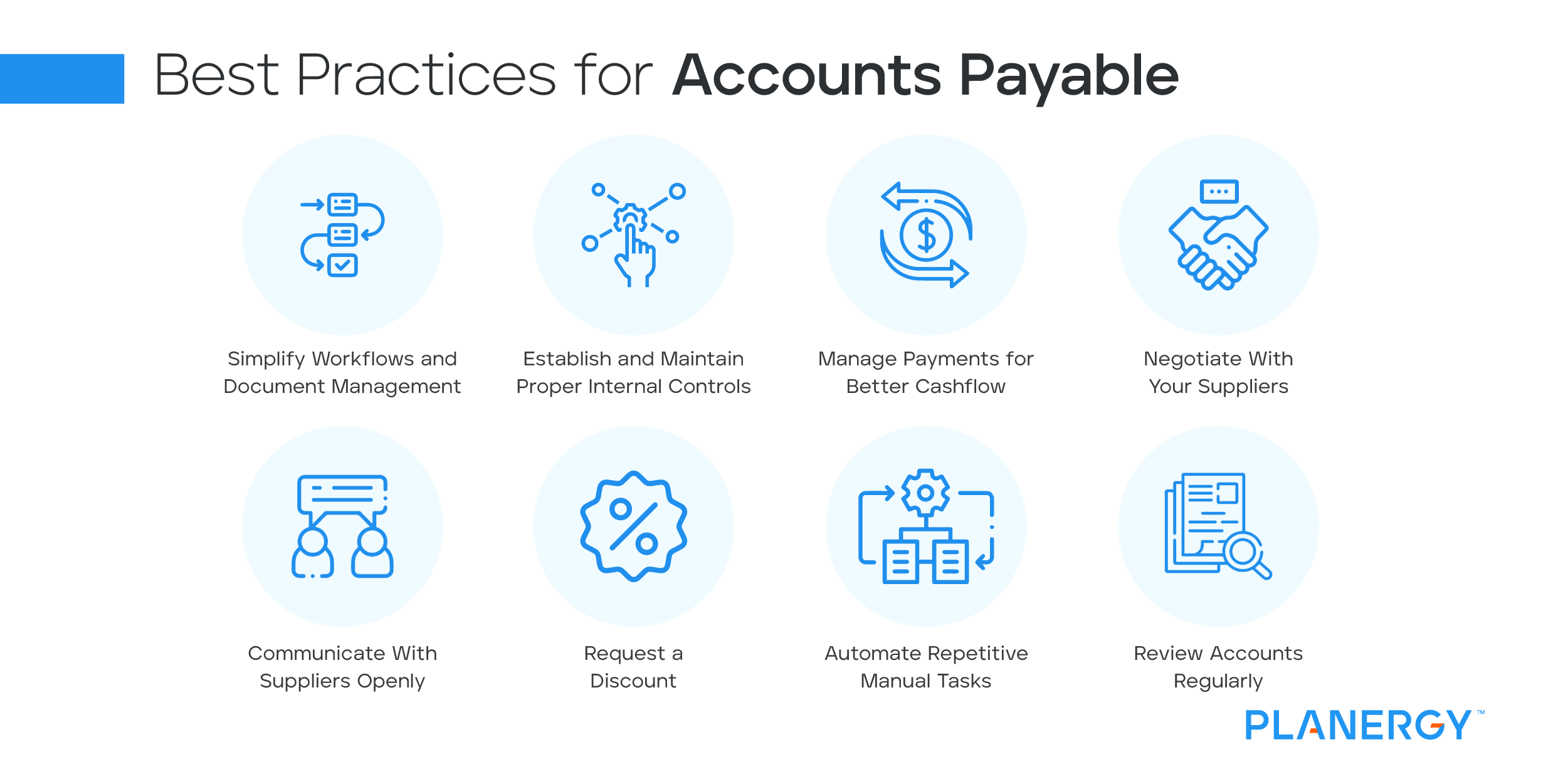

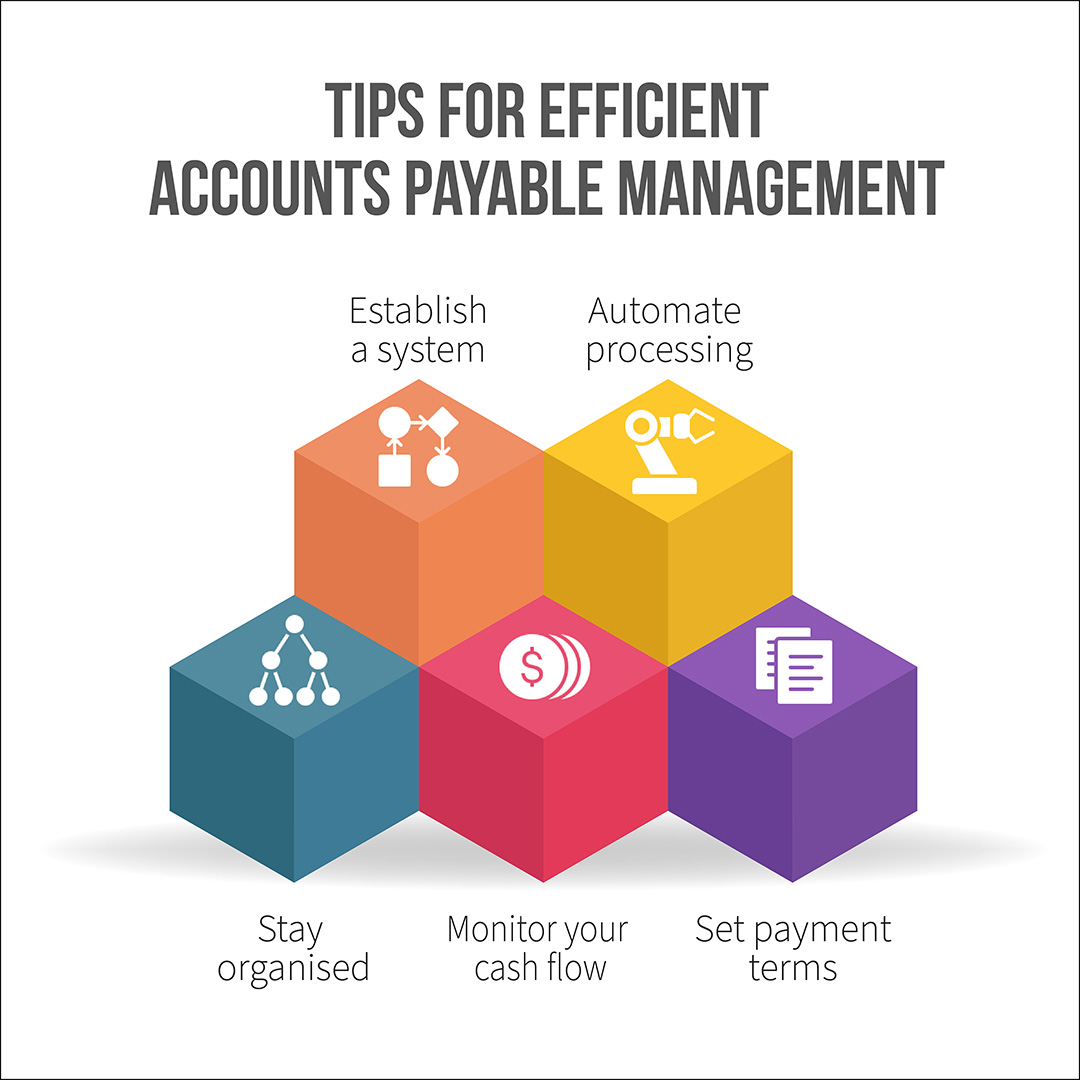

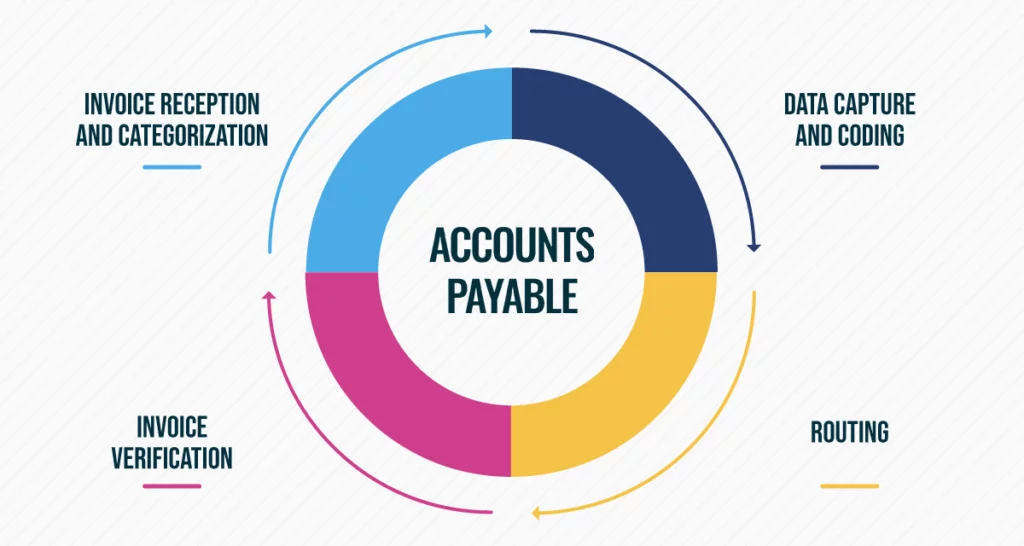

Practices For Accounts Payable - Here are a few tips and tricks to get you there: 10 best practices to optimize your accounts payable department. Read on to learn how businesses can improve their accounts payable. Thus, it’s in your best interest to understand and update your accounts payable best practices on a regular basis. Simplify the accounts payable workflow; Review our comprehensive list of accounts payable best practices that you can start implementing today to optimize your ap process. Manual accounts payable processes waste time and money, and often cause costly errors. Accounts payable kpis provide valuable insights into the organization's payables performance, enabling accurate assessment and forecasting. By identifying trends and patterns in ap data, a company can optimize payment. Accounts payable is responsible for distributing invoice processing, internal reimbursement payments, controlling and administering petty cash, and distributing sales tax exemption certificates.

Simplify the accounts payable workflow; Review our comprehensive list of accounts payable best practices that you can start implementing today to optimize your ap process. Accounts payable kpis provide valuable insights into the