Tennessee Sales Tax Exemption Form - This application for exemption m ust be prepared and executed in triplicate by the dealer/seller and purchaser at the time of the sale of the motor v ehicle or trailer. Application for broadband infrastructure sales and use tax exemption; The original mus t be retained. Application for research and development machinery sales and use tax. If an organization qualifies as exempt from sales and use tax under tenn. To understand the scope of exemptions and reduced rates, the purchases that remain taxable, and how to effectively administer these tax provisions, click the link on the left.

This application for exemption m ust be prepared and executed in triplicate by the dealer/seller and purchaser at the time of the sale of the motor v ehicle or trailer. To understand the scope of exemptions and reduced rates, the purchases that remain taxable, and how to effectively administer these tax provisions, click the link on the left. Application for broadband infrastructure sales and use tax exemption; The original mus t be retained. If an organization qualifies as exempt from sales and use tax under tenn. Application for research and development machinery sales and use tax.

Application for broadband infrastructure sales and use tax exemption; To understand the scope of exemptions and reduced rates, the purchases that remain taxable, and how to effectively administer these tax provisions, click the link on the left. The original mus t be retained. Application for research and development machinery sales and use tax. If an organization qualifies as exempt from sales and use tax under tenn. This application for exemption m ust be prepared and executed in triplicate by the dealer/seller and purchaser at the time of the sale of the motor v ehicle or trailer.

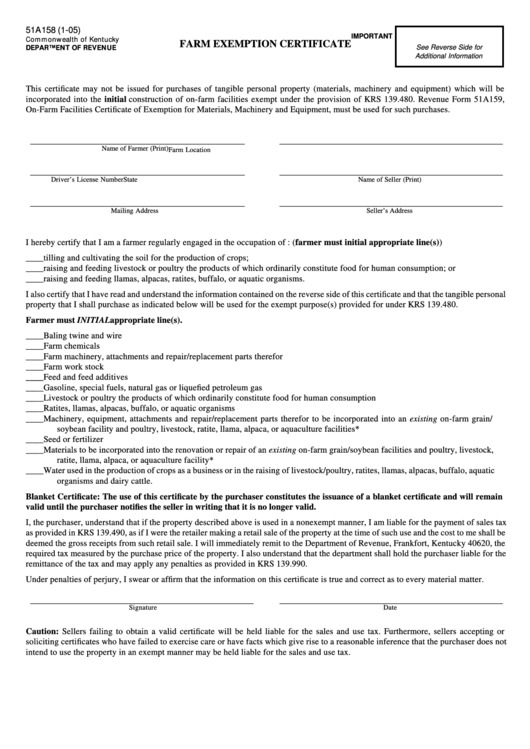

Kentucky Sales Tax Farm Exemption Form Fill Online Printable

If an organization qualifies as exempt from sales and use tax under tenn. This application for exemption m ust be prepared and executed in triplicate by the dealer/seller and purchaser at the time of the sale of the motor v ehicle or trailer. To understand the scope of exemptions and reduced rates, the purchases that remain taxable, and how to.

Tennessee State Tax Withholding Form

This application for exemption m ust be prepared and executed in triplicate by the dealer/seller and purchaser at the time of the sale of the motor v ehicle or trailer. If an organization qualifies as exempt from sales and use tax under tenn. Application for broadband infrastructure sales and use tax exemption; Application for research and development machinery sales and.

