Native American Tax Exempt Form - Senate bill 855 includes expansion of gross income exclusions for native americans. Indian tribes and their wholly owned entities aren’t subject to income tax. An exception exists for businesses incorporated under state law. You may be exempt from tax if. Insights into indian tribal governments being treated as states for certain federal tax purposes, i.e., contributions, excise. Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment.

Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment. Indian tribes and their wholly owned entities aren’t subject to income tax. Insights into indian tribal governments being treated as states for certain federal tax purposes, i.e., contributions, excise. Senate bill 855 includes expansion of gross income exclusions for native americans. You may be exempt from tax if. An exception exists for businesses incorporated under state law.

You may be exempt from tax if. Senate bill 855 includes expansion of gross income exclusions for native americans. An exception exists for businesses incorporated under state law. Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment. Insights into indian tribal governments being treated as states for certain federal tax purposes, i.e., contributions, excise. Indian tribes and their wholly owned entities aren’t subject to income tax.

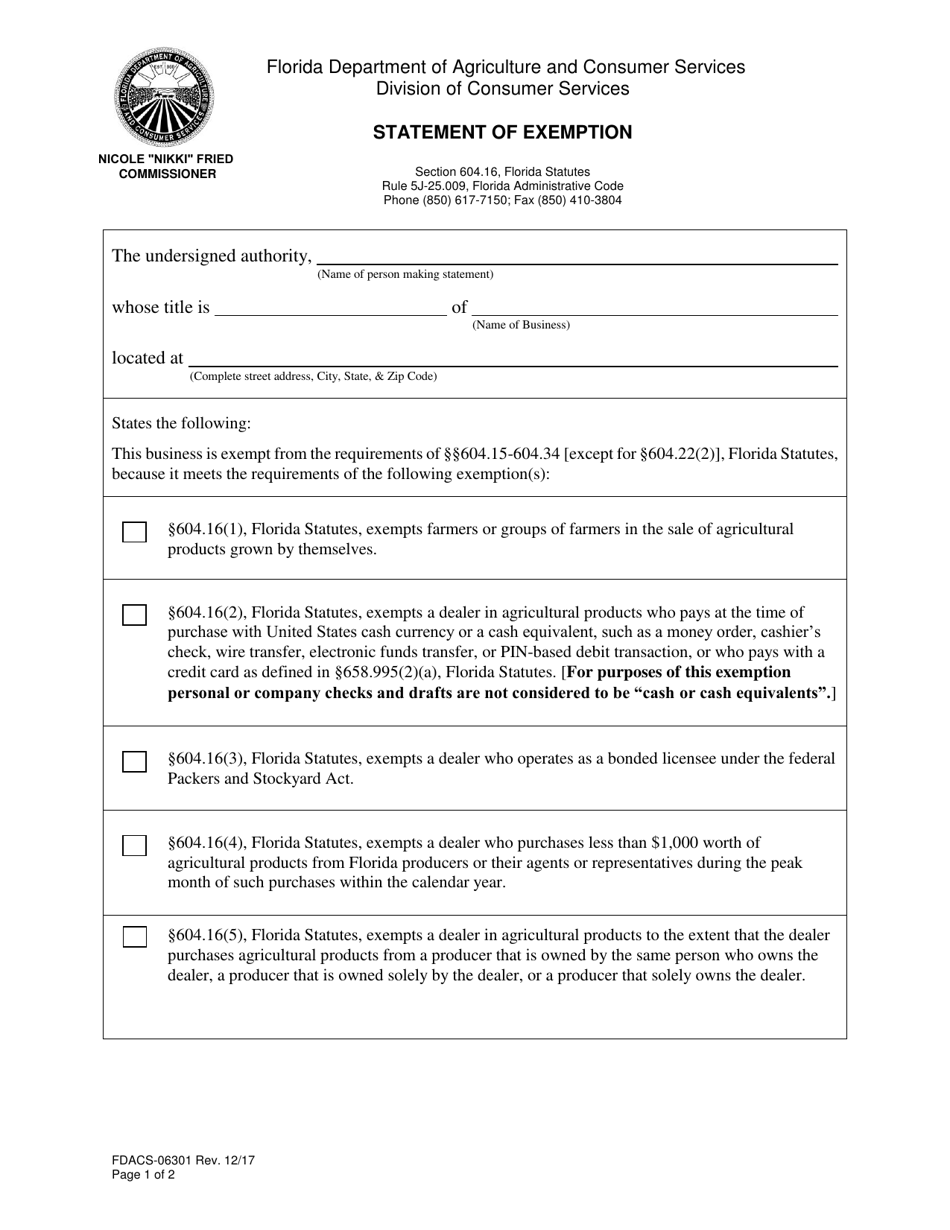

Form FDACS06301 Fill Out, Sign Online and Download Fillable PDF

Insights into indian tribal governments being treated as states for certain federal tax purposes, i.e., contributions, excise. Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment. You may be exempt from tax if. Indian tribes and their wholly owned entities aren’t subject to income tax. An exception exists for businesses incorporated.

