Taxation In Italy Wikipedia - This guide will break down. Personal income taxation in italy is progressive. 232 rows the list focuses on the main types of taxes: Taxation in italy is levied by the central and regional governments and is collected by the. Corporate tax, individual income tax, and sales tax, including vat and gst and capital. Italy has a complex tax structure that funds its public services and maintains the italian economy. Taxation in italy is levied by the central and regional governments and is collected by the italian agency of revenue (agenzia delle.

232 rows the list focuses on the main types of taxes: Italy has a complex tax structure that funds its public services and maintains the italian economy. Taxation in italy is levied by the central and regional governments and is collected by the italian agency of revenue (agenzia delle. Personal income taxation in italy is progressive. Corporate tax, individual income tax, and sales tax, including vat and gst and capital. This guide will break down. Taxation in italy is levied by the central and regional governments and is collected by the.

Personal income taxation in italy is progressive. Taxation in italy is levied by the central and regional governments and is collected by the italian agency of revenue (agenzia delle. Italy has a complex tax structure that funds its public services and maintains the italian economy. 232 rows the list focuses on the main types of taxes: Corporate tax, individual income tax, and sales tax, including vat and gst and capital. This guide will break down. Taxation in italy is levied by the central and regional governments and is collected by the.

Taxation in Italy YouTube

Personal income taxation in italy is progressive. Italy has a complex tax structure that funds its public services and maintains the italian economy. 232 rows the list focuses on the main types of taxes: Taxation in italy is levied by the central and regional governments and is collected by the. This guide will break down.

