What S Form 2441 - Information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to file. You can’t claim a credit for child and dependent care expenses if your filing status. Go to www.irs.gov/form2441 for instructions and the latest information. Form 2441 is the form taxpayers use to claim a tax credit for the money they pay to someone who takes care of their dependents while they’re at work or. For the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go.

For the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go. Form 2441 is the form taxpayers use to claim a tax credit for the money they pay to someone who takes care of their dependents while they’re at work or. You can’t claim a credit for child and dependent care expenses if your filing status. Go to www.irs.gov/form2441 for instructions and the latest information. Information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to file.

Information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to file. Go to www.irs.gov/form2441 for instructions and the latest information. You can’t claim a credit for child and dependent care expenses if your filing status. Form 2441 is the form taxpayers use to claim a tax credit for the money they pay to someone who takes care of their dependents while they’re at work or. For the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go.

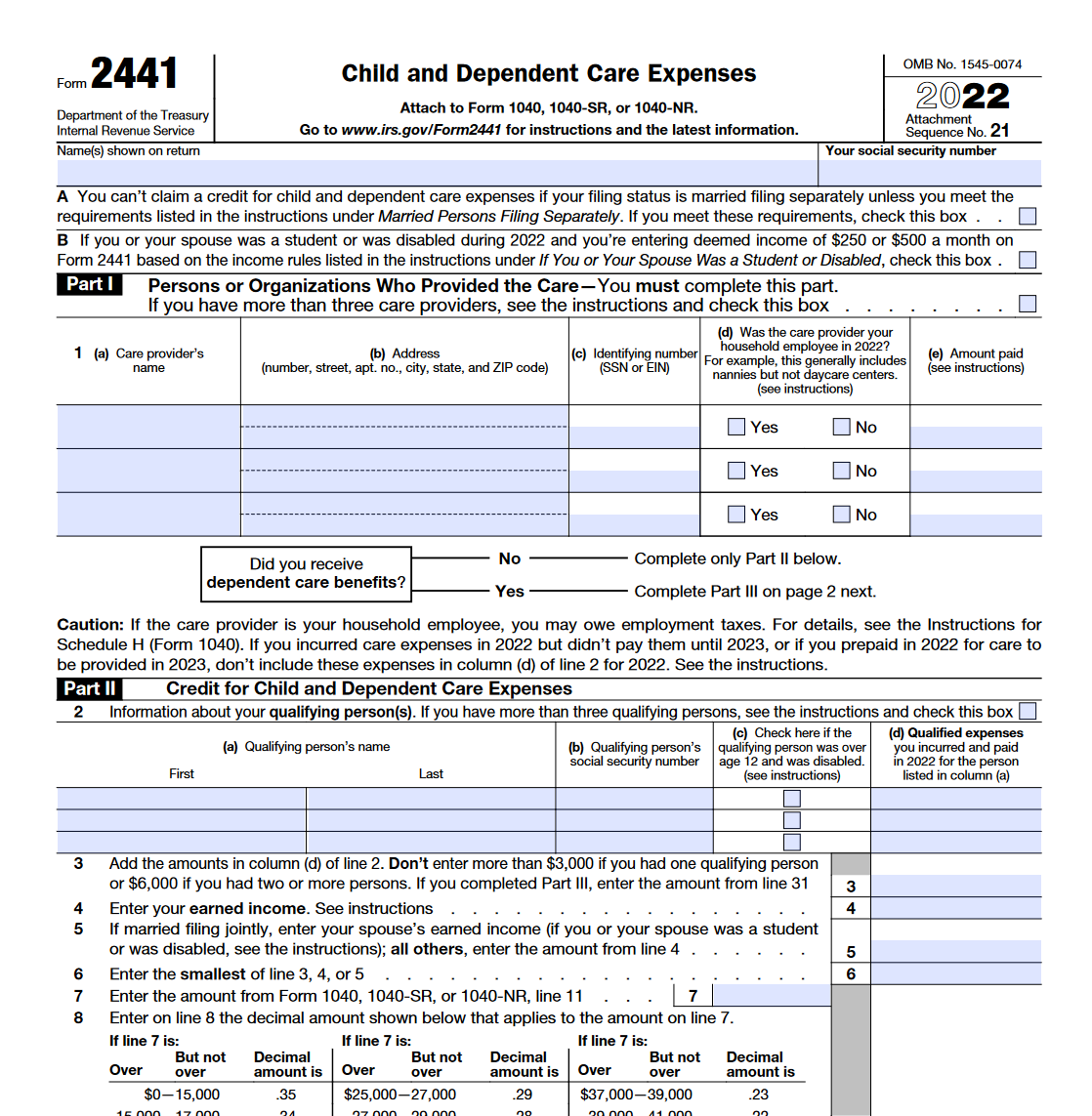

IRS Form 2441 Instructions Child and Dependent Care Expenses

You can’t claim a credit for child and dependent care expenses if your filing status. Go to www.irs.gov/form2441 for instructions and the latest information. Information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to file. Form 2441 is the form taxpayers use to claim a tax credit for the money they.

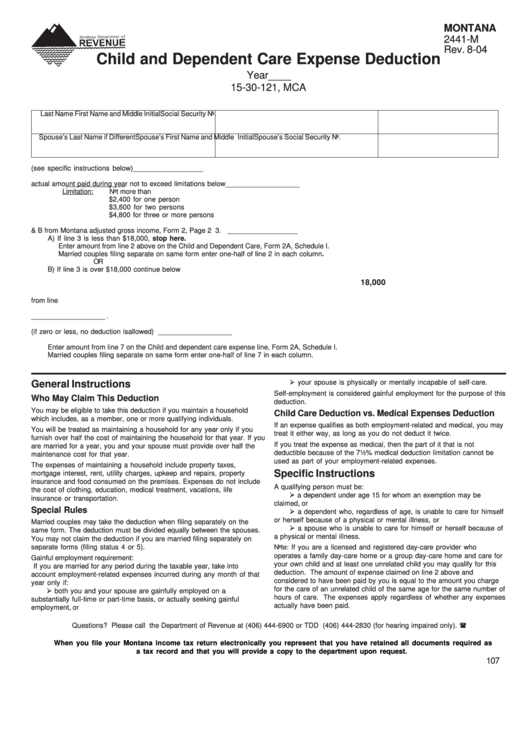

Fillable Montana Form 2441M Child And Dependent Care Expense

Go to www.irs.gov/form2441 for instructions and the latest information. You can’t claim a credit for child and dependent care expenses if your filing status. Form 2441 is the form taxpayers use to claim a tax credit for the money they pay to someone who takes care of their dependents while they’re at work or. Information about form 2441, child and.

IRS Form 2441. Child and Dependent Care Expenses Forms Docs 2023

You can’t claim a credit for child and dependent care expenses if your filing status. Information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to file. For the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go. Go to www.irs.gov/form2441.

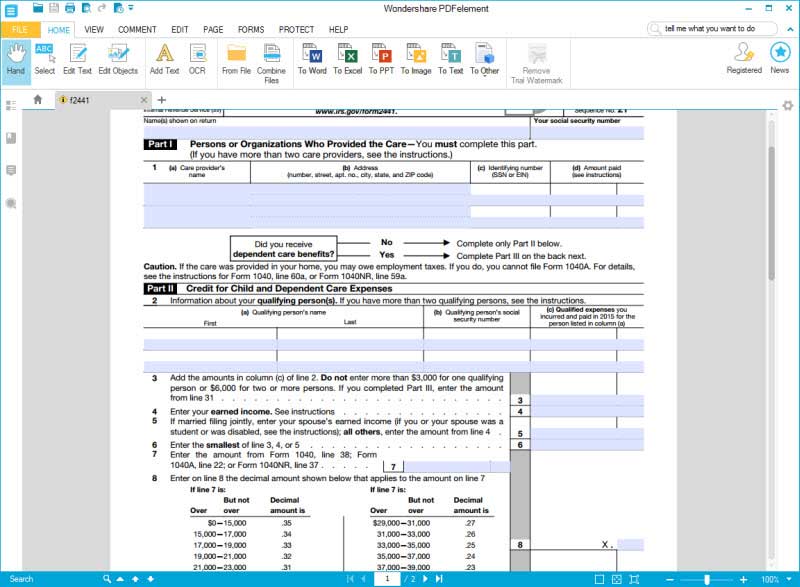

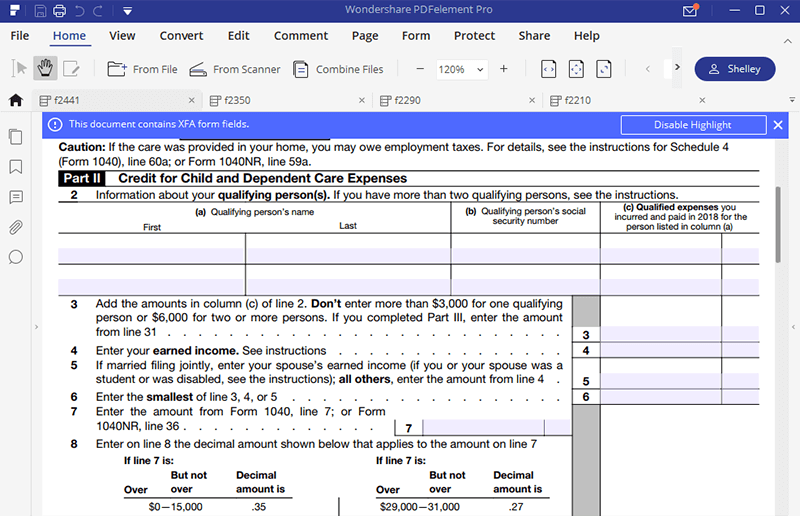

Instructions for How to Fill in IRS Form 2441

For the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go. You can’t claim a credit for child and dependent care expenses if your filing status. Form 2441 is the form taxpayers use to claim a tax credit for the money they pay to someone who takes care of.

