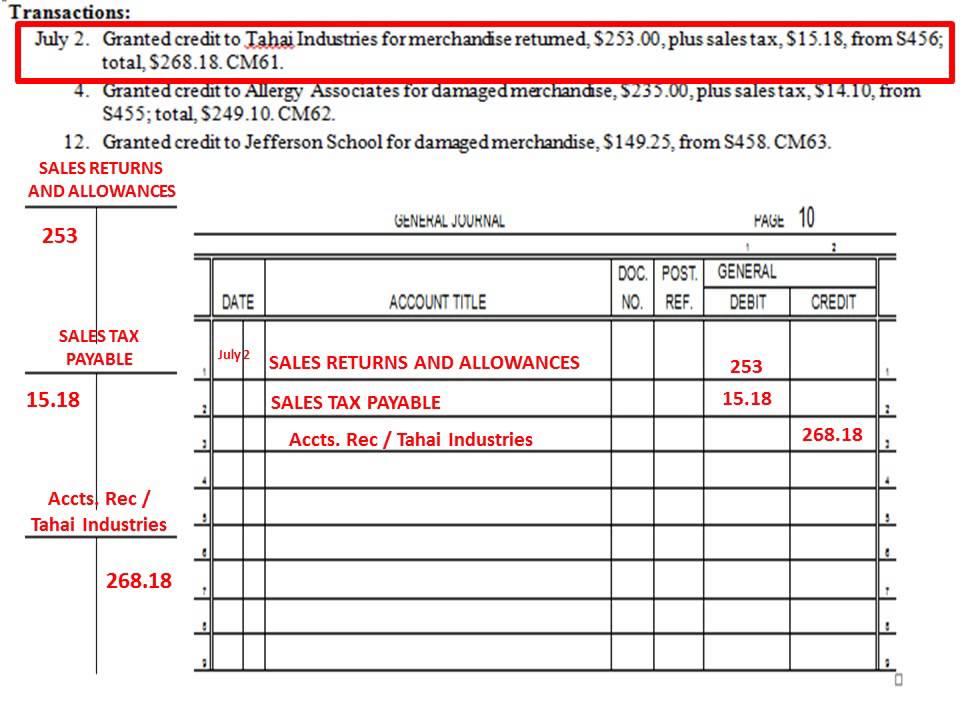

Returns And Allowances - See examples of journal entries and financial. Learn how to record sales returns and allowances in a special journal and post them to ledger accounts. Learn what sales returns and allowances are, how they are accounted for, and how they are presented in the income statement. As the seller, whistling flute needs to show not only the return of the inventory but also the reduction in sales. Learn the definitions, reasons and accounting treatment of sales returns and allowances. Sales returns and allowance are the contra account to the sales revenues where the previously recognized. See the format, explanation, and. Are sales returns and allowances an expense? Because we want to preserve.

Learn what sales returns and allowances are, how they are accounted for, and how they are presented in the income statement. Are sales returns and allowances an expense? Sales returns and allowance are the contra account to the sales revenues where the previously recognized. Learn how to record sales returns and allowances in a special journal and post them to ledger accounts. As the seller, whistling flute needs to show not only the return of the inventory but also the reduction in sales. Learn the definitions, reasons and accounting treatment of sales returns and allowances. See the format, explanation, and. See examples of journal entries and financial. Because we want to preserve.

Learn the definitions, reasons and accounting treatment of sales returns and allowances. Are sales returns and allowances an expense? See examples of journal entries and financial. Sales returns and allowance are the contra account to the sales revenues where the previously recognized. Learn how to record sales returns and allowances in a special journal and post them to ledger accounts. See the format, explanation, and. Learn what sales returns and allowances are, how they are accounted for, and how they are presented in the income statement. Because we want to preserve. As the seller, whistling flute needs to show not only the return of the inventory but also the reduction in sales.

