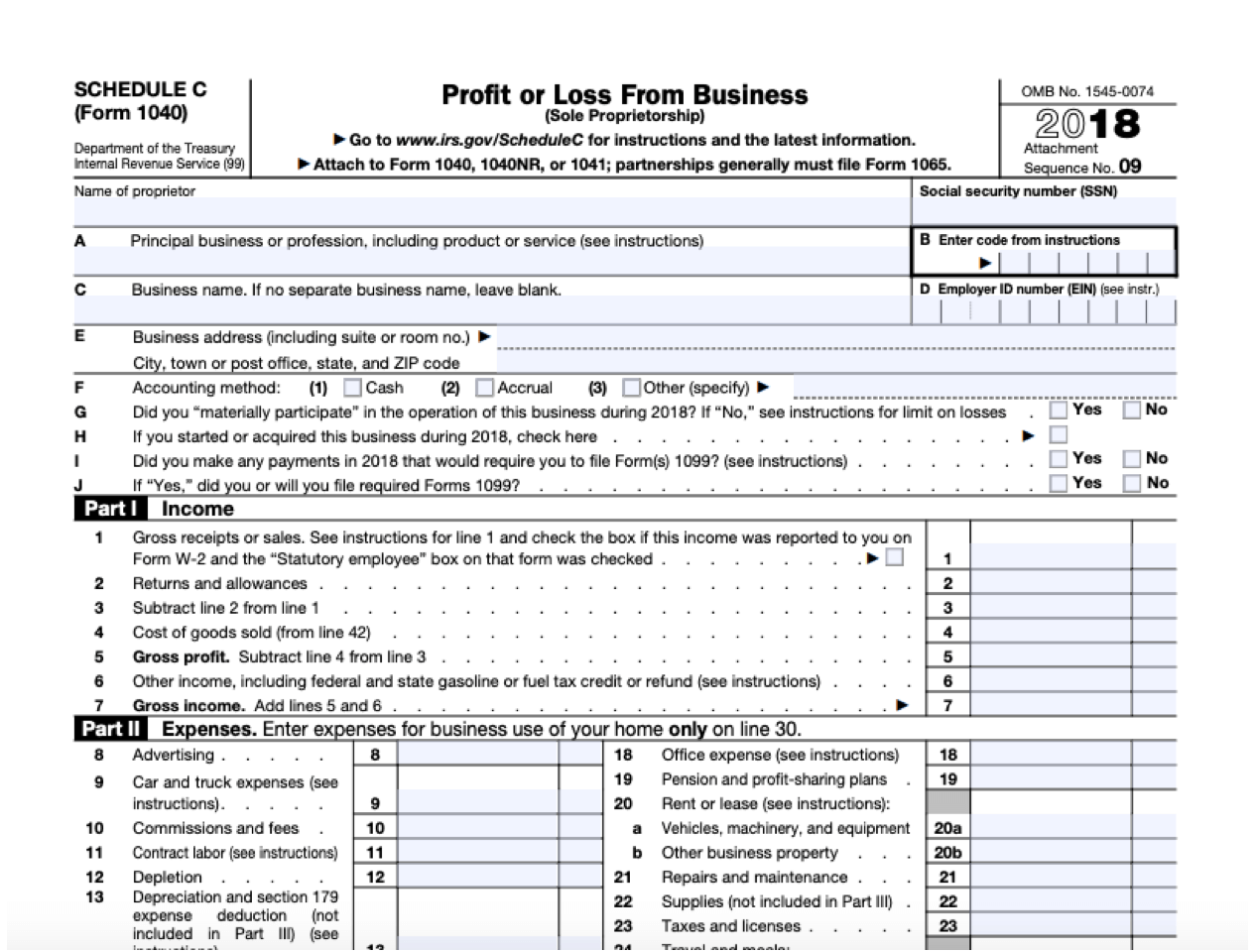

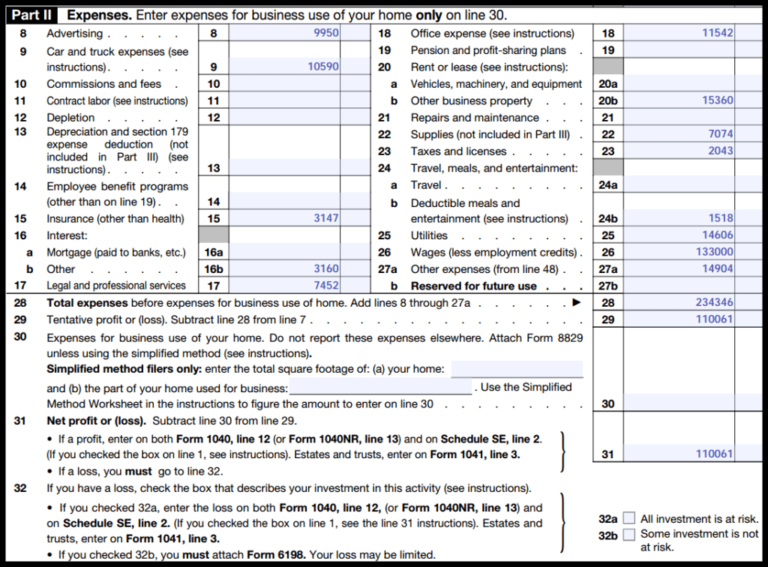

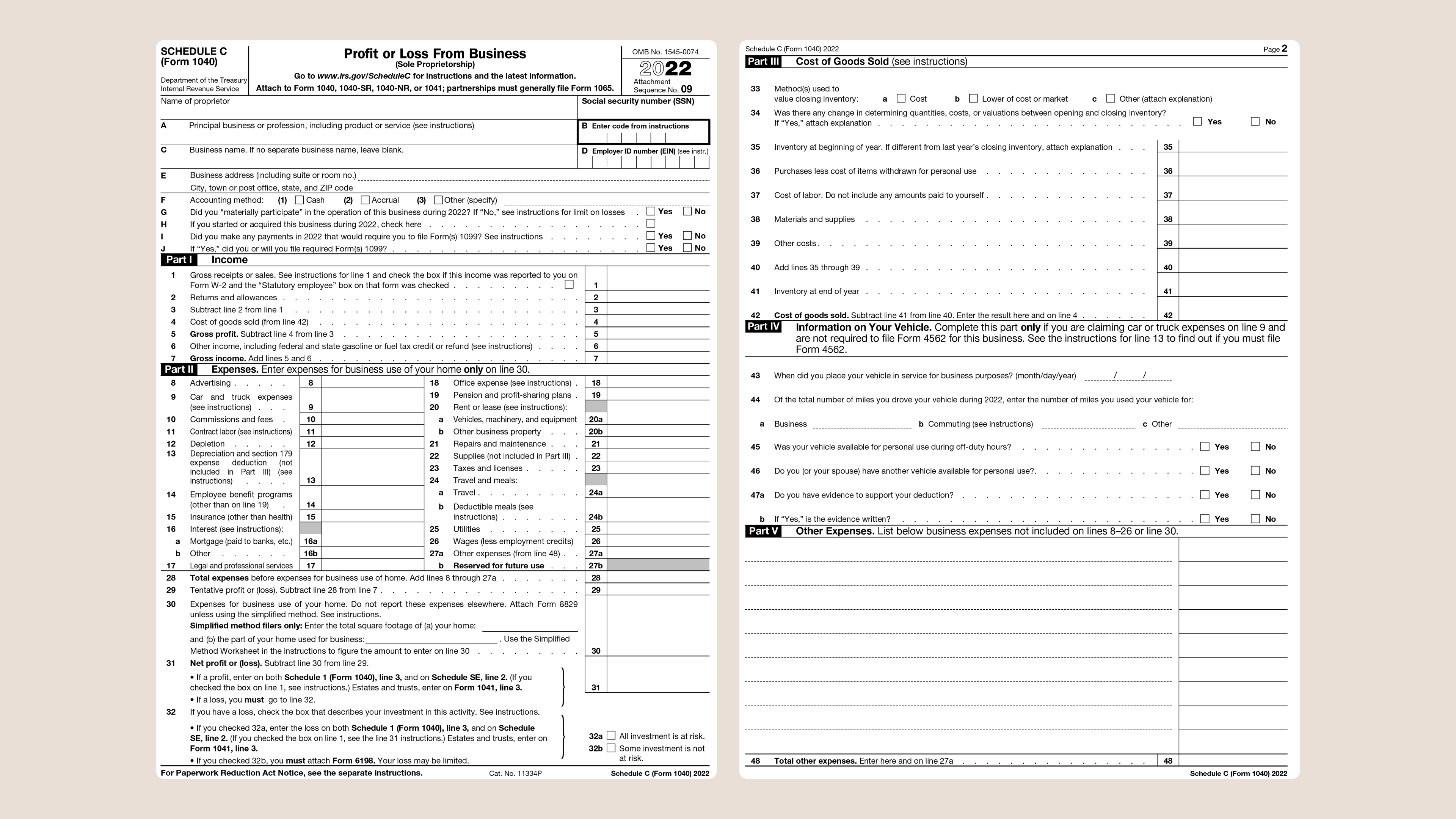

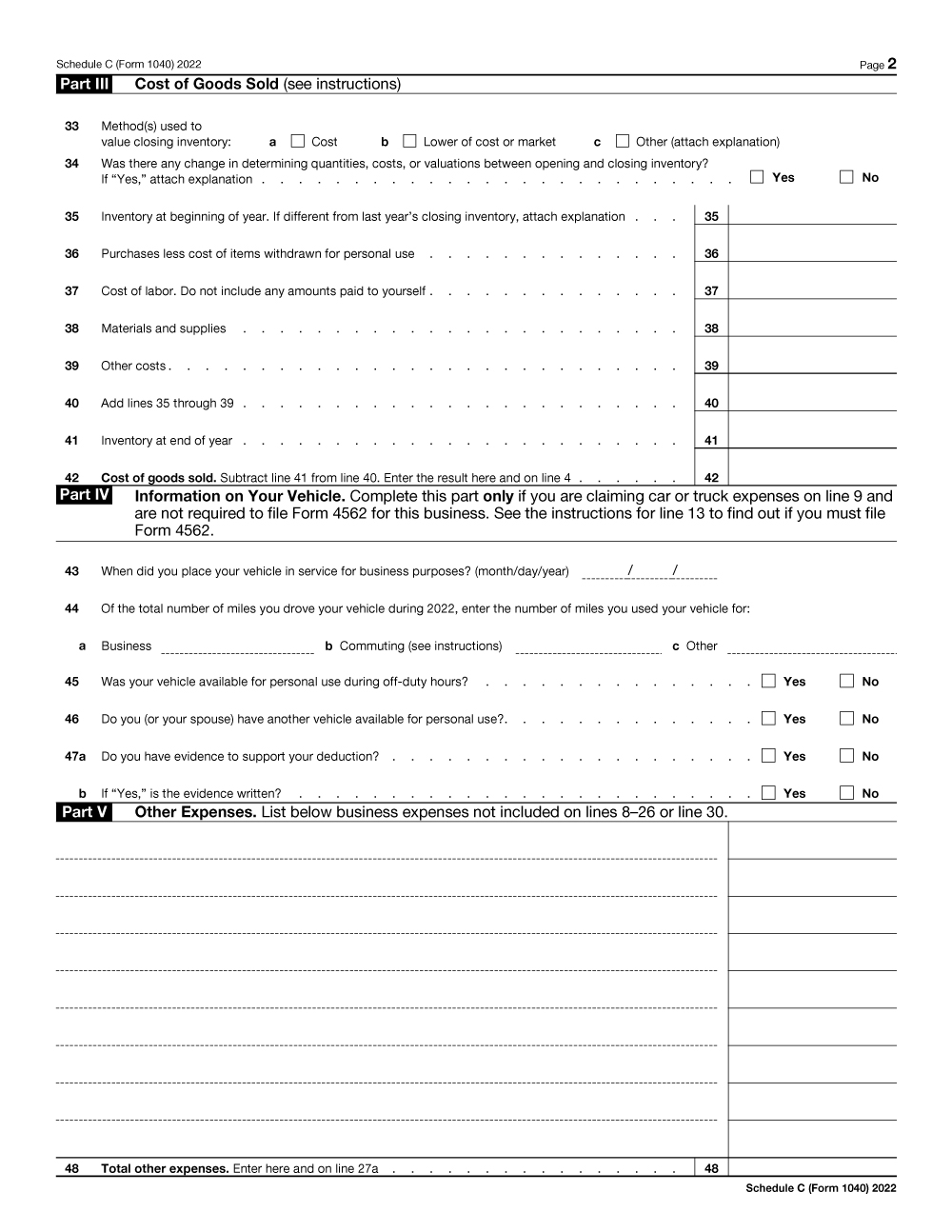

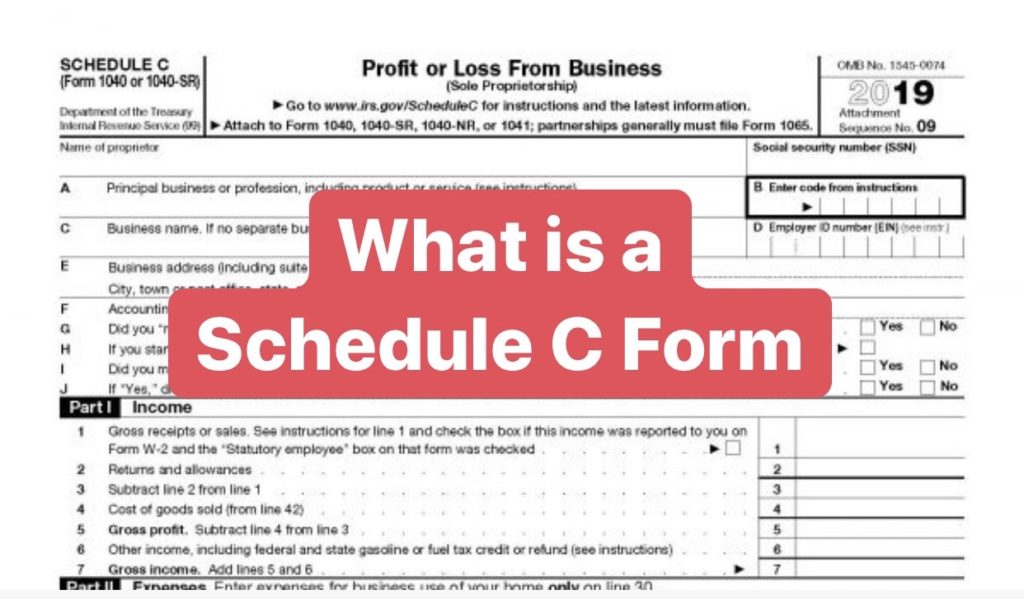

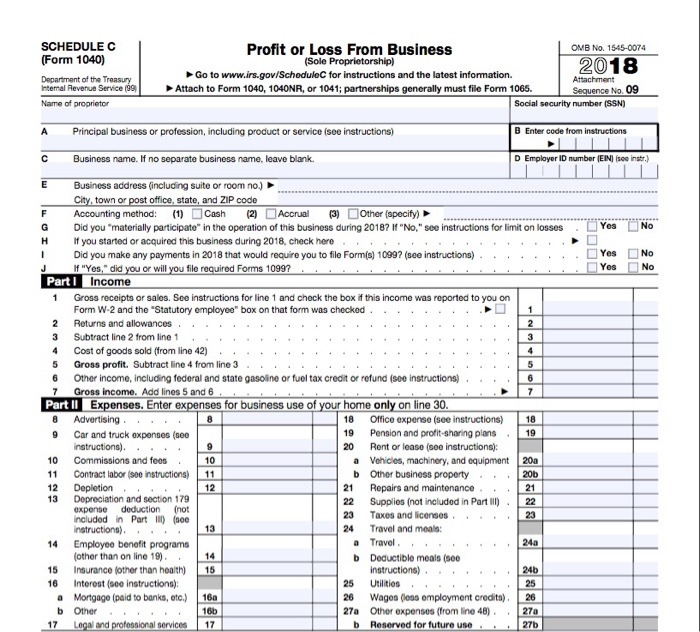

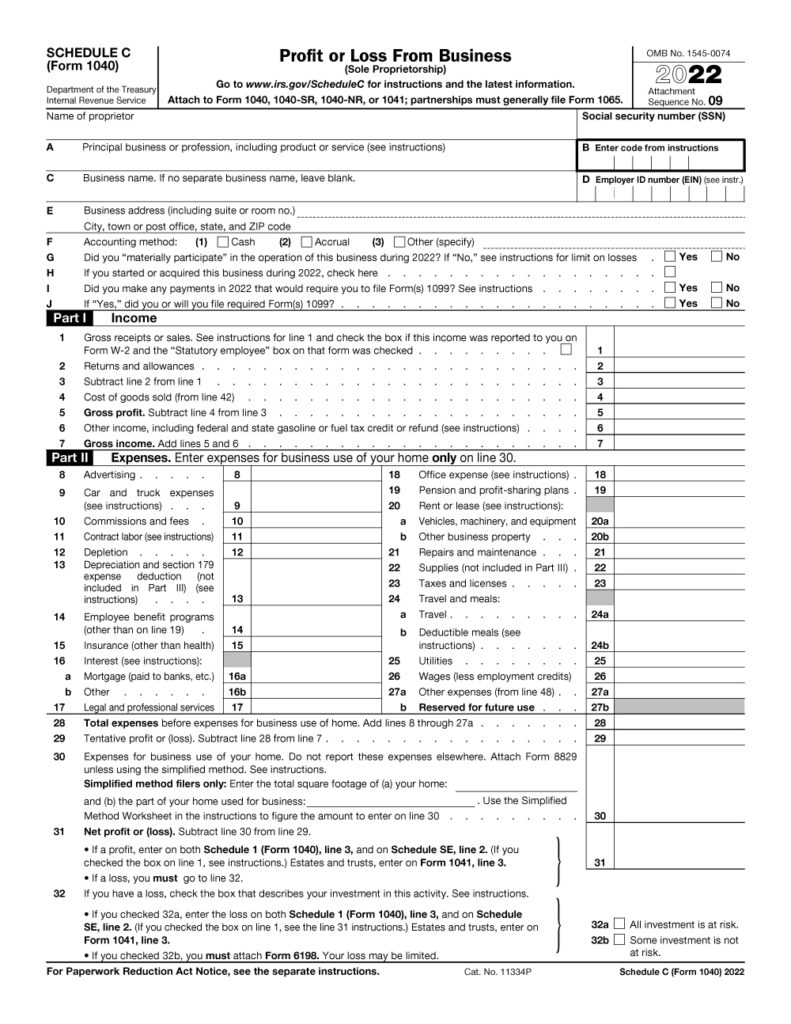

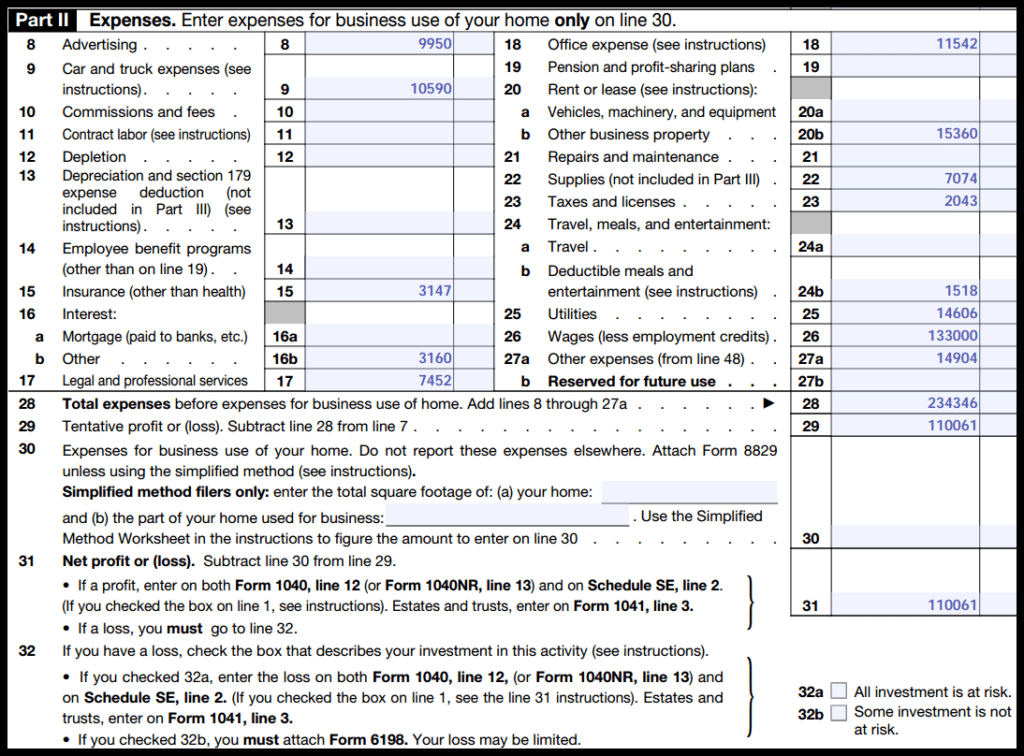

Schedule C Tax Form Instructions - This document allows you to report income, deductions, profits, and losses for your business. Here is what schedule c form 1040 looks like. An activity qualifies as a business if your primary purpose for. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. The irs’s instructions for schedule c; Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; Your ssn (social security number) your ein (employer. Before you fill it out, you’ll need: Schedule c must be submitted with.

Before you fill it out, you’ll need: An activity qualifies as a business if your primary purpose for. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. This document allows you to report income, deductions, profits, and losses for your business. Schedule c must be submitted with. Your ssn (social security number) your ein (employer. The irs’s instructions for schedule c; Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; Here is what schedule c form 1040 looks like.

Here is what schedule c form 1040 looks like. Before you fill it out, you’ll need: This document allows you to report income, deductions, profits, and losses for your business. An activity qualifies as a business if your primary purpose for. The irs’s instructions for schedule c; Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; Schedule c must be submitted with. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Your ssn (social security number) your ein (employer.

Do I Have To Fill Out A Schedule C For 2024 Mlb Schedule 2024

This document allows you to report income, deductions, profits, and losses for your business. Here is what schedule c form 1040 looks like. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Your ssn (social security number) your ein (employer. An activity qualifies as a.

Irs Schedule C Form 2023 Printable Forms Free Online

Here is what schedule c form 1040 looks like. The irs’s instructions for schedule c; Schedule c must be submitted with. Before you fill it out, you’ll need: Your ssn (social security number) your ein (employer.

Schedule C Instructions 2024 Tax Form Aurie Carissa

Your ssn (social security number) your ein (employer. Here is what schedule c form 1040 looks like. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a.

Free Printable Schedule C Form

