Mn Sales Tax Form - You may owe use tax on taxable goods and. Sales tax applies and combine with the state tax to form one rate. Sales tax applies to most retail sales of goods and some services in minnesota. There are general local sales taxes that apply to all transactions, as well as.

Sales tax applies to most retail sales of goods and some services in minnesota. You may owe use tax on taxable goods and. Sales tax applies and combine with the state tax to form one rate. There are general local sales taxes that apply to all transactions, as well as.

Sales tax applies to most retail sales of goods and some services in minnesota. There are general local sales taxes that apply to all transactions, as well as. You may owe use tax on taxable goods and. Sales tax applies and combine with the state tax to form one rate.

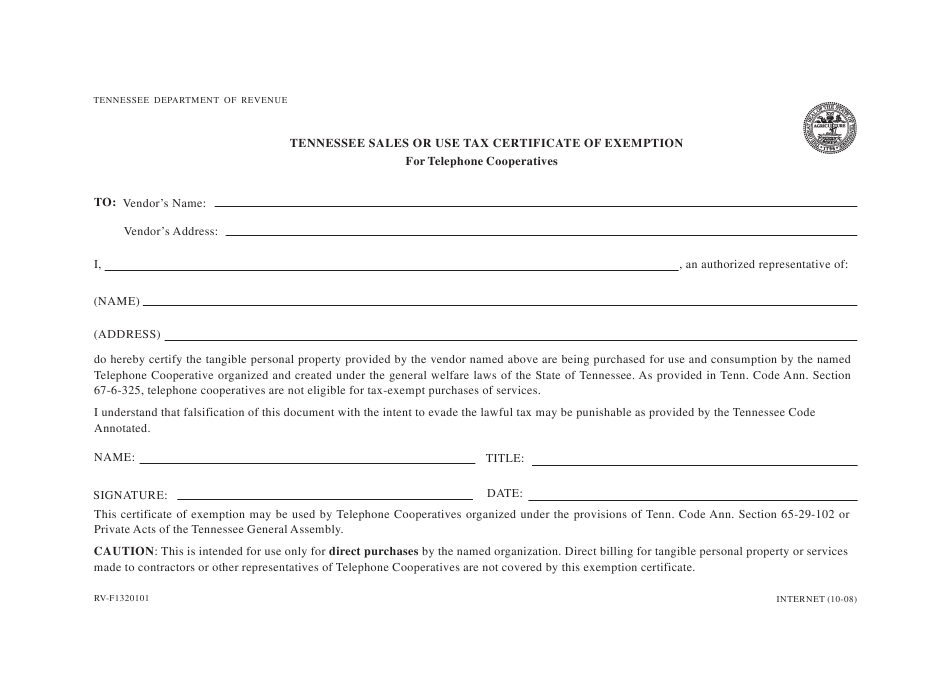

State Sales Tax Exemption Form Tn

You may owe use tax on taxable goods and. Sales tax applies to most retail sales of goods and some services in minnesota. There are general local sales taxes that apply to all transactions, as well as. Sales tax applies and combine with the state tax to form one rate.

