Nys Real Property Tax Exemption Forms - For a list of available property tax exemptions in new york state, see assessor manuals, exemption administration, part 1:. The application packets linked below include all relevant forms and instructions needed to apply for each type of exemption. 141 rows exemption applications must be filed with your local assessor’s office. See our municipal profiles for your local assessor’s. The real property tax law requires all properties in each municipality (except in new york city and nassau county) to be assessed at a uniform. Exemption applications must be filed with your local assessor’s office. See our municipal profiles for your local assessor’s. Access various tax forms such a changing your name, exemptions, grievances and more.

The real property tax law requires all properties in each municipality (except in new york city and nassau county) to be assessed at a uniform. For a list of available property tax exemptions in new york state, see assessor manuals, exemption administration, part 1:. Exemption applications must be filed with your local assessor’s office. The application packets linked below include all relevant forms and instructions needed to apply for each type of exemption. See our municipal profiles for your local assessor’s. See our municipal profiles for your local assessor’s. 141 rows exemption applications must be filed with your local assessor’s office. Access various tax forms such a changing your name, exemptions, grievances and more.

The real property tax law requires all properties in each municipality (except in new york city and nassau county) to be assessed at a uniform. See our municipal profiles for your local assessor’s. The application packets linked below include all relevant forms and instructions needed to apply for each type of exemption. Access various tax forms such a changing your name, exemptions, grievances and more. For a list of available property tax exemptions in new york state, see assessor manuals, exemption administration, part 1:. 141 rows exemption applications must be filed with your local assessor’s office. Exemption applications must be filed with your local assessor’s office. See our municipal profiles for your local assessor’s.

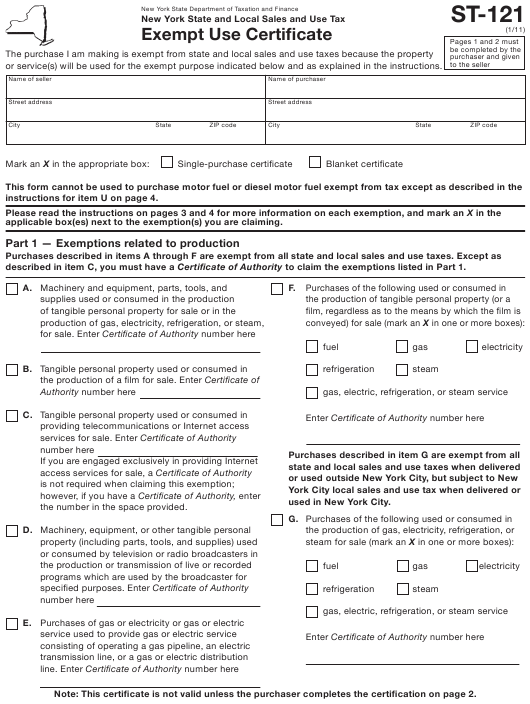

Form St 127 Nys And Local Sales And Use Tax Exemption Certificate

Exemption applications must be filed with your local assessor’s office. See our municipal profiles for your local assessor’s. Access various tax forms such a changing your name, exemptions, grievances and more. For a list of available property tax exemptions in new york state, see assessor manuals, exemption administration, part 1:. 141 rows exemption applications must be filed with your local.

