Nebraska Inheritance Tax Worksheet - Nebraska law requires the the personal representative of an estate to submit a report summarizing inheritance taxes by class of. In short, when a loved one dies and you inherit their property, you may be subject to an inheritance tax on that property. Distribution of proceeds from estate; In 2022, nebraska, through lb 310, changed its inheritance tax law. These changes are discussed as an update to this article. Nebraska inheritance tax is computed on the fair market value of annuities, life estates, terms for years, remainders, and.

These changes are discussed as an update to this article. Nebraska inheritance tax is computed on the fair market value of annuities, life estates, terms for years, remainders, and. In 2022, nebraska, through lb 310, changed its inheritance tax law. Distribution of proceeds from estate; Nebraska law requires the the personal representative of an estate to submit a report summarizing inheritance taxes by class of. In short, when a loved one dies and you inherit their property, you may be subject to an inheritance tax on that property.

In 2022, nebraska, through lb 310, changed its inheritance tax law. Nebraska law requires the the personal representative of an estate to submit a report summarizing inheritance taxes by class of. These changes are discussed as an update to this article. In short, when a loved one dies and you inherit their property, you may be subject to an inheritance tax on that property. Distribution of proceeds from estate; Nebraska inheritance tax is computed on the fair market value of annuities, life estates, terms for years, remainders, and.

34 Nebraska Inheritance Tax Worksheet support worksheet

Nebraska inheritance tax is computed on the fair market value of annuities, life estates, terms for years, remainders, and. In 2022, nebraska, through lb 310, changed its inheritance tax law. Nebraska law requires the the personal representative of an estate to submit a report summarizing inheritance taxes by class of. In short, when a loved one dies and you inherit.

Nebraska Inheritance Tax Worksheet Excel

In short, when a loved one dies and you inherit their property, you may be subject to an inheritance tax on that property. In 2022, nebraska, through lb 310, changed its inheritance tax law. These changes are discussed as an update to this article. Nebraska inheritance tax is computed on the fair market value of annuities, life estates, terms for.

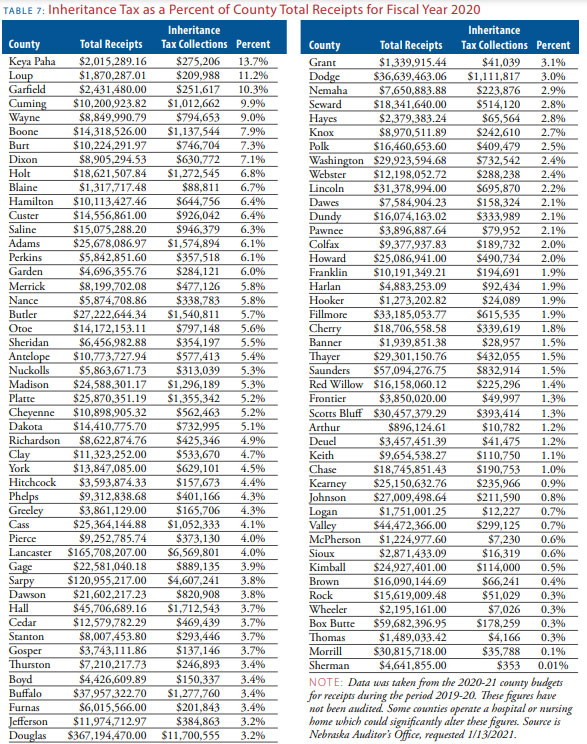

Nebraska County Inheritance Tax Worksheets

Nebraska law requires the the personal representative of an estate to submit a report summarizing inheritance taxes by class of. These changes are discussed as an update to this article. Nebraska inheritance tax is computed on the fair market value of annuities, life estates, terms for years, remainders, and. In short, when a loved one dies and you inherit their.

Does Nebraska Have an Inheritance Tax? Hightower Reff Law

Nebraska law requires the the personal representative of an estate to submit a report summarizing inheritance taxes by class of. In short, when a loved one dies and you inherit their property, you may be subject to an inheritance tax on that property. In 2022, nebraska, through lb 310, changed its inheritance tax law. Nebraska inheritance tax is computed on.

Nebraska Inheritance Tax Worksheet Excel

These changes are discussed as an update to this article. Nebraska inheritance tax is computed on the fair market value of annuities, life estates, terms for years, remainders, and. In short, when a loved one dies and you inherit their property, you may be subject to an inheritance tax on that property. In 2022, nebraska, through lb 310, changed its.

