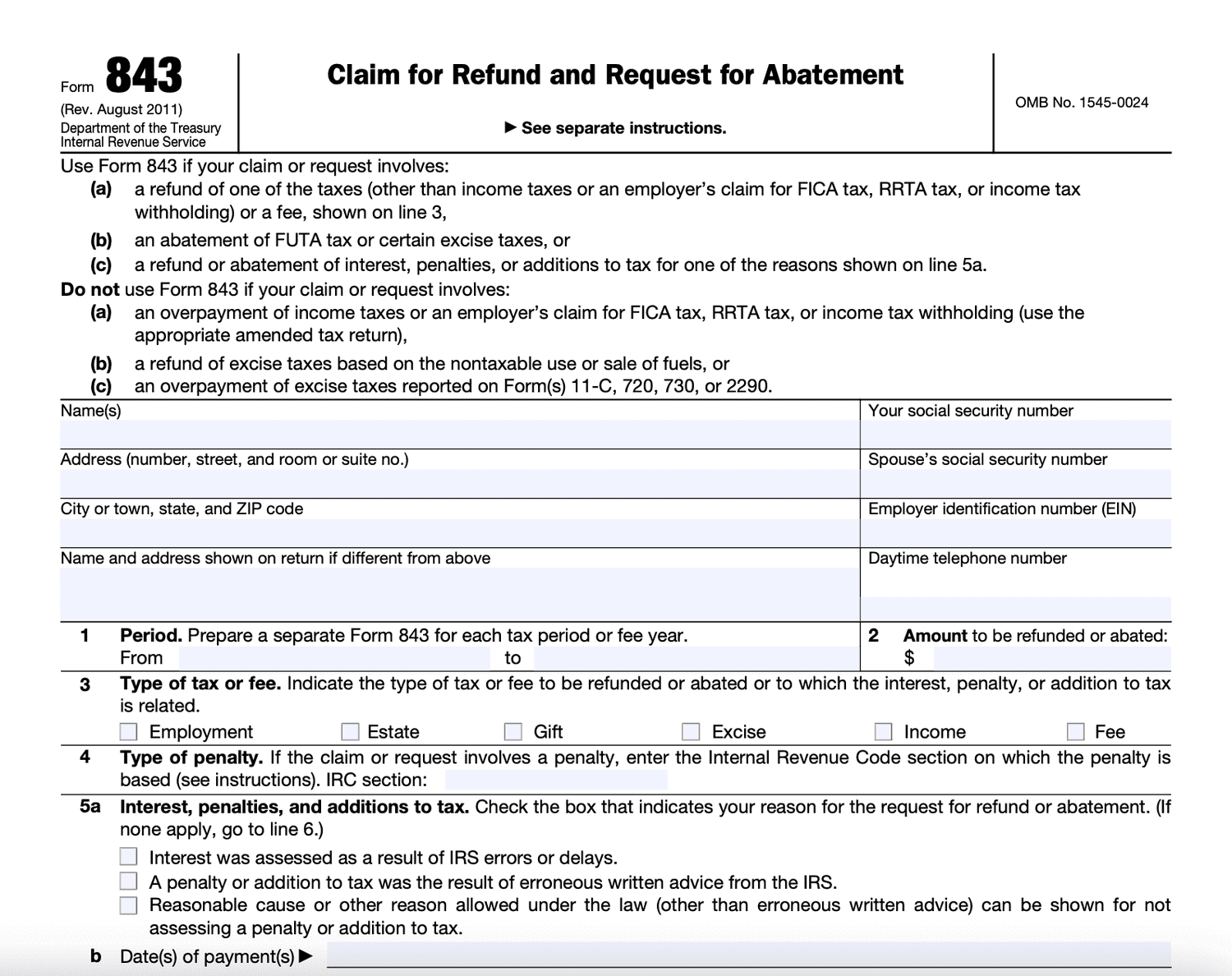

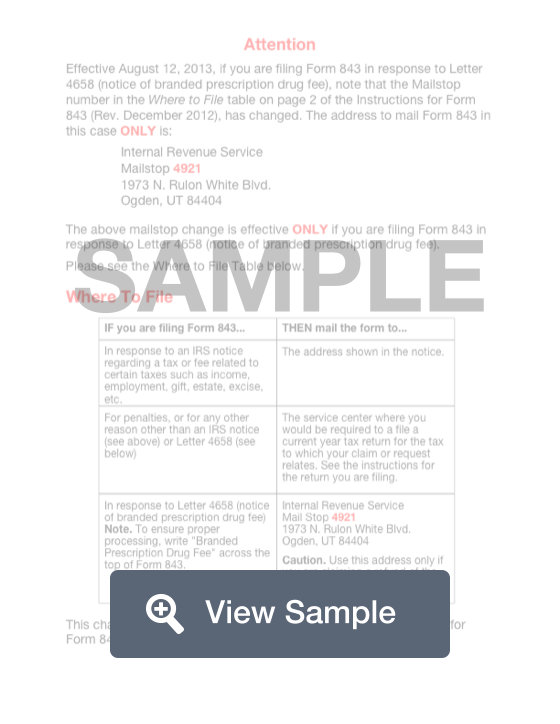

Where Do I Mail Form 843 For Penalty Abatement - You cannot use form 843 and you must use form 4720 to request a refund of an overpayment computed on form 4720, part iii, line. For penalties, or for any other reason other than an irs notice (see above), an estate tax claim for refund (see above), or letter 4658 (see below) the. Mail the form to the address indicted in the instructions. These are based on if you are responding to a notice and. Where do i mail form 843?

Mail the form to the address indicted in the instructions. Where do i mail form 843? You cannot use form 843 and you must use form 4720 to request a refund of an overpayment computed on form 4720, part iii, line. These are based on if you are responding to a notice and. For penalties, or for any other reason other than an irs notice (see above), an estate tax claim for refund (see above), or letter 4658 (see below) the.

Mail the form to the address indicted in the instructions. For penalties, or for any other reason other than an irs notice (see above), an estate tax claim for refund (see above), or letter 4658 (see below) the. You cannot use form 843 and you must use form 4720 to request a refund of an overpayment computed on form 4720, part iii, line. These are based on if you are responding to a notice and. Where do i mail form 843?

Requesting a Refund or Abatement from the IRS When Can You Use Form 843?

You cannot use form 843 and you must use form 4720 to request a refund of an overpayment computed on form 4720, part iii, line. These are based on if you are responding to a notice and. Mail the form to the address indicted in the instructions. Where do i mail form 843? For penalties, or for any other reason.

Form 843 Understanding Refunds and Penalties SuperMoney

You cannot use form 843 and you must use form 4720 to request a refund of an overpayment computed on form 4720, part iii, line. For penalties, or for any other reason other than an irs notice (see above), an estate tax claim for refund (see above), or letter 4658 (see below) the. Where do i mail form 843? Mail.

