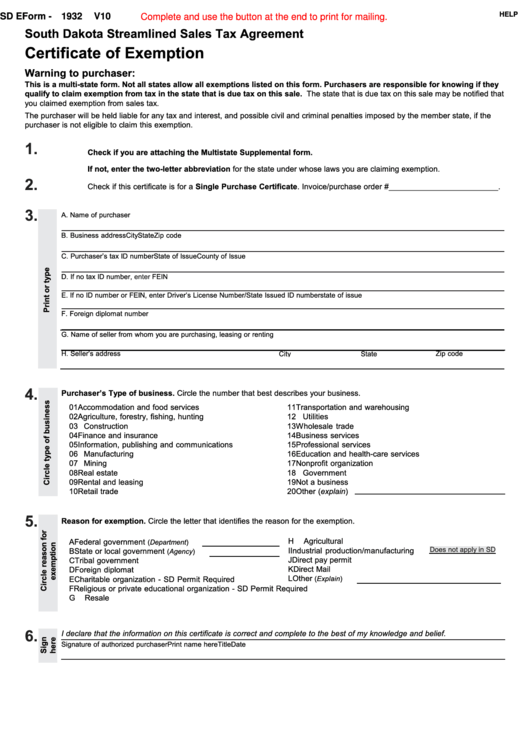

Sd Sales Tax Exemption Form - To be exempt from sales and use tax, a private educational institution must: Find the exemption certificate, the law, and the contact. Learn how to apply for sales tax exemption for governmental entities in south dakota. Be an institution currently recognized as exempt under section. Use this form to claim exemption from sales tax on purchases of otherwise taxable items in south dakota or other member states. South dakota streamlined sales tax agreement certificate of exemption warning to purchaser:

Learn how to apply for sales tax exemption for governmental entities in south dakota. Find the exemption certificate, the law, and the contact. Use this form to claim exemption from sales tax on purchases of otherwise taxable items in south dakota or other member states. South dakota streamlined sales tax agreement certificate of exemption warning to purchaser: To be exempt from sales and use tax, a private educational institution must: Be an institution currently recognized as exempt under section.

To be exempt from sales and use tax, a private educational institution must: Use this form to claim exemption from sales tax on purchases of otherwise taxable items in south dakota or other member states. South dakota streamlined sales tax agreement certificate of exemption warning to purchaser: Be an institution currently recognized as exempt under section. Learn how to apply for sales tax exemption for governmental entities in south dakota. Find the exemption certificate, the law, and the contact.

Sd Eform 1932 V10 South Dakota Streamlined Sales Tax Agreement

Learn how to apply for sales tax exemption for governmental entities in south dakota. South dakota streamlined sales tax agreement certificate of exemption warning to purchaser: Find the exemption certificate, the law, and the contact. Use this form to claim exemption from sales tax on purchases of otherwise taxable items in south dakota or other member states. Be an institution.

Louisiana sales tax exemption form pdf Fill out & sign online DocHub

Be an institution currently recognized as exempt under section. Find the exemption certificate, the law, and the contact. To be exempt from sales and use tax, a private educational institution must: Use this form to claim exemption from sales tax on purchases of otherwise taxable items in south dakota or other member states. South dakota streamlined sales tax agreement certificate.

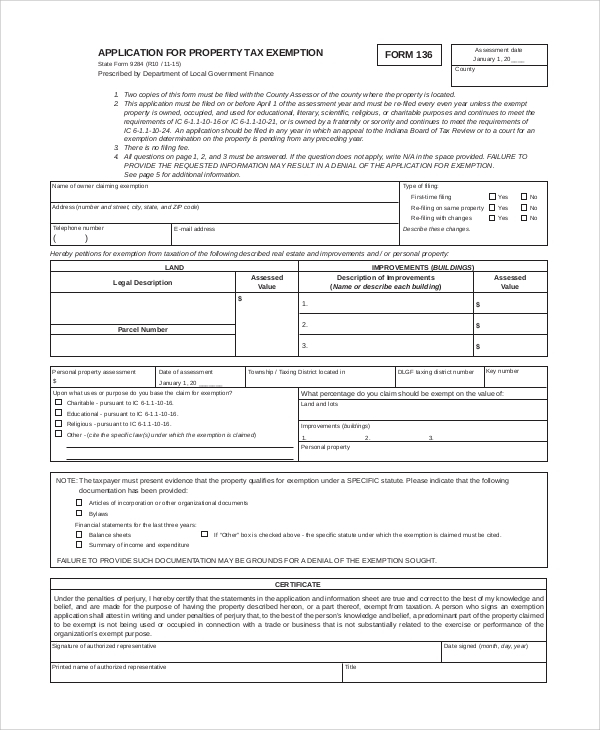

What Is A Tax Exemption Form

Be an institution currently recognized as exempt under section. Use this form to claim exemption from sales tax on purchases of otherwise taxable items in south dakota or other member states. Find the exemption certificate, the law, and the contact. Learn how to apply for sales tax exemption for governmental entities in south dakota. South dakota streamlined sales tax agreement.

Blanket Certificate Of Exemption Form Fill Online, Printable

Find the exemption certificate, the law, and the contact. To be exempt from sales and use tax, a private educational institution must: Use this form to claim exemption from sales tax on purchases of otherwise taxable items in south dakota or other member states. Be an institution currently recognized as exempt under section. Learn how to apply for sales tax.

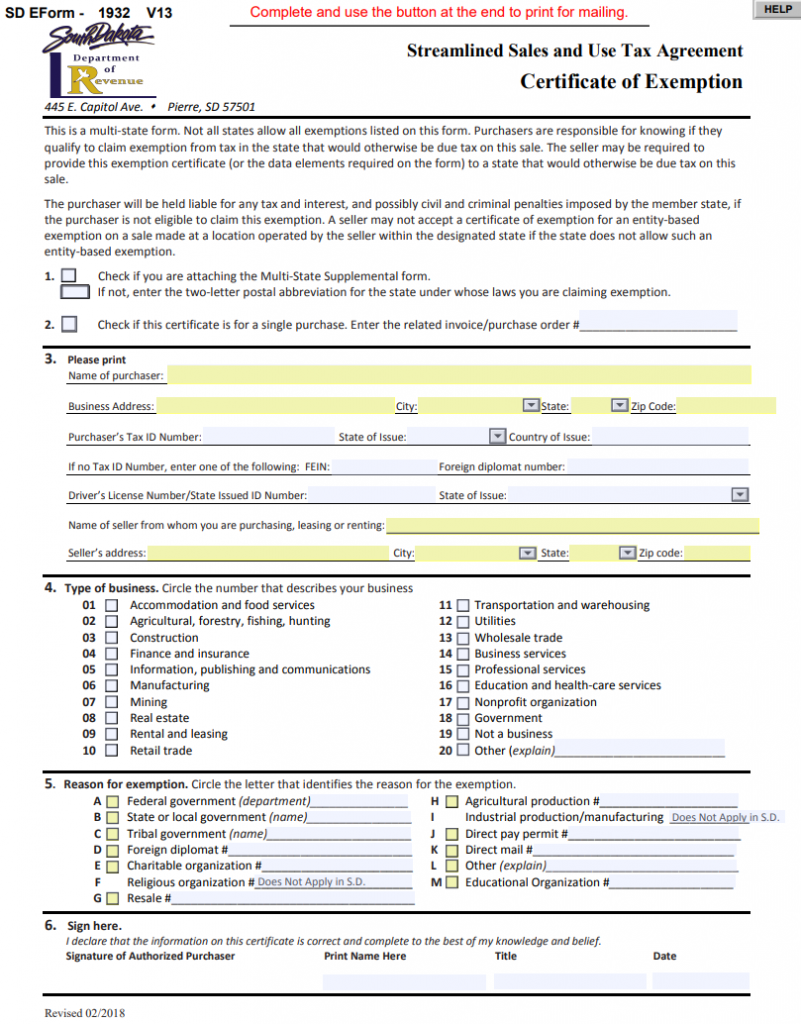

2009 Form SD Streamlined Sales and Use Tax Certificate of Exemption

South dakota streamlined sales tax agreement certificate of exemption warning to purchaser: Learn how to apply for sales tax exemption for governmental entities in south dakota. Use this form to claim exemption from sales tax on purchases of otherwise taxable items in south dakota or other member states. Find the exemption certificate, the law, and the contact. Be an institution.

State Of Tn Sales Tax Exemption Form

Use this form to claim exemption from sales tax on purchases of otherwise taxable items in south dakota or other member states. Find the exemption certificate, the law, and the contact. South dakota streamlined sales tax agreement certificate of exemption warning to purchaser: Learn how to apply for sales tax exemption for governmental entities in south dakota. Be an institution.

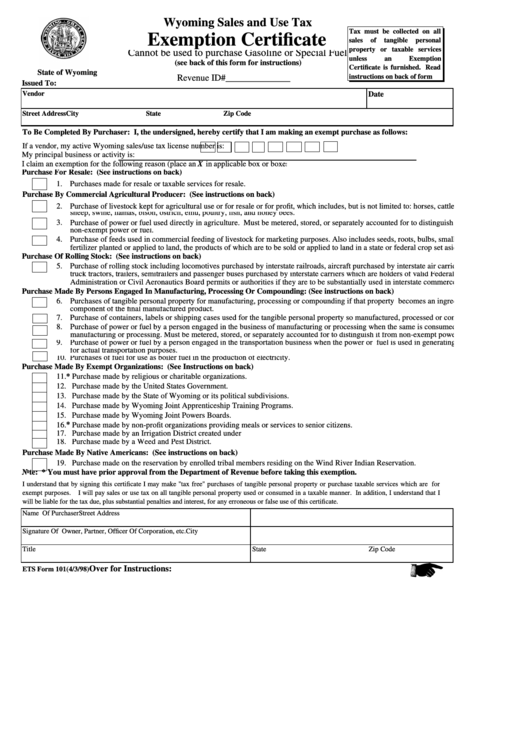

Wyoming Sales Tax Exemption Certificate Ets Form 101

South dakota streamlined sales tax agreement certificate of exemption warning to purchaser: Find the exemption certificate, the law, and the contact. To be exempt from sales and use tax, a private educational institution must: Use this form to claim exemption from sales tax on purchases of otherwise taxable items in south dakota or other member states. Be an institution currently.

Sd Certificate Of Exemption For Sales Tax

Learn how to apply for sales tax exemption for governmental entities in south dakota. South dakota streamlined sales tax agreement certificate of exemption warning to purchaser: To be exempt from sales and use tax, a private educational institution must: Use this form to claim exemption from sales tax on purchases of otherwise taxable items in south dakota or other member.

Sd Certificate Of Exemption For Sales Tax

Use this form to claim exemption from sales tax on purchases of otherwise taxable items in south dakota or other member states. South dakota streamlined sales tax agreement certificate of exemption warning to purchaser: Find the exemption certificate, the law, and the contact. Be an institution currently recognized as exempt under section. To be exempt from sales and use tax,.

North Dakota Sales Tax Exempt Form

Be an institution currently recognized as exempt under section. Learn how to apply for sales tax exemption for governmental entities in south dakota. Use this form to claim exemption from sales tax on purchases of otherwise taxable items in south dakota or other member states. Find the exemption certificate, the law, and the contact. South dakota streamlined sales tax agreement.

South Dakota Streamlined Sales Tax Agreement Certificate Of Exemption Warning To Purchaser:

Find the exemption certificate, the law, and the contact. Use this form to claim exemption from sales tax on purchases of otherwise taxable items in south dakota or other member states. Be an institution currently recognized as exempt under section. To be exempt from sales and use tax, a private educational institution must: