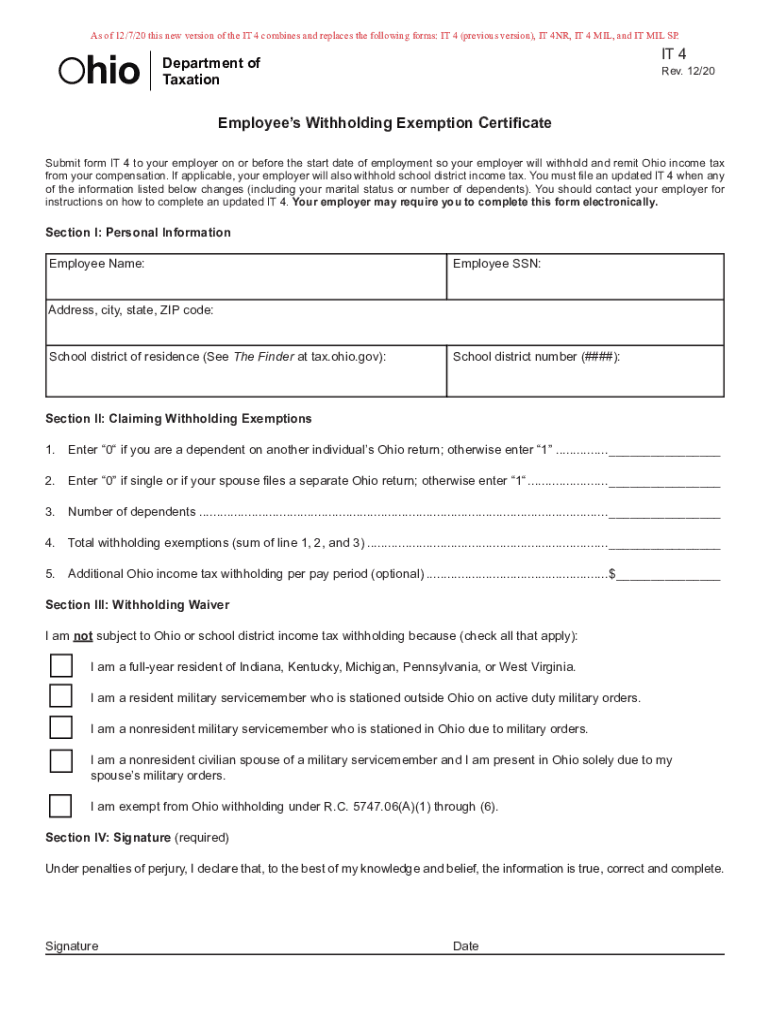

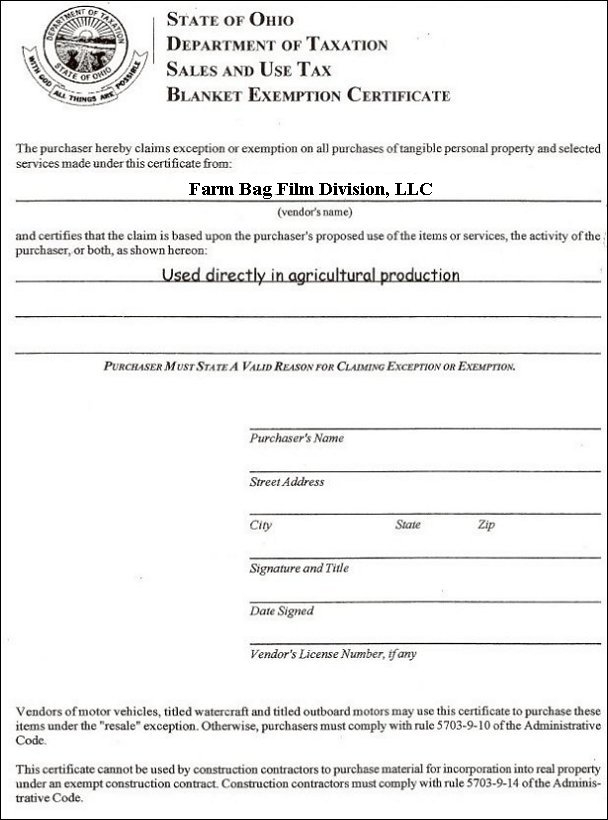

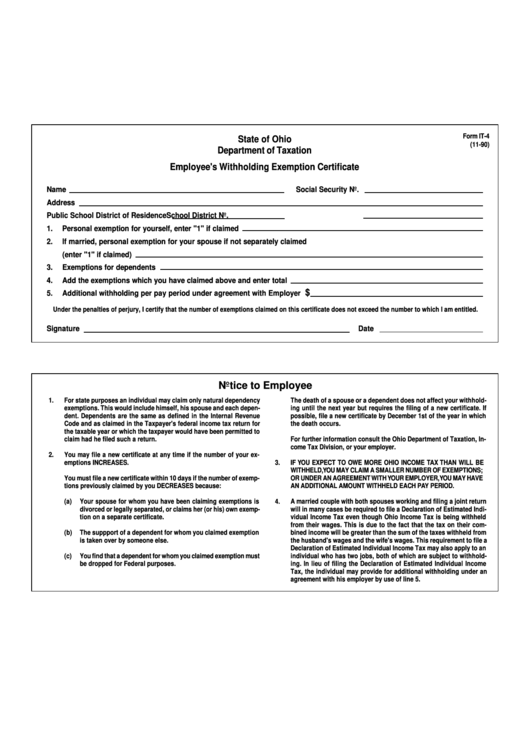

Ohio State Withholding Form - The department of taxation recently revised form it 4, employee’s withholding exemption certificate. Each employee must complete an ohio form it 4, employee’s withholding exemption certificate, or the employer shall withhold tax from the. You must withhold ohio income tax from the compensation that the employee earned in ohio, unless the employee is a legal resident of one. More details on employer withholding are available below. The federation of tax administrators maintains. Ohio form it 4, employee’s withholding exemption certificate, is a tax form issued by the ohio department of taxation. The ohio department of taxation provides a searchable. Access the forms you need to file taxes or do business in ohio. Archived tax forms (prior to 2006). Request a state of ohio income tax form be mailed to you.

The ohio department of taxation provides a searchable. The federation of tax administrators maintains. Ohio form it 4, employee’s withholding exemption certificate, is a tax form issued by the ohio department of taxation. You must withhold ohio income tax from the compensation that the employee earned in ohio, unless the employee is a legal resident of one. The department of taxation recently revised form it 4, employee’s withholding exemption certificate. More details on employer withholding are available below. Request a state of ohio income tax form be mailed to you. This updated form, or an electronic. Each employee must complete an ohio form it 4, employee’s withholding exemption certificate, or the employer shall withhold tax from the. Access the forms you need to file taxes or do business in ohio.

Archived tax forms (prior to 2006). Access the forms you need to file taxes or do business in ohio. The department of taxation recently revised form it 4, employee’s withholding exemption certificate. Request a state of ohio income tax form be mailed to you. You must withhold ohio income tax from the compensation that the employee earned in ohio, unless the employee is a legal resident of one. More details on employer withholding are available below. Ohio form it 4, employee’s withholding exemption certificate, is a tax form issued by the ohio department of taxation. Each employee must complete an ohio form it 4, employee’s withholding exemption certificate, or the employer shall withhold tax from the. The federation of tax administrators maintains. The ohio department of taxation provides a searchable.

Ohio State Withholding Tax Form 2022

The department of taxation recently revised form it 4, employee’s withholding exemption certificate. Request a state of ohio income tax form be mailed to you. More details on employer withholding are available below. Archived tax forms (prior to 2006). This updated form, or an electronic.

State Of Ohio State Tax Withholding Form

This updated form, or an electronic. Request a state of ohio income tax form be mailed to you. The federation of tax administrators maintains. Ohio form it 4, employee’s withholding exemption certificate, is a tax form issued by the ohio department of taxation. Each employee must complete an ohio form it 4, employee’s withholding exemption certificate, or the employer shall.

Ohio Department Of Taxation Employee Withholding Form

The federation of tax administrators maintains. Archived tax forms (prior to 2006). Access the forms you need to file taxes or do business in ohio. The ohio department of taxation provides a searchable. The department of taxation recently revised form it 4, employee’s withholding exemption certificate.

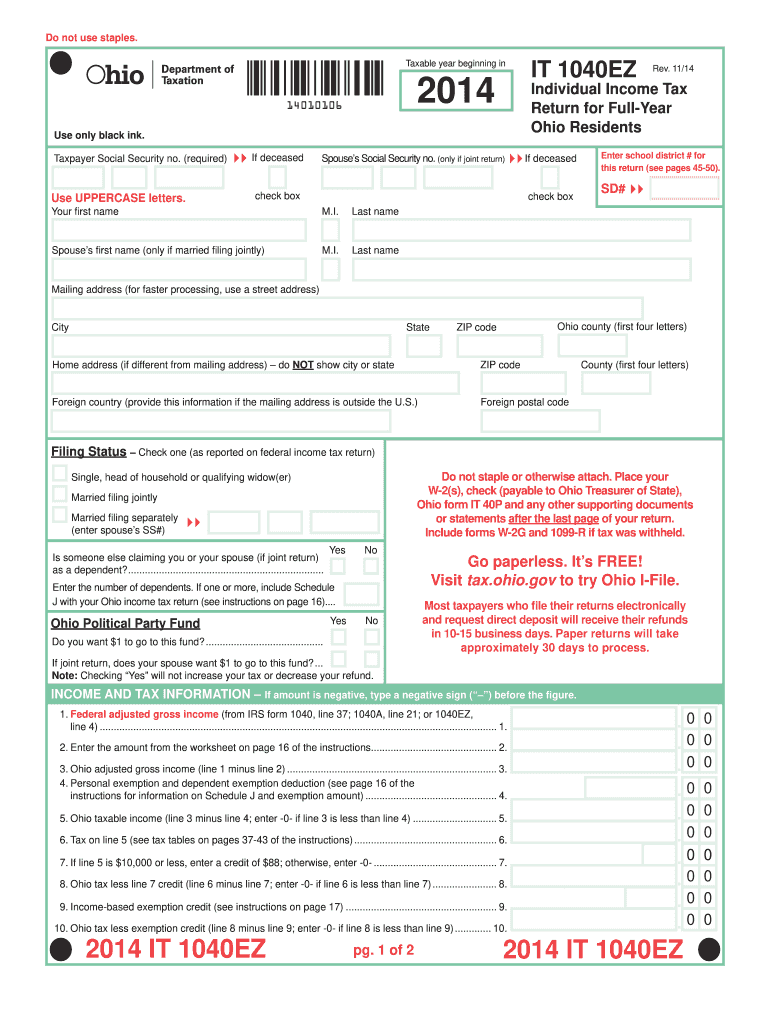

Ohio Tax 20142024 Form Fill Out and Sign Printable PDF Template

Ohio form it 4, employee’s withholding exemption certificate, is a tax form issued by the ohio department of taxation. Access the forms you need to file taxes or do business in ohio. This updated form, or an electronic. You must withhold ohio income tax from the compensation that the employee earned in ohio, unless the employee is a legal resident.

Ohio State Tax Forms Printable Printable Form 2024

Ohio form it 4, employee’s withholding exemption certificate, is a tax form issued by the ohio department of taxation. The department of taxation recently revised form it 4, employee’s withholding exemption certificate. Archived tax forms (prior to 2006). More details on employer withholding are available below. The ohio department of taxation provides a searchable.

Ohio Tax Withholding Form 2023 Printable Forms Free Online

This updated form, or an electronic. More details on employer withholding are available below. Each employee must complete an ohio form it 4, employee’s withholding exemption certificate, or the employer shall withhold tax from the. Access the forms you need to file taxes or do business in ohio. Request a state of ohio income tax form be mailed to you.

Ohio State Withholding Form It 501

You must withhold ohio income tax from the compensation that the employee earned in ohio, unless the employee is a legal resident of one. The ohio department of taxation provides a searchable. This updated form, or an electronic. Each employee must complete an ohio form it 4, employee’s withholding exemption certificate, or the employer shall withhold tax from the. More.

Top Ohio Withholding Form Templates free to download in PDF format

You must withhold ohio income tax from the compensation that the employee earned in ohio, unless the employee is a legal resident of one. Access the forms you need to file taxes or do business in ohio. Each employee must complete an ohio form it 4, employee’s withholding exemption certificate, or the employer shall withhold tax from the. This updated.