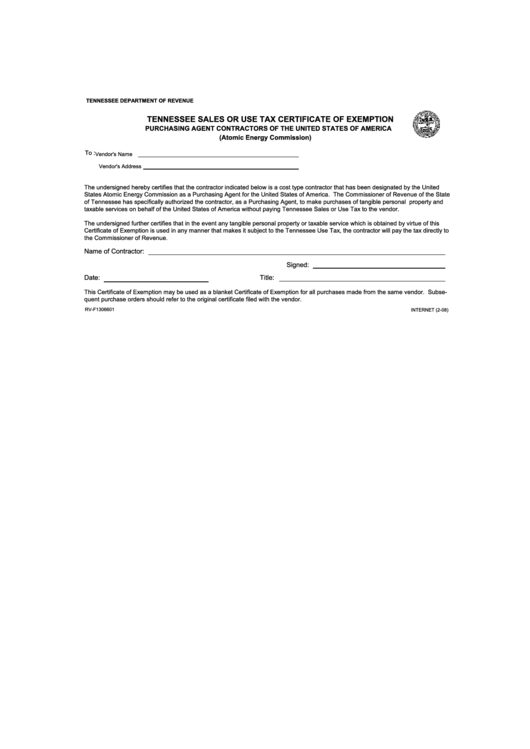

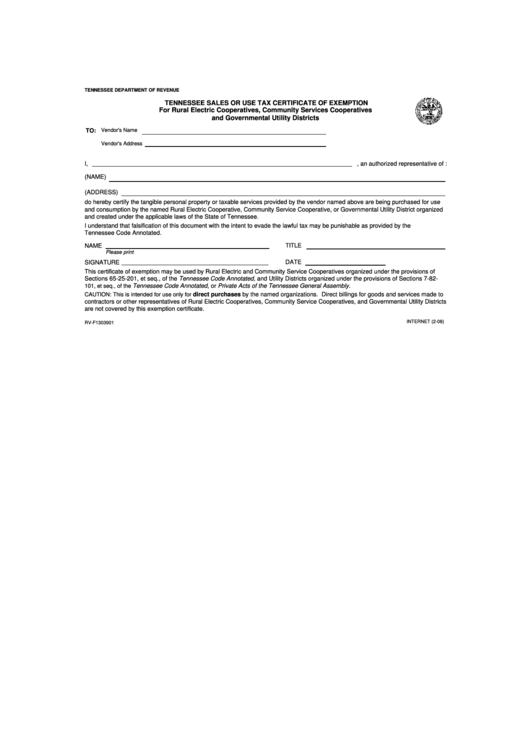

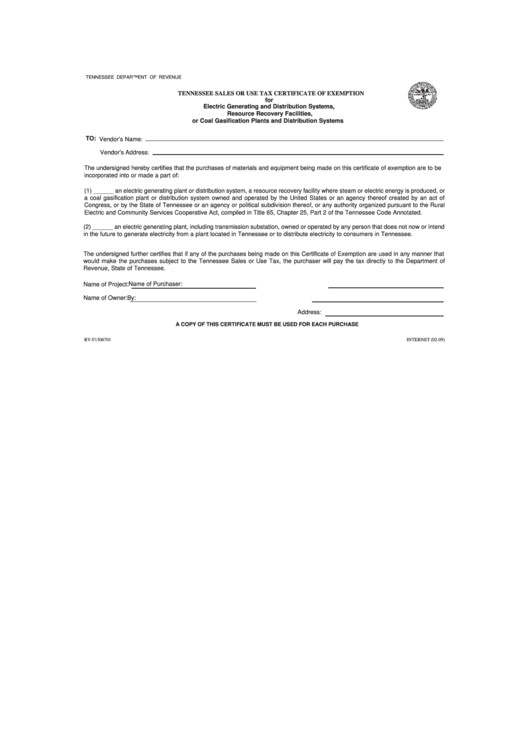

Form RvF1303901 Tennessee Sales Or Use Tax Certificate Of Exemption

This application for exemption m ust be prepared and executed in triplicate by the dealer/seller and purchaser at the time of the sale of the motor v ehicle or trailer. Application for broadband infrastructure sales and use tax exemption; If an organization qualifies as exempt from sales and use tax under tenn. To understand the scope of exemptions and reduced.

Tennessee Tax Clearance Certificate prntbl.concejomunicipaldechinu.gov.co

Application for research and development machinery sales and use tax. This application for exemption m ust be prepared and executed in triplicate by the dealer/seller and purchaser at the time of the sale of the motor v ehicle or trailer. The original mus t be retained. To understand the scope of exemptions and reduced rates, the purchases that remain taxable,.

Tn Exemption Form ≡ Fill Out Printable PDF Forms Online

To understand the scope of exemptions and reduced rates, the purchases that remain taxable, and how to effectively administer these tax provisions, click the link on the left. This application for exemption m ust be prepared and executed in triplicate by the dealer/seller and purchaser at the time of the sale of the motor v ehicle or trailer. Application for.