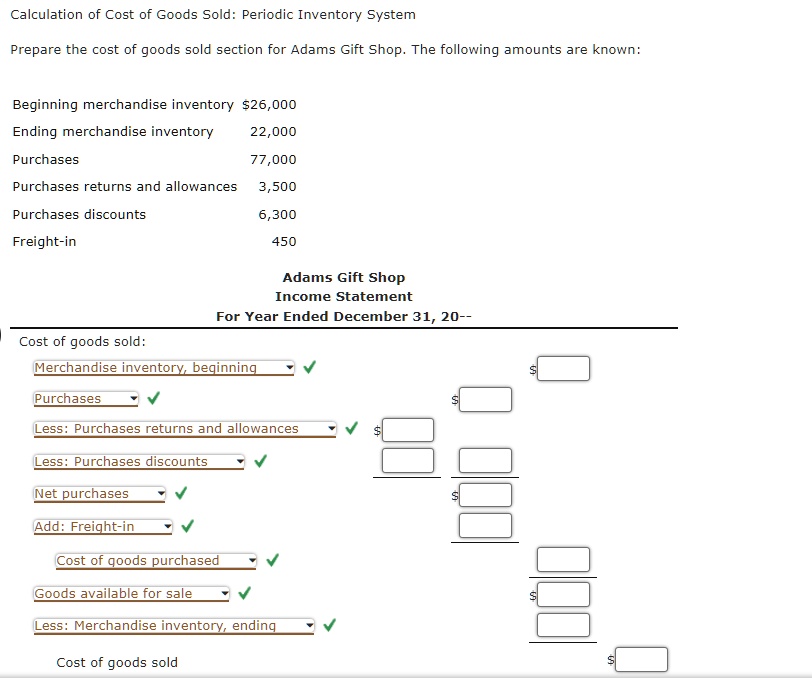

Purchase Returns and Allowances Periodic Inventory Wize University

Sales returns and allowance are the contra account to the sales revenues where the previously recognized. See the format, explanation, and. Learn the definitions, reasons and accounting treatment of sales returns and allowances. Are sales returns and allowances an expense? As the seller, whistling flute needs to show not only the return of the inventory but also the reduction in.

