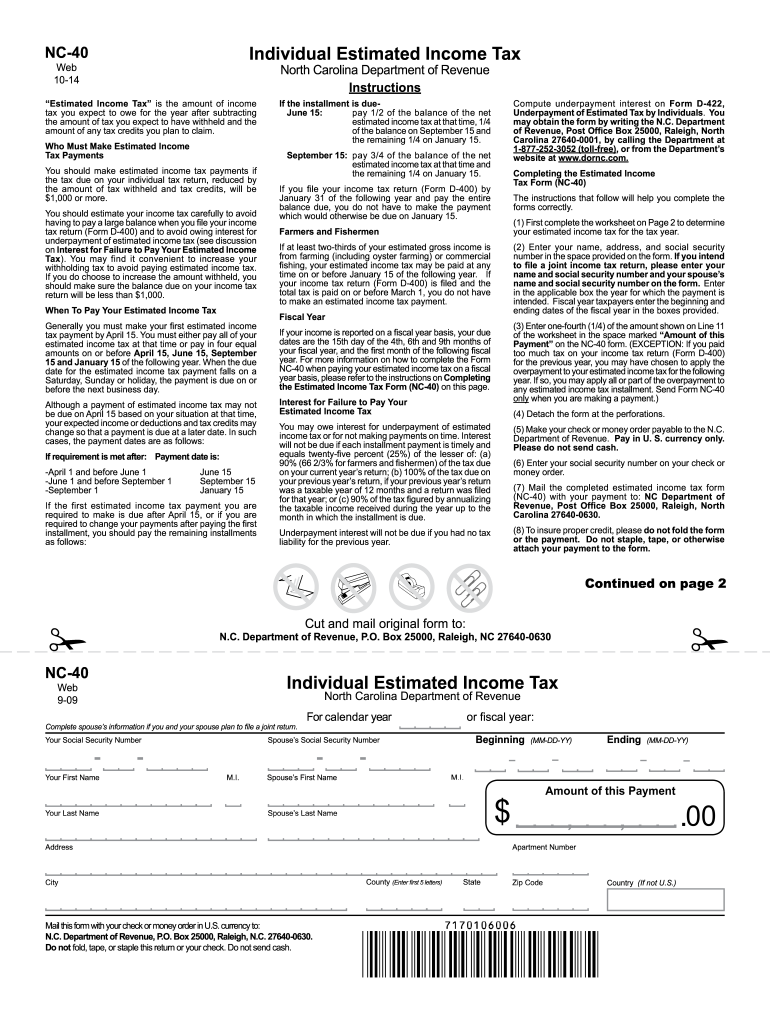

Nc 40 Tax Form - Use the create form button located below to generate the printable form. To pay individual estimated income tax: Use efile to schedule payments for the entire year. You must pay estimated income tax if you are self employed or do not pay sufficient tax. Download or print the 2023 north carolina (individual estimated income tax) (2023) and other income tax forms from the north carolina. Want to schedule all four payments?

You must pay estimated income tax if you are self employed or do not pay sufficient tax. Use efile to schedule payments for the entire year. Download or print the 2023 north carolina (individual estimated income tax) (2023) and other income tax forms from the north carolina. Want to schedule all four payments? To pay individual estimated income tax: Use the create form button located below to generate the printable form.

Use efile to schedule payments for the entire year. To pay individual estimated income tax: You must pay estimated income tax if you are self employed or do not pay sufficient tax. Use the create form button located below to generate the printable form. Want to schedule all four payments? Download or print the 2023 north carolina (individual estimated income tax) (2023) and other income tax forms from the north carolina.

