Ohio Sales Tax Exemption Form - Find out the types of exemptions, the application. Learn the requirements, reasons, and id. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. What purchases are exempt from the ohio sales tax? Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Download and complete this form to claim a sales tax exemption in multiple states, including ohio. There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Learn how to apply for a sales tax exemption number in ohio and when you need to use it.

Download and complete this form to claim a sales tax exemption in multiple states, including ohio. Learn the requirements, reasons, and id. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. What purchases are exempt from the ohio sales tax? There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. Learn how to apply for a sales tax exemption number in ohio and when you need to use it. Find out the types of exemptions, the application. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio.

Learn how to apply for a sales tax exemption number in ohio and when you need to use it. There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. Download and complete this form to claim a sales tax exemption in multiple states, including ohio. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Find out the types of exemptions, the application. What purchases are exempt from the ohio sales tax? Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. Learn the requirements, reasons, and id.

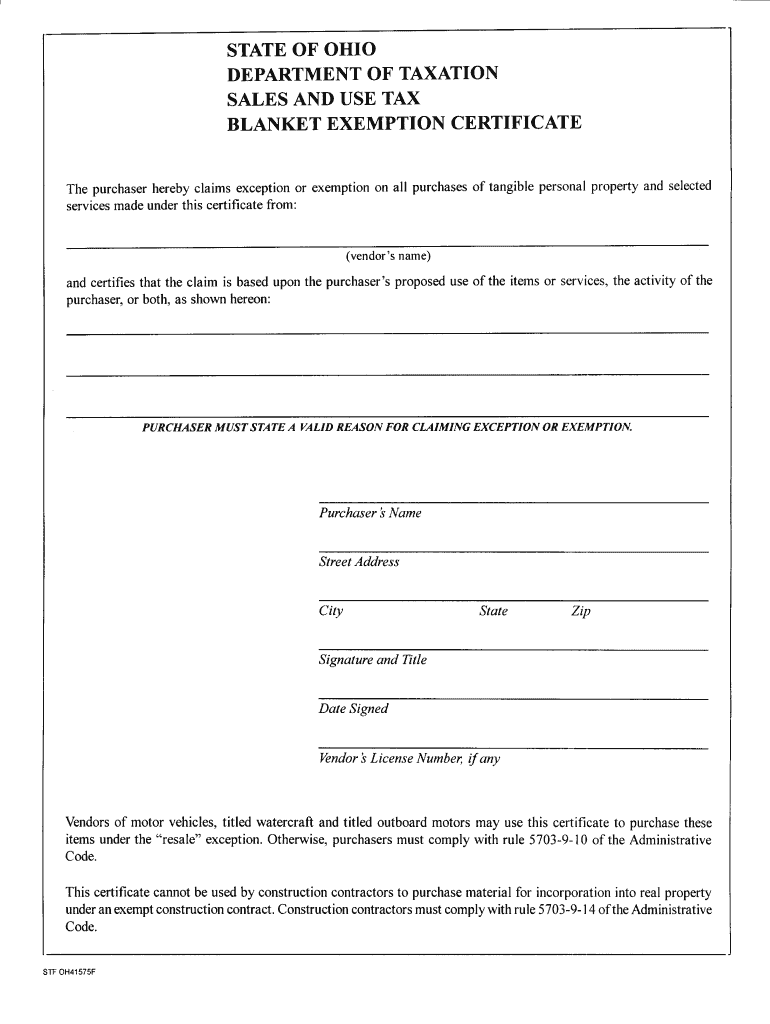

blanket certificate of exemption ohio Fill Online, Printable, Fillable

What purchases are exempt from the ohio sales tax? There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. Download and complete this form to claim a sales tax exemption in multiple states, including ohio. Download.