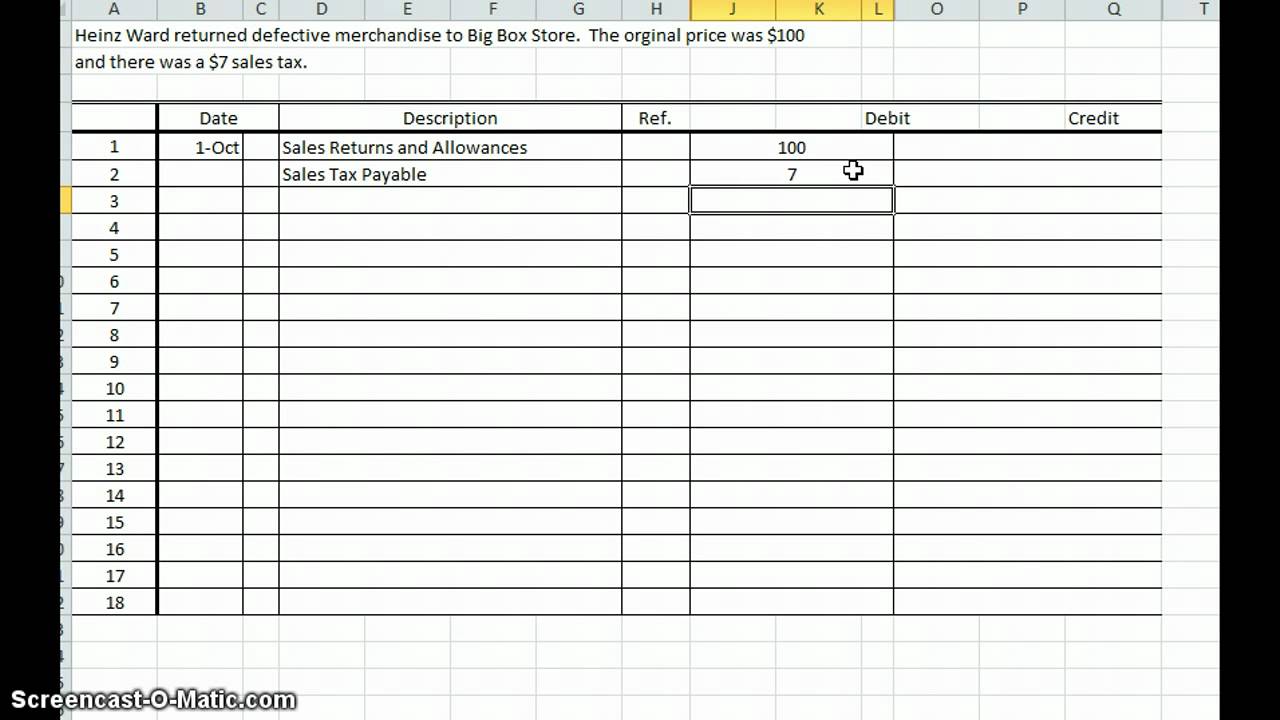

How to Record a Sales Return for Accounting Business Accounting

Because we want to preserve. See the format, explanation, and. Sales returns and allowance are the contra account to the sales revenues where the previously recognized. As the seller, whistling flute needs to show not only the return of the inventory but also the reduction in sales. Learn what sales returns and allowances are, how they are accounted for, and.

Sales returns and allowances YouTube

See examples of journal entries and financial. Sales returns and allowance are the contra account to the sales revenues where the previously recognized. Learn the definitions, reasons and accounting treatment of sales returns and allowances. Are sales returns and allowances an expense? As the seller, whistling flute needs to show not only the return of the inventory but also the.

What is sales return and allowances? 2024

Learn the definitions, reasons and accounting treatment of sales returns and allowances. Learn how to record sales returns and allowances in a special journal and post them to ledger accounts. Because we want to preserve. Are sales returns and allowances an expense? As the seller, whistling flute needs to show not only the return of the inventory but also the.

Tax Reporting for Returns & Allowances Tax Laws Do Not Factor in

Are sales returns and allowances an expense? As the seller, whistling flute needs to show not only the return of the inventory but also the reduction in sales. Sales returns and allowance are the contra account to the sales revenues where the previously recognized. See the format, explanation, and. Because we want to preserve.

Sales Returns and Allowances Recording Returns in Your Books

Sales returns and allowance are the contra account to the sales revenues where the previously recognized. As the seller, whistling flute needs to show not only the return of the inventory but also the reduction in sales. Learn what sales returns and allowances are, how they are accounted for, and how they are presented in the income statement. See examples.

SOLVED Calculation of Cost of Goods Sold Periodic Inventory System

Learn how to record sales returns and allowances in a special journal and post them to ledger accounts. Sales returns and allowance are the contra account to the sales revenues where the previously recognized. See the format, explanation, and. As the seller, whistling flute needs to show not only the return of the inventory but also the reduction in sales..

