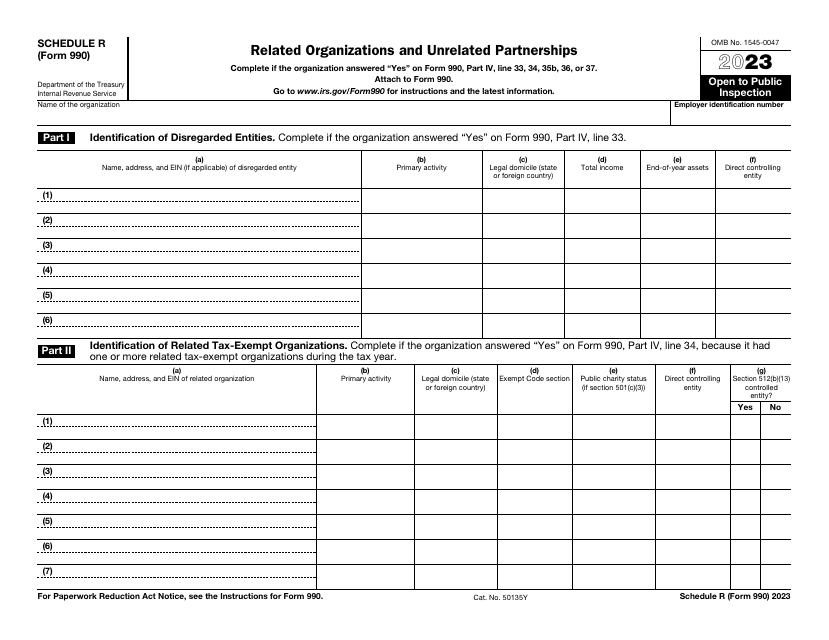

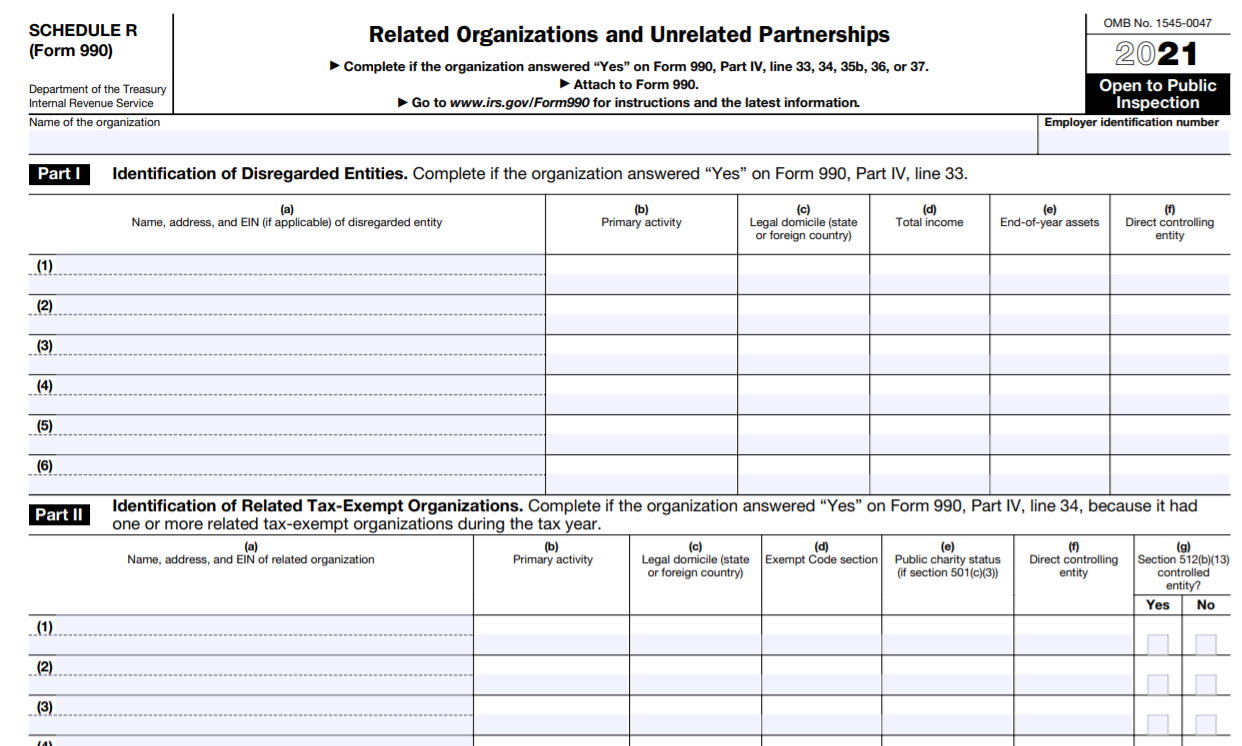

Schedule R Instructions Form 990 - Report each type of transaction for which you had $50,000 or more with a particular controlled entity during the fiscal year you’re. Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions. Schedule r is filed by the organization with form 990 to report information on related organizations and transactions made. Nonresident alien income tax return : This document provides guidelines for completing schedule r of form 990, detailing related organizations and unrelated partnerships. Instruction 990 (schedule r) instructions for.

Instruction 990 (schedule r) instructions for. This document provides guidelines for completing schedule r of form 990, detailing related organizations and unrelated partnerships. Report each type of transaction for which you had $50,000 or more with a particular controlled entity during the fiscal year you’re. Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions. Schedule r is filed by the organization with form 990 to report information on related organizations and transactions made. Nonresident alien income tax return :

Nonresident alien income tax return : Schedule r is filed by the organization with form 990 to report information on related organizations and transactions made. Instruction 990 (schedule r) instructions for. Report each type of transaction for which you had $50,000 or more with a particular controlled entity during the fiscal year you’re. Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions. This document provides guidelines for completing schedule r of form 990, detailing related organizations and unrelated partnerships.

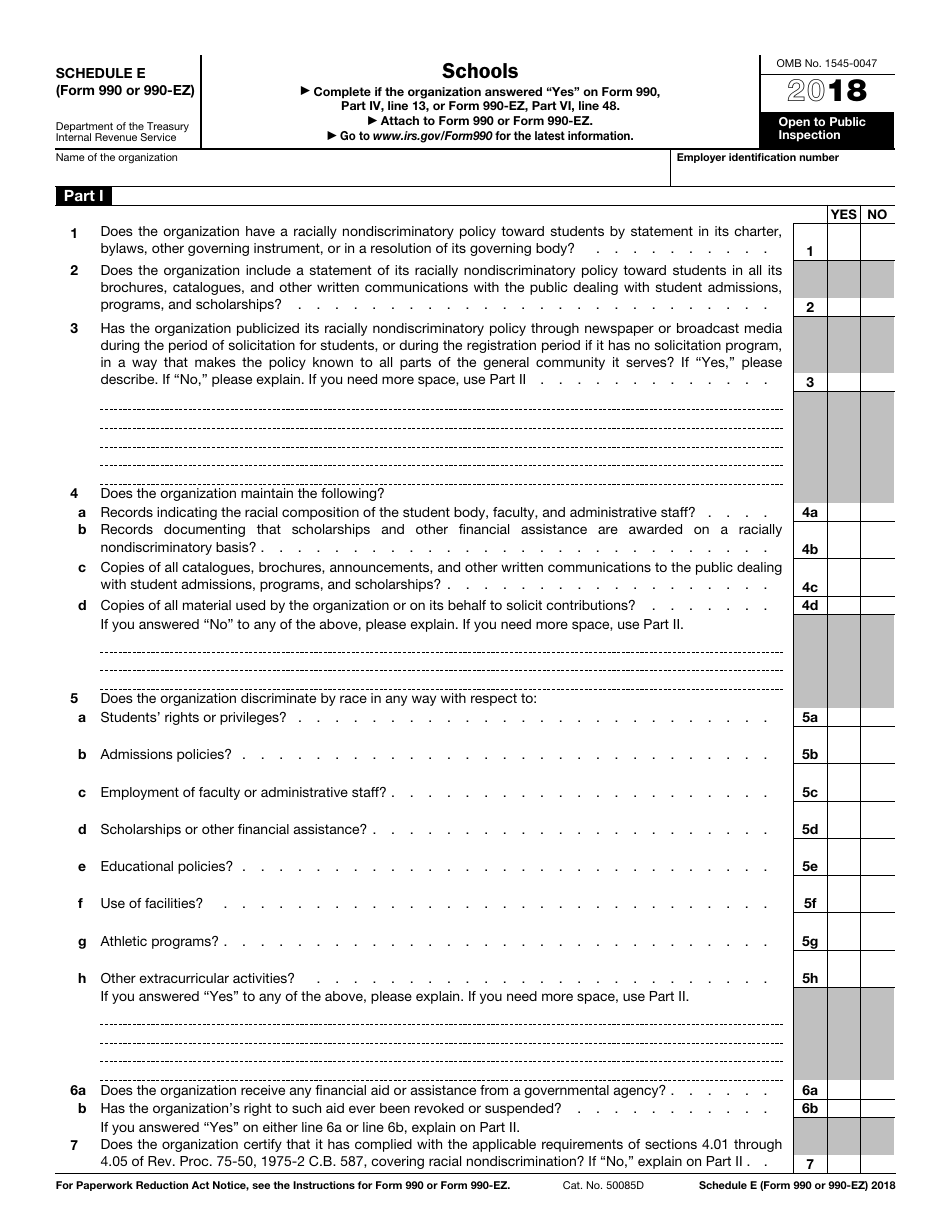

IRS Form 990 (990EZ) Schedule E 2018 Fill Out, Sign Online and

Nonresident alien income tax return : This document provides guidelines for completing schedule r of form 990, detailing related organizations and unrelated partnerships. Instruction 990 (schedule r) instructions for. Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions. Report each type of transaction for which you had.

Form 990 (Schedule R) Related Organizations and Unrelated

Schedule r is filed by the organization with form 990 to report information on related organizations and transactions made. This document provides guidelines for completing schedule r of form 990, detailing related organizations and unrelated partnerships. Nonresident alien income tax return : Instruction 990 (schedule r) instructions for. Schedule r (form 990) is used by an organization that files form.

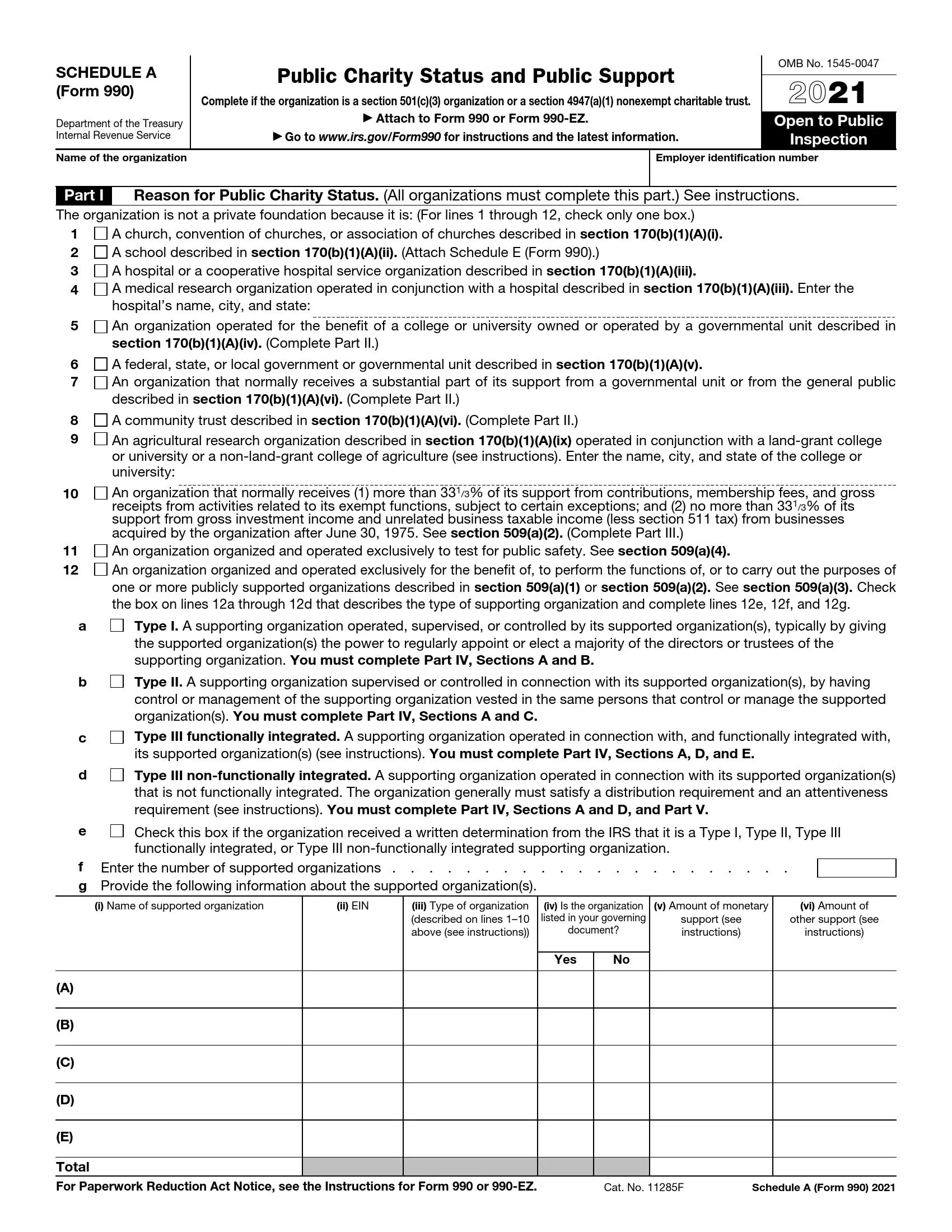

IRS Schedule A Form 990 or 990EZ ≡ Fill Out Printable PDF Forms Online

Report each type of transaction for which you had $50,000 or more with a particular controlled entity during the fiscal year you’re. Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions. Instruction 990 (schedule r) instructions for. This document provides guidelines for completing schedule r of form.

2021 IRS Form 990 by Ozarks Food Harvest Issuu

Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions. Nonresident alien income tax return : Schedule r is filed by the organization with form 990 to report information on related organizations and transactions made. Instruction 990 (schedule r) instructions for. This document provides guidelines for completing schedule.

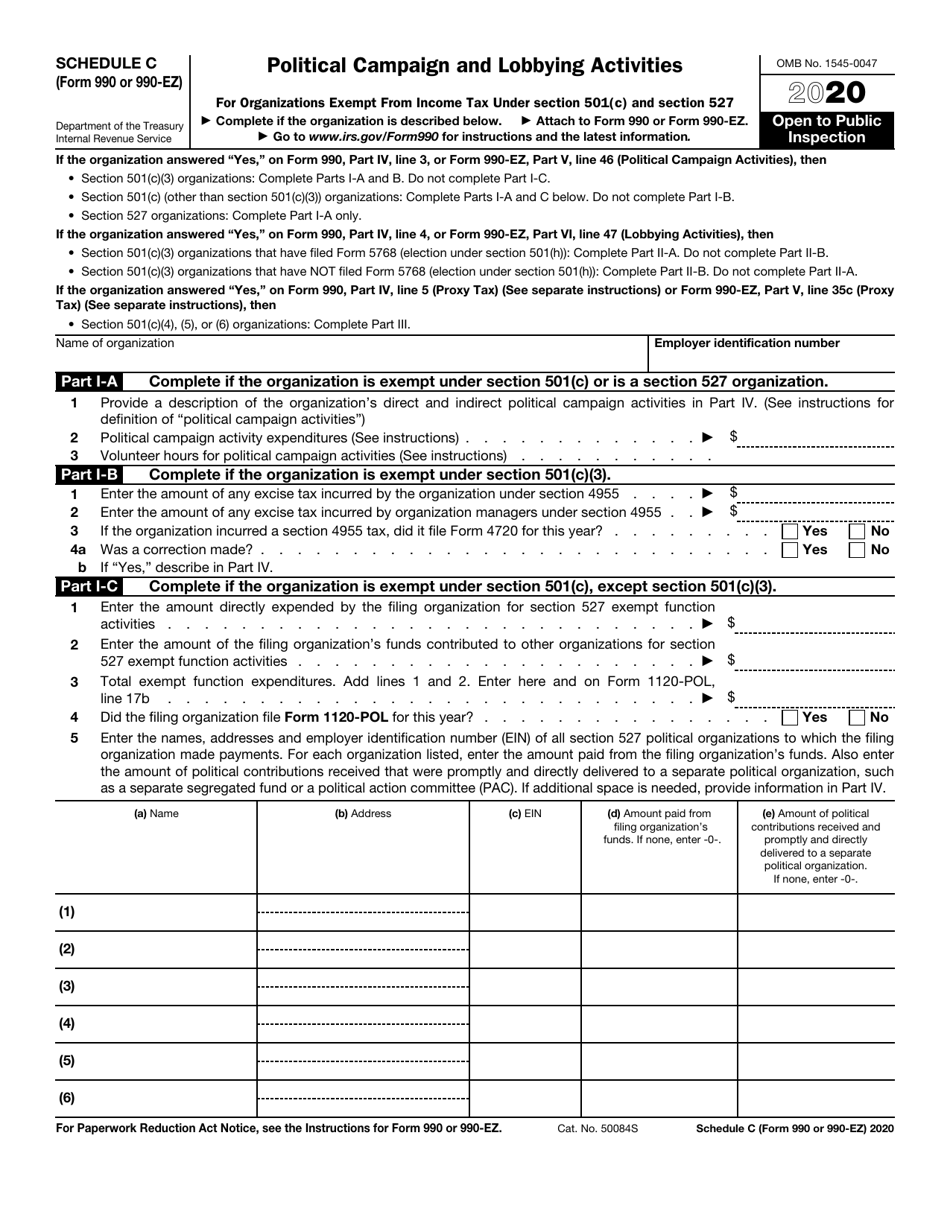

IRS Form 990 (990EZ) Schedule C Download Fillable PDF or Fill Online

Report each type of transaction for which you had $50,000 or more with a particular controlled entity during the fiscal year you’re. Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions. Nonresident alien income tax return : Schedule r is filed by the organization with form 990.

990 schedule b instructions Fill online, Printable, Fillable Blank

Schedule r is filed by the organization with form 990 to report information on related organizations and transactions made. Instruction 990 (schedule r) instructions for. Report each type of transaction for which you had $50,000 or more with a particular controlled entity during the fiscal year you’re. Nonresident alien income tax return : Schedule r (form 990) is used by.

IRS Form 990 Schedule R Download Fillable PDF or Fill Online Related

Nonresident alien income tax return : This document provides guidelines for completing schedule r of form 990, detailing related organizations and unrelated partnerships. Instruction 990 (schedule r) instructions for. Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions. Report each type of transaction for which you had.

990 schedule r instructions Fill out & sign online DocHub

This document provides guidelines for completing schedule r of form 990, detailing related organizations and unrelated partnerships. Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions. Schedule r is filed by the organization with form 990 to report information on related organizations and transactions made. Report each.

IRS Instructions Schedule A (990 Or 990EZ) 20202022 Fill out Tax

Instruction 990 (schedule r) instructions for. Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions. Report each type of transaction for which you had $50,000 or more with a particular controlled entity during the fiscal year you’re. Schedule r is filed by the organization with form 990.

IRS Form 990 Schedule R Instructions Related Organizations and

Instruction 990 (schedule r) instructions for. Report each type of transaction for which you had $50,000 or more with a particular controlled entity during the fiscal year you’re. Schedule r is filed by the organization with form 990 to report information on related organizations and transactions made. Nonresident alien income tax return : Schedule r (form 990) is used by.

Nonresident Alien Income Tax Return :

Schedule r is filed by the organization with form 990 to report information on related organizations and transactions made. Instruction 990 (schedule r) instructions for. Report each type of transaction for which you had $50,000 or more with a particular controlled entity during the fiscal year you’re. This document provides guidelines for completing schedule r of form 990, detailing related organizations and unrelated partnerships.