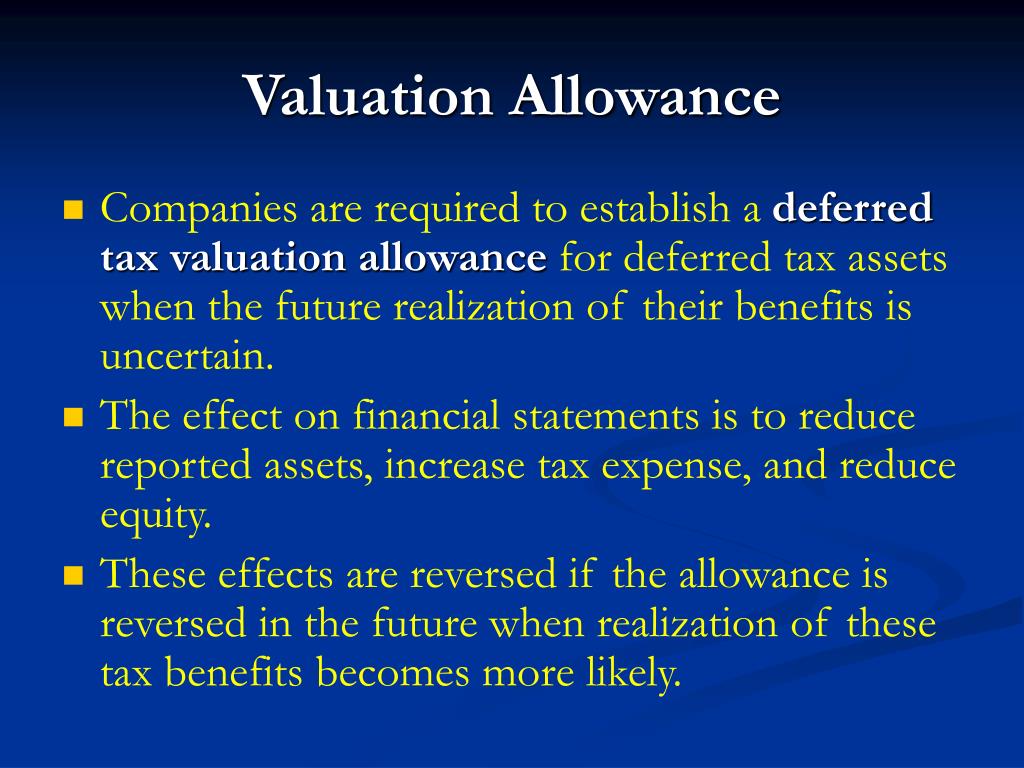

What Is A Valuation Allowance - A valuation allowance is a reduction to a deferred tax asset when there is a low probability of realizing its benefit. A valuation allowance is a reserve that is used to offset the amount of a deferred tax asset. Learn how to account for. The amount of the allowance is based on that.

A valuation allowance is a reserve that is used to offset the amount of a deferred tax asset. Learn how to account for. The amount of the allowance is based on that. A valuation allowance is a reduction to a deferred tax asset when there is a low probability of realizing its benefit.

The amount of the allowance is based on that. A valuation allowance is a reserve that is used to offset the amount of a deferred tax asset. A valuation allowance is a reduction to a deferred tax asset when there is a low probability of realizing its benefit. Learn how to account for.

