Trust Accounting Template California - In california, a trustee is required to account to the beneficiaries as to the activities of the trust unless certain exceptions apply. Fiduciary (or trust) accounting and understanding the fiduciary duty are included in the practice guide to help cpas provide better. In california, trustees are required to provide trust accounting to beneficiaries in accordance with the california probate code.

Fiduciary (or trust) accounting and understanding the fiduciary duty are included in the practice guide to help cpas provide better. In california, trustees are required to provide trust accounting to beneficiaries in accordance with the california probate code. In california, a trustee is required to account to the beneficiaries as to the activities of the trust unless certain exceptions apply.

In california, a trustee is required to account to the beneficiaries as to the activities of the trust unless certain exceptions apply. Fiduciary (or trust) accounting and understanding the fiduciary duty are included in the practice guide to help cpas provide better. In california, trustees are required to provide trust accounting to beneficiaries in accordance with the california probate code.

Risk Assessment Property Template in MS Excel, Google Sheets Download

Fiduciary (or trust) accounting and understanding the fiduciary duty are included in the practice guide to help cpas provide better. In california, a trustee is required to account to the beneficiaries as to the activities of the trust unless certain exceptions apply. In california, trustees are required to provide trust accounting to beneficiaries in accordance with the california probate code.

Trust Accounting Template California

In california, a trustee is required to account to the beneficiaries as to the activities of the trust unless certain exceptions apply. Fiduciary (or trust) accounting and understanding the fiduciary duty are included in the practice guide to help cpas provide better. In california, trustees are required to provide trust accounting to beneficiaries in accordance with the california probate code.

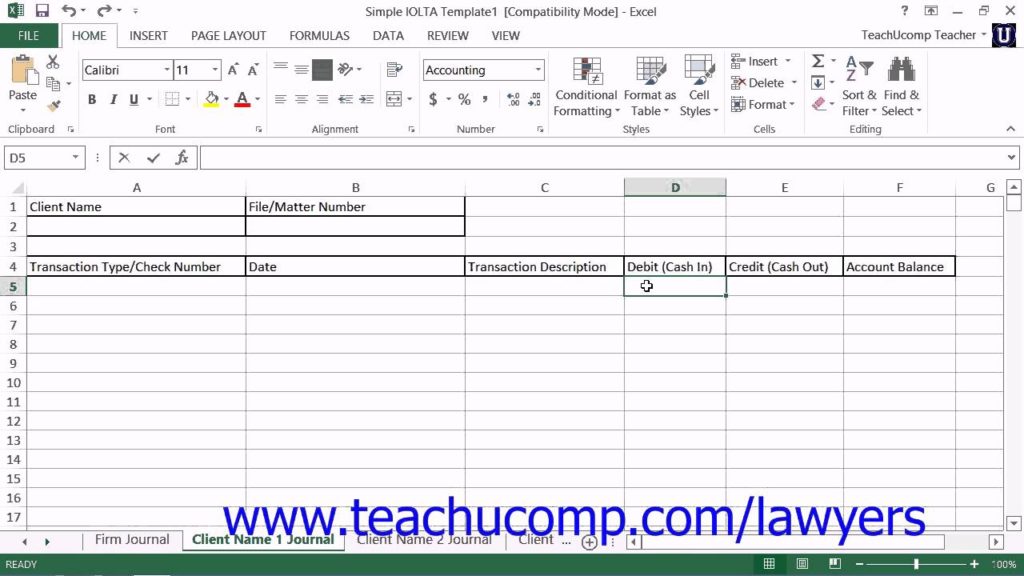

Trust Accounting Excel Template California

Fiduciary (or trust) accounting and understanding the fiduciary duty are included in the practice guide to help cpas provide better. In california, a trustee is required to account to the beneficiaries as to the activities of the trust unless certain exceptions apply. In california, trustees are required to provide trust accounting to beneficiaries in accordance with the california probate code.