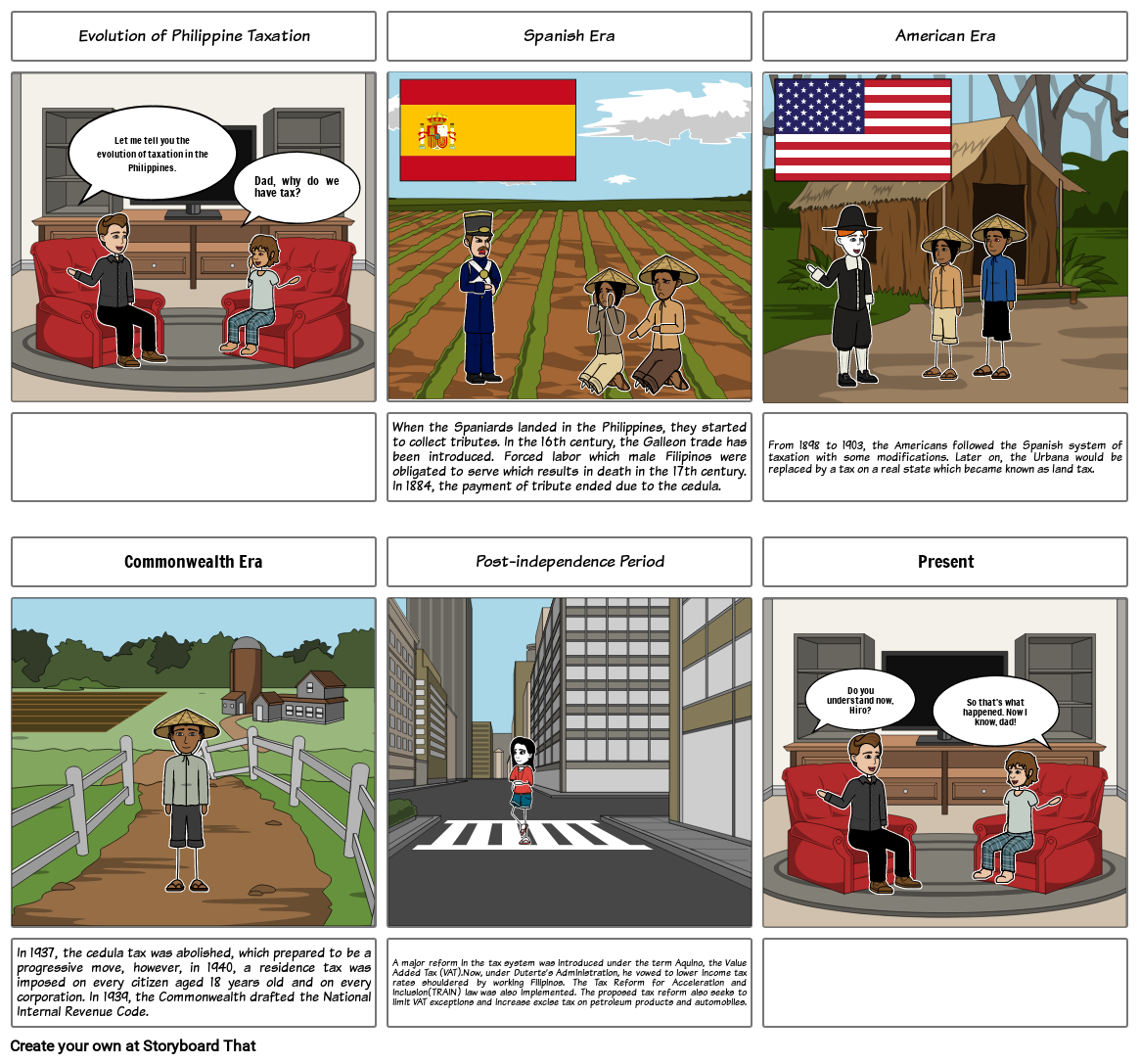

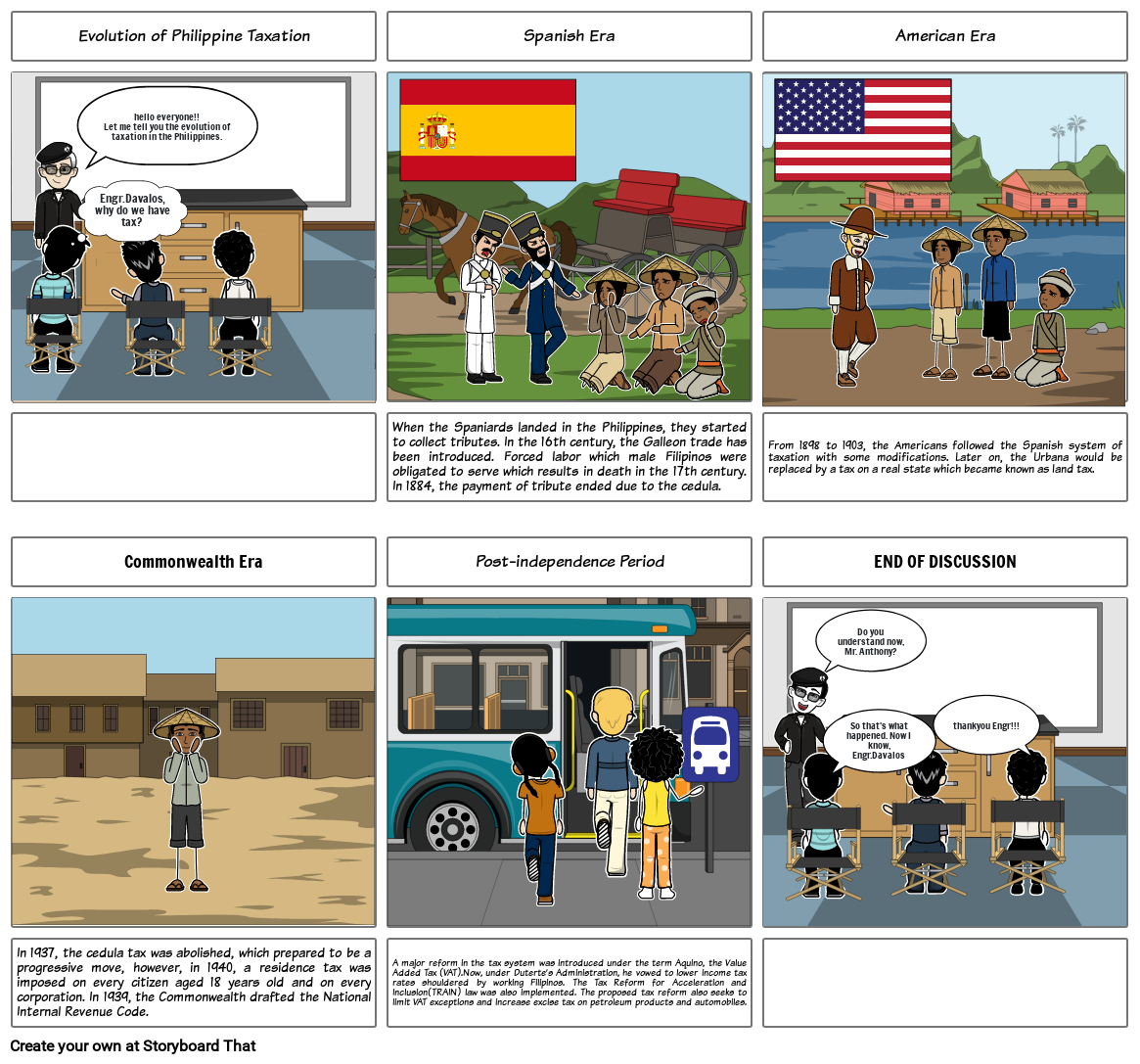

EVOLUTION OF PHILIPPINE TAXATION Storyboard by 0cee0e49

Personal income taxation in italy is progressive. Taxation in italy is levied by the central and regional governments and is collected by the. This guide will break down. Taxation in italy is levied by the central and regional governments and is collected by the italian agency of revenue (agenzia delle. 232 rows the list focuses on the main types of.

Morning view of Li Cossi beach, summer scene of Costa Paradiso

This guide will break down. Personal income taxation in italy is progressive. Corporate tax, individual income tax, and sales tax, including vat and gst and capital. Taxation in italy is levied by the central and regional governments and is collected by the italian agency of revenue (agenzia delle. 232 rows the list focuses on the main types of taxes:

Crypto taxation alternatives to Italy to pay less tax

232 rows the list focuses on the main types of taxes: Italy has a complex tax structure that funds its public services and maintains the italian economy. Personal income taxation in italy is progressive. Corporate tax, individual income tax, and sales tax, including vat and gst and capital. This guide will break down.

HOW TO MANAGE YOUR ITALIAN TAXES FOR THE FIRST TIME CHOOSE YOUR

Corporate tax, individual income tax, and sales tax, including vat and gst and capital. Personal income taxation in italy is progressive. 232 rows the list focuses on the main types of taxes: Italy has a complex tax structure that funds its public services and maintains the italian economy. This guide will break down.

