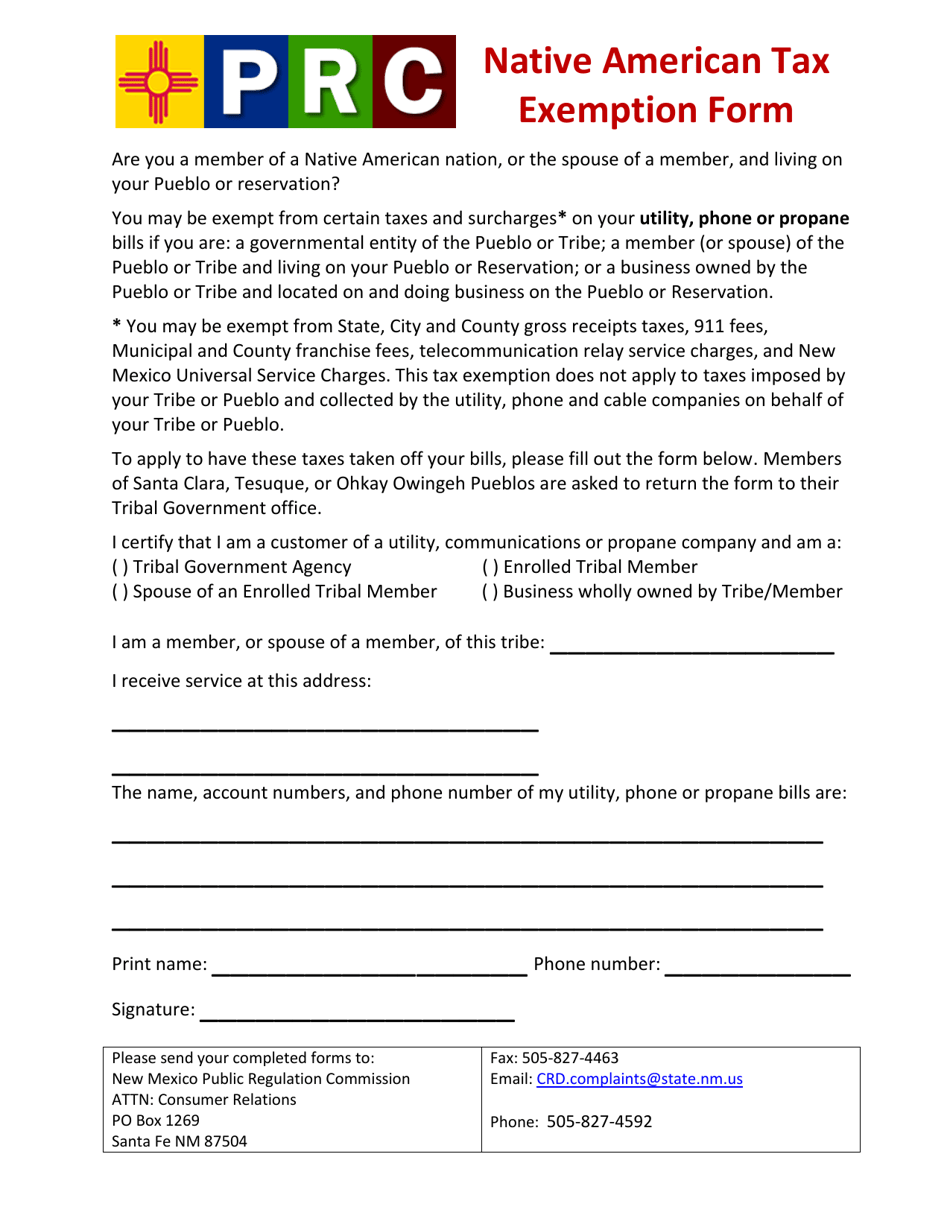

Native American Tax Exemption Form - Indian tribes and their wholly owned entities aren’t subject to income tax. Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment. An exception exists for businesses incorporated under state law.

An exception exists for businesses incorporated under state law. Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment. Indian tribes and their wholly owned entities aren’t subject to income tax.

Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment. An exception exists for businesses incorporated under state law. Indian tribes and their wholly owned entities aren’t subject to income tax.

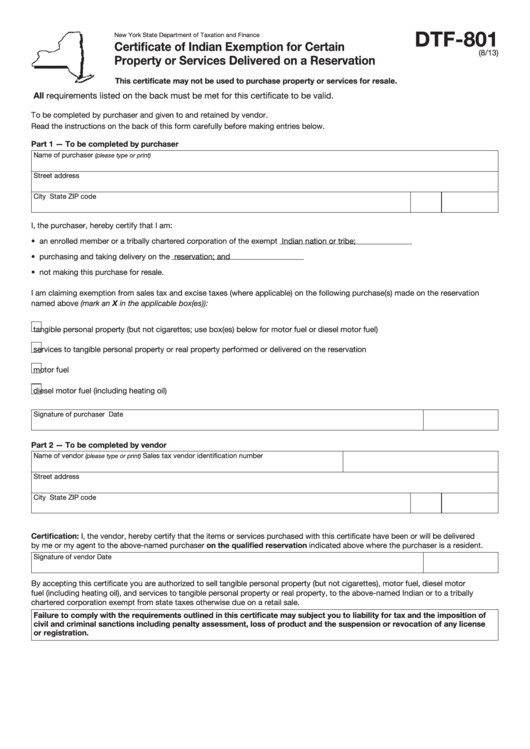

Form Dtf801 Certificate Of Indian Exemption For Certain Property Or

Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment. An exception exists for businesses incorporated under state law. Indian tribes and their wholly owned entities aren’t subject to income tax.

