Tax Resident Malaysia - It determines how much tax you need to pay and. The malaysian tax system generally determines tax residency based on the physical presence of an individual in malaysia for 182. An individual is regarded as tax resident if he meets any of the following conditions, i.e. Tax residence status of individuals. Understanding your tax residency status is crucial when it comes to taxation in malaysia.

It determines how much tax you need to pay and. An individual is regarded as tax resident if he meets any of the following conditions, i.e. Understanding your tax residency status is crucial when it comes to taxation in malaysia. The malaysian tax system generally determines tax residency based on the physical presence of an individual in malaysia for 182. Tax residence status of individuals.

The malaysian tax system generally determines tax residency based on the physical presence of an individual in malaysia for 182. Understanding your tax residency status is crucial when it comes to taxation in malaysia. Tax residence status of individuals. It determines how much tax you need to pay and. An individual is regarded as tax resident if he meets any of the following conditions, i.e.

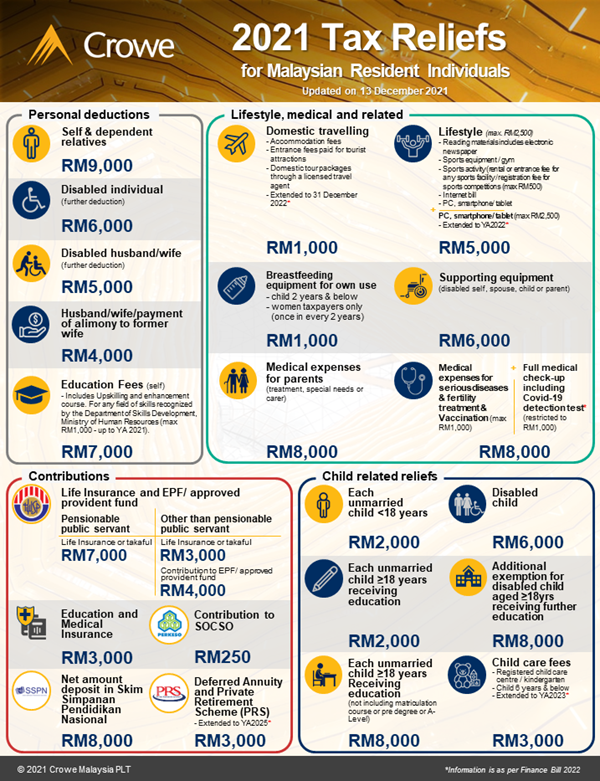

Infographic of 2021 Tax Reliefs for Malaysian Resident Individuals

Understanding your tax residency status is crucial when it comes to taxation in malaysia. Tax residence status of individuals. An individual is regarded as tax resident if he meets any of the following conditions, i.e. It determines how much tax you need to pay and. The malaysian tax system generally determines tax residency based on the physical presence of an.

Tax Planning Strategies Dignity Consultant

Tax residence status of individuals. Understanding your tax residency status is crucial when it comes to taxation in malaysia. An individual is regarded as tax resident if he meets any of the following conditions, i.e. The malaysian tax system generally determines tax residency based on the physical presence of an individual in malaysia for 182. It determines how much tax.

Malaysia Personal Tax Guide 2017

An individual is regarded as tax resident if he meets any of the following conditions, i.e. The malaysian tax system generally determines tax residency based on the physical presence of an individual in malaysia for 182. Understanding your tax residency status is crucial when it comes to taxation in malaysia. It determines how much tax you need to pay and..

Tax 2022 Table Malaysia Latest News Update

It determines how much tax you need to pay and. The malaysian tax system generally determines tax residency based on the physical presence of an individual in malaysia for 182. An individual is regarded as tax resident if he meets any of the following conditions, i.e. Tax residence status of individuals. Understanding your tax residency status is crucial when it.

What are the criteria for an individual to a tax resident in

The malaysian tax system generally determines tax residency based on the physical presence of an individual in malaysia for 182. Understanding your tax residency status is crucial when it comes to taxation in malaysia. It determines how much tax you need to pay and. Tax residence status of individuals. An individual is regarded as tax resident if he meets any.

7 Tips to File Malaysian Tax For Beginners Swingvy Malaysia

It determines how much tax you need to pay and. An individual is regarded as tax resident if he meets any of the following conditions, i.e. Tax residence status of individuals. Understanding your tax residency status is crucial when it comes to taxation in malaysia. The malaysian tax system generally determines tax residency based on the physical presence of an.

Tax Resident status in Malaysia Read On

Tax residence status of individuals. The malaysian tax system generally determines tax residency based on the physical presence of an individual in malaysia for 182. It determines how much tax you need to pay and. An individual is regarded as tax resident if he meets any of the following conditions, i.e. Understanding your tax residency status is crucial when it.

