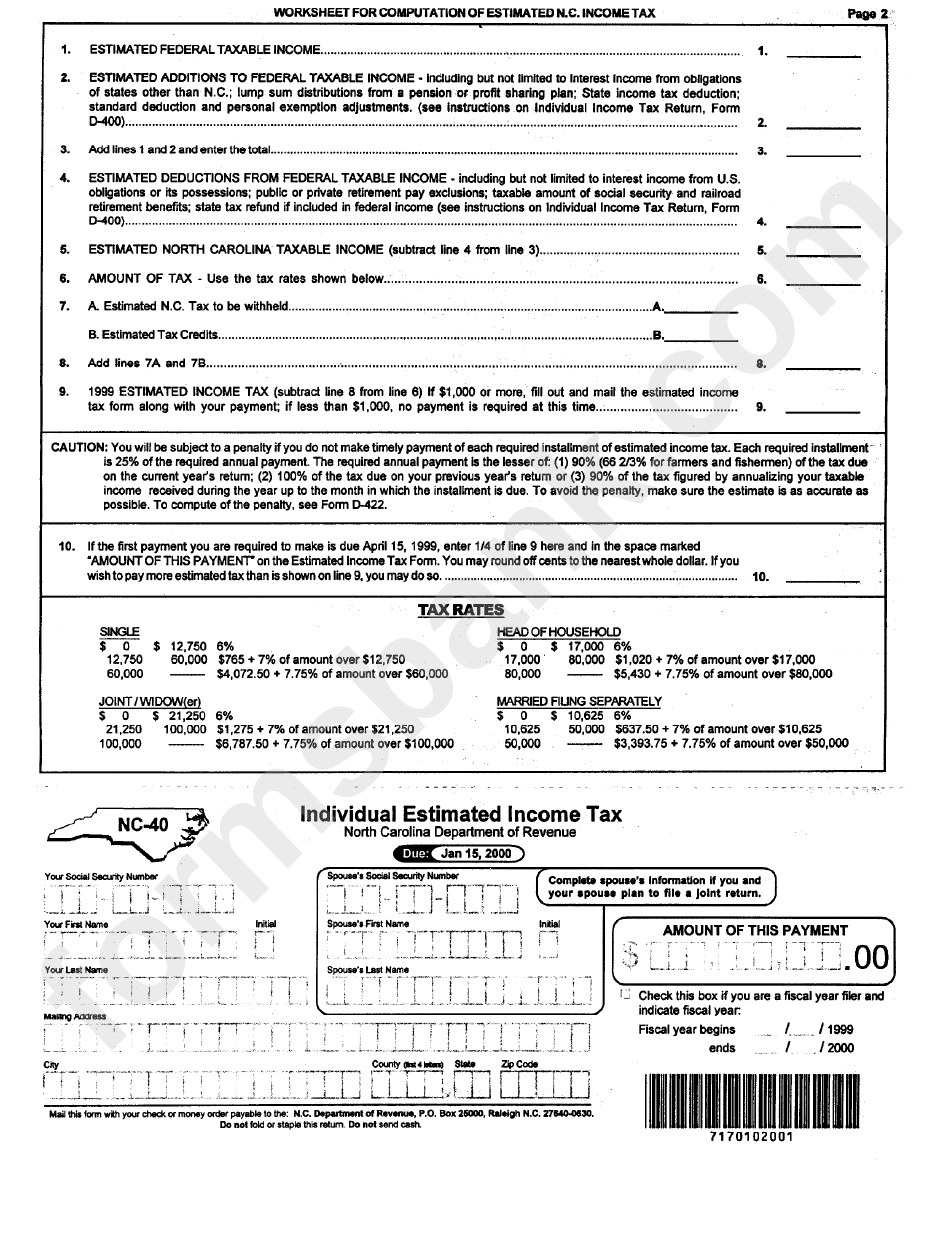

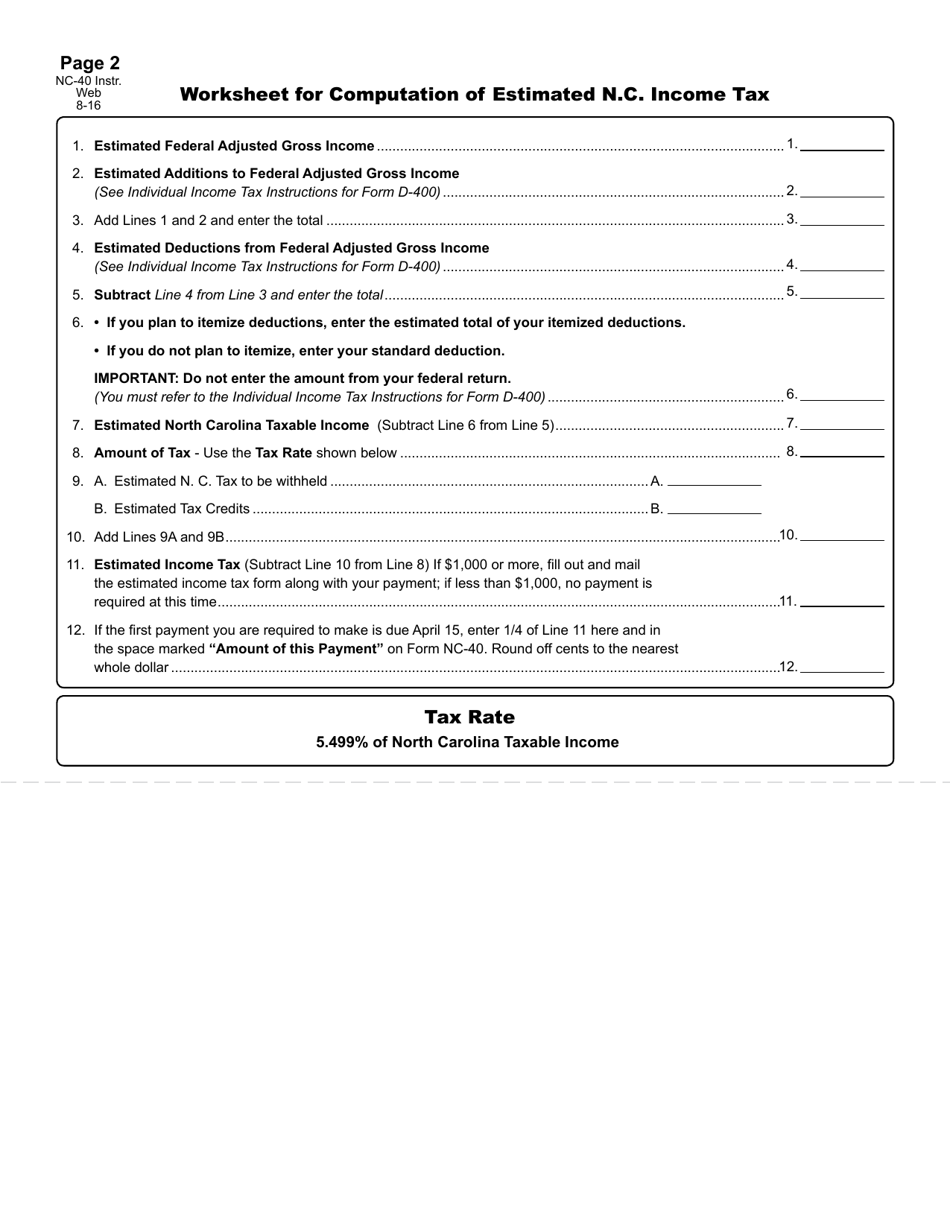

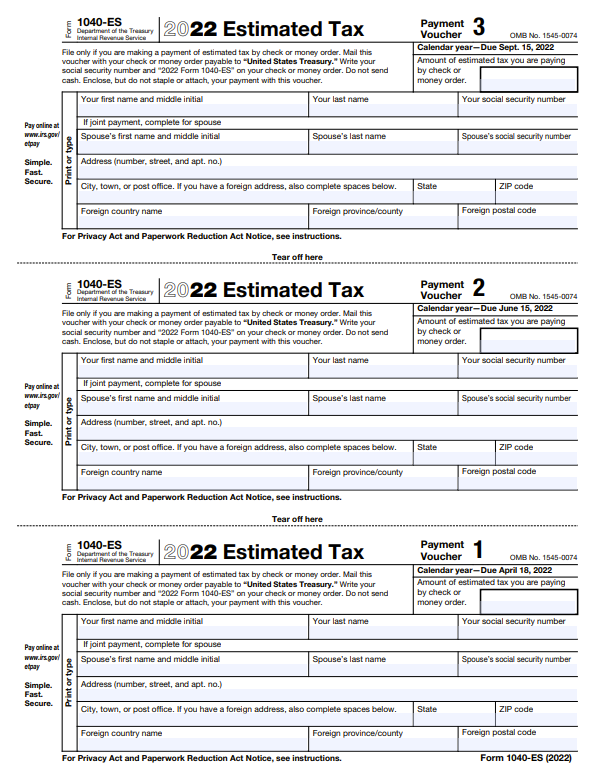

North Carolina Estimated Tax Form 2023 - You must pay estimated income tax if you are self employed or do not pay sufficient tax. Download or print the 2023 north carolina (individual estimated income tax) (2023) and other income tax forms from the north carolina. Click here for help if the form does not appear after you click create form. Choose calendar year or select a begin date and end date:. However, you may pay your estimated tax.

However, you may pay your estimated tax. Download or print the 2023 north carolina (individual estimated income tax) (2023) and other income tax forms from the north carolina. You must pay estimated income tax if you are self employed or do not pay sufficient tax. Choose calendar year or select a begin date and end date:. Click here for help if the form does not appear after you click create form.

Download or print the 2023 north carolina (individual estimated income tax) (2023) and other income tax forms from the north carolina. Choose calendar year or select a begin date and end date:. Click here for help if the form does not appear after you click create form. You must pay estimated income tax if you are self employed or do not pay sufficient tax. However, you may pay your estimated tax.

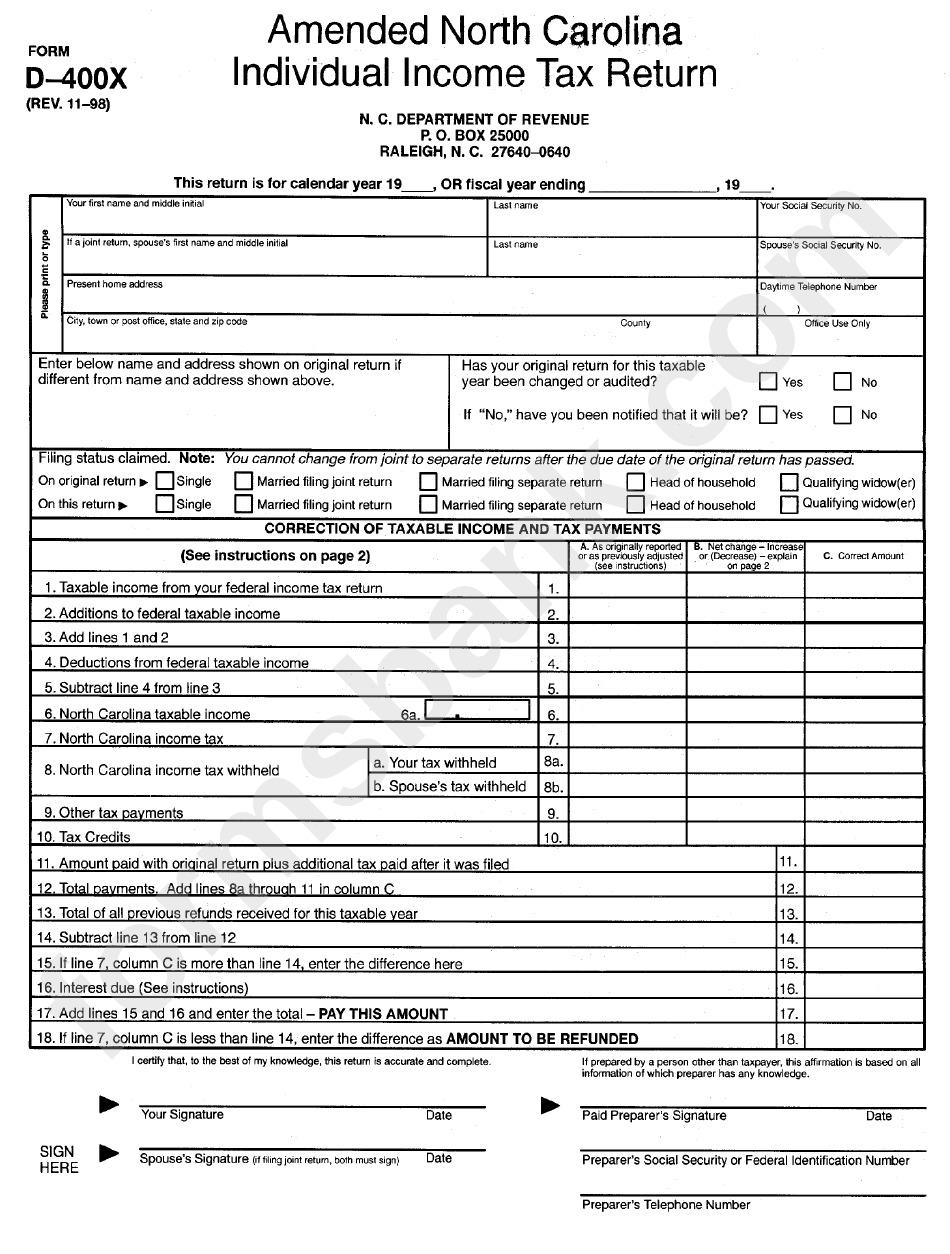

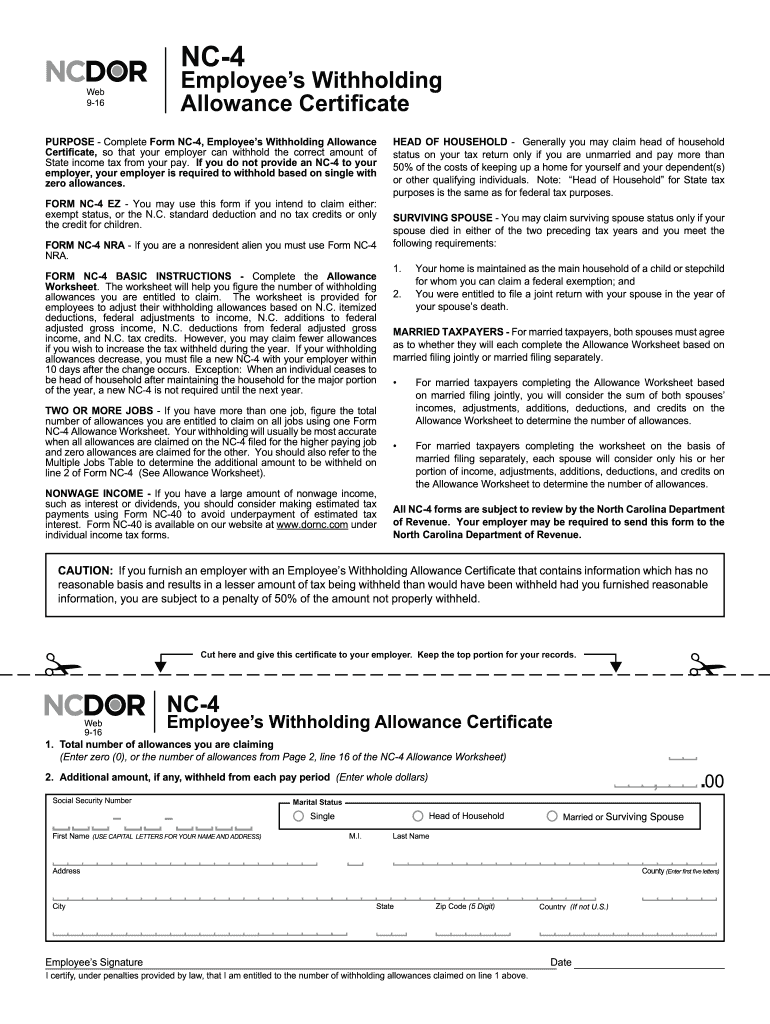

North Carolina State Tax Withholding Form 2024 Dian Kathie

You must pay estimated income tax if you are self employed or do not pay sufficient tax. However, you may pay your estimated tax. Choose calendar year or select a begin date and end date:. Click here for help if the form does not appear after you click create form. Download or print the 2023 north carolina (individual estimated income.

Nc Estimated Tax Payments 2024 Ruthe Clarissa

Download or print the 2023 north carolina (individual estimated income tax) (2023) and other income tax forms from the north carolina. Click here for help if the form does not appear after you click create form. However, you may pay your estimated tax. You must pay estimated income tax if you are self employed or do not pay sufficient tax..

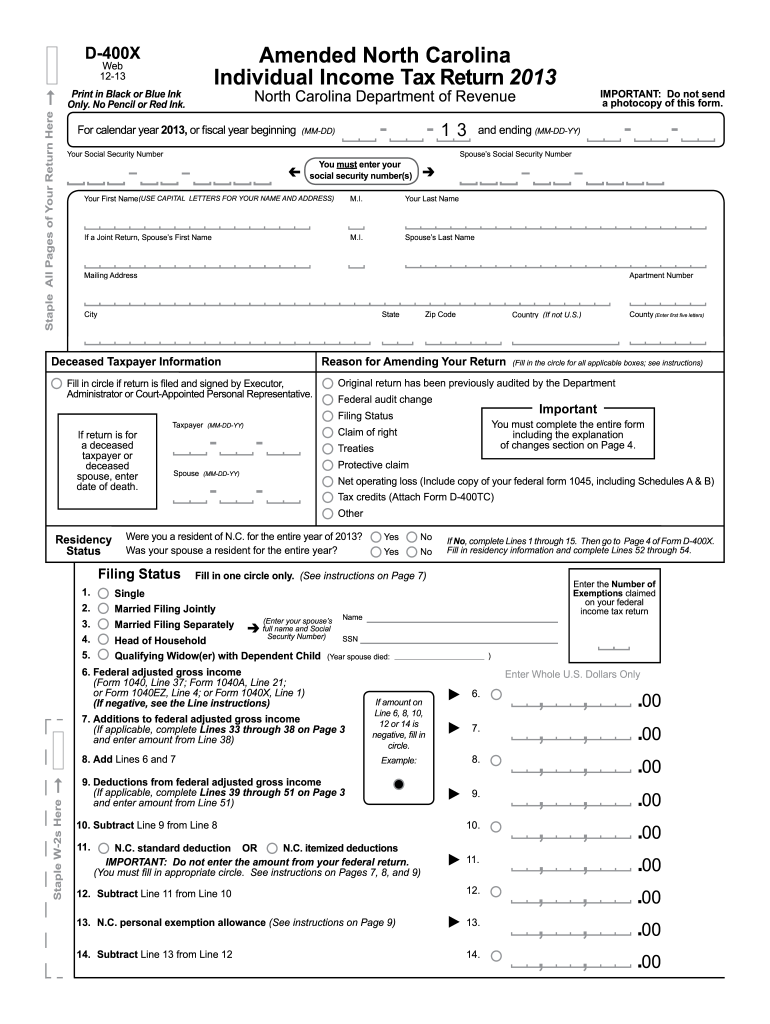

Nc State Tax Forms Printable

Choose calendar year or select a begin date and end date:. You must pay estimated income tax if you are self employed or do not pay sufficient tax. Download or print the 2023 north carolina (individual estimated income tax) (2023) and other income tax forms from the north carolina. However, you may pay your estimated tax. Click here for help.

Kansas Estimated Tax Form 2023 Printable Forms Free Online

Choose calendar year or select a begin date and end date:. You must pay estimated income tax if you are self employed or do not pay sufficient tax. Click here for help if the form does not appear after you click create form. Download or print the 2023 north carolina (individual estimated income tax) (2023) and other income tax forms.

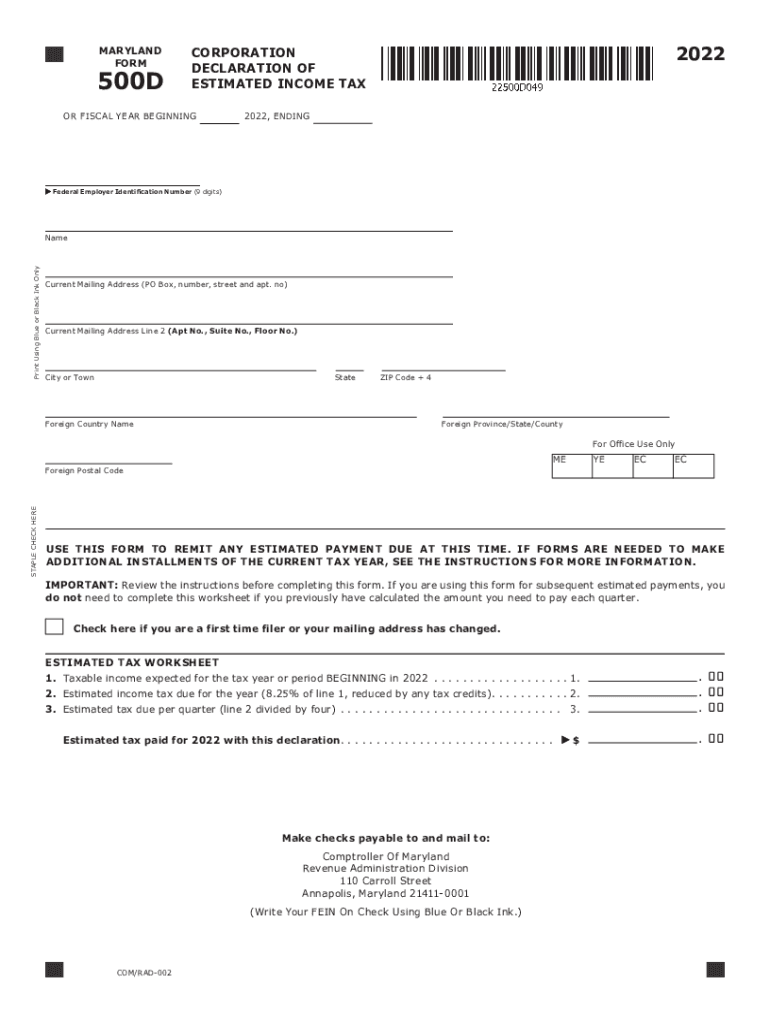

2022 Form MD Comptroller 500D Fill Online, Printable, Fillable, Blank

Choose calendar year or select a begin date and end date:. You must pay estimated income tax if you are self employed or do not pay sufficient tax. Download or print the 2023 north carolina (individual estimated income tax) (2023) and other income tax forms from the north carolina. Click here for help if the form does not appear after.

Irs Estimated Tax Forms 2024 Lyndy Loretta

You must pay estimated income tax if you are self employed or do not pay sufficient tax. Download or print the 2023 north carolina (individual estimated income tax) (2023) and other income tax forms from the north carolina. However, you may pay your estimated tax. Click here for help if the form does not appear after you click create form..

North Carolina Estimated Tax Form 2024 Vivi Alvinia

Choose calendar year or select a begin date and end date:. You must pay estimated income tax if you are self employed or do not pay sufficient tax. Click here for help if the form does not appear after you click create form. Download or print the 2023 north carolina (individual estimated income tax) (2023) and other income tax forms.

Minnesota Estimated Tax Form 2024 Torie Harmonia

Download or print the 2023 north carolina (individual estimated income tax) (2023) and other income tax forms from the north carolina. Click here for help if the form does not appear after you click create form. Choose calendar year or select a begin date and end date:. You must pay estimated income tax if you are self employed or do.

North Carolina State Tax Withholding Form 2023 Printable Forms Free

Download or print the 2023 north carolina (individual estimated income tax) (2023) and other income tax forms from the north carolina. Click here for help if the form does not appear after you click create form. Choose calendar year or select a begin date and end date:. You must pay estimated income tax if you are self employed or do.

North Carolina Estimated Tax Form 2024 Vivi Alvinia

Click here for help if the form does not appear after you click create form. You must pay estimated income tax if you are self employed or do not pay sufficient tax. Choose calendar year or select a begin date and end date:. However, you may pay your estimated tax. Download or print the 2023 north carolina (individual estimated income.

Click Here For Help If The Form Does Not Appear After You Click Create Form.

Download or print the 2023 north carolina (individual estimated income tax) (2023) and other income tax forms from the north carolina. You must pay estimated income tax if you are self employed or do not pay sufficient tax. However, you may pay your estimated tax. Choose calendar year or select a begin date and end date:.