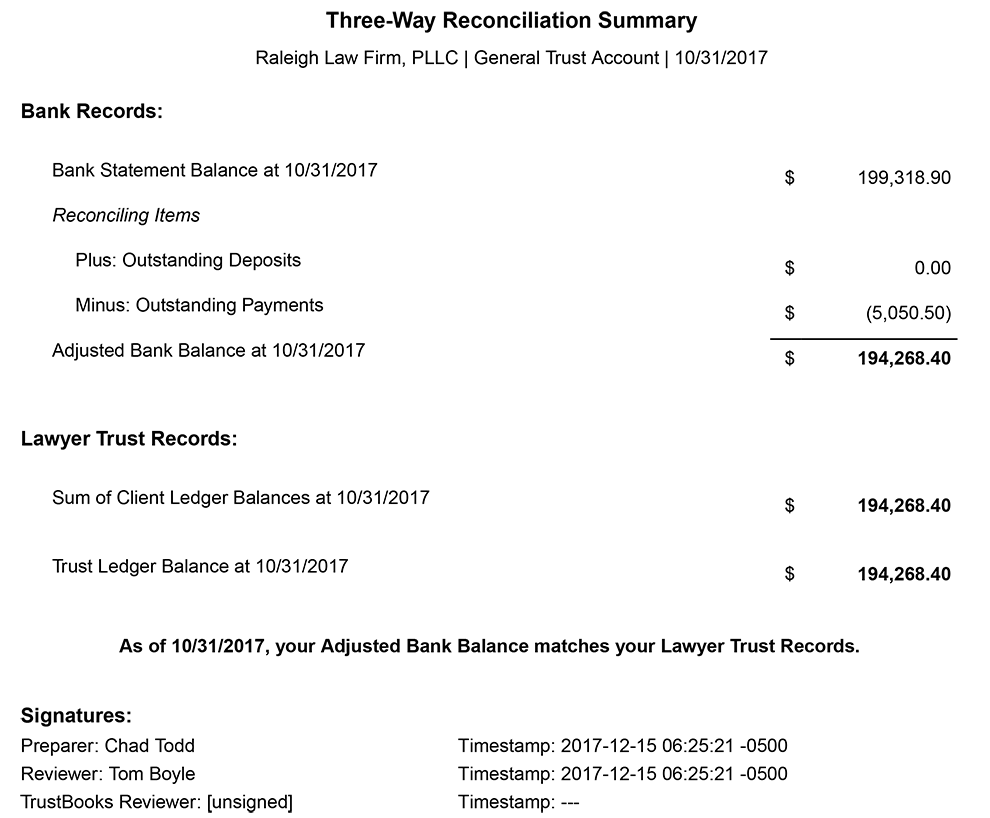

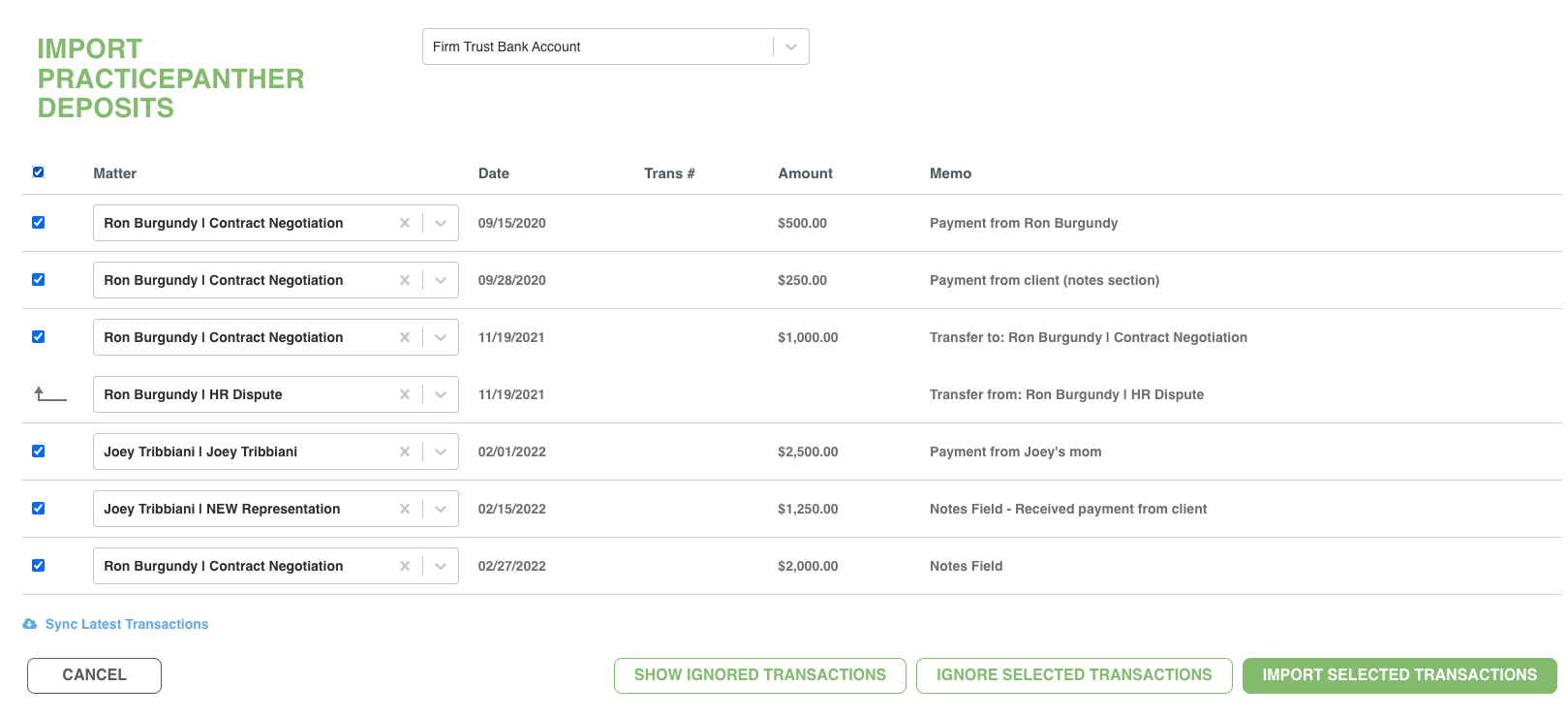

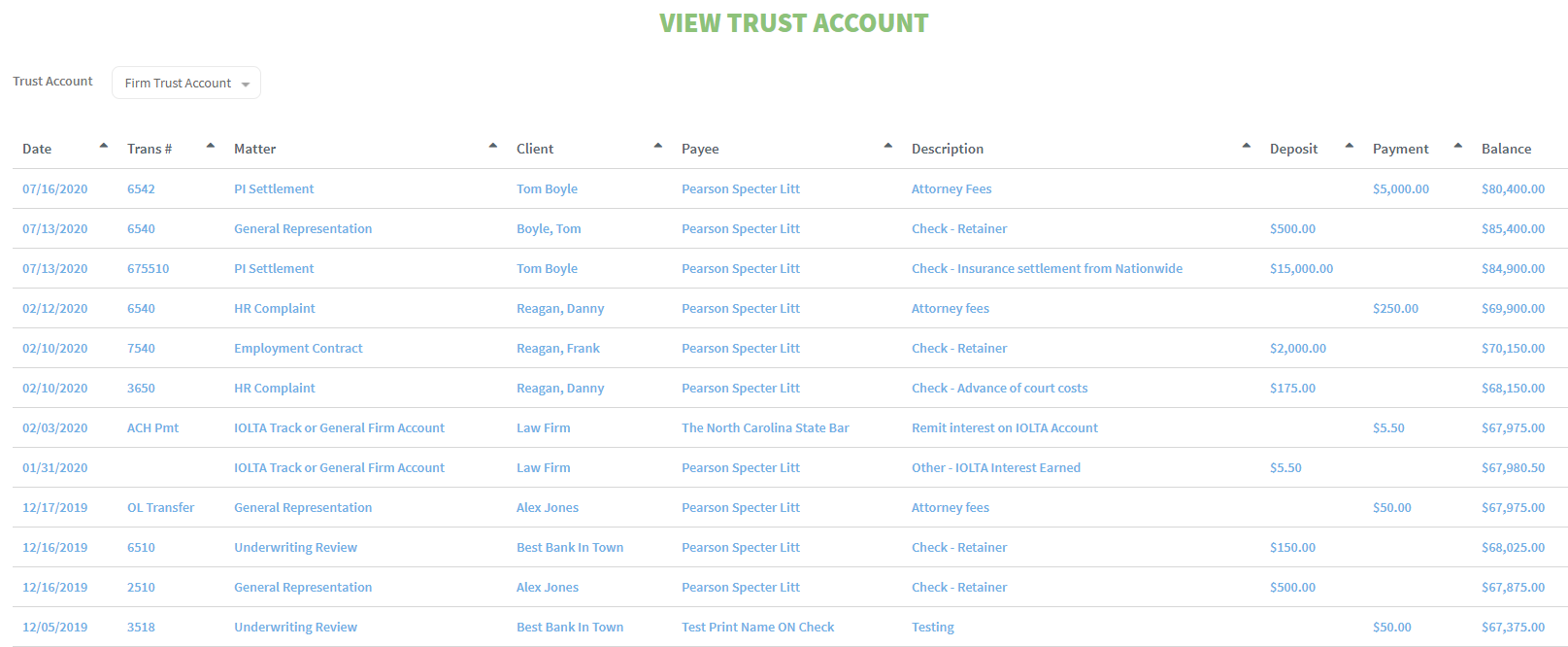

Florida Trust Accounting Software TrustBooks

Fiduciary (or trust) accounting and understanding the fiduciary duty are included in the practice guide to help cpas provide better. In california, trustees are required to provide trust accounting to beneficiaries in accordance with the california probate code. In california, a trustee is required to account to the beneficiaries as to the activities of the trust unless certain exceptions apply.

Trust Accounting Template California

Fiduciary (or trust) accounting and understanding the fiduciary duty are included in the practice guide to help cpas provide better. In california, a trustee is required to account to the beneficiaries as to the activities of the trust unless certain exceptions apply. In california, trustees are required to provide trust accounting to beneficiaries in accordance with the california probate code.

