Where Do I Mail Form 9465 - If you have already filed your. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. Learn how to mail form 9465 for different types of taxpayers and returns. I live in colorado, should i mail the forms to austin, tx or to san francisco, ca? Attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Find the correct address for your state and situation from. To request an installment agreement, the taxpayer must complete form 9465.

Learn how to mail form 9465 for different types of taxpayers and returns. To request an installment agreement, the taxpayer must complete form 9465. I live in colorado, should i mail the forms to austin, tx or to san francisco, ca? Attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. If you have already filed your. Find the correct address for your state and situation from.

Learn how to mail form 9465 for different types of taxpayers and returns. Find the correct address for your state and situation from. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. If you have already filed your. Attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. I live in colorado, should i mail the forms to austin, tx or to san francisco, ca? To request an installment agreement, the taxpayer must complete form 9465.

9465 mailing address Fill out & sign online DocHub

Attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. Learn how to mail form 9465 for different types of taxpayers and returns. If you have.

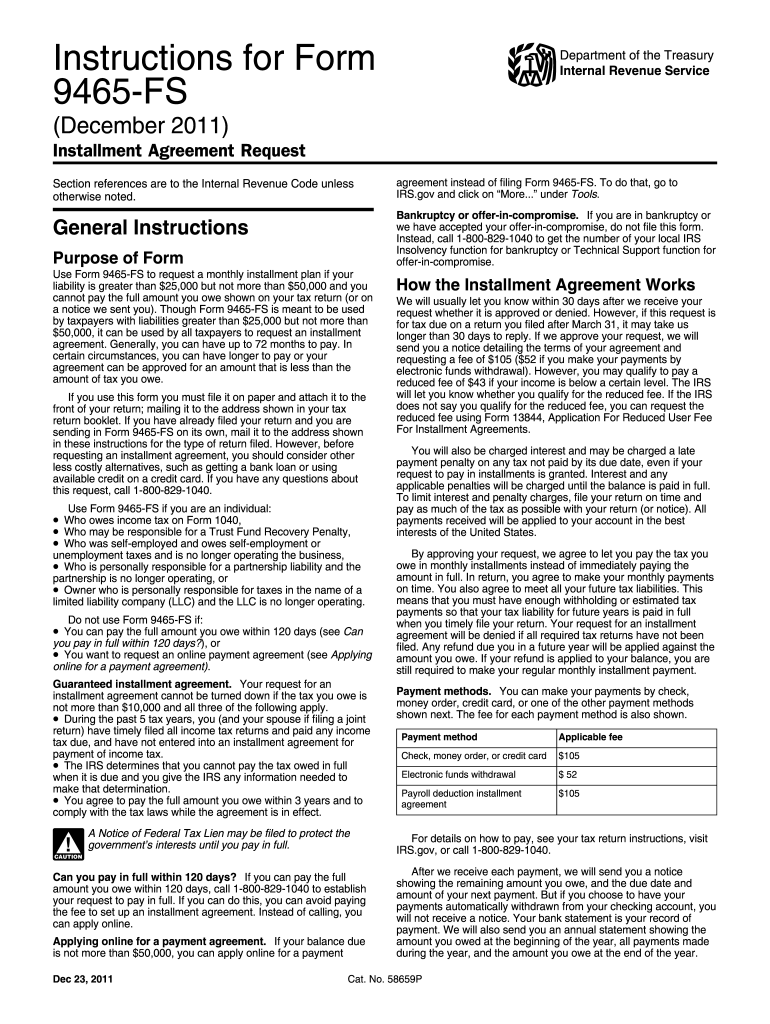

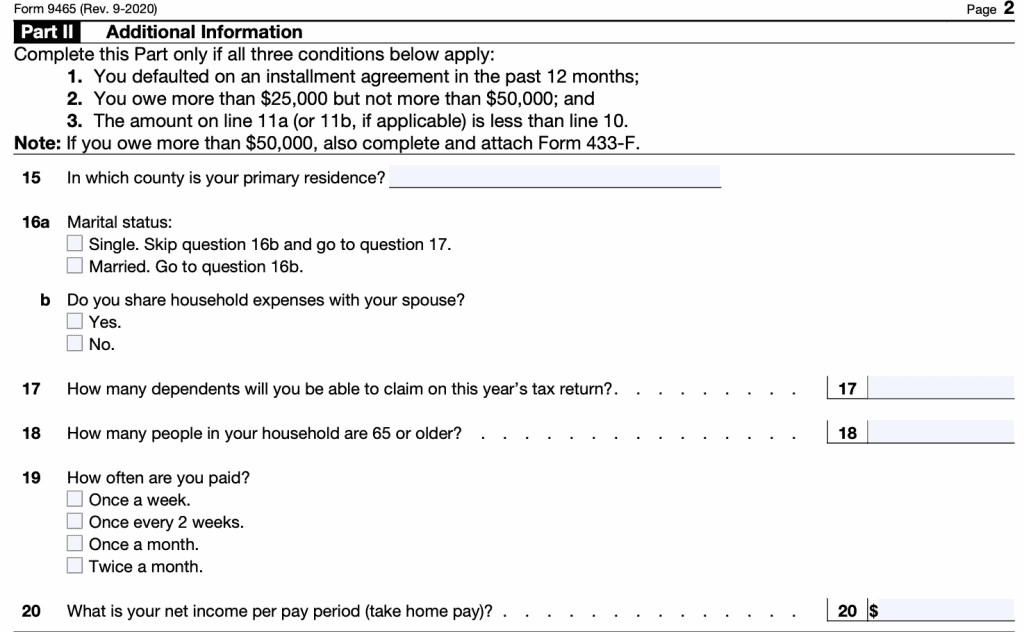

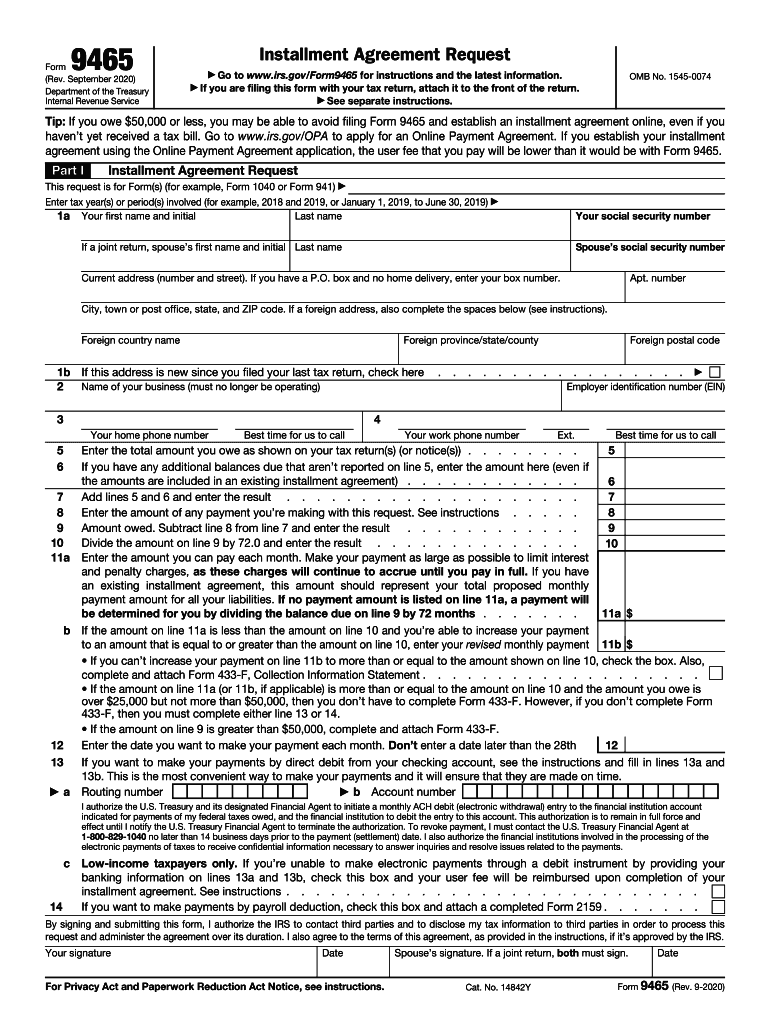