organization's payables performance, enabling accurate assessment and forecasting. By identifying trends and patterns in ap data, a company can optimize payment. Here are a few tips and tricks to get you there: Manual accounts payable processes waste time and money, and often cause costly errors. Read on to learn how businesses can improve their accounts payable. Accounts payable is responsible for distributing invoice processing, internal reimbursement payments, controlling and administering petty cash, and distributing sales tax exemption certificates. 10 best practices to optimize your accounts payable department. Thus, it’s in your best interest to understand and update your accounts payable best practices on a regular basis.

10 best practices to optimize your accounts payable department. Read on to learn how businesses can improve their accounts payable. By identifying trends and patterns in ap data, a company can optimize payment. Manual accounts payable processes waste time and money, and often cause costly errors. Accounts payable is responsible for distributing invoice processing, internal reimbursement payments, controlling and administering petty cash, and distributing sales tax exemption certificates. Thus, it’s in your best interest to understand and update your accounts payable best practices on a regular basis. Simplify the accounts payable workflow; Accounts payable kpis provide valuable insights into the organization's payables performance, enabling accurate assessment and forecasting. Review our comprehensive list of accounts payable best practices that you can start implementing today to optimize your ap process. Here are a few tips and tricks to get you there:

Best Practices for Accounts Payable Processes Planergy Software

Here are a few tips and tricks to get you there: Accounts payable is responsible for distributing invoice processing, internal reimbursement payments, controlling and administering petty cash, and distributing sales tax exemption certificates. By identifying trends and patterns in ap data, a company can optimize payment. Read on to learn how businesses can improve their accounts payable. Review our comprehensive.

22 Accounts Payable Best Practices For Your Business

Accounts payable kpis provide valuable insights into the organization's payables performance, enabling accurate assessment and forecasting. Accounts payable is responsible for distributing invoice processing, internal reimbursement payments, controlling and administering petty cash, and distributing sales tax exemption certificates. Thus, it’s in your best interest to understand and update your accounts payable best practices on a regular basis. Read on to.

Accounts Payable Technology 10 Tools to Streamline AP

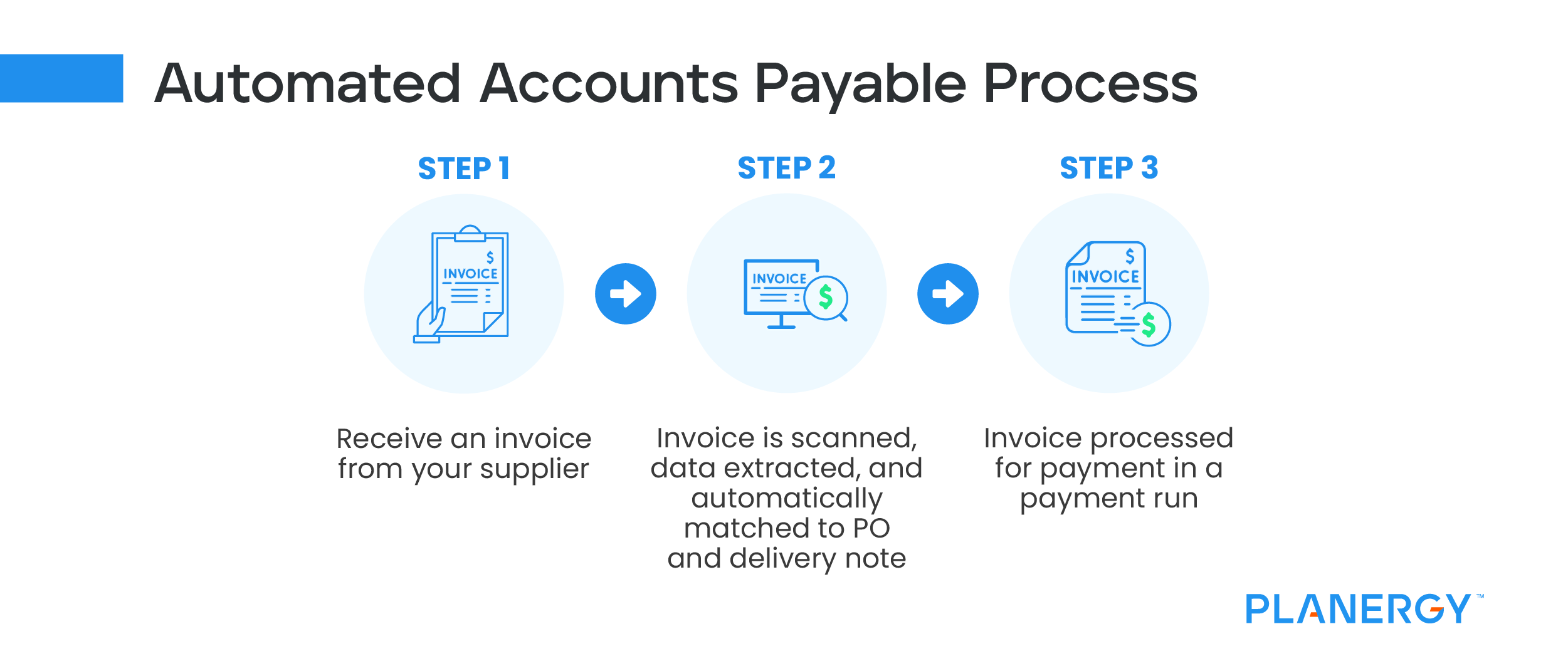

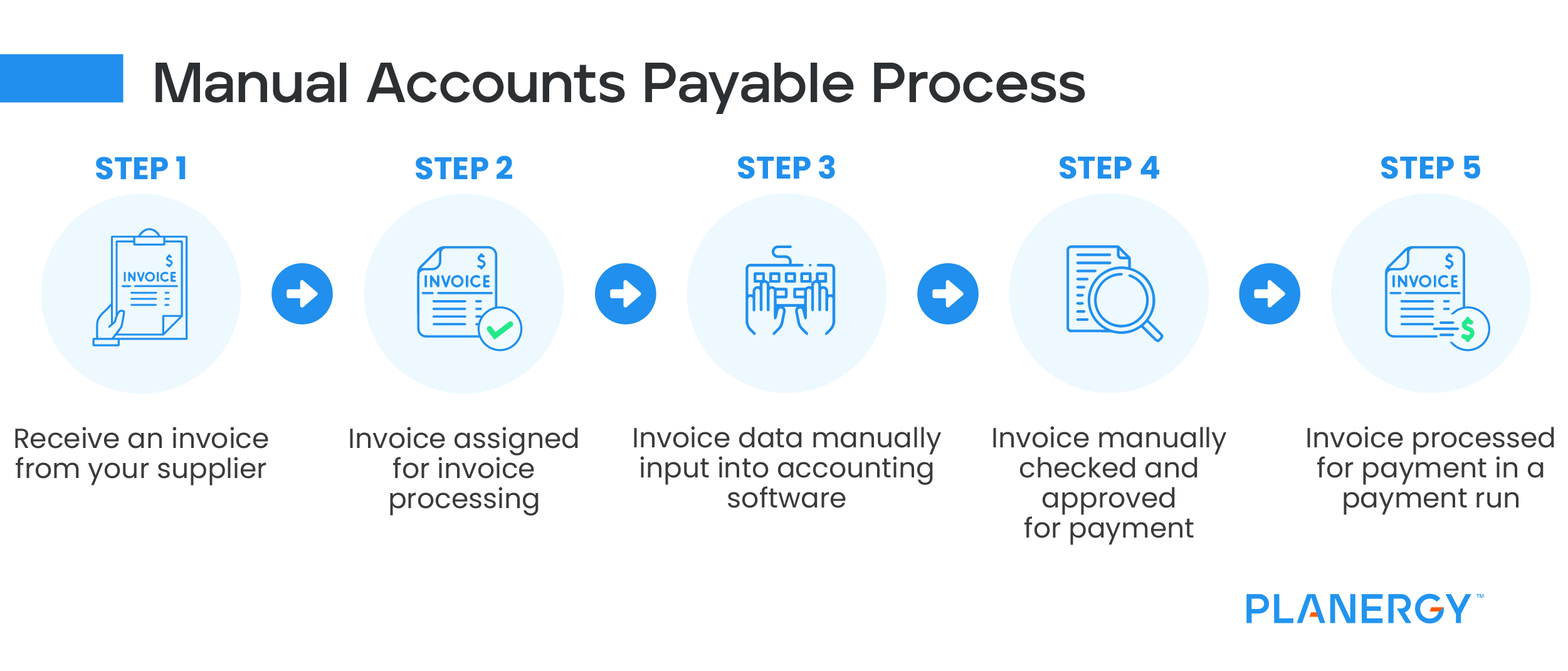

Accounts payable is responsible for distributing invoice processing, internal reimbursement payments, controlling and administering petty cash, and distributing sales tax exemption certificates. Manual accounts payable processes waste time and money, and often cause costly errors. By identifying trends and patterns in ap data, a company can optimize payment. 10 best practices to optimize your accounts payable department. Accounts payable kpis.

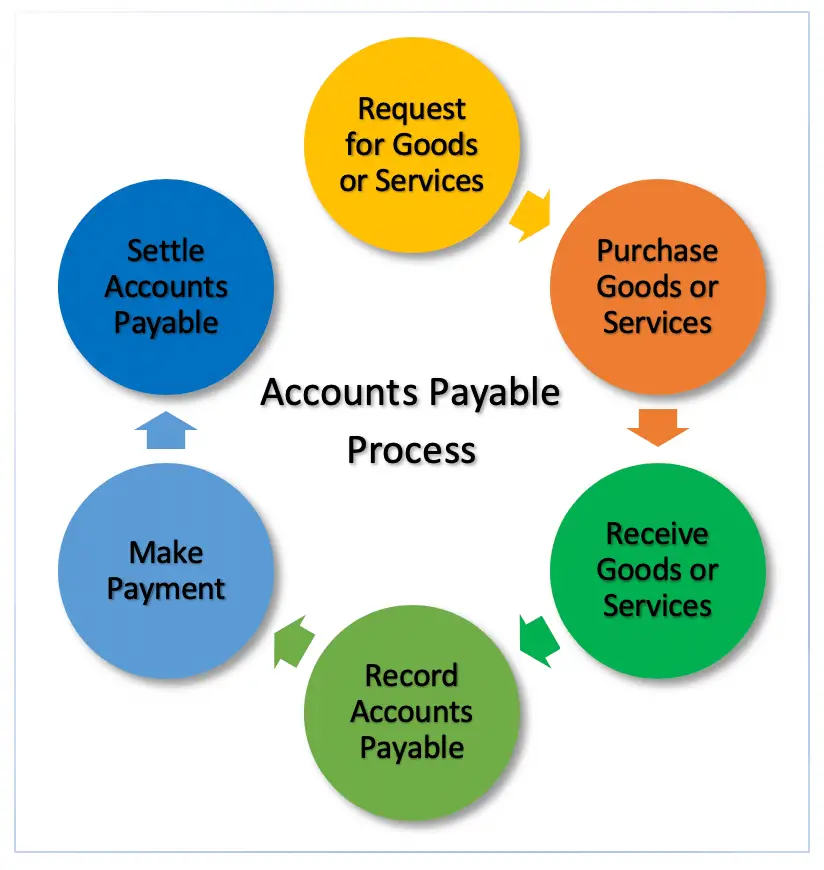

Accounts Payable Process 7 Steps of Payables Process Accountinguide

Review our comprehensive list of accounts payable best practices that you can start implementing today to optimize your ap process. Here are a few tips and tricks to get you there: Accounts payable is responsible for distributing invoice processing, internal reimbursement payments, controlling and administering petty cash, and distributing sales tax exemption certificates. Accounts payable kpis provide valuable insights into.

Best Practices for Accounts Payable Processes PLANERGY Software

Accounts payable is responsible for distributing invoice processing, internal reimbursement payments, controlling and administering petty cash, and distributing sales tax exemption certificates. 10 best practices to optimize your accounts payable department. Simplify the accounts payable workflow; Review our comprehensive list of accounts payable best practices that you can start implementing today to optimize your ap process. By identifying trends and.

Best Practices for Accounts Payable Processes Planergy Software

Manual accounts payable processes waste time and money, and often cause costly errors. By identifying trends and patterns in ap data, a company can optimize payment. 10 best practices to optimize your accounts payable department. Accounts payable kpis provide valuable insights into the organization's payables performance, enabling accurate assessment and forecasting. Read on to learn how businesses can improve their.

What Is The Accounts Payable Process Small Business

By identifying trends and patterns in ap data, a company can optimize payment. Manual accounts payable processes waste time and money, and often cause costly errors. Here are a few tips and tricks to get you there: Accounts payable is responsible for distributing invoice processing, internal reimbursement payments, controlling and administering petty cash, and distributing sales tax exemption certificates. Review.

10 Accounts Payable Best Practices For the Ages

Thus, it’s in your best interest to understand and update your accounts payable best practices on a regular basis. Simplify the accounts payable workflow; 10 best practices to optimize your accounts payable department. By identifying trends and patterns in ap data, a company can optimize payment. Accounts payable is responsible for distributing invoice processing, internal reimbursement payments, controlling and administering.

Accounts Payable 101 Understanding the Fundamentals

Accounts payable is responsible for distributing invoice processing, internal reimbursement payments, controlling and administering petty cash, and distributing sales tax exemption certificates. Manual accounts payable processes waste time and money, and often cause costly errors. Thus, it’s in your best interest to understand and update your accounts payable best practices on a regular basis. Review our comprehensive list of accounts.

8 Tips to Reduce Errors in Accounts Payable

Here are a few tips and tricks to get you there: Thus, it’s in your best interest to understand and update your accounts payable best practices on a regular basis. Accounts payable kpis provide valuable insights into the organization's payables performance, enabling accurate assessment and forecasting. 10 best practices to optimize your accounts payable department. Manual accounts payable processes waste.

Accounts Payable Is Responsible For Distributing Invoice Processing, Internal Reimbursement Payments, Controlling And Administering Petty Cash, And Distributing Sales Tax Exemption Certificates.

Simplify the accounts payable workflow; Review our comprehensive list of accounts payable best practices that you can start implementing today to optimize your ap process. Thus, it’s in your best interest to understand and update your accounts payable best practices on a regular basis. 10 best practices to optimize your accounts payable department.

Accounts Payable Kpis Provide Valuable Insights Into The Organization's Payables Performance, Enabling Accurate Assessment And Forecasting.

Read on to learn how businesses can improve their accounts payable. By identifying trends and patterns in ap data, a company can optimize payment. Here are a few tips and tricks to get you there: Manual accounts payable processes waste time and money, and often cause costly errors.