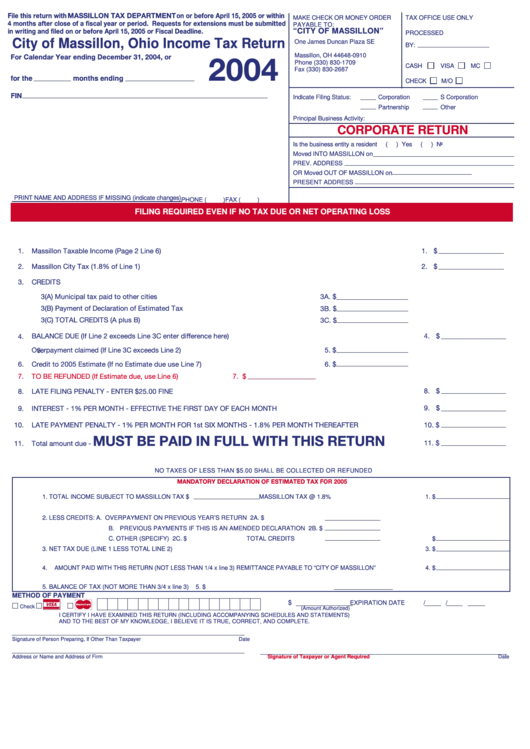

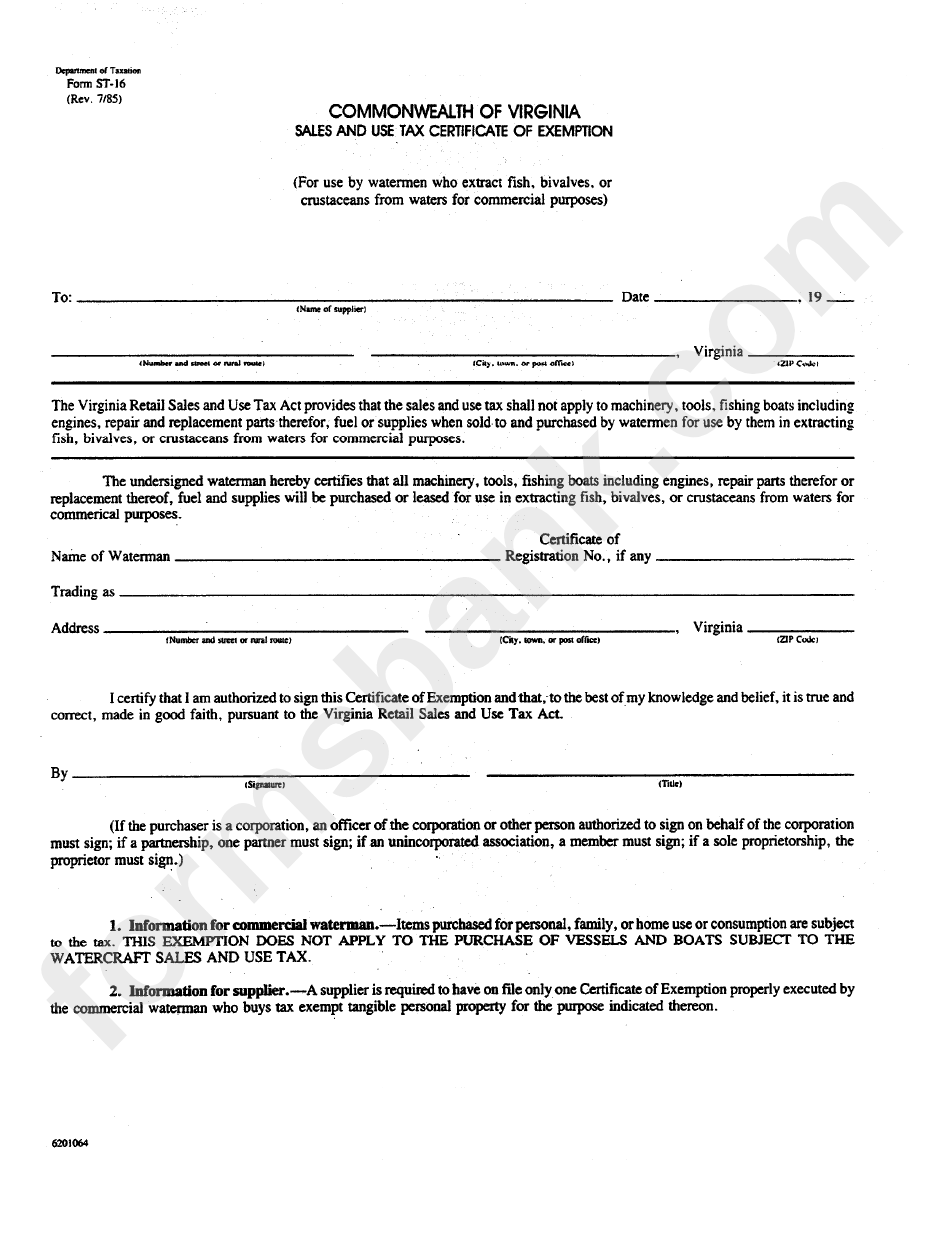

Sales Tax Exempt Form 2024 Va

Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio..

Icc Mc Sales Tax Exemption Form Ohio

What purchases are exempt from the ohio sales tax? There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. Download and complete this form to claim a sales tax exemption in multiple.

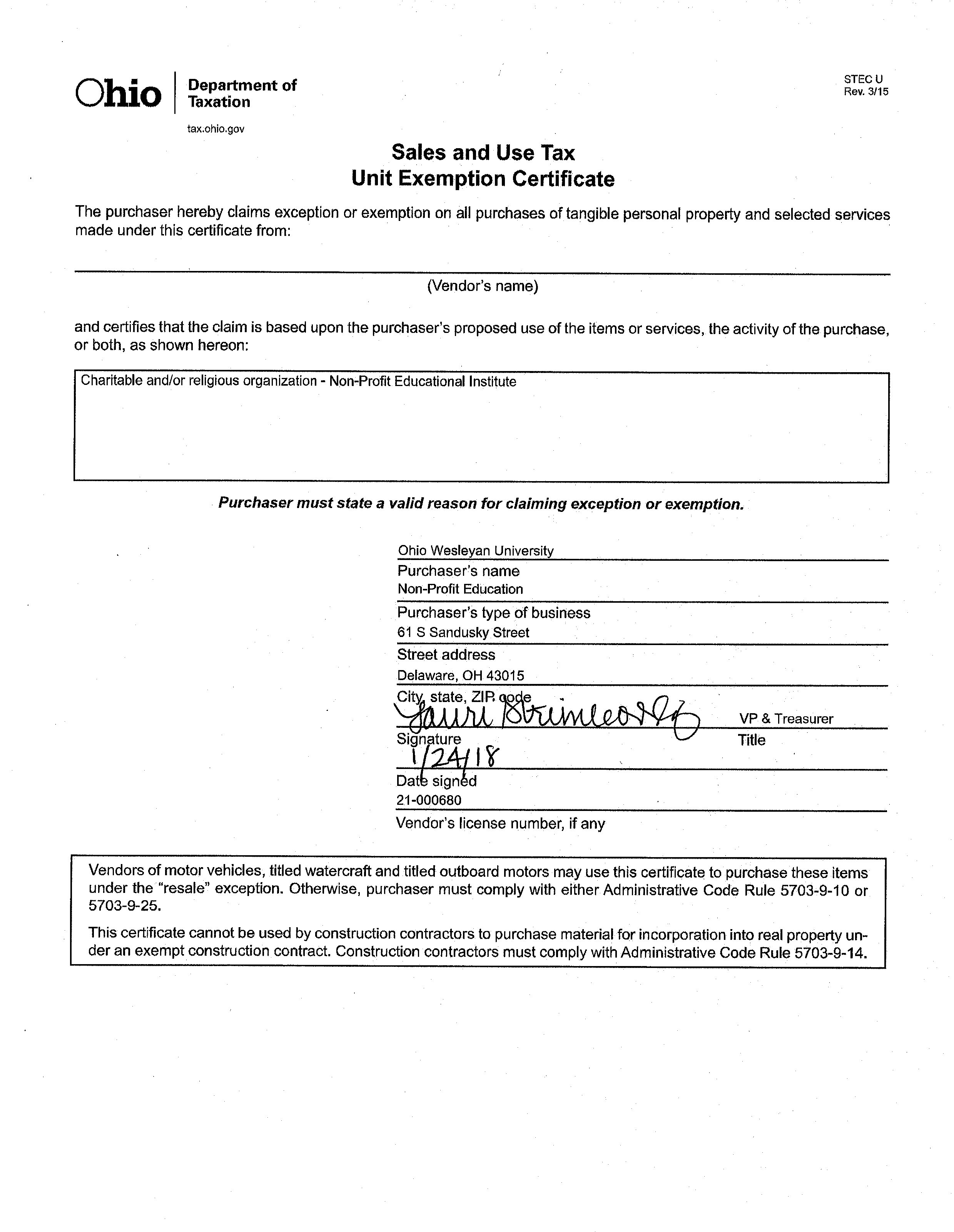

Ohio tax exempt form Fill out & sign online DocHub

There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Find out the types.

Ohio Sales Tax Exemption Form 2024 Pdf Ranee Casandra

While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. What purchases are exempt from the ohio sales tax? Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a.

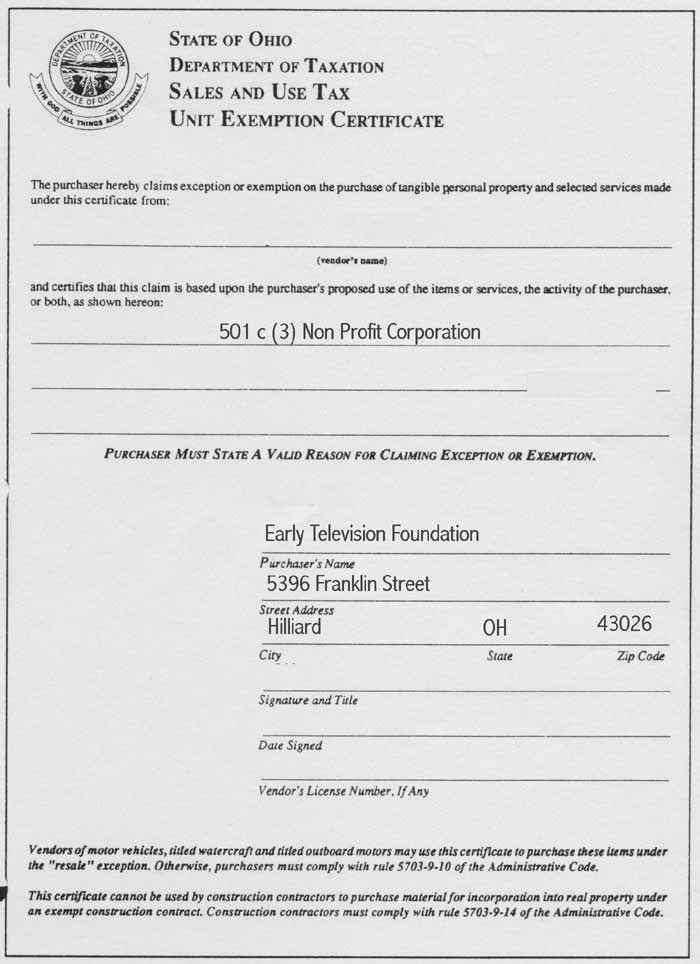

The Early Television Foundation

There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate..

Sales Tax Exempt Certificate Fill Online, Printable, Fillable, Blank

Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Learn the requirements, reasons, and id. What purchases are exempt from the ohio sales tax? Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. There.

Ohio Sales And Use Tax Blanket Exemption Certificate Instructions

What purchases are exempt from the ohio sales tax? Learn how to apply for a sales tax exemption number in ohio and when you need to use it. While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. Download and complete this form to claim a sales tax exemption in multiple states, including ohio..

Form St16 Sales And Use Tax Certificate Of Exemption Commonwealth

Learn how to apply for a sales tax exemption number in ohio and when you need to use it. While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. Download and fill out this form to.

Texas Sales And Use Tax Resale Certificate Example / 01 315 Form Fill

Learn how to apply for a sales tax exemption number in ohio and when you need to use it. What purchases are exempt from the ohio sales tax? While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. Download and complete this form to claim a sales tax exemption in multiple states, including ohio..

Learn The Requirements, Reasons, And Id.

Download and complete this form to claim a sales tax exemption in multiple states, including ohio. Find out the types of exemptions, the application. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. What purchases are exempt from the ohio sales tax?

There Is A Special Contractor's Exemption Certificate And A Construction Contract Exemption Certificate Prescribed By The Tax Commissioner.

Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Learn how to apply for a sales tax exemption number in ohio and when you need to use it. While the ohio sales tax of 5.75% applies to most transactions, there are certain items that.