How to be a Tax Resident in Malaysia ANC Group

Understanding your tax residency status is crucial when it comes to taxation in malaysia. The malaysian tax system generally determines tax residency based on the physical presence of an individual in malaysia for 182. It determines how much tax you need to pay and. Tax residence status of individuals. An individual is regarded as tax resident if he meets any.

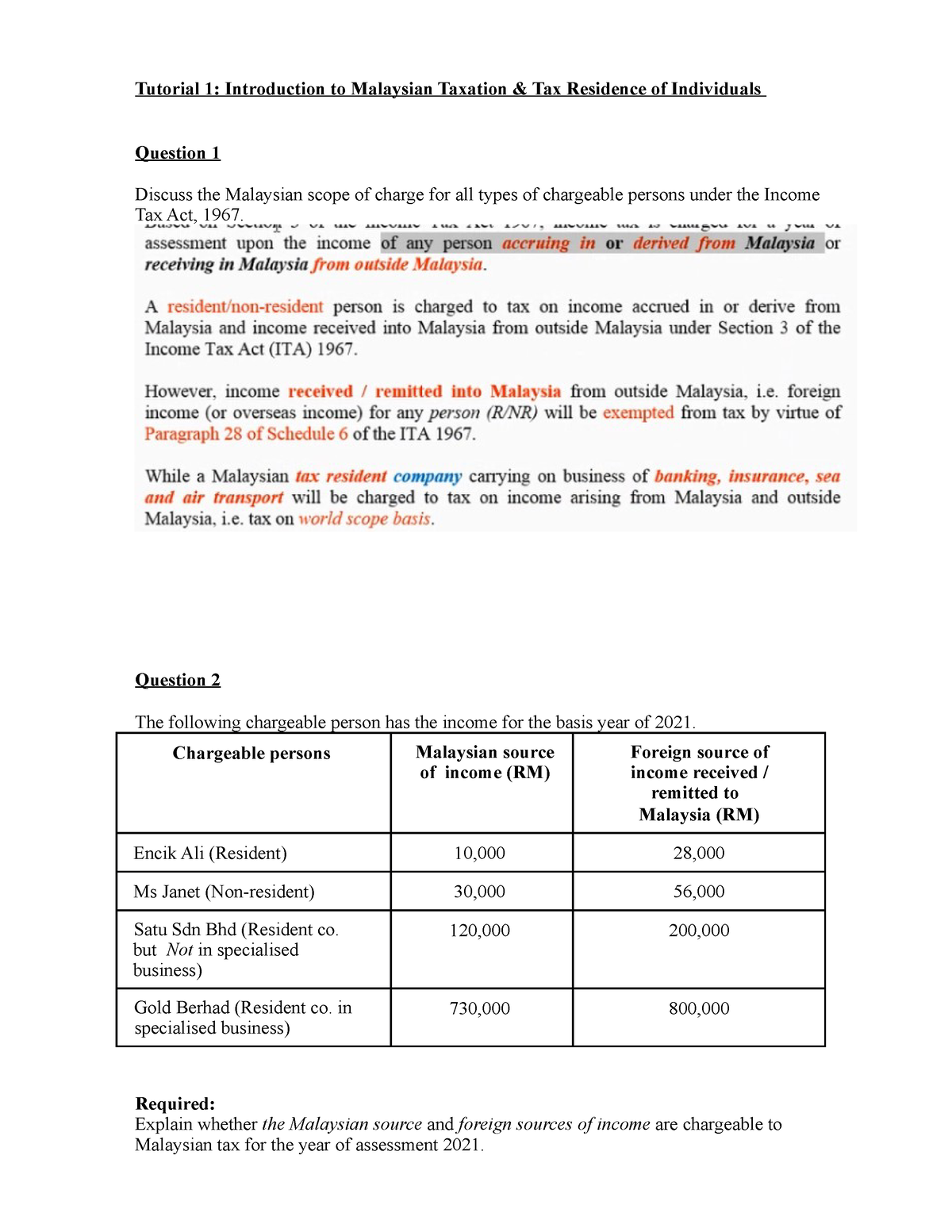

Tutorial 1 Introduction and Resident status Tutorial 1 Introduction

An individual is regarded as tax resident if he meets any of the following conditions, i.e. The malaysian tax system generally determines tax residency based on the physical presence of an individual in malaysia for 182. Tax residence status of individuals. It determines how much tax you need to pay and. Understanding your tax residency status is crucial when it.

How to be a Tax Resident in Malaysia ANC Group

Understanding your tax residency status is crucial when it comes to taxation in malaysia. It determines how much tax you need to pay and. An individual is regarded as tax resident if he meets any of the following conditions, i.e. Tax residence status of individuals. The malaysian tax system generally determines tax residency based on the physical presence of an.

Understanding Your Tax Residency Status Is Crucial When It Comes To Taxation In Malaysia.

The malaysian tax system generally determines tax residency based on the physical presence of an individual in malaysia for 182. Tax residence status of individuals. It determines how much tax you need to pay and. An individual is regarded as tax resident if he meets any of the following conditions, i.e.