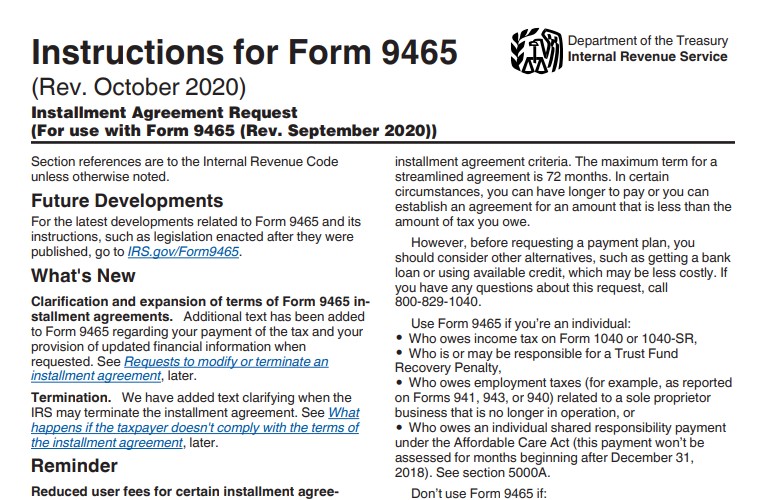

IRS Form 9465 Guide to IRS Installment Agreement Requests

If you have already filed your. Find the correct address for your state and situation from. Attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe..

IRS Form 9465 Instructions Your Installment Agreement Request

I live in colorado, should i mail the forms to austin, tx or to san francisco, ca? Find the correct address for your state and situation from. To request an installment agreement, the taxpayer must complete form 9465. Attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. If.

Irs Form 9465 Form Fillable Printable Forms Free Online

Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. Attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Find the correct address for your state and situation from. I live in colorado, should i.

Irs Form 9465 Printable

To request an installment agreement, the taxpayer must complete form 9465. Learn how to mail form 9465 for different types of taxpayers and returns. Find the correct address for your state and situation from. Attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Form 9465 is used by.

What to Know About IRS Form 9465

Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. To request an installment agreement, the taxpayer must complete form 9465. Learn how to mail form 9465 for different types of taxpayers and returns. I live in colorado, should i mail the forms to austin, tx or.

Irs Form 9465 Form Fillable Printable Forms Free Online

Learn how to mail form 9465 for different types of taxpayers and returns. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. I live in colorado, should i mail the forms to austin, tx or to san francisco, ca? Attach form 9465 to the front of.

How to use form 9465 instructions for your irs payment plan Artofit

Learn how to mail form 9465 for different types of taxpayers and returns. Find the correct address for your state and situation from. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. To request an installment agreement, the taxpayer must complete form 9465. Attach form 9465.

Where to mail form 9465 Fill out & sign online DocHub

To request an installment agreement, the taxpayer must complete form 9465. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. Find the correct address for your state and situation from. Learn how to mail form 9465 for different types of taxpayers and returns. Attach form 9465.

How to Complete Form 9465 for Electronic Filing and Payment by

If you have already filed your. I live in colorado, should i mail the forms to austin, tx or to san francisco, ca? Find the correct address for your state and situation from. Attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Form 9465 is used by taxpayers.

Learn How To Mail Form 9465 For Different Types Of Taxpayers And Returns.

If you have already filed your. I live in colorado, should i mail the forms to austin, tx or to san francisco, ca? Attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe.

Find The Correct Address For Your State And Situation From.

To request an installment agreement, the taxpayer must complete form 9465.