The Essential Trust Accounting Guide Trust Accounting Software

In california, a trustee is required to account to the beneficiaries as to the activities of the trust unless certain exceptions apply. In california, trustees are required to provide trust accounting to beneficiaries in accordance with the california probate code. Fiduciary (or trust) accounting and understanding the fiduciary duty are included in the practice guide to help cpas provide better.

Trust Accounting Excel Template California

In california, trustees are required to provide trust accounting to beneficiaries in accordance with the california probate code. Fiduciary (or trust) accounting and understanding the fiduciary duty are included in the practice guide to help cpas provide better. In california, a trustee is required to account to the beneficiaries as to the activities of the trust unless certain exceptions apply.

Trust Accounting Excel Template California

Fiduciary (or trust) accounting and understanding the fiduciary duty are included in the practice guide to help cpas provide better. In california, trustees are required to provide trust accounting to beneficiaries in accordance with the california probate code. In california, a trustee is required to account to the beneficiaries as to the activities of the trust unless certain exceptions apply.

Trust Accounting Excel Template prntbl.concejomunicipaldechinu.gov.co

Fiduciary (or trust) accounting and understanding the fiduciary duty are included in the practice guide to help cpas provide better. In california, trustees are required to provide trust accounting to beneficiaries in accordance with the california probate code. In california, a trustee is required to account to the beneficiaries as to the activities of the trust unless certain exceptions apply.