Nebraska inheritance tax worksheet Fill out & sign online DocHub

In short, when a loved one dies and you inherit their property, you may be subject to an inheritance tax on that property. These changes are discussed as an update to this article. In 2022, nebraska, through lb 310, changed its inheritance tax law. Distribution of proceeds from estate; Nebraska inheritance tax is computed on the fair market value of.

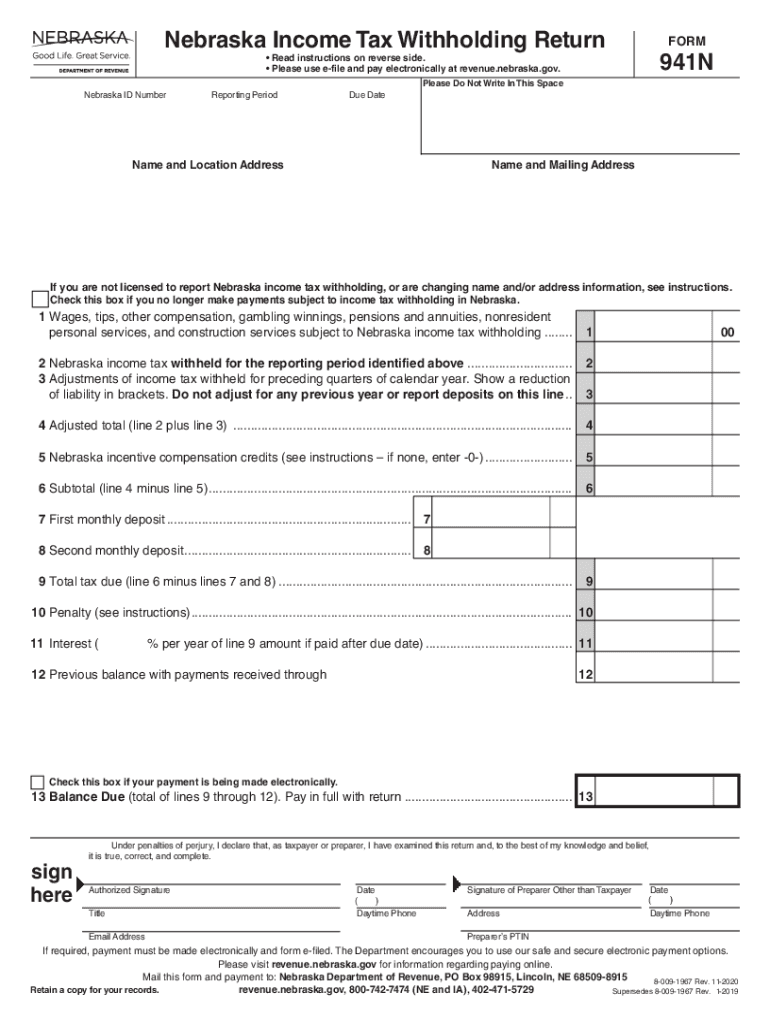

Nebraska Inheritance Tax Return

In 2022, nebraska, through lb 310, changed its inheritance tax law. Distribution of proceeds from estate; In short, when a loved one dies and you inherit their property, you may be subject to an inheritance tax on that property. Nebraska law requires the the personal representative of an estate to submit a report summarizing inheritance taxes by class of. Nebraska.

Nebraska Inheritance Tax Worksheet Fill Online, Printable, Fillable

These changes are discussed as an update to this article. In short, when a loved one dies and you inherit their property, you may be subject to an inheritance tax on that property. Distribution of proceeds from estate; In 2022, nebraska, through lb 310, changed its inheritance tax law. Nebraska law requires the the personal representative of an estate to.

Nebraska Inheritance Tax Return

Nebraska inheritance tax is computed on the fair market value of annuities, life estates, terms for years, remainders, and. In short, when a loved one dies and you inherit their property, you may be subject to an inheritance tax on that property. Nebraska law requires the the personal representative of an estate to submit a report summarizing inheritance taxes by.

Inheritance Tax Worksheet 500 PDF Form FormsPal

Distribution of proceeds from estate; In short, when a loved one dies and you inherit their property, you may be subject to an inheritance tax on that property. In 2022, nebraska, through lb 310, changed its inheritance tax law. These changes are discussed as an update to this article. Nebraska inheritance tax is computed on the fair market value of.

These Changes Are Discussed As An Update To This Article.

In 2022, nebraska, through lb 310, changed its inheritance tax law. Nebraska inheritance tax is computed on the fair market value of annuities, life estates, terms for years, remainders, and. In short, when a loved one dies and you inherit their property, you may be subject to an inheritance tax on that property. Nebraska law requires the the personal representative of an estate to submit a report summarizing inheritance taxes by class of.