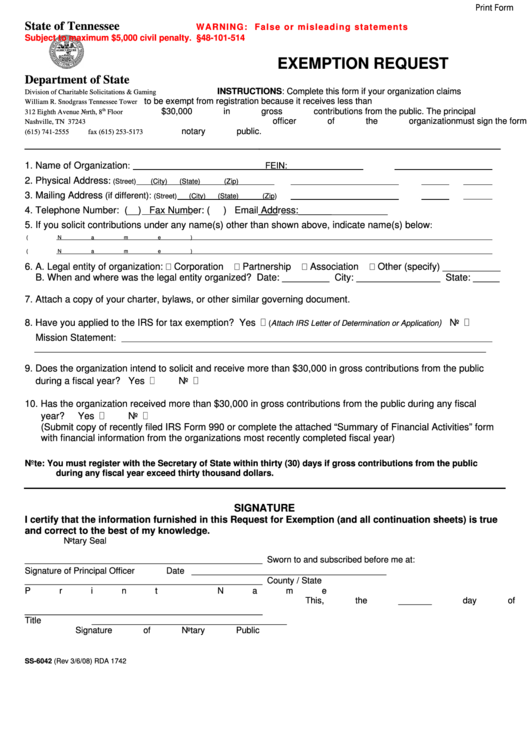

Fillable Exemption Request Form State Of Tennessee printable pdf download

Application for broadband infrastructure sales and use tax exemption; To understand the scope of exemptions and reduced rates, the purchases that remain taxable, and how to effectively administer these tax provisions, click the link on the left. The original mus t be retained. If an organization qualifies as exempt from sales and use tax under tenn. Application for research and.

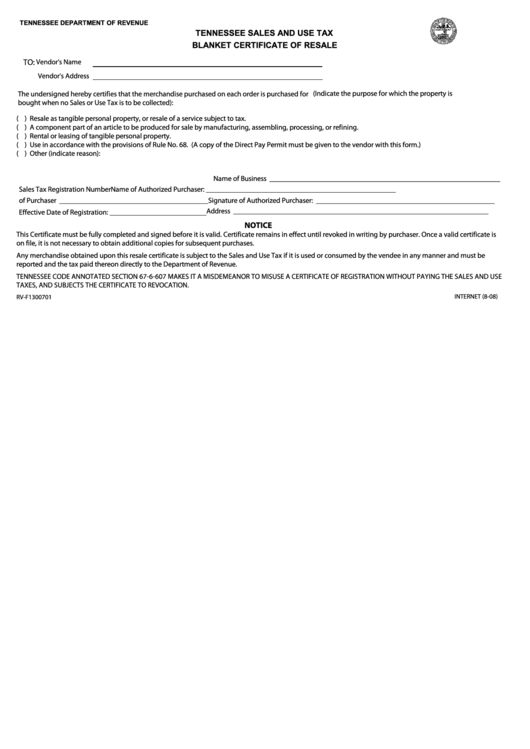

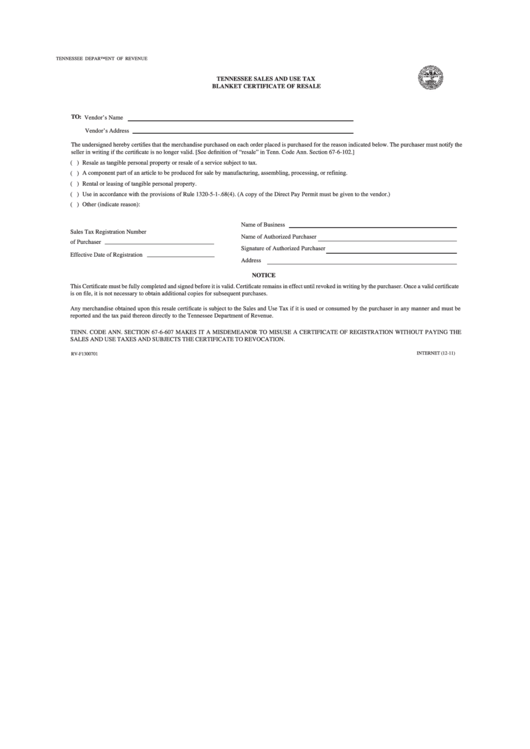

Form RvF1300701 Tennessee Sales And Use Tax Blanket Certificate Of

Application for broadband infrastructure sales and use tax exemption; To understand the scope of exemptions and reduced rates, the purchases that remain taxable, and how to effectively administer these tax provisions, click the link on the left. Application for research and development machinery sales and use tax. The original mus t be retained. This application for exemption m ust be.