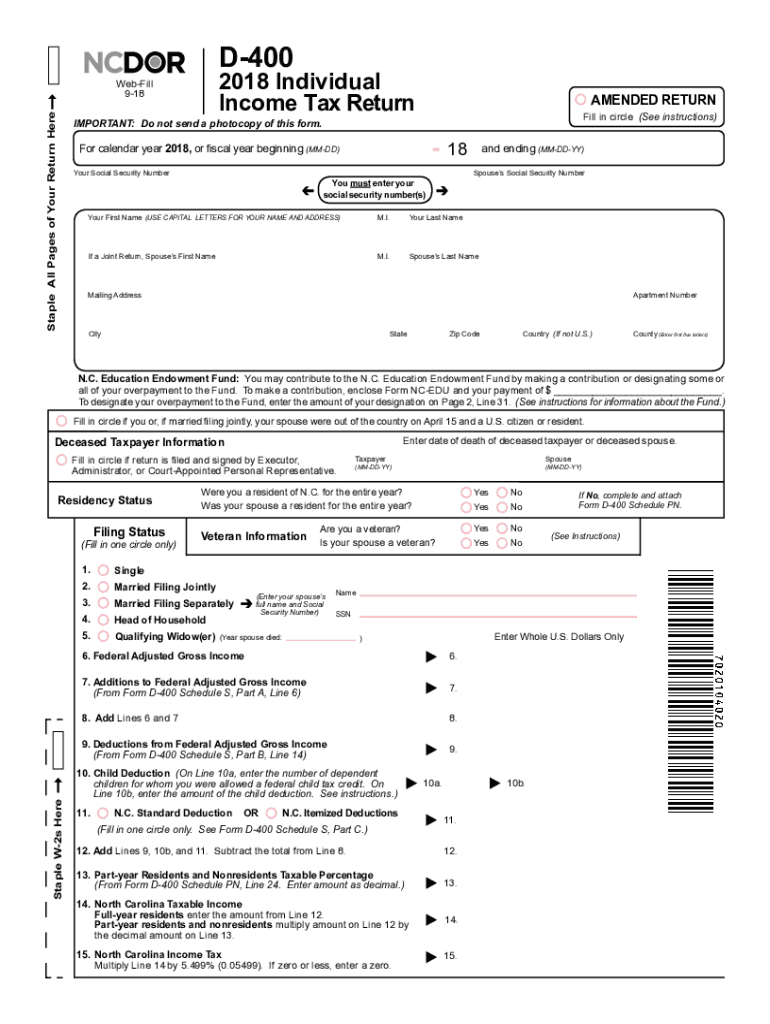

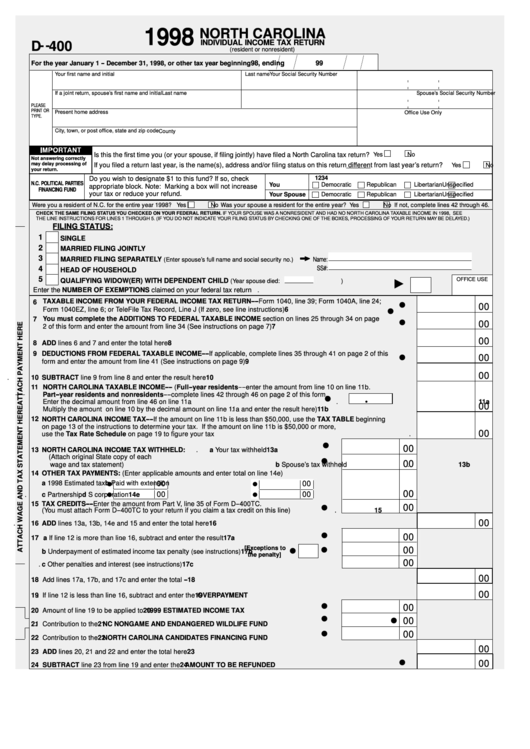

Printable Forms For Nc Tax Returns Printable Forms Free Online

Use efile to schedule payments for the entire year. To pay individual estimated income tax: Use the create form button located below to generate the printable form. Download or print the 2023 north carolina (individual estimated income tax) (2023) and other income tax forms from the north carolina. Want to schedule all four payments?

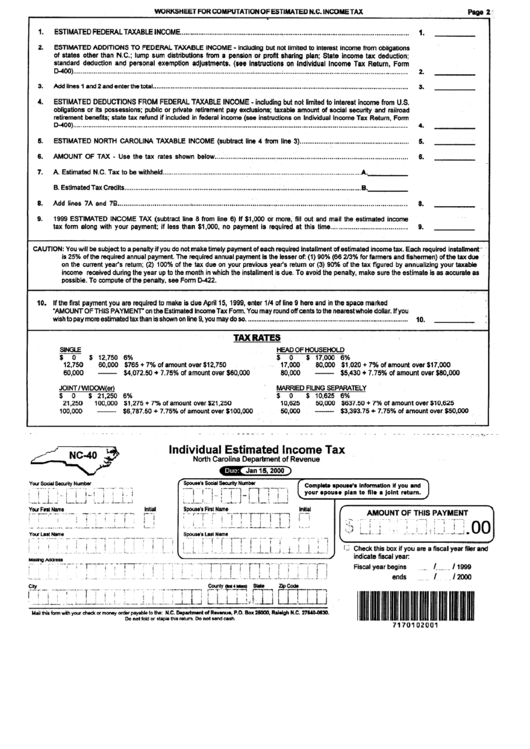

Printable Nc 40 Form Printable Form 2024

You must pay estimated income tax if you are self employed or do not pay sufficient tax. Use the create form button located below to generate the printable form. Want to schedule all four payments? Download or print the 2023 north carolina (individual estimated income tax) (2023) and other income tax forms from the north carolina. Use efile to schedule.

Printable Nc State Tax Forms Printable Forms Free Online

You must pay estimated income tax if you are self employed or do not pay sufficient tax. Use the create form button located below to generate the printable form. To pay individual estimated income tax: Want to schedule all four payments? Download or print the 2023 north carolina (individual estimated income tax) (2023) and other income tax forms from the.

2014 Form NC NC40 Fill Online, Printable, Fillable, Blank pdfFiller

Use efile to schedule payments for the entire year. Download or print the 2023 north carolina (individual estimated income tax) (2023) and other income tax forms from the north carolina. To pay individual estimated income tax: Use the create form button located below to generate the printable form. Want to schedule all four payments?

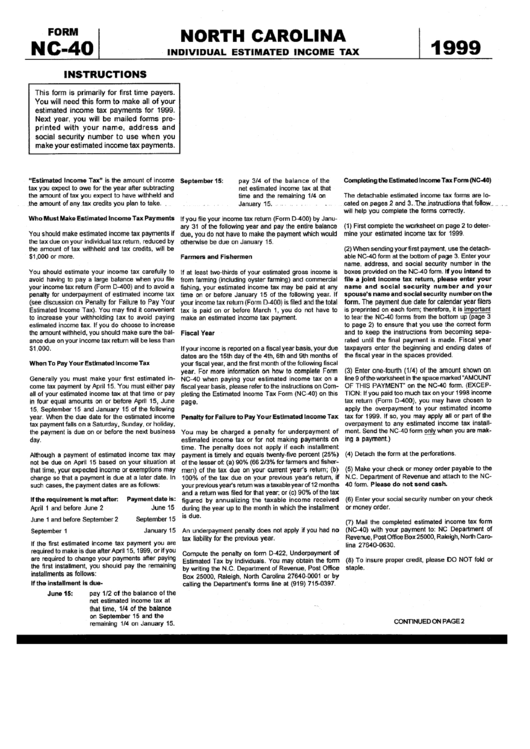

Form Nc40 Individual Estimated Tax 1999 printable pdf download

Use the create form button located below to generate the printable form. Use efile to schedule payments for the entire year. Download or print the 2023 north carolina (individual estimated income tax) (2023) and other income tax forms from the north carolina. You must pay estimated income tax if you are self employed or do not pay sufficient tax. Want.

Nc Tax Form Printable Printable Forms Free Online

You must pay estimated income tax if you are self employed or do not pay sufficient tax. Download or print the 2023 north carolina (individual estimated income tax) (2023) and other income tax forms from the north carolina. Want to schedule all four payments? Use efile to schedule payments for the entire year. To pay individual estimated income tax:

