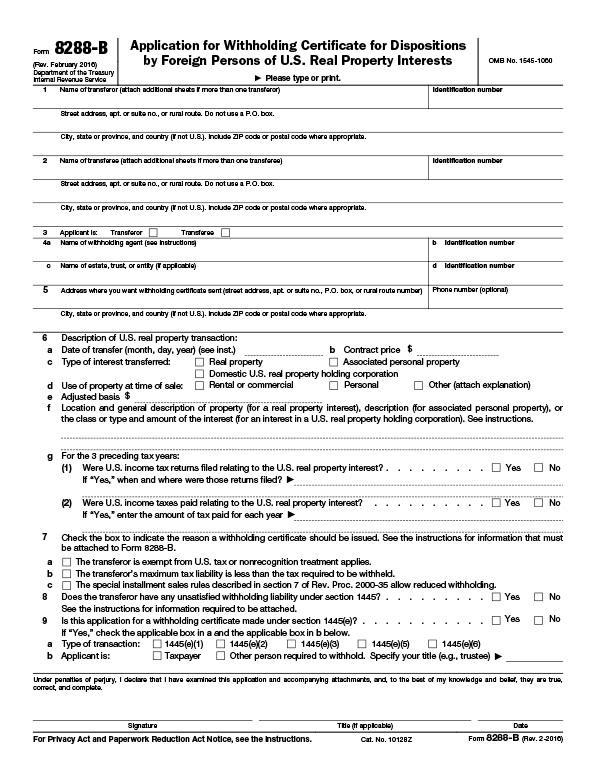

The Foreign Investment in Real Property Tax Act (FIRPTA)

You must file form 1310 if the description in line a, line b, or line c on the form. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Irs form 1310 is filed to claim a refund on behalf of.

Irs Form 1310 Printable Printable Forms Free Online

Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. Use form 1310 to claim a refund on behalf of a deceased taxpayer. You must file form 1310 if the description in line a, line b, or line c on the form. Irs form 1310 is filed to claim a refund on behalf of.

Use Form 1310 To Claim A Refund On Behalf Of A Deceased Taxpayer.

Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. Irs form 1310 is filed to claim a refund on behalf of a deceased taxpayer. When a taxpayer dies, the taxpayer’s personal. You must file form 1310 if the description in line a, line b, or line c on the form.