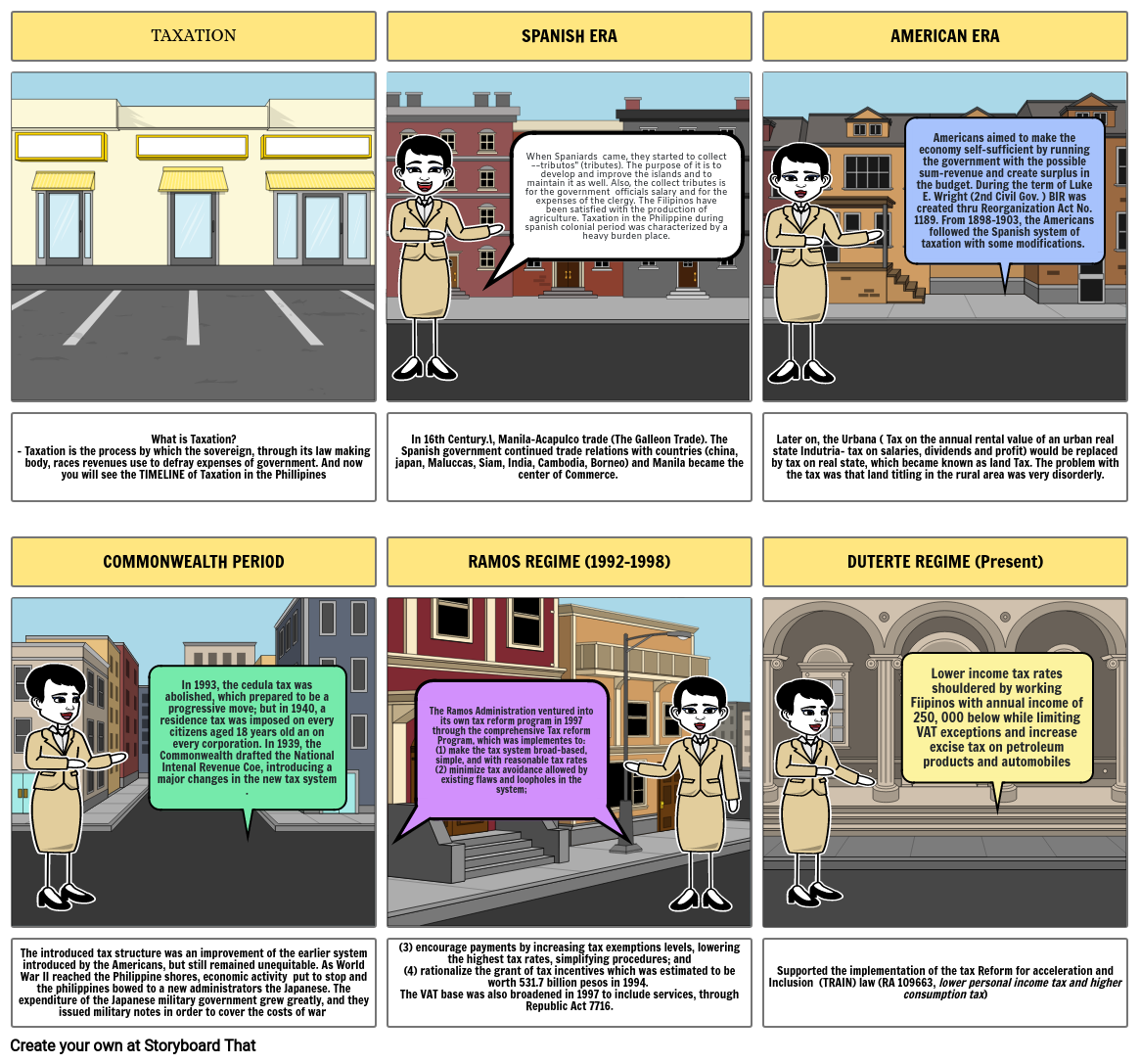

evolution of taxation storyboard by abreil Storyboard

Corporate tax, individual income tax, and sales tax, including vat and gst and capital. Taxation in italy is levied by the central and regional governments and is collected by the. Italy has a complex tax structure that funds its public services and maintains the italian economy. Taxation in italy is levied by the central and regional governments and is collected.

Reform of international taxation in Italy Taxand

232 rows the list focuses on the main types of taxes: Taxation in italy is levied by the central and regional governments and is collected by the. Taxation in italy is levied by the central and regional governments and is collected by the italian agency of revenue (agenzia delle. This guide will break down. Italy has a complex tax structure.