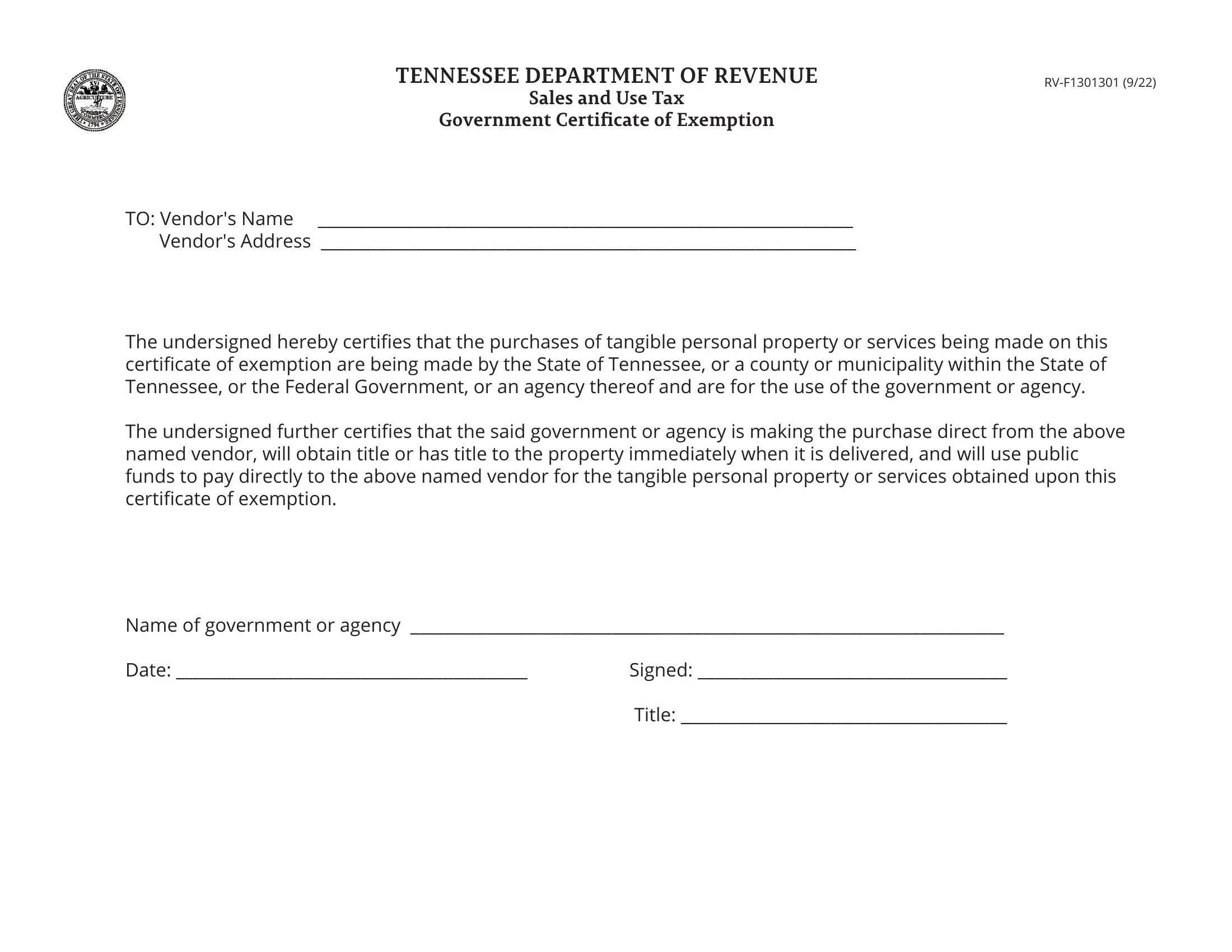

20222024 Form TN RVF1301301 Fill Online, Printable, Fillable, Blank

To understand the scope of exemptions and reduced rates, the purchases that remain taxable, and how to effectively administer these tax provisions, click the link on the left. Application for research and development machinery sales and use tax. If an organization qualifies as exempt from sales and use tax under tenn. Application for broadband infrastructure sales and use tax exemption;.

Tax exemption form Fill out & sign online DocHub

The original mus t be retained. If an organization qualifies as exempt from sales and use tax under tenn. To understand the scope of exemptions and reduced rates, the purchases that remain taxable, and how to effectively administer these tax provisions, click the link on the left. This application for exemption m ust be prepared and executed in triplicate by.

Form RvF1306701 Tennessee Sales Or Use Tax Certificate Of Exemption

To understand the scope of exemptions and reduced rates, the purchases that remain taxable, and how to effectively administer these tax provisions, click the link on the left. The original mus t be retained. This application for exemption m ust be prepared and executed in triplicate by the dealer/seller and purchaser at the time of the sale of the motor.

Application For Research And Development Machinery Sales And Use Tax.

This application for exemption m ust be prepared and executed in triplicate by the dealer/seller and purchaser at the time of the sale of the motor v ehicle or trailer. To understand the scope of exemptions and reduced rates, the purchases that remain taxable, and how to effectively administer these tax provisions, click the link on the left. If an organization qualifies as exempt from sales and use tax under tenn. The original mus t be retained.