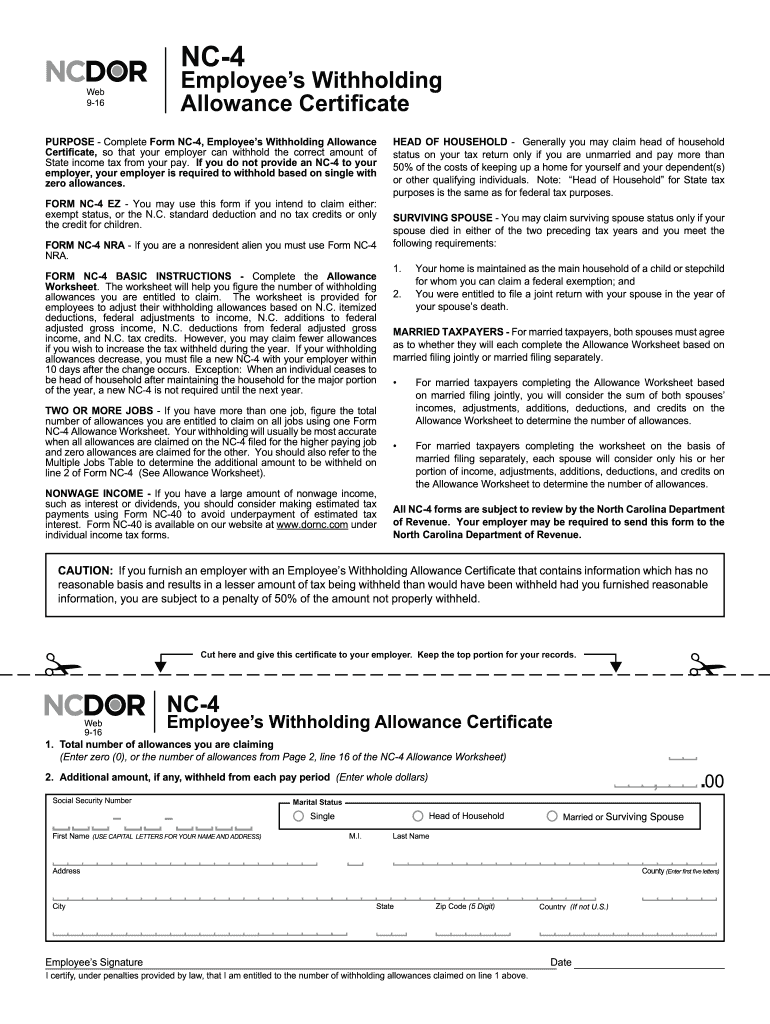

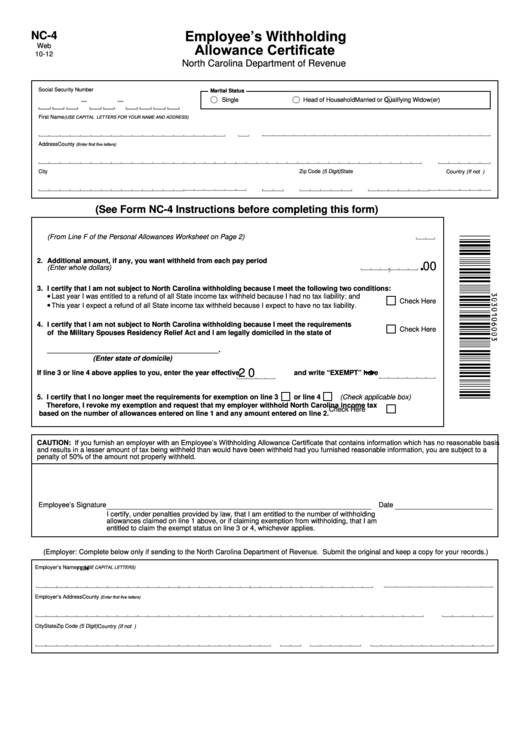

Nc4 Form 2024 Kris Stormie

You must pay estimated income tax if you are self employed or do not pay sufficient tax. Use the create form button located below to generate the printable form. To pay individual estimated income tax: Use efile to schedule payments for the entire year. Download or print the 2023 north carolina (individual estimated income tax) (2023) and other income tax.

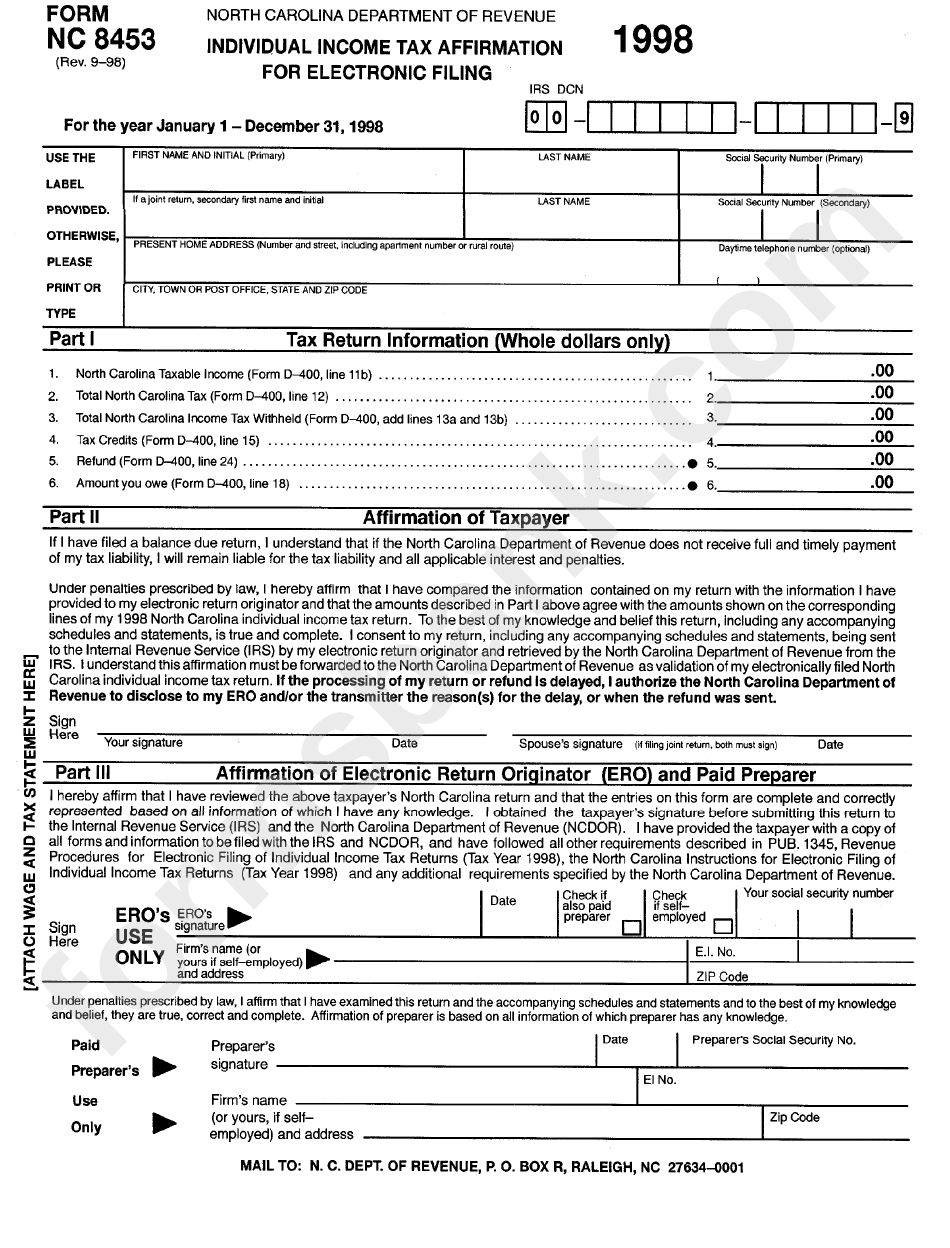

Form NC40 PTE Fill Out, Sign Online and Download Printable PDF

Download or print the 2023 north carolina (individual estimated income tax) (2023) and other income tax forms from the north carolina. To pay individual estimated income tax: Want to schedule all four payments? Use efile to schedule payments for the entire year. Use the create form button located below to generate the printable form.

North Carolina State Tax Form Printable Printable Forms Free Online

Download or print the 2023 north carolina (individual estimated income tax) (2023) and other income tax forms from the north carolina. Use the create form button located below to generate the printable form. You must pay estimated income tax if you are self employed or do not pay sufficient tax. To pay individual estimated income tax: Use efile to schedule.

Nc State Tax Forms Printable

Want to schedule all four payments? You must pay estimated income tax if you are self employed or do not pay sufficient tax. Use the create form button located below to generate the printable form. Use efile to schedule payments for the entire year. To pay individual estimated income tax:

Use The Create Form Button Located Below To Generate The Printable Form.

Download or print the 2023 north carolina (individual estimated income tax) (2023) and other income tax forms from the north carolina. You must pay estimated income tax if you are self employed or do not pay sufficient tax. To pay individual estimated income tax: Use efile to schedule payments for the entire year.