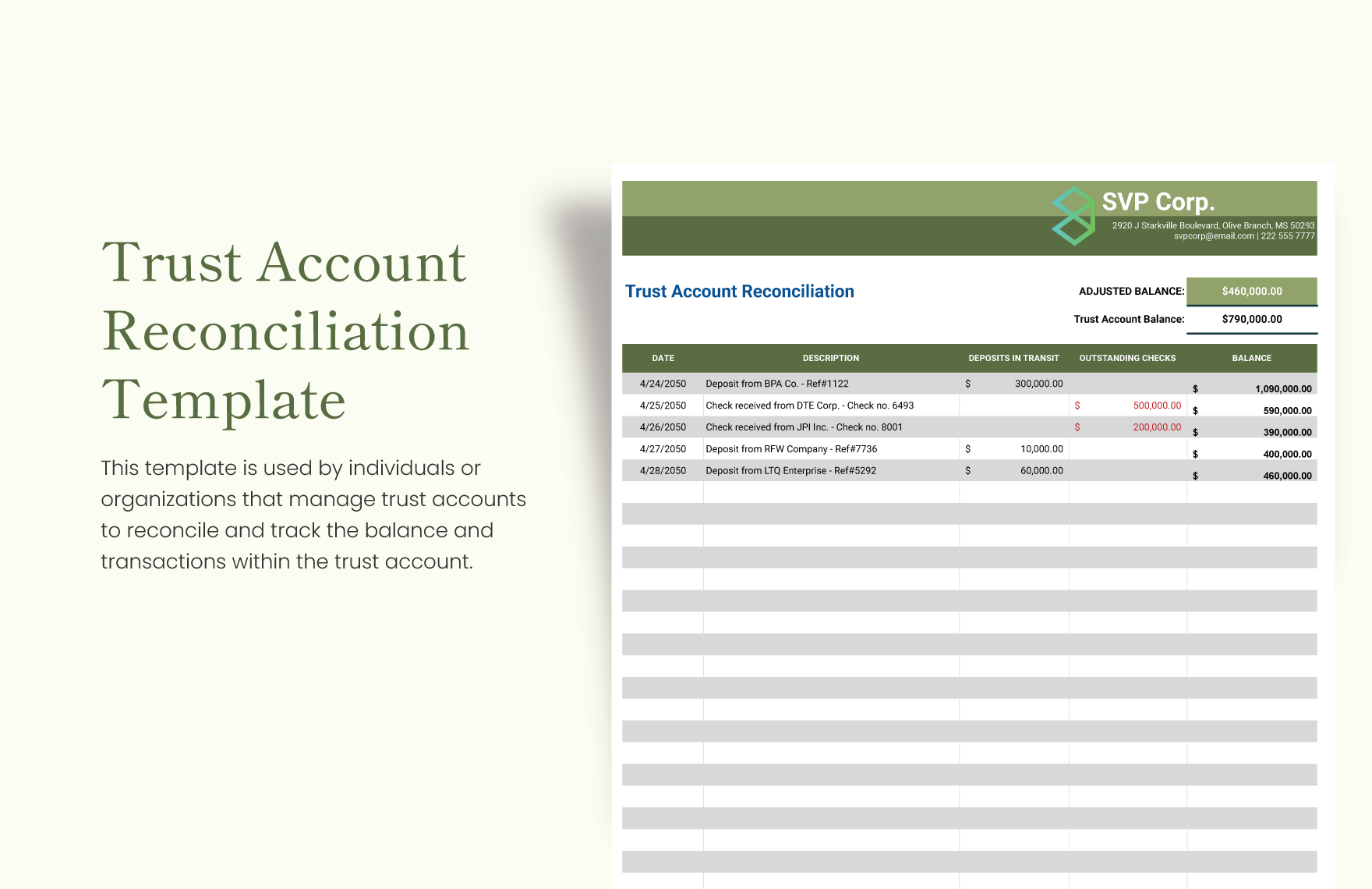

Trust Accounting Spreadsheet Template

Fiduciary (or trust) accounting and understanding the fiduciary duty are included in the practice guide to help cpas provide better. In california, a trustee is required to account to the beneficiaries as to the activities of the trust unless certain exceptions apply. In california, trustees are required to provide trust accounting to beneficiaries in accordance with the california probate code.

Fiduciary (Or Trust) Accounting And Understanding The Fiduciary Duty Are Included In The Practice Guide To Help Cpas Provide Better.

In california, trustees are required to provide trust accounting to beneficiaries in accordance with the california probate code. In california, a trustee is required to account to the beneficiaries as to the activities of the trust unless certain exceptions apply.