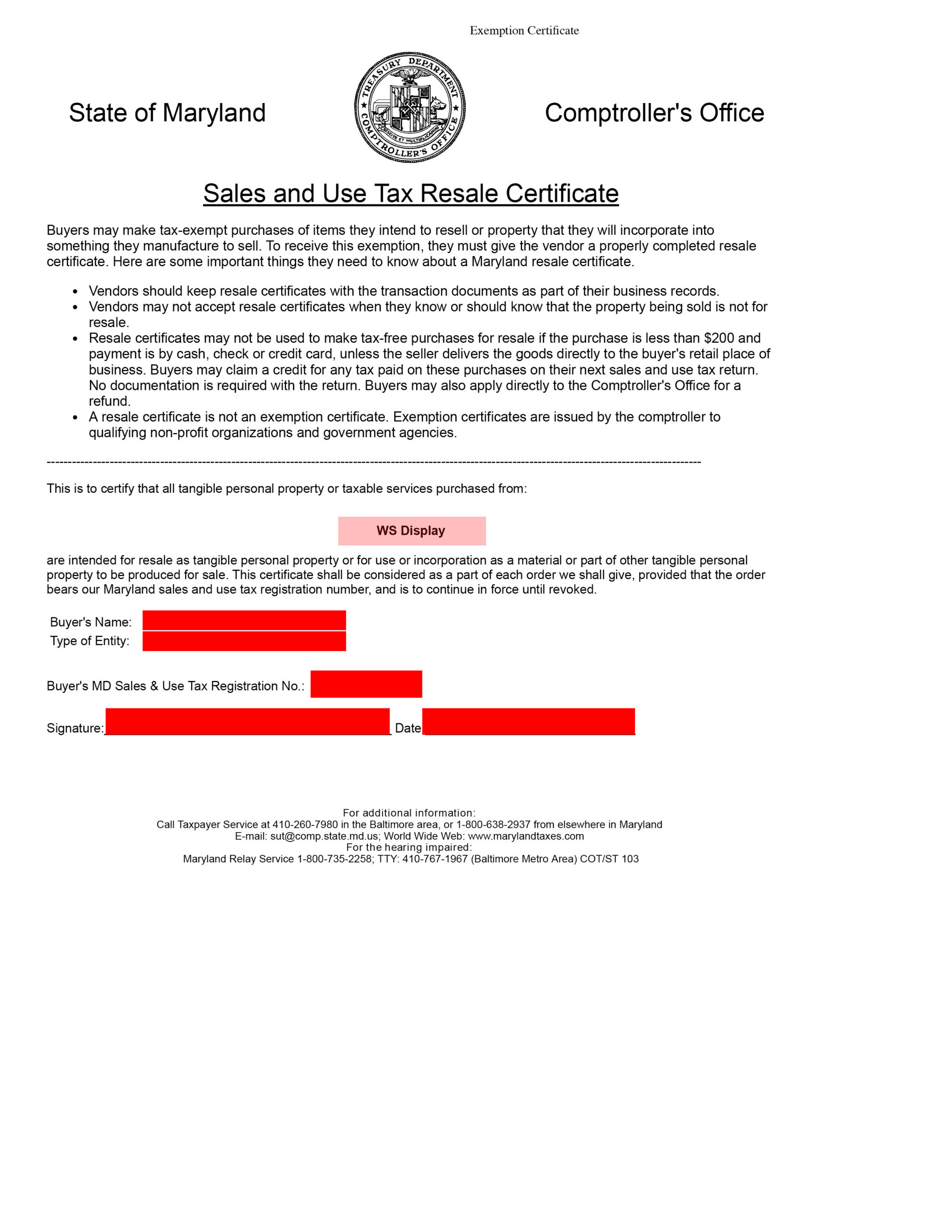

Maryland Sales Tax Exempt Form 2023

Indian tribes and their wholly owned entities aren’t subject to income tax. An exception exists for businesses incorporated under state law. Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment.

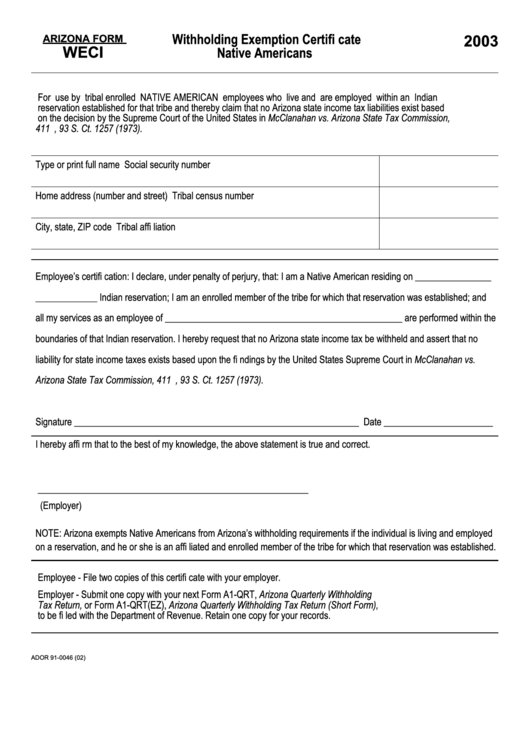

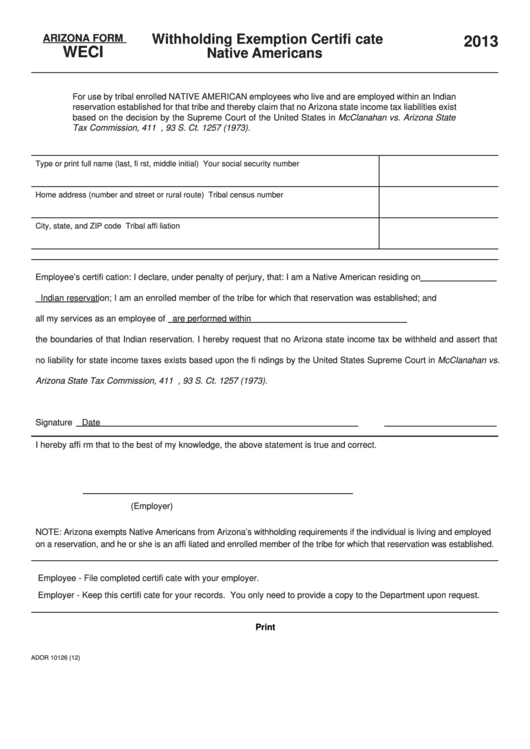

Arizona Form Weci Withholding Exemption Certificate Native Americans

An exception exists for businesses incorporated under state law. Indian tribes and their wholly owned entities aren’t subject to income tax. Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment.