Schedule c must be submitted with. Before you fill it out, you’ll need: Your ssn (social security number) your ein (employer. The irs’s instructions for schedule c; An activity qualifies as a business if your primary purpose for.

IRS Schedule C Instructions Step By Step Including C EZ 1040 Form

The irs’s instructions for schedule c; Before you fill it out, you’ll need: An activity qualifies as a business if your primary purpose for. This document allows you to report income, deductions, profits, and losses for your business. Schedule c must be submitted with.

Understanding the Schedule C Tax Form

Before you fill it out, you’ll need: This document allows you to report income, deductions, profits, and losses for your business. Your ssn (social security number) your ein (employer. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Schedule c must be submitted with.

Schedule C (Form 1040) 2023 Instructions

Schedule c must be submitted with. An activity qualifies as a business if your primary purpose for. Your ssn (social security number) your ein (employer. Before you fill it out, you’ll need: The irs’s instructions for schedule c;

What is an IRS Schedule C Form?

Schedule c must be submitted with. The irs’s instructions for schedule c; Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Before you fill it out, you’ll need: Information about schedule c (form 1040), profit or loss from business, used to report income or loss.

ACE 346 Homework 1 Schedule C Dave Sanders does

This document allows you to report income, deductions, profits, and losses for your business. The irs’s instructions for schedule c; Here is what schedule c form 1040 looks like. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; Before you fill.

Schedule C (Form 1040) 2023 Instructions

Here is what schedule c form 1040 looks like. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. This document allows you to report income, deductions, profits, and losses for your business. Before you fill it out, you’ll need: Schedule c must be submitted with.

Before You Fill It Out, You’ll Need:

Your ssn (social security number) your ein (employer. This document allows you to report income, deductions, profits, and losses for your business. Here is what schedule c form 1040 looks like. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor.

Information About Schedule C (Form 1040), Profit Or Loss From Business, Used To Report Income Or Loss From A Business Operated Or Profession Practiced As A Sole Proprietor;

Schedule c must be submitted with. The irs’s instructions for schedule c; An activity qualifies as a business if your primary purpose for.

:max_bytes(150000):strip_icc()/ScreenShot2022-12-14at2.10.22PM-ed1958c9bbb642398aec3cacd721b244.png)