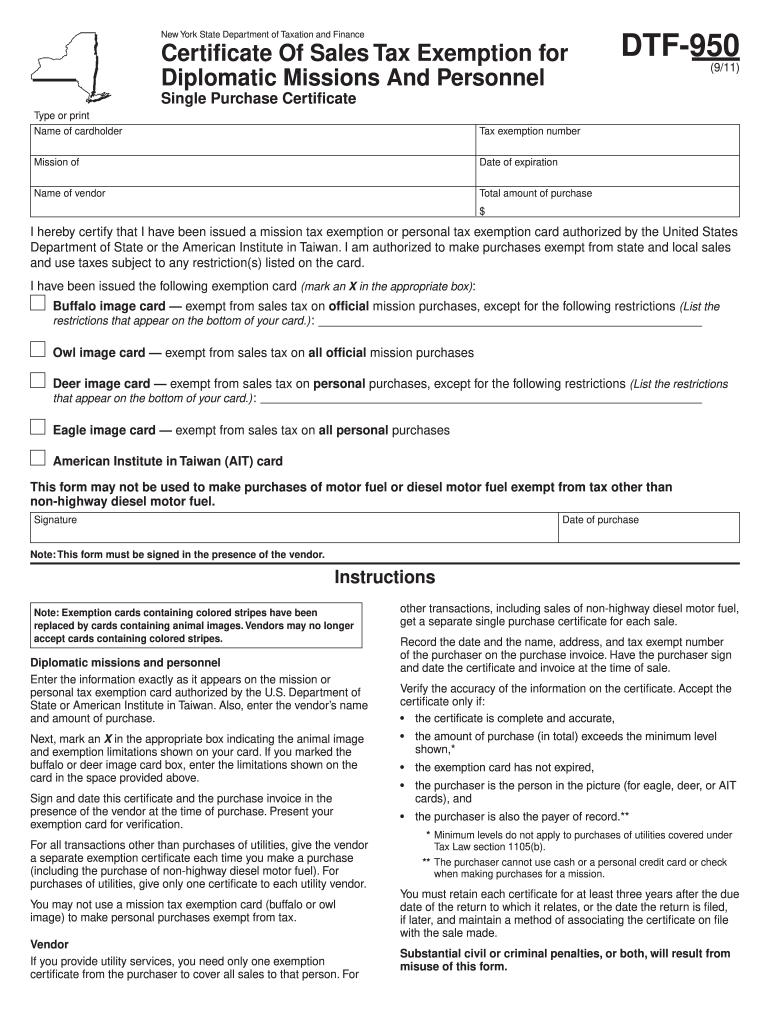

Nys tax exempt form Fill out & sign online DocHub

See our municipal profiles for your local assessor’s. Exemption applications must be filed with your local assessor’s office. The real property tax law requires all properties in each municipality (except in new york city and nassau county) to be assessed at a uniform. 141 rows exemption applications must be filed with your local assessor’s office. The application packets linked below.

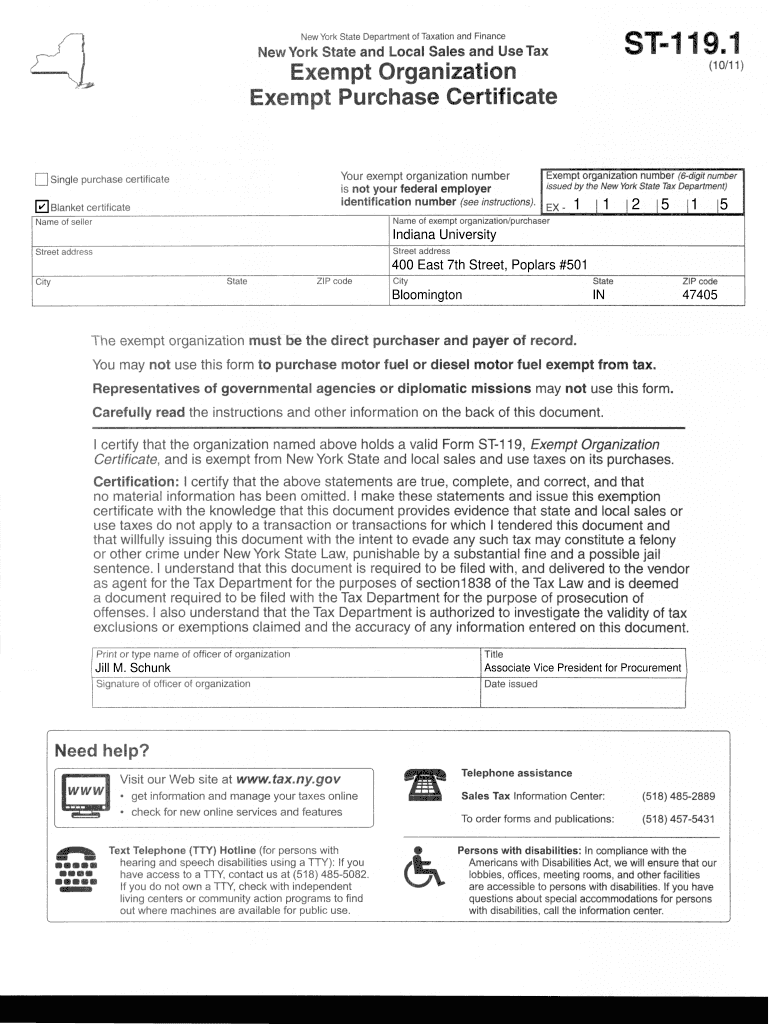

New York State Tax Exempt Form St 119

Access various tax forms such a changing your name, exemptions, grievances and more. 141 rows exemption applications must be filed with your local assessor’s office. The real property tax law requires all properties in each municipality (except in new york city and nassau county) to be assessed at a uniform. For a list of available property tax exemptions in new.

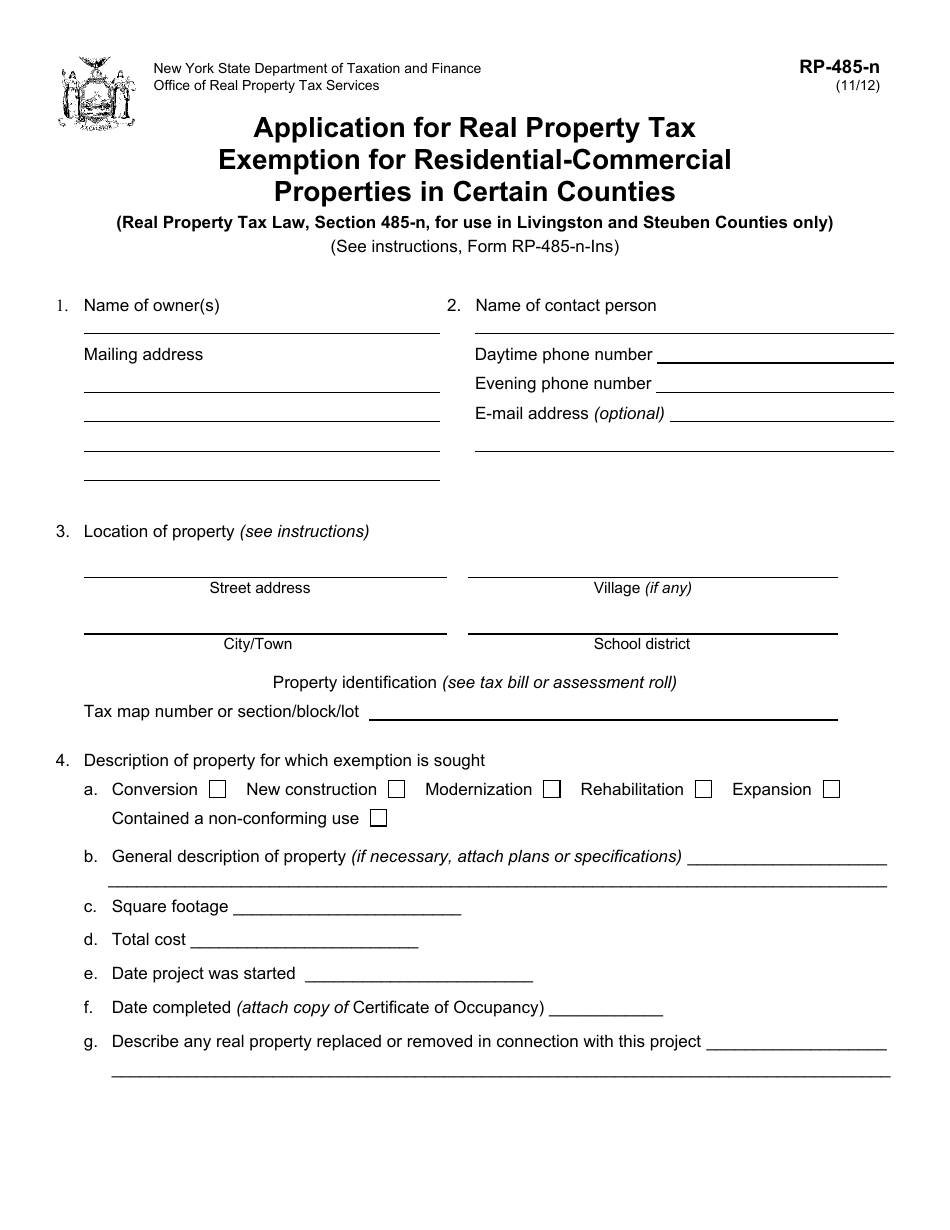

Form RP485N Fill Out, Sign Online and Download Fillable PDF, New

Access various tax forms such a changing your name, exemptions, grievances and more. The real property tax law requires all properties in each municipality (except in new york city and nassau county) to be assessed at a uniform. For a list of available property tax exemptions in new york state, see assessor manuals, exemption administration, part 1:. See our municipal.

Agricultural Tax Exempt Form Nys

See our municipal profiles for your local assessor’s. Exemption applications must be filed with your local assessor’s office. 141 rows exemption applications must be filed with your local assessor’s office. The real property tax law requires all properties in each municipality (except in new york city and nassau county) to be assessed at a uniform. See our municipal profiles for.

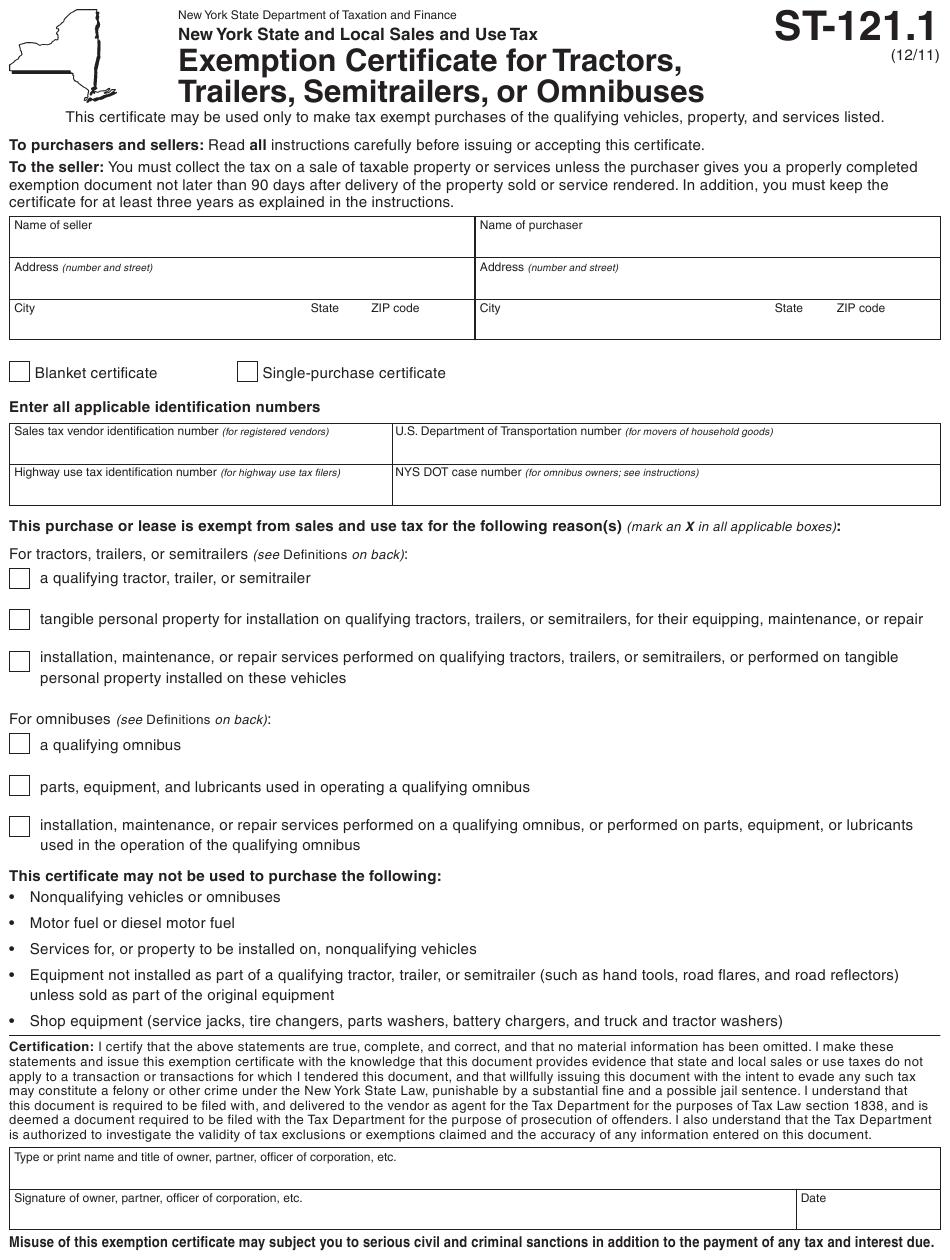

Nys Tractor Trailer Tax Exempt Form

For a list of available property tax exemptions in new york state, see assessor manuals, exemption administration, part 1:. 141 rows exemption applications must be filed with your local assessor’s office. Access various tax forms such a changing your name, exemptions, grievances and more. See our municipal profiles for your local assessor’s. The application packets linked below include all relevant.

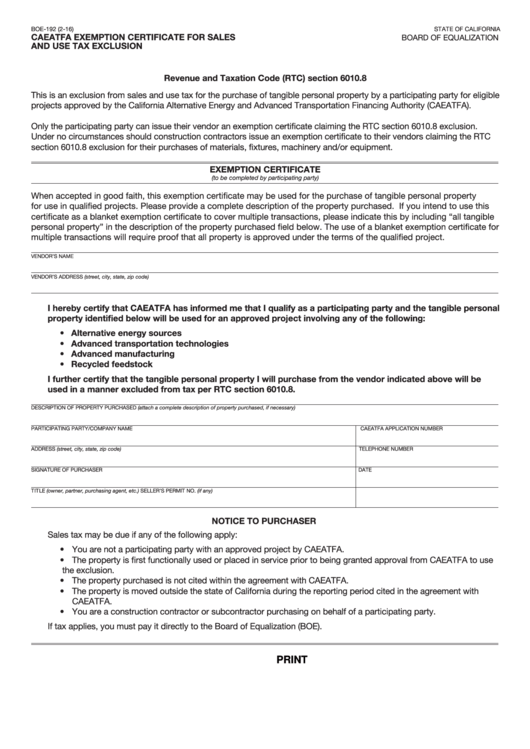

Fillable Caeatfa Exemption Certificate For Sales And Use Tax Exclusion

The application packets linked below include all relevant forms and instructions needed to apply for each type of exemption. 141 rows exemption applications must be filed with your local assessor’s office. See our municipal profiles for your local assessor’s. Exemption applications must be filed with your local assessor’s office. The real property tax law requires all properties in each municipality.

Nys Tax Exempt Form St125

See our municipal profiles for your local assessor’s. See our municipal profiles for your local assessor’s. Exemption applications must be filed with your local assessor’s office. For a list of available property tax exemptions in new york state, see assessor manuals, exemption administration, part 1:. The application packets linked below include all relevant forms and instructions needed to apply for.

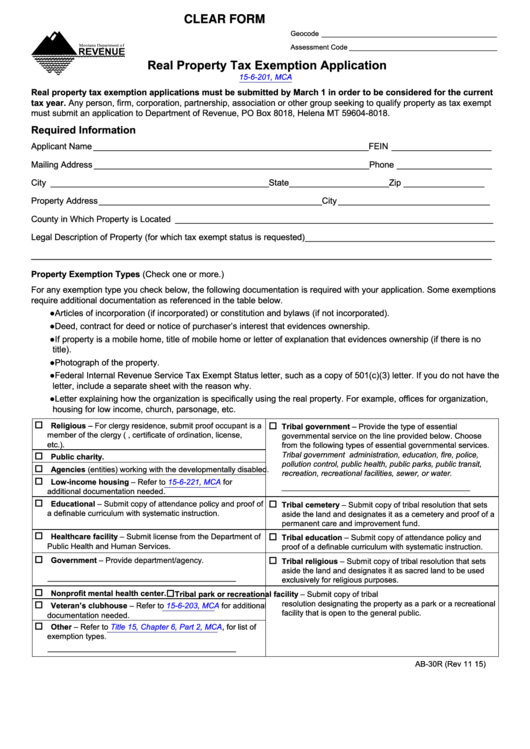

Top 21 Property Tax Exemption Form Templates free to download in PDF format

141 rows exemption applications must be filed with your local assessor’s office. For a list of available property tax exemptions in new york state, see assessor manuals, exemption administration, part 1:. The application packets linked below include all relevant forms and instructions needed to apply for each type of exemption. Exemption applications must be filed with your local assessor’s office..

St 121 Fillable Form Printable Forms Free Online

For a list of available property tax exemptions in new york state, see assessor manuals, exemption administration, part 1:. The application packets linked below include all relevant forms and instructions needed to apply for each type of exemption. 141 rows exemption applications must be filed with your local assessor’s office. See our municipal profiles for your local assessor’s. The real.

See Our Municipal Profiles For Your Local Assessor’s.

For a list of available property tax exemptions in new york state, see assessor manuals, exemption administration, part 1:. See our municipal profiles for your local assessor’s. Exemption applications must be filed with your local assessor’s office. 141 rows exemption applications must be filed with your local assessor’s office.

The Application Packets Linked Below Include All Relevant Forms And Instructions Needed To Apply For Each Type Of Exemption.

Access various tax forms such a changing your name, exemptions, grievances and more. The real property tax law requires all properties in each municipality (except in new york city and nassau county) to be assessed at a uniform.