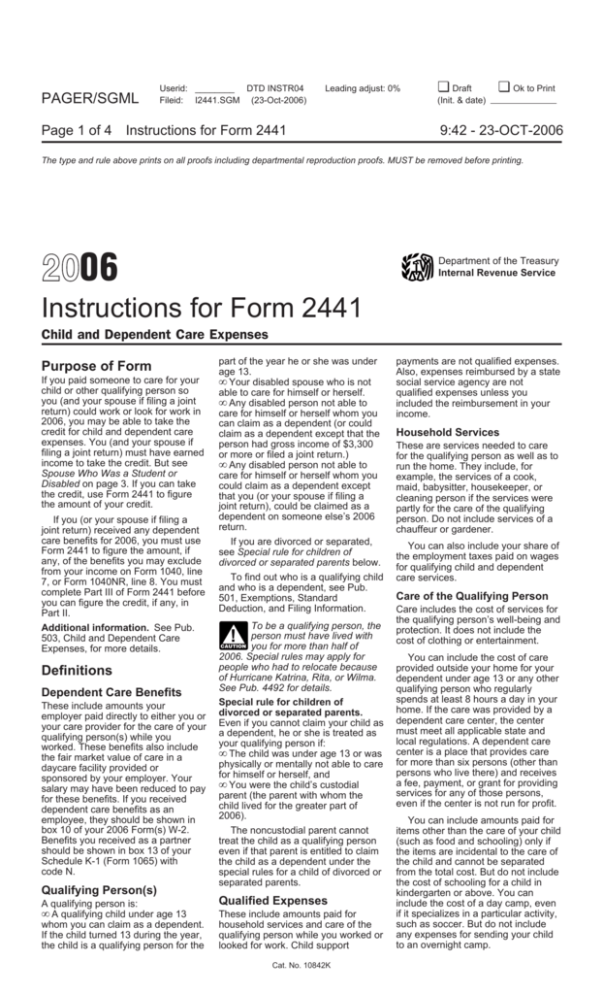

Instructions for Form 2441

You can’t claim a credit for child and dependent care expenses if your filing status. Go to www.irs.gov/form2441 for instructions and the latest information. Form 2441 is the form taxpayers use to claim a tax credit for the money they pay to someone who takes care of their dependents while they’re at work or. Information about form 2441, child and.

Instructions for How to Fill in IRS Form 2441

Go to www.irs.gov/form2441 for instructions and the latest information. You can’t claim a credit for child and dependent care expenses if your filing status. Information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to file. For the latest information about developments related to form 2441 and its instructions, such as legislation.

Publication 17, Your Federal Tax; Chapter 33 Child and

For the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go. Form 2441 is the form taxpayers use to claim a tax credit for the money they pay to someone who takes care of their dependents while they’re at work or. Information about form 2441, child and dependent care.

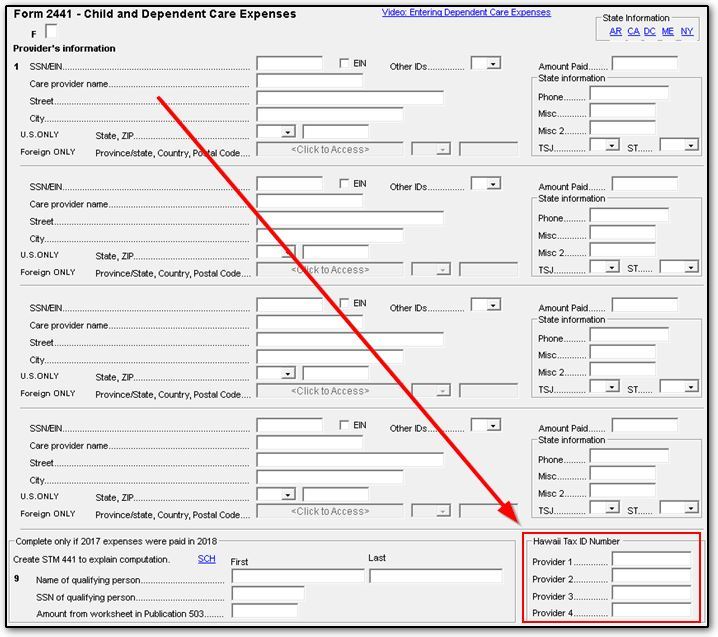

1040 Form 2441 Hawaii Tax ID Number (2441)

Information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to file. Go to www.irs.gov/form2441 for instructions and the latest information. You can’t claim a credit for child and dependent care expenses if your filing status. For the latest information about developments related to form 2441 and its instructions, such as legislation.

Filling form 2441 Children & Dependent Care Expenses Lendstart

Go to www.irs.gov/form2441 for instructions and the latest information. For the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go. Form 2441 is the form taxpayers use to claim a tax credit for the money they pay to someone who takes care of their dependents while they’re at work.

Form 2441 2023 Printable Forms Free Online

Form 2441 is the form taxpayers use to claim a tax credit for the money they pay to someone who takes care of their dependents while they’re at work or. For the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go. You can’t claim a credit for child and.

Go To Www.irs.gov/Form2441 For Instructions And The Latest Information.

You can’t claim a credit for child and dependent care expenses if your filing status. For the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go. Form 2441 is the form taxpayers use to claim a tax credit for the money they pay to someone who takes care of their dependents while they’re at work or. Information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to file.

:max_bytes(150000):strip_icc()/f2441Pg1-386902f42b8a4e61b03a246af9d9b0e2.jpg)