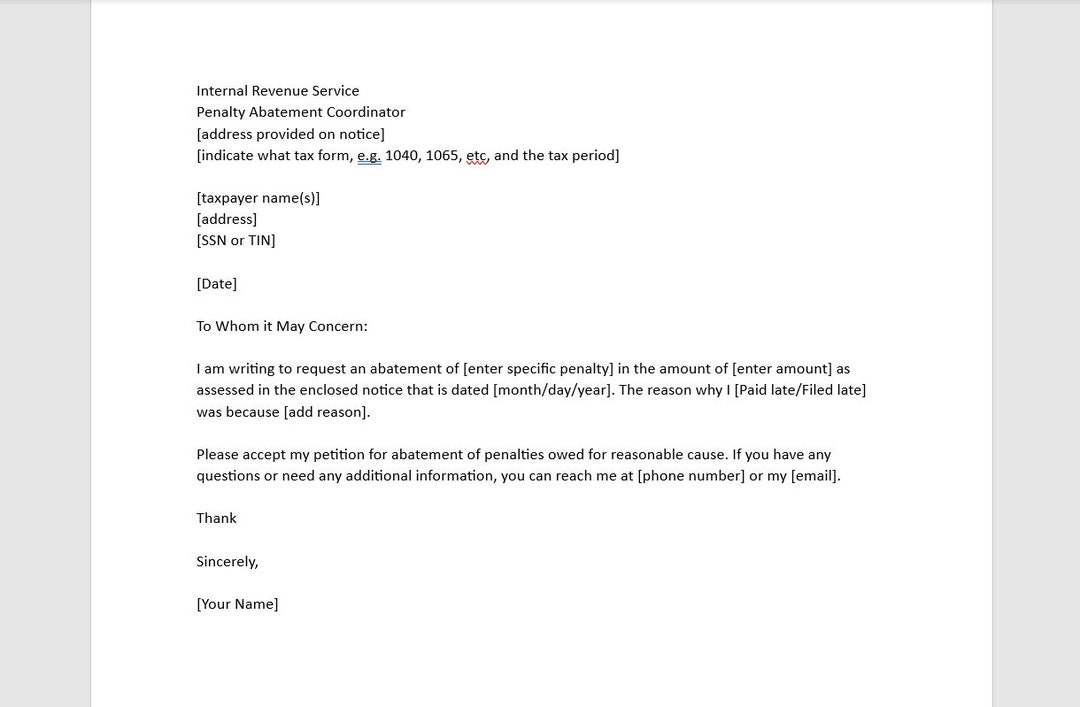

Request To Waive Penalty Letter Request Waiver on Penalty Interest

You cannot use form 843 and you must use form 4720 to request a refund of an overpayment computed on form 4720, part iii, line. Mail the form to the address indicted in the instructions. For penalties, or for any other reason other than an irs notice (see above), an estate tax claim for refund (see above), or letter 4658.

Form 843 Refund & Abatement Request Fill Out Online PDF FormSwift

For penalties, or for any other reason other than an irs notice (see above), an estate tax claim for refund (see above), or letter 4658 (see below) the. You cannot use form 843 and you must use form 4720 to request a refund of an overpayment computed on form 4720, part iii, line. Where do i mail form 843? Mail.

Penalty Abatement Request Letter, Penalty Abatement Request Letter

Where do i mail form 843? Mail the form to the address indicted in the instructions. You cannot use form 843 and you must use form 4720 to request a refund of an overpayment computed on form 4720, part iii, line. For penalties, or for any other reason other than an irs notice (see above), an estate tax claim for.

Form 843 for First Time Abatement Assistance Late Filing Tax Penalty

Mail the form to the address indicted in the instructions. For penalties, or for any other reason other than an irs notice (see above), an estate tax claim for refund (see above), or letter 4658 (see below) the. You cannot use form 843 and you must use form 4720 to request a refund of an overpayment computed on form 4720,.

How to remove IRS tax penalties in 3 easy steps. The IRS Penalty

Where do i mail form 843? Mail the form to the address indicted in the instructions. These are based on if you are responding to a notice and. You cannot use form 843 and you must use form 4720 to request a refund of an overpayment computed on form 4720, part iii, line. For penalties, or for any other reason.

IRS Form 843. Claim for Refund and Request for Abatement Forms Docs

For penalties, or for any other reason other than an irs notice (see above), an estate tax claim for refund (see above), or letter 4658 (see below) the. You cannot use form 843 and you must use form 4720 to request a refund of an overpayment computed on form 4720, part iii, line. Mail the form to the address indicted.

Form 843 Request for Penalty Abatement YouTube

Mail the form to the address indicted in the instructions. You cannot use form 843 and you must use form 4720 to request a refund of an overpayment computed on form 4720, part iii, line. For penalties, or for any other reason other than an irs notice (see above), an estate tax claim for refund (see above), or letter 4658.

Tax Help Alert 6 IRS Penalty/Interest Abatement Request (Form 843

Mail the form to the address indicted in the instructions. For penalties, or for any other reason other than an irs notice (see above), an estate tax claim for refund (see above), or letter 4658 (see below) the. Where do i mail form 843? These are based on if you are responding to a notice and. You cannot use form.

Where Do I Mail Form 843?

Mail the form to the address indicted in the instructions. For penalties, or for any other reason other than an irs notice (see above), an estate tax claim for refund (see above), or letter 4658 (see below) the. These are based on if you are responding to a notice and. You cannot use form 843 and you must use form 4720 to request a refund of an overpayment computed on form 4720, part iii, line.