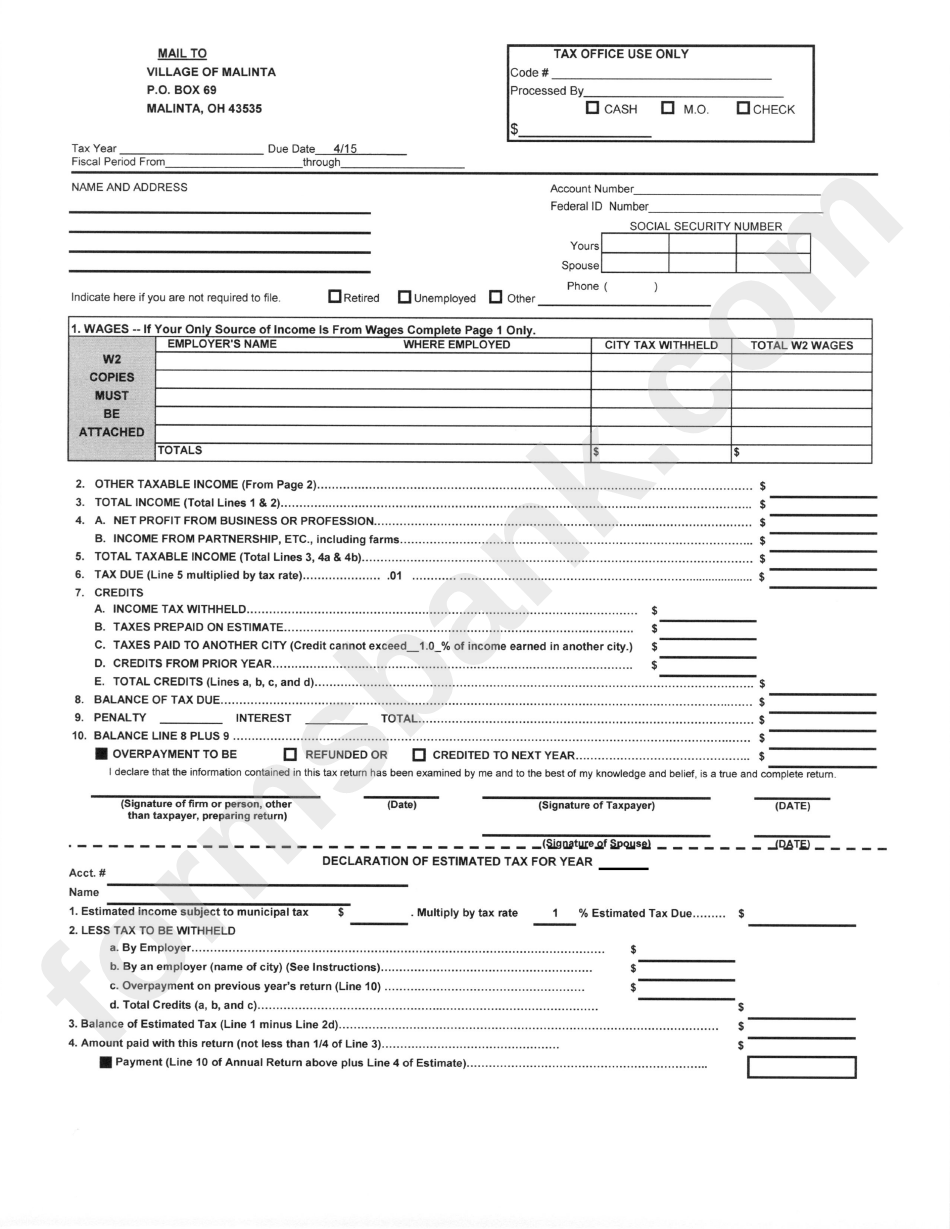

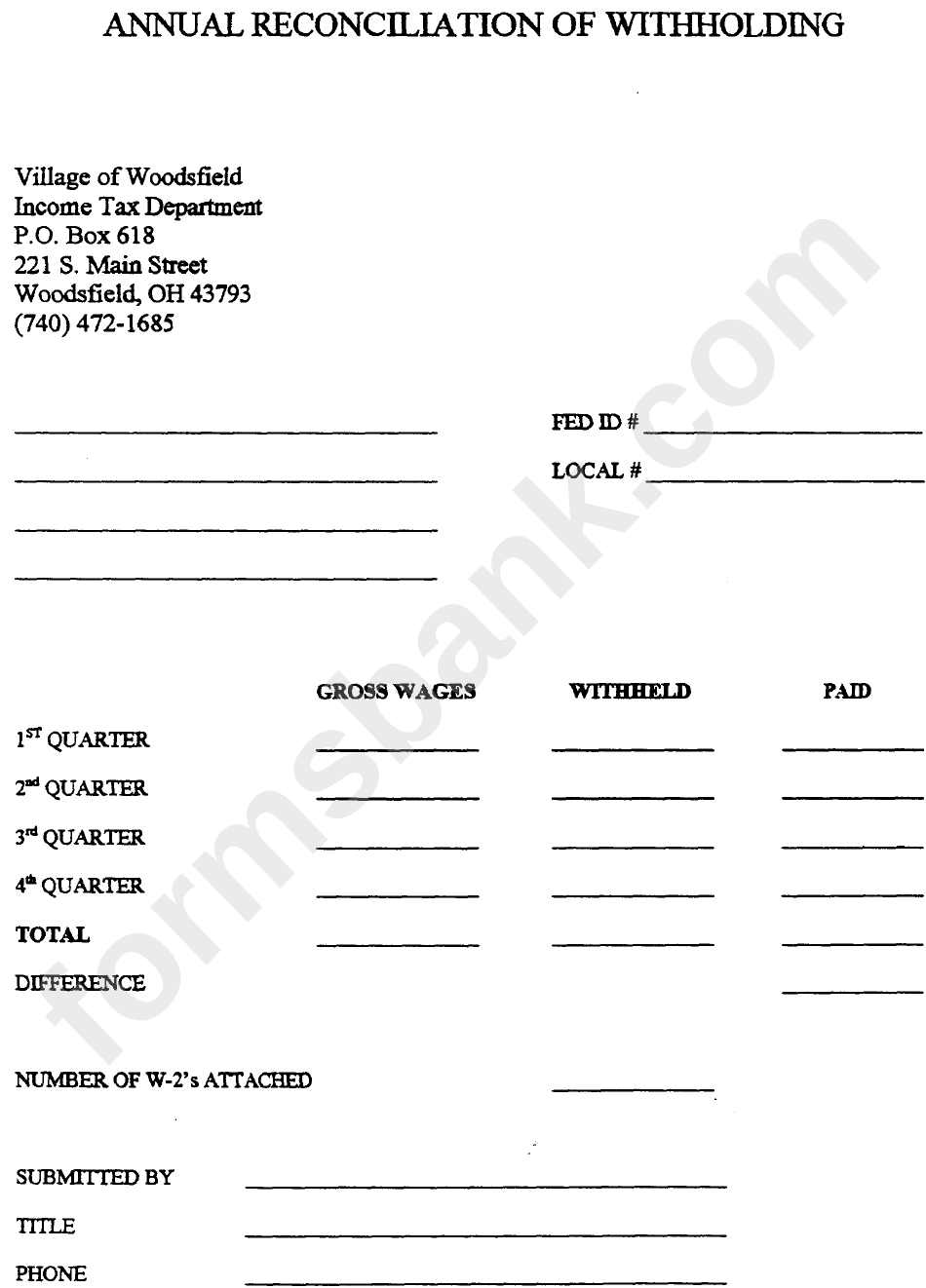

Annual Reconciliation Form Of Withholding State Of Ohio printable pdf

Ohio form it 4, employee’s withholding exemption certificate, is a tax form issued by the ohio department of taxation. The federation of tax administrators maintains. Each employee must complete an ohio form it 4, employee’s withholding exemption certificate, or the employer shall withhold tax from the. The ohio department of taxation provides a searchable. This updated form, or an electronic.

Online Ohio State Tax Withholding Form

Request a state of ohio income tax form be mailed to you. More details on employer withholding are available below. Each employee must complete an ohio form it 4, employee’s withholding exemption certificate, or the employer shall withhold tax from the. The federation of tax administrators maintains. Access the forms you need to file taxes or do business in ohio.

The Federation Of Tax Administrators Maintains.

More details on employer withholding are available below. This updated form, or an electronic. Each employee must complete an ohio form it 4, employee’s withholding exemption certificate, or the employer shall withhold tax from the. The ohio department of taxation provides a searchable.

Request A State Of Ohio Income Tax Form Be Mailed To You.

Archived tax forms (prior to 2006). Access the forms you need to file taxes or do business in ohio. You must withhold ohio income tax from the compensation that the employee earned in ohio, unless the employee is a legal resident of one. Ohio form it 4, employee’s withholding exemption certificate, is a tax form issued by the ohio department of taxation.