Tax exempt form Fill out & sign online DocHub

An exception exists for businesses incorporated under state law. Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment. Insights into indian tribal governments being treated as states for certain federal tax purposes, i.e., contributions, excise. Indian tribes and their wholly owned entities aren’t subject to income tax. You may be exempt.

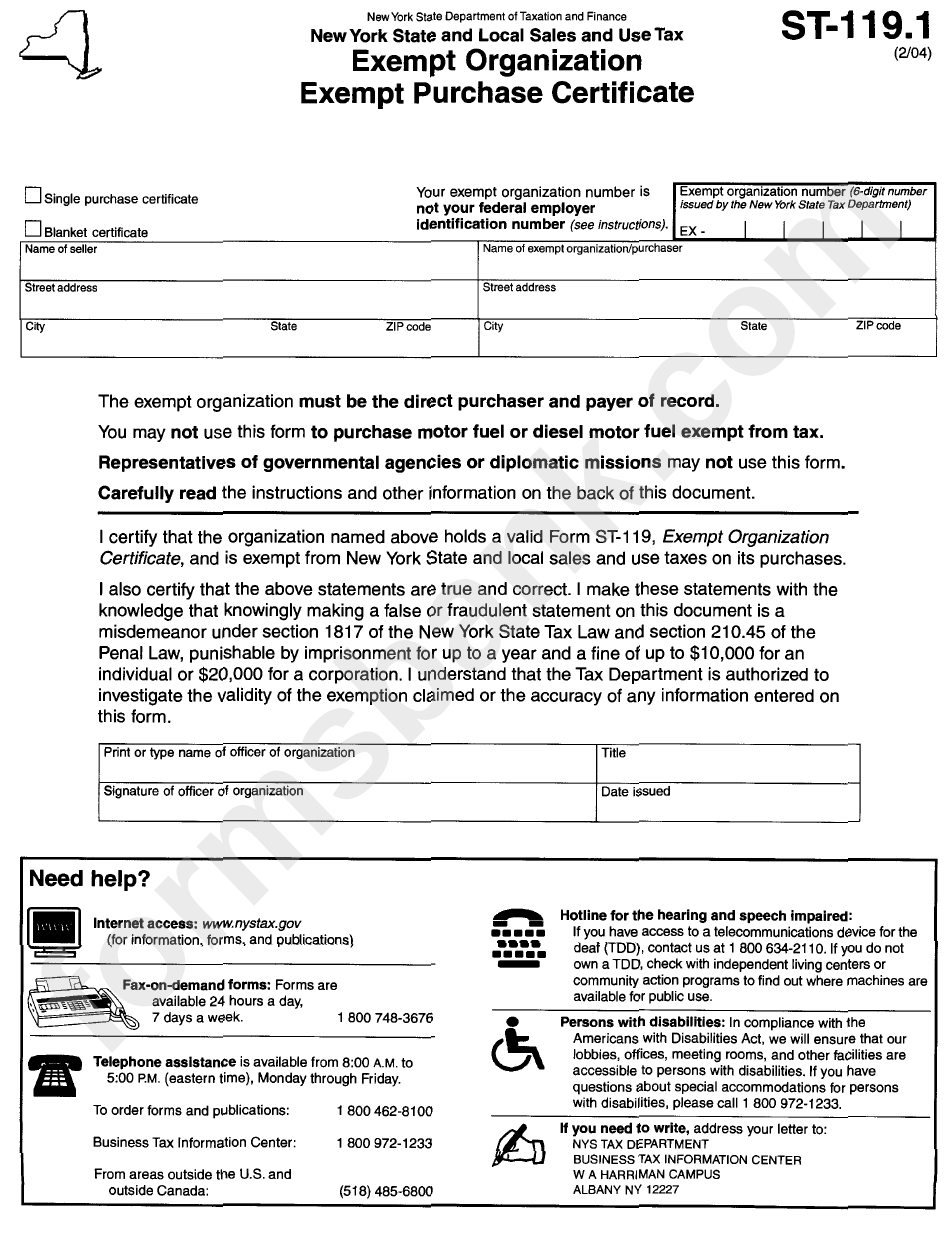

St119.1 Exempt Purchase Certificate printable pdf download

An exception exists for businesses incorporated under state law. Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment. Insights into indian tribal governments being treated as states for certain federal tax purposes, i.e., contributions, excise. Indian tribes and their wholly owned entities aren’t subject to income tax. Senate bill 855 includes.