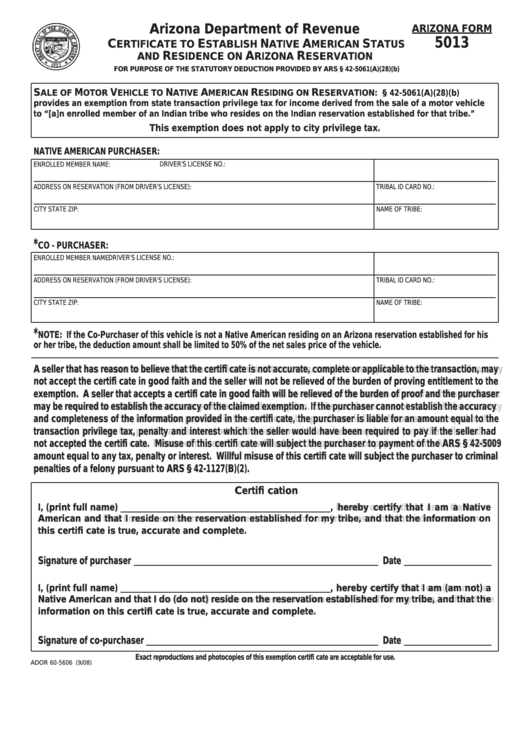

Arizona Form 5013 Certificate To Establish Native American Status And

An exception exists for businesses incorporated under state law. Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment. Indian tribes and their wholly owned entities aren’t subject to income tax.

Fillable Arizona Form Weci Withholding Exemption Certificate Native

Indian tribes and their wholly owned entities aren’t subject to income tax. Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment. An exception exists for businesses incorporated under state law.

New Mexico Native American Tax Exemption Form Fill Out, Sign Online

Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment. Indian tribes and their wholly owned entities aren’t subject to income tax. An exception exists for businesses incorporated under state law.

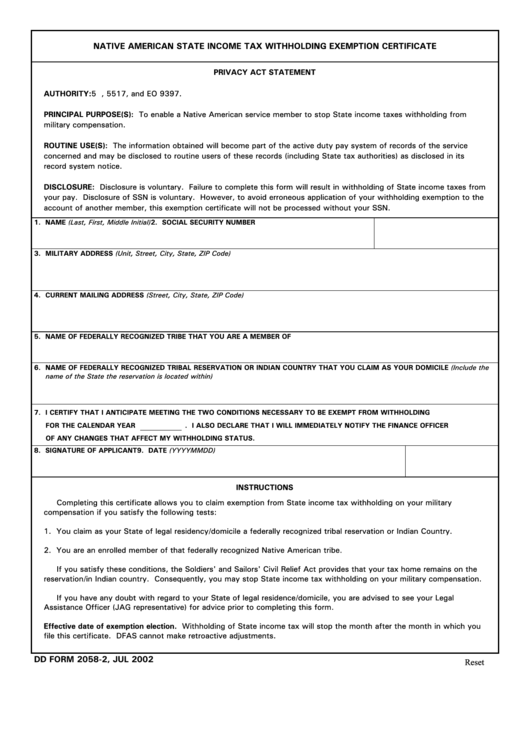

Fillable Dd Form 20582 Native American State Tax Withholding

Indian tribes and their wholly owned entities aren’t subject to income tax. Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment. An exception exists for businesses incorporated under state law.

nativeexemption KTOO

An exception exists for businesses incorporated under state law. Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment. Indian tribes and their wholly owned entities aren’t subject to income tax.

Indian Status Tax Exemption Overview for First Nations, Indigenous

Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment. Indian tribes and their wholly owned entities aren’t subject to income tax. An exception exists for businesses incorporated under state law.

2023 Oregon Withholding Form Printable Forms Free Online

Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment. Indian tribes and their wholly owned entities aren’t subject to income tax. An exception exists for businesses incorporated under state law.

Indian Tribes And Their Wholly Owned Entities Aren’t Subject To Income Tax.

An exception exists for businesses incorporated under state law. Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment.