Military Tax Exempt Form Hotel - Mission tax exemption cards are used by foreign missions to obtain exemption from certain taxes, including taxes on hotel stays and lodging, on. You can find out if the state where you are traveling is tax exempt on the per diem screen in the defense travel system (dts). The integrated lodging program ensures that travelers are staying in quality lodging facilities that are close to tdy.

Mission tax exemption cards are used by foreign missions to obtain exemption from certain taxes, including taxes on hotel stays and lodging, on. You can find out if the state where you are traveling is tax exempt on the per diem screen in the defense travel system (dts). The integrated lodging program ensures that travelers are staying in quality lodging facilities that are close to tdy.

You can find out if the state where you are traveling is tax exempt on the per diem screen in the defense travel system (dts). Mission tax exemption cards are used by foreign missions to obtain exemption from certain taxes, including taxes on hotel stays and lodging, on. The integrated lodging program ensures that travelers are staying in quality lodging facilities that are close to tdy.

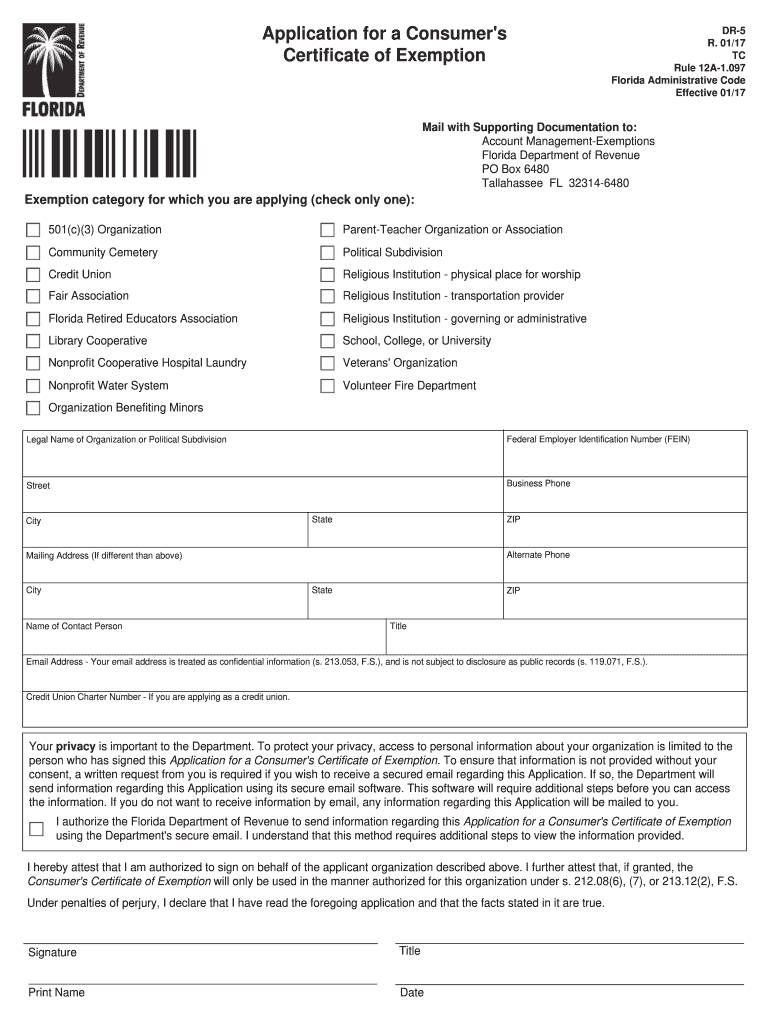

Florida Military Exemption Tax Complete with ease airSlate SignNow

Mission tax exemption cards are used by foreign missions to obtain exemption from certain taxes, including taxes on hotel stays and lodging, on. You can find out if the state where you are traveling is tax exempt on the per diem screen in the defense travel system (dts). The integrated lodging program ensures that travelers are staying in quality lodging.

Hotel tax exempt after 30 days Fill out & sign online DocHub

Mission tax exemption cards are used by foreign missions to obtain exemption from certain taxes, including taxes on hotel stays and lodging, on. The integrated lodging program ensures that travelers are staying in quality lodging facilities that are close to tdy. You can find out if the state where you are traveling is tax exempt on the per diem screen.

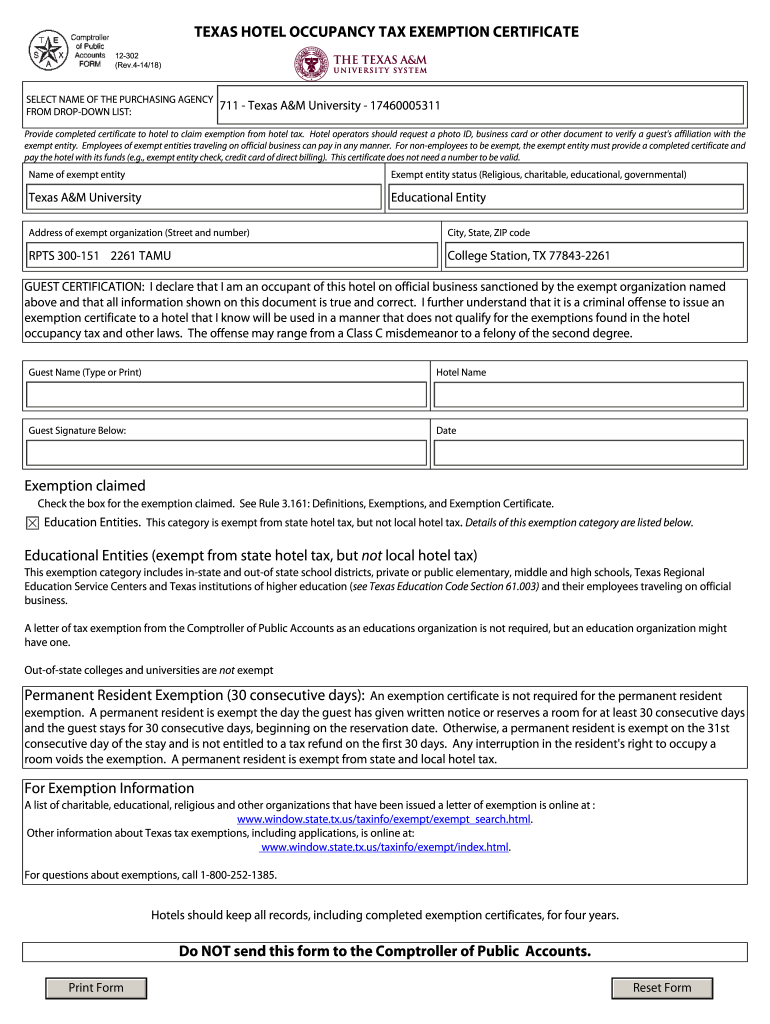

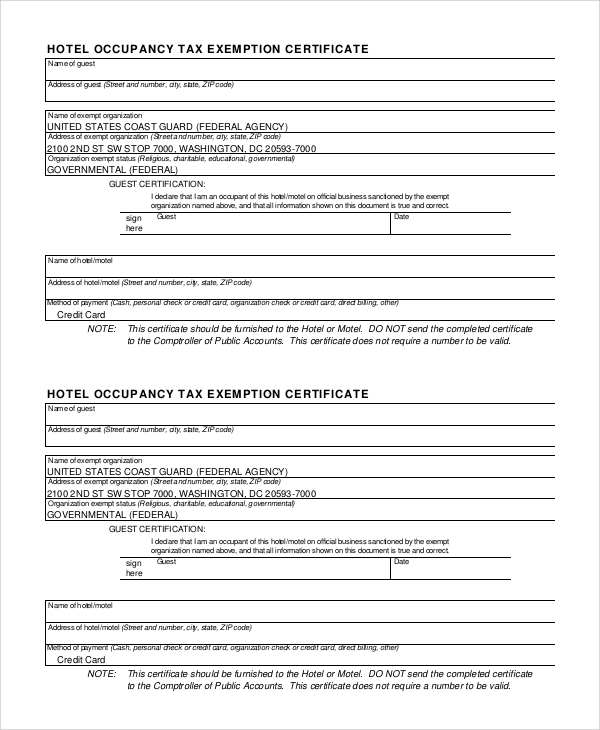

Texas Hotel Tax Exempt Form Fillable Printable Forms Free Online

The integrated lodging program ensures that travelers are staying in quality lodging facilities that are close to tdy. You can find out if the state where you are traveling is tax exempt on the per diem screen in the defense travel system (dts). Mission tax exemption cards are used by foreign missions to obtain exemption from certain taxes, including taxes.

Florida Hotel Tax Exempt Form US Legal Forms

Mission tax exemption cards are used by foreign missions to obtain exemption from certain taxes, including taxes on hotel stays and lodging, on. You can find out if the state where you are traveling is tax exempt on the per diem screen in the defense travel system (dts). The integrated lodging program ensures that travelers are staying in quality lodging.

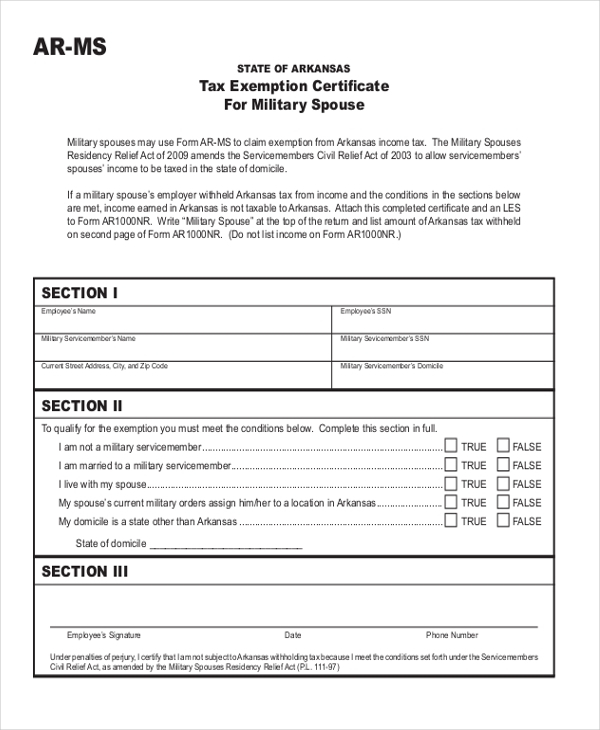

Military State Tax Exemption Form

Mission tax exemption cards are used by foreign missions to obtain exemption from certain taxes, including taxes on hotel