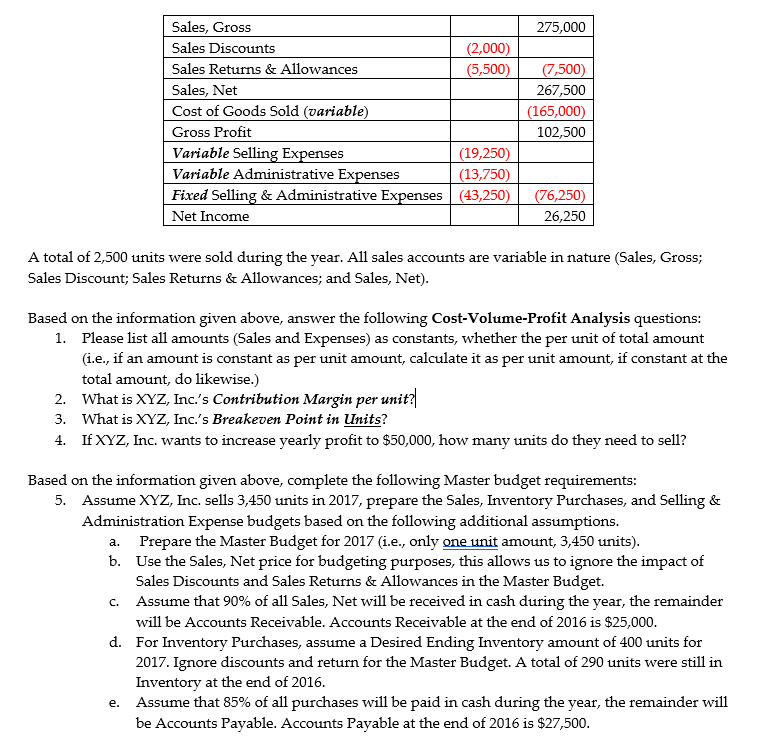

Solved Sales, Gross Sales Discounts Sales Returns &

See the format, explanation, and. As the seller, whistling flute needs to show not only the return of the inventory but also the reduction in sales. Sales returns and allowance are the contra account to the sales revenues where the previously recognized. Learn the definitions, reasons and accounting treatment of sales returns and allowances. Are sales returns and allowances an.

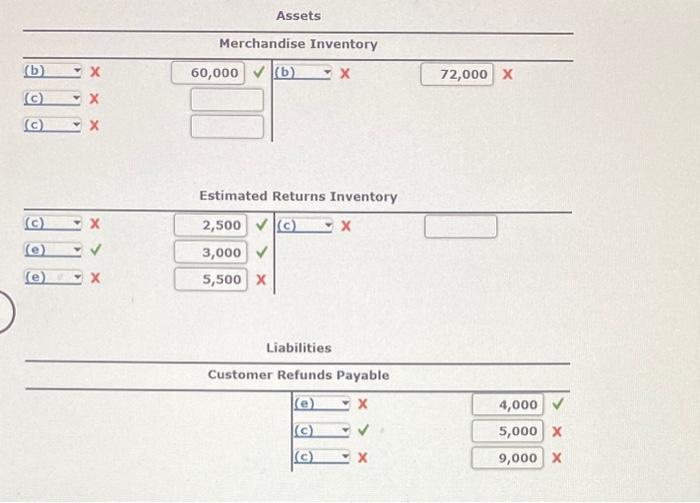

Solved Adjustment for Merchandise Inventory Using T

Sales returns and allowance are the contra account to the sales revenues where the previously recognized. As the seller, whistling flute needs to show not only the return of the inventory but also the reduction in sales. See the format, explanation, and. See examples of journal entries and financial. Are sales returns and allowances an expense?

How to Account for Returns and Allowances on a Balance Sheet Bizfluent

Learn what sales returns and allowances are, how they are accounted for, and how they are presented in the income statement. Learn how to record sales returns and allowances in a special journal and post them to ledger accounts. Learn the definitions, reasons and accounting treatment of sales returns and allowances. See examples of journal entries and financial. Because we.

Learn How To Record Sales Returns And Allowances In A Special Journal And Post Them To Ledger Accounts.

Learn the definitions, reasons and accounting treatment of sales returns and allowances. Learn what sales returns and allowances are, how they are accounted for, and how they are presented in the income statement. Because we want to preserve. As the seller, whistling flute needs to show not only the return of the inventory but also the reduction in sales.

See Examples Of Journal Entries And Financial.

Sales returns and allowance are the contra account to the sales revenues where the previously recognized. See the format, explanation, and. Are sales returns and allowances an expense?