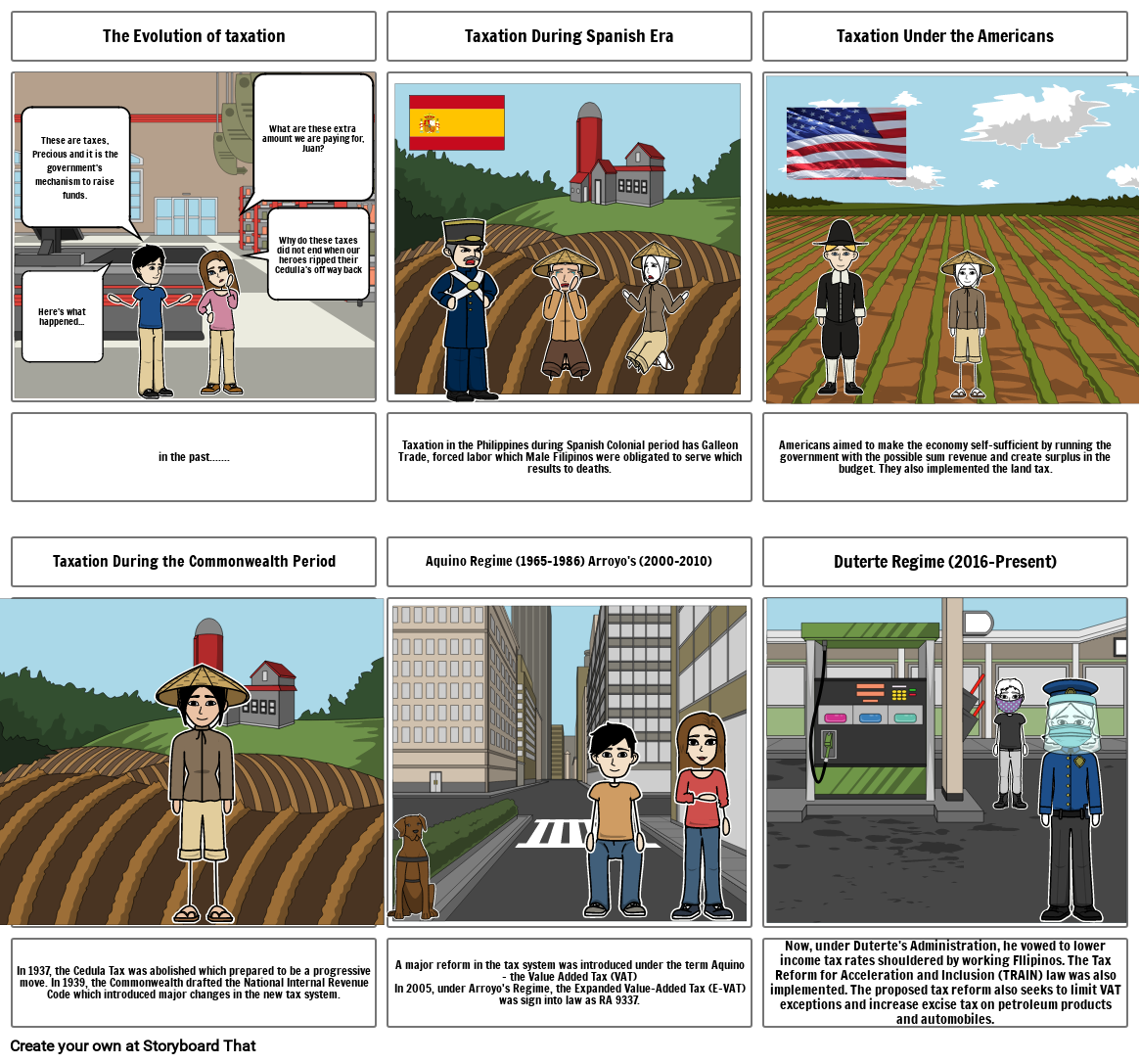

history of taxation Storyboard by 87c03591

Taxation in italy is levied by the central and regional governments and is collected by the. Italy has a complex tax structure that funds its public services and maintains the italian economy. This guide will break down. 232 rows the list focuses on the main types of taxes: Corporate tax, individual income tax, and sales tax, including vat and gst.

Evolution of Philippine Taxation Storyboard by 5890319d

This guide will break down. 232 rows the list focuses on the main types of taxes: Corporate tax, individual income tax, and sales tax, including vat and gst and capital. Taxation in italy is levied by the central and regional governments and is collected by the. Italy has a complex tax structure that funds its public services and maintains the.

SIMPLE TAX GUIDE FOR FOREIGNERS IN ITALY Migrants Digest

Taxation in italy is levied by the central and regional governments and is collected by the italian agency of revenue (agenzia delle. Taxation in italy is levied by the central and regional governments and is collected by the. Italy has a complex tax structure that funds its public services and maintains the italian economy. Corporate tax, individual income tax, and.

Corporate Tax, Individual Income Tax, And Sales Tax, Including Vat And Gst And Capital.

232 rows the list focuses on the main types of taxes: Taxation in italy is levied by the central and regional governments and is collected by the italian agency of revenue (agenzia delle. Personal income taxation in italy is progressive. Italy has a complex tax structure that funds its public services and maintains the italian economy.

This Guide Will Break Down.

Taxation in italy is levied by the central and regional governments and is collected by the.