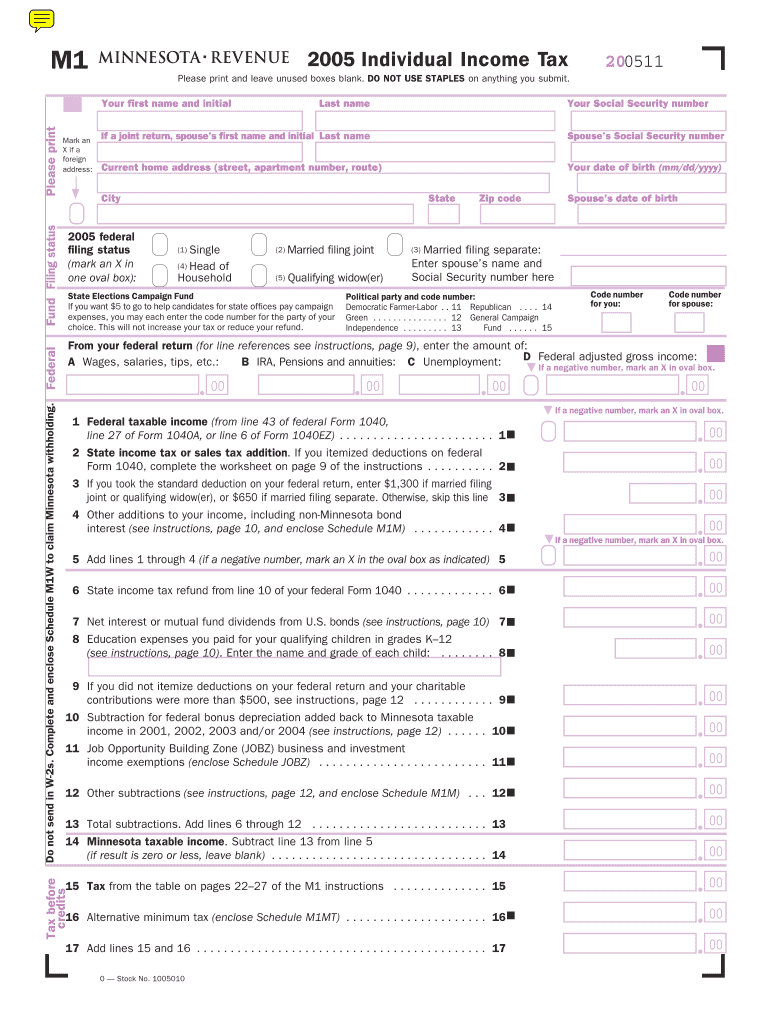

Mn Tax Refund Calendar Janel Othelia

Sales tax applies and combine with the state tax to form one rate. There are general local sales taxes that apply to all transactions, as well as. You may owe use tax on taxable goods and. Sales tax applies to most retail sales of goods and some services in minnesota.

Mn Sales Tax Increase 2024 Meara Jeanelle

There are general local sales taxes that apply to all transactions, as well as. Sales tax applies and combine with the state tax to form one rate. You may owe use tax on taxable goods and. Sales tax applies to most retail sales of goods and some services in minnesota.

Minnesota state tax form Fill out & sign online DocHub

Sales tax applies to most retail sales of goods and some services in minnesota. You may owe use tax on taxable goods and. There are general local sales taxes that apply to all transactions, as well as. Sales tax applies and combine with the state tax to form one rate.

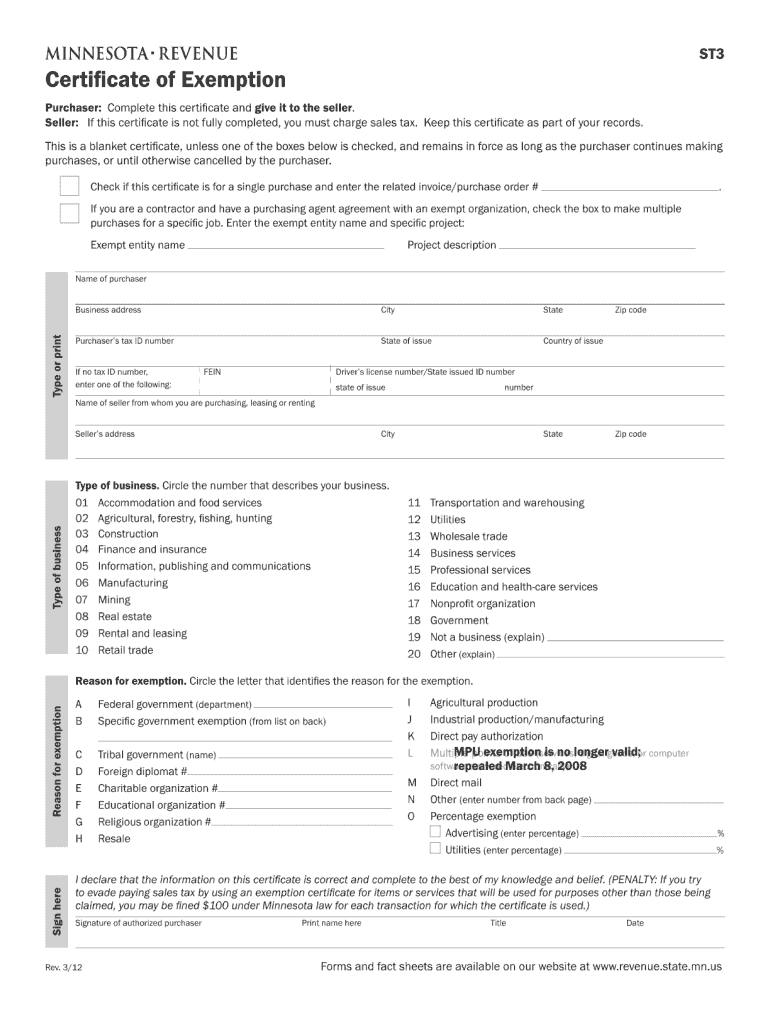

MN ST3 Sales Taxes In The United States Use Tax

You may owe use tax on taxable goods and. Sales tax applies to most retail sales of goods and some services in minnesota. Sales tax applies and combine with the state tax to form one rate. There are general local sales taxes that apply to all transactions, as well as.

Mn Fillable Tax Forms Printable Forms Free Online

There are general local sales taxes that apply to all transactions, as well as. Sales tax applies and combine with the state tax to form one rate. Sales tax applies to most retail sales of goods and some services in minnesota. You may owe use tax on taxable goods and.

Minnesota Certificate of Exemption St3 Form Fill Out and Sign

Sales tax applies to most retail sales of goods and some services in minnesota. Sales tax applies and combine with the state tax to form one rate. You may owe use tax on taxable goods and. There are general local sales taxes that apply to all transactions, as well as.

MN DoR ST5 1992 Fill out Tax Template Online US Legal Forms

Sales tax applies to most retail sales of goods and some services in minnesota. Sales tax applies and combine with the state tax to form one rate. There are general local sales taxes that apply to all transactions, as well as. You may owe use tax on taxable goods and.

2016 minnesota tax forms Fill out & sign online DocHub

Sales tax applies and combine with the state tax to form one rate. You may owe use tax on taxable goods and. There are general local sales taxes that apply to all transactions, as well as. Sales tax applies to most retail sales of goods and some services in minnesota.

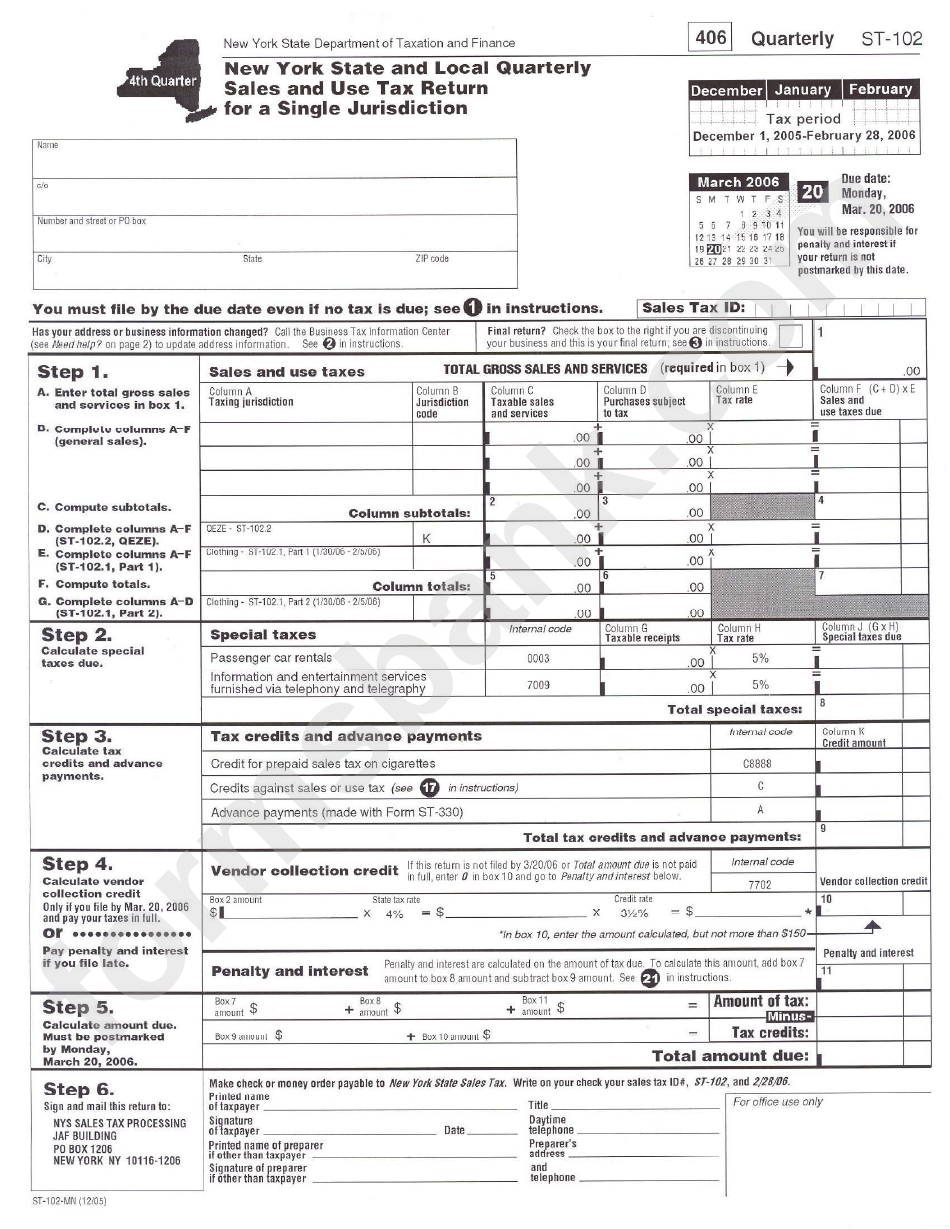

Form St102Mn Quarterly Sales And Use Tax Return For Single

There are general local sales taxes that apply to all transactions, as well as. Sales tax applies and combine with the state tax to form one rate. Sales tax applies to most retail sales of goods and some services in minnesota. You may owe use tax on taxable goods and.

Sales Tax Applies To Most Retail Sales Of Goods And Some Services In Minnesota.

You may owe use tax on taxable goods and. Sales tax applies and combine with the state tax to form one rate. There are general local sales taxes that apply to all transactions, as well as.