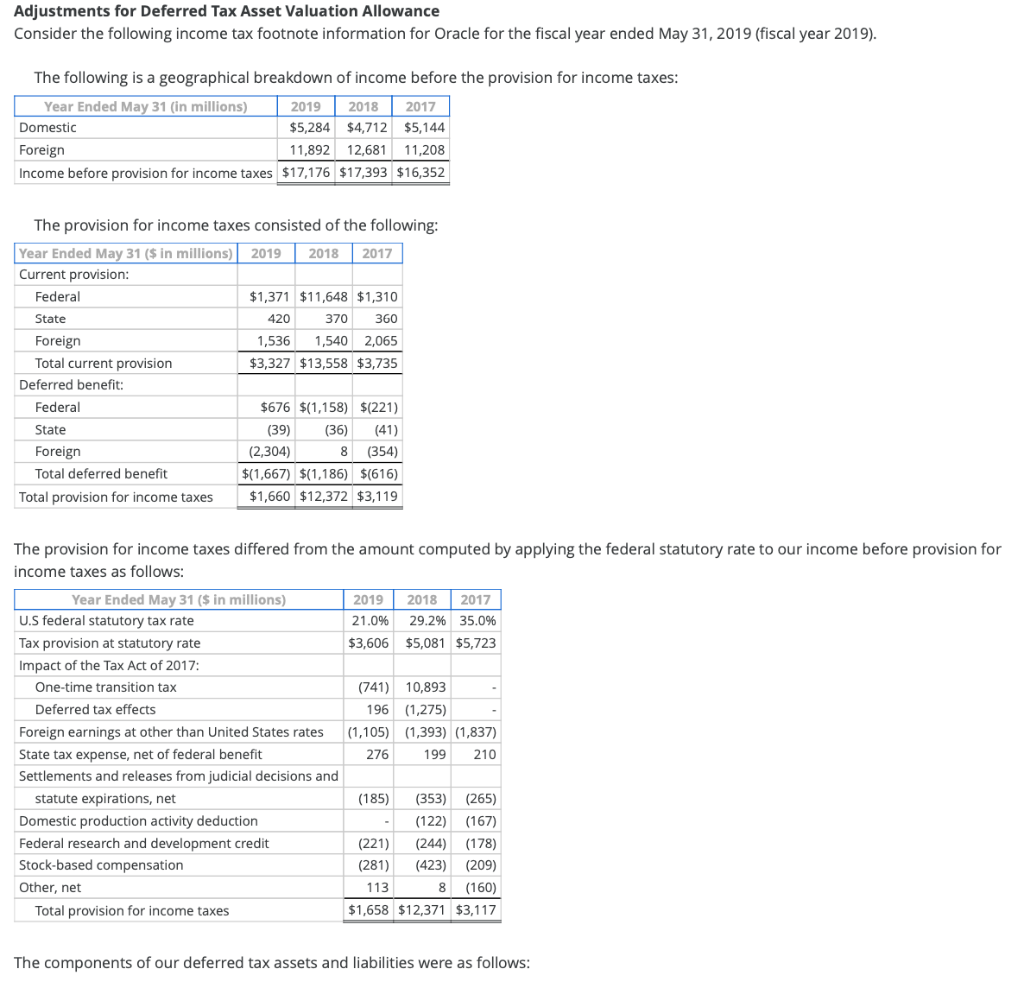

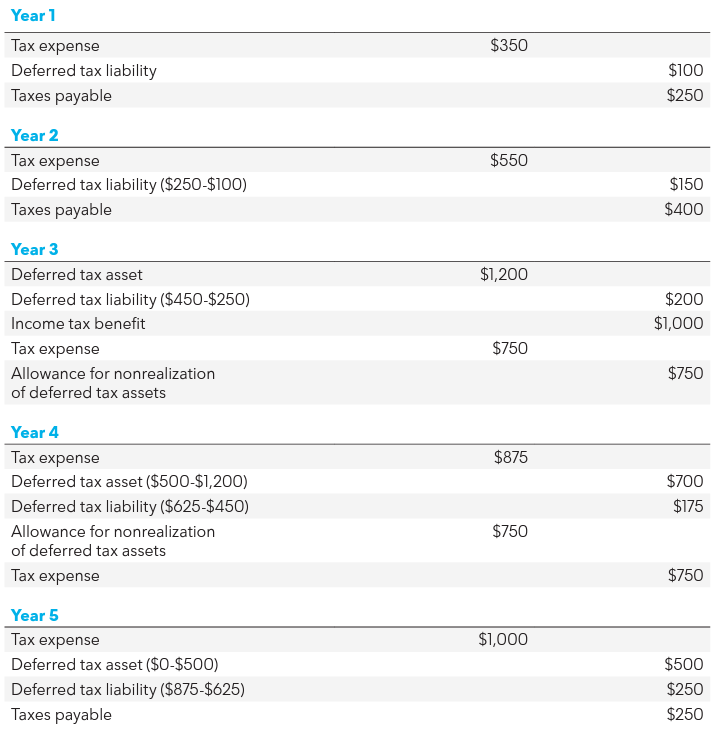

Adjustments for Deferred Tax Asset Valuation

A valuation allowance is a reduction to a deferred tax asset when there is a low probability of realizing its benefit. The amount of the allowance is based on that. A valuation allowance is a reserve that is used to offset the amount of a deferred tax asset. Learn how to account for.

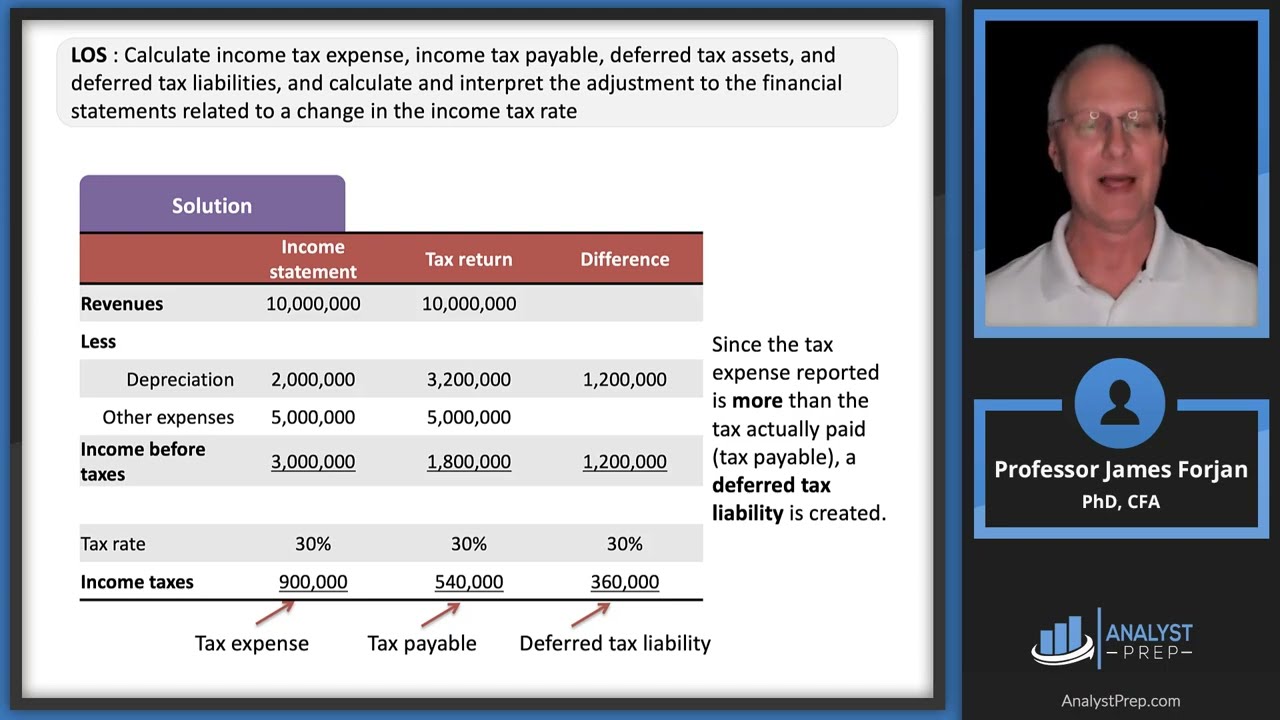

Valuation Allowance for Deferred Tax Assets CFA Level 1 AnalystPrep

The amount of the allowance is based on that. A valuation allowance is a reduction to a deferred tax asset when there is a low probability of realizing its benefit. A valuation allowance is a reserve that is used to offset the amount of a deferred tax asset. Learn how to account for.

What is Valuation Allowance?

The amount of the allowance is based on that. Learn how to account for. A valuation allowance is a reduction to a deferred tax asset when there is a low probability of realizing its benefit. A valuation allowance is a reserve that is used to offset the amount of a deferred tax asset.

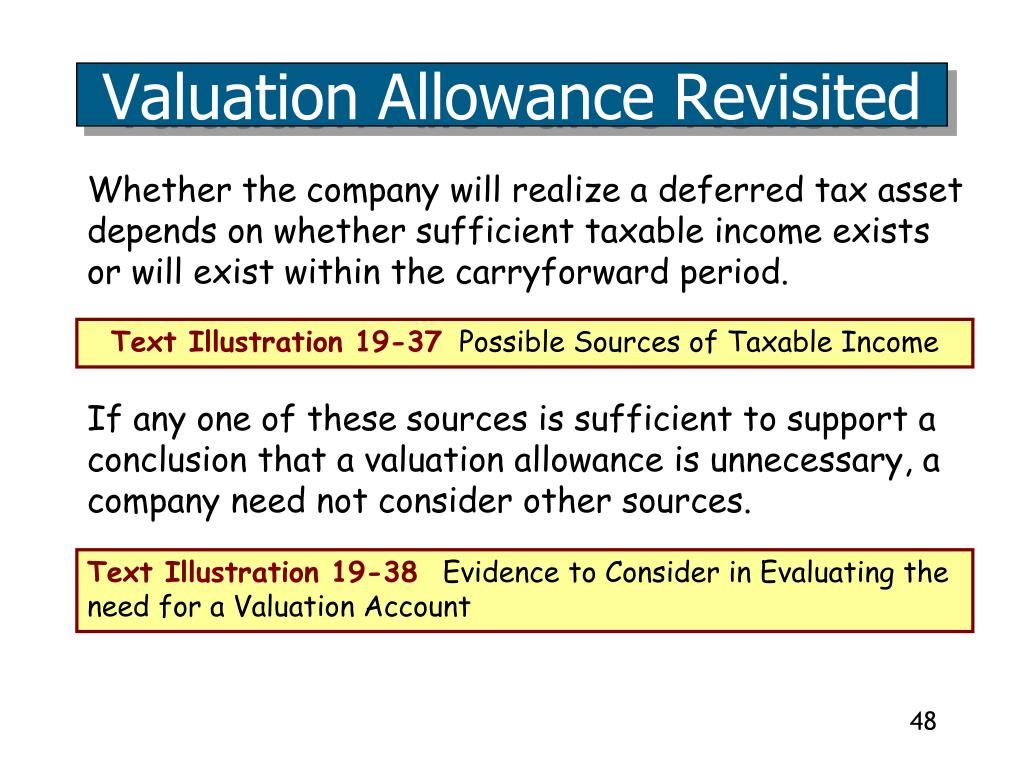

PPT C H A P T E R 19 PowerPoint Presentation, free download ID3041049

A valuation allowance is a reduction to a deferred tax asset when there is a low probability of realizing its benefit. Learn how to account for. The amount of the allowance is based on that. A valuation allowance is a reserve that is used to offset the amount of a deferred tax asset.

PPT Module 5 PowerPoint Presentation, free download ID933435

A valuation allowance is a reserve that is used to offset the amount of a deferred tax asset. Learn how to account for. The amount of the allowance is based on that. A valuation allowance is a reduction to a deferred tax asset when there is a low probability of realizing its benefit.

Valuation Allowance For Deferred Tax Assets A Quick Guide

A valuation allowance is a reserve that is used to offset the amount of a deferred tax asset. A valuation allowance is a reduction to a deferred tax asset when there is a low probability of realizing its benefit. Learn how to account for. The amount of the allowance is based on that.

Example How Is a Valuation Allowance Recorded for Deferred Tax Assets?

Learn how to account for. The amount of the allowance is based on that. A valuation allowance is a reduction to a deferred tax asset when there is a low probability of realizing its benefit. A valuation allowance is a reserve that is used to offset the amount of a deferred tax asset.

Valuation Allowance Basics YouTube

Learn how to account for. The amount of the allowance is based on that. A valuation allowance is a reserve that is used to offset the amount of a deferred tax asset. A valuation allowance is a reduction to a deferred tax asset when there is a low probability of realizing its benefit.

Fannie Mae (FNMA) Fannie Mae Deferred Tax Asset (Valuation...

A valuation allowance is a reduction to a deferred tax asset when there is a low probability of realizing its benefit. The amount of the allowance is based on that. A valuation allowance is a reserve that is used to offset the amount of a deferred tax asset. Learn how to account for.

Accounting for Taxes ppt download

A valuation allowance is a reserve that is used to offset the amount of a deferred tax asset. The amount of the allowance is based on that. A valuation allowance is a reduction to a deferred tax asset when there is a low probability of realizing its benefit. Learn how to account for.

A Valuation Allowance Is A Reserve That Is Used To Offset The Amount Of A Deferred Tax Asset.

A valuation allowance is a reduction to a deferred tax asset when there is a low probability of realizing its benefit. The amount of the allowance is based on that. Learn how to account for.

_2-28-2013_p3.png)