California Taxexempt Form 2023

Insights into indian tribal governments being treated as states for certain federal tax purposes, i.e., contributions, excise. An exception exists for businesses incorporated under state law. You may be exempt from tax if. Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment. Indian tribes and their wholly owned entities aren’t subject.

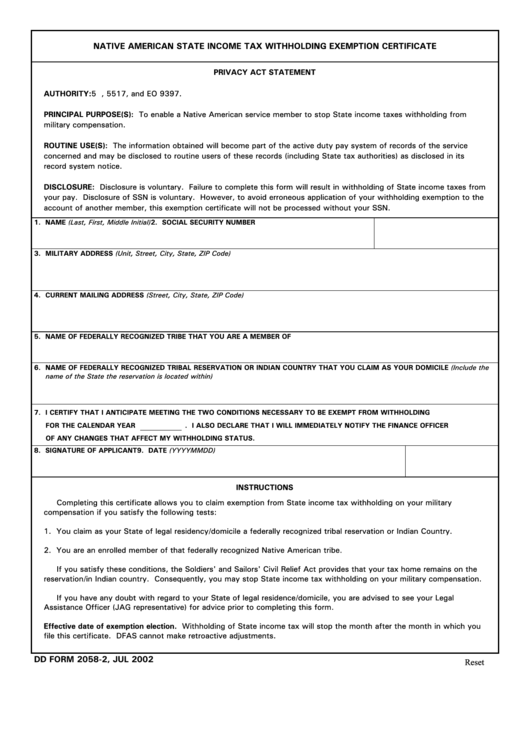

Fillable Dd Form 20582 Native American State Tax Withholding

Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment. You may be exempt from tax if. Senate bill 855 includes expansion of gross income exclusions for native americans. An exception exists for businesses incorporated under state law. Insights into indian tribal governments being treated as states for certain federal tax purposes,.

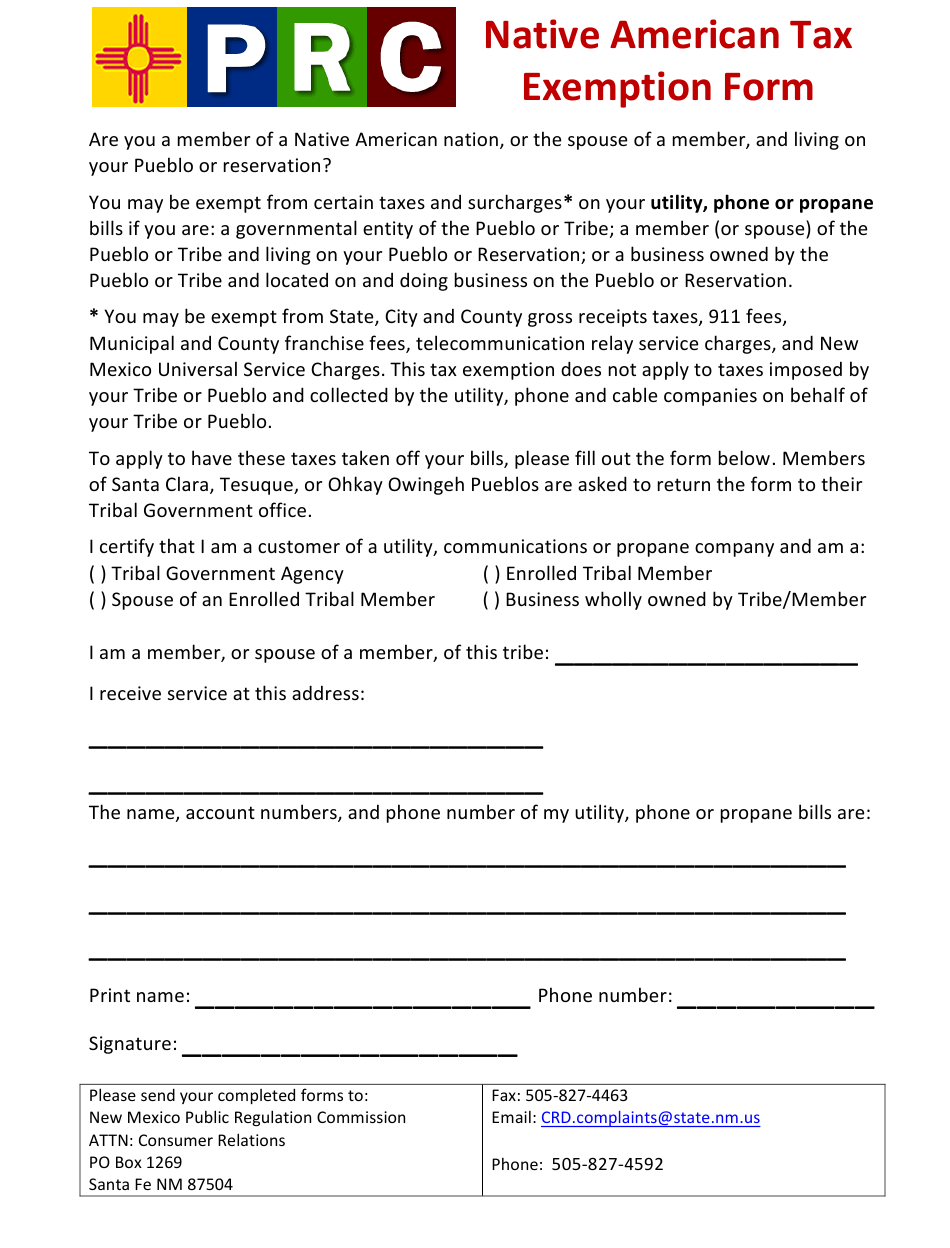

Tax Exempt Form New Mexico

You may be exempt from tax if. Insights into indian tribal governments being treated as states for certain federal tax purposes, i.e., contributions, excise. An exception exists for businesses incorporated under state law. Indian tribes and their wholly owned entities aren’t subject to income tax. Senate bill 855 includes expansion of gross income exclusions for native americans.

Sd Certificate Of Exemption For Sales Tax

An exception exists for businesses incorporated under state law. Insights into indian tribal governments being treated as states for certain federal tax purposes, i.e., contributions, excise. Indian tribes and their wholly owned entities aren’t subject to income tax. You may be exempt from tax if. Senate bill 855 includes expansion of gross income exclusions for native americans.

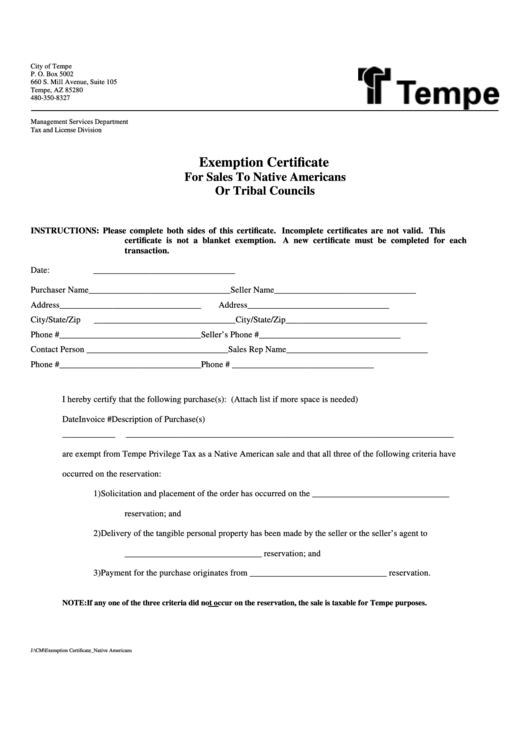

Exemption Certificate For Sales To Native Americans Or Tribal Councils

Insights into indian tribal governments being treated as states for certain federal tax purposes, i.e., contributions, excise. Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment. Senate bill 855 includes expansion of gross income exclusions for native americans. You may be exempt from tax if. Indian tribes and their wholly owned.

Exemption California State Tax Form 2024

You may be exempt from tax if. Insights into indian tribal governments being treated as states for certain federal tax purposes, i.e., contributions, excise. Senate bill 855 includes expansion of gross income exclusions for native americans. An exception exists for businesses incorporated under state law. Indian tribes and their wholly owned entities aren’t subject to income tax.

New York State Tax Exempt Certificate Form

Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment. You may be exempt from tax if. Senate bill 855 includes expansion of gross income exclusions for native americans. Indian tribes and their wholly owned entities aren’t subject to income tax. Insights into indian tribal governments being treated as states for certain.

You May Be Exempt From Tax If.

Senate bill 855 includes expansion of gross income exclusions for native americans. Find tax information for native american tribal governments and members, including tax law, filing and reporting requirements, employment. Indian tribes and their wholly owned entities aren’t subject to income tax. Insights into indian tribal governments being treated as states for certain federal tax purposes, i.e., contributions, excise.