What Is A 8300 Form - Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file. The law requires trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form. Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. Form 8300 is a document that businesses use to report cash payments received in excess of $10,000 from a single transaction.

Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. Form 8300 is a document that businesses use to report cash payments received in excess of $10,000 from a single transaction. Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file. The law requires trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form.

Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file. Form 8300 is a document that businesses use to report cash payments received in excess of $10,000 from a single transaction. The law requires trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form. Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash.

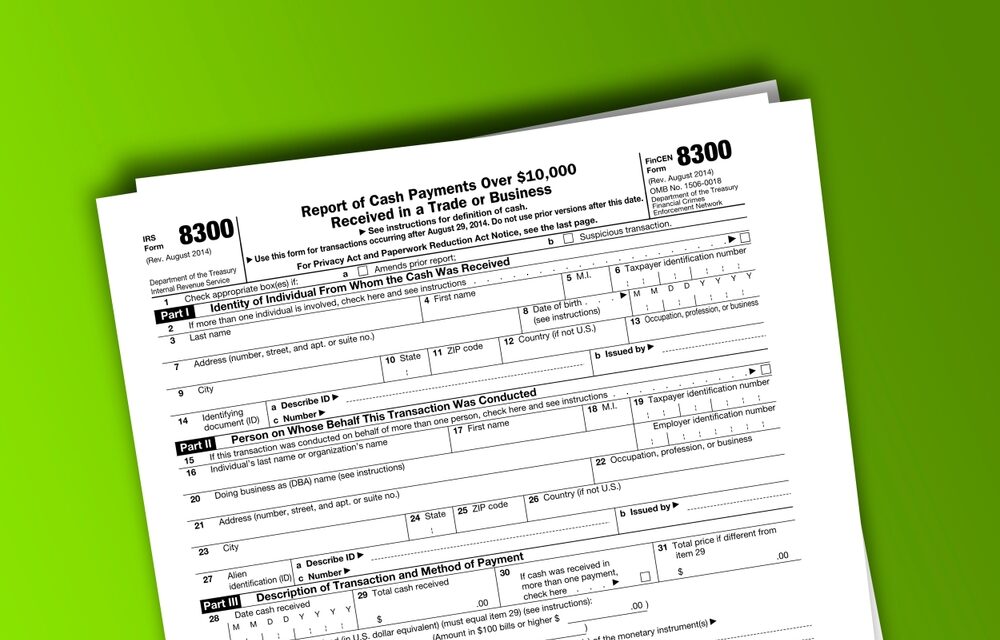

Form 8300 Reporting Cash Payments over 10,000 HM&M

Form 8300 is a document that businesses use to report cash payments received in excess of $10,000 from a single transaction. Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. The law requires trades and businesses report cash payments of more than $10,000 to the federal.

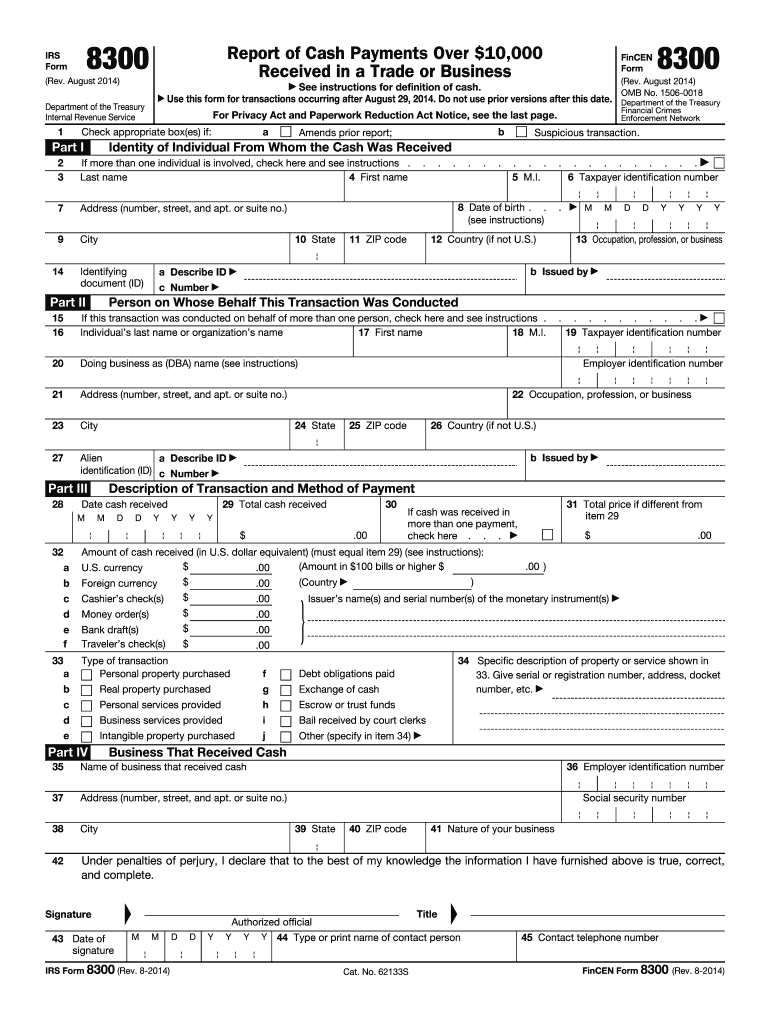

8300 Irs Form 2023 Printable Forms Free Online

Form 8300 is a document that businesses use to report cash payments received in excess of $10,000 from a single transaction. Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file. The law requires trades and businesses report cash payments of more than $10,000 to.

Fillable Form 8300 Report Of Cash Payments Over 10,000 Received In A

Form 8300 is a document that businesses use to report cash payments received in excess of $10,000 from a single transaction. Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file. Each person engaged in a trade or business who, in the course of that.

IRS Form 8300 Reporting Cash Sales Over 10,000

Form 8300 is a document that businesses use to report cash payments received in excess of $10,000 from a single transaction. The law requires trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form. Each person engaged in a trade or business who, in the course of that trade or business, receives.

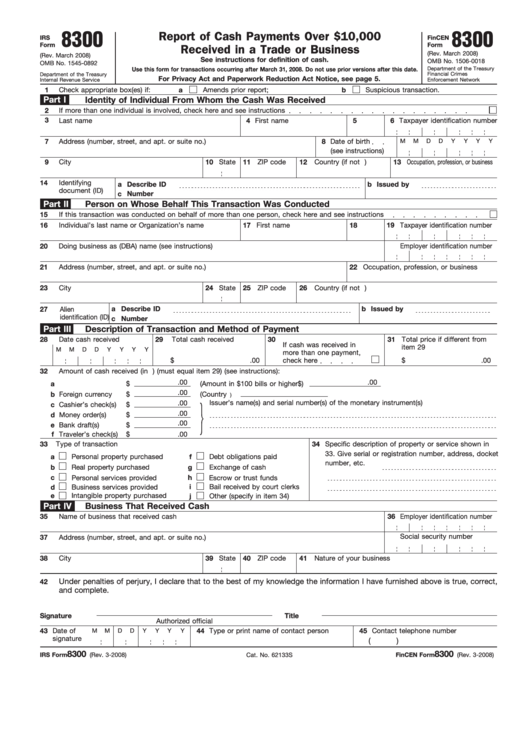

2014 Form IRS 8300 Fill Online, Printable, Fillable, Blank pdfFiller

Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file. Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. Form 8300 is a document that businesses use to report cash payments.

Fillable Form 8300 Report Of Cash Payments Over 10,000 Usd Received

The law requires trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form. Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file. Form 8300 is a document that businesses use to report cash payments received in.

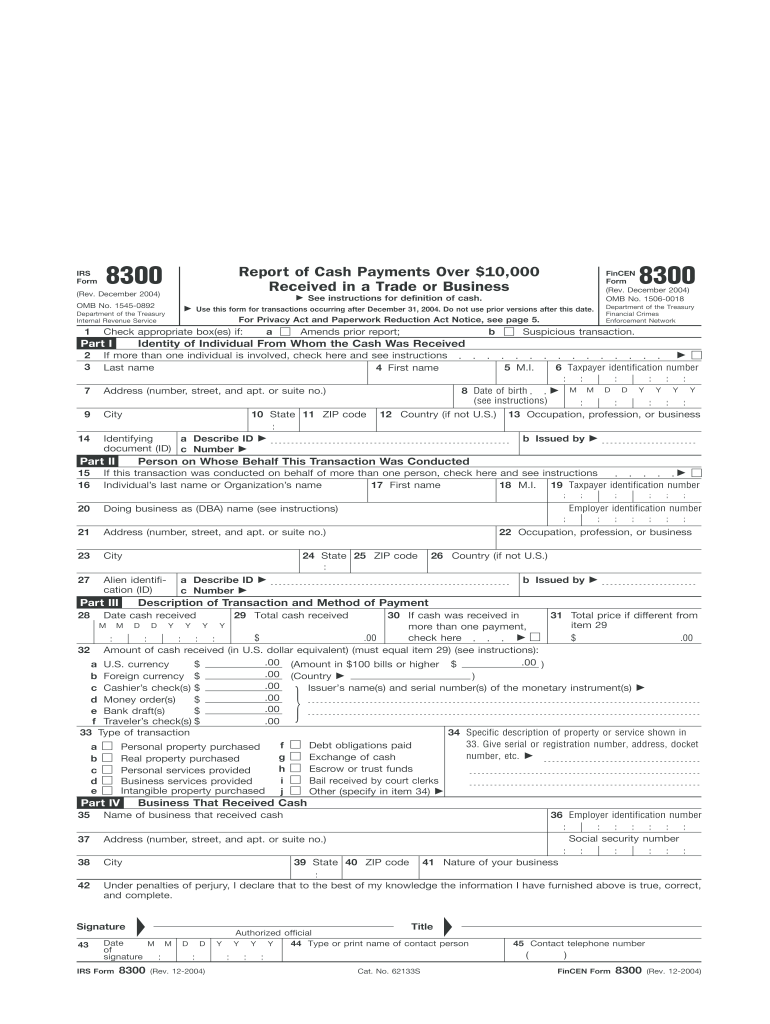

2004 Form IRS 8300 Fill Online, Printable, Fillable, Blank PDFfiller

Form 8300 is a document that businesses use to report cash payments received in excess of $10,000 from a single transaction. Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. The law requires trades and businesses report cash payments of more than $10,000 to the federal.

Form 8300 Scuba Exchange Art

Form 8300 is a document that businesses use to report cash payments received in excess of $10,000 from a single transaction. The law requires trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form. Each person engaged in a trade or business who, in the course of that trade or business, receives.

What Is Form 8300 and How Do You File It? Hourly, Inc.

Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file. The law requires trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form. Form 8300 is a document that businesses use to report cash payments received in.

What Is Form 8300 and How Do You File It? Hourly, Inc.

The law requires trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form. Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. Form 8300 is a document that businesses use to report cash payments received in excess of.

The Law Requires Trades And Businesses Report Cash Payments Of More Than $10,000 To The Federal Government By Filing Irs/Fincen Form.

Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file. Form 8300 is a document that businesses use to report cash payments received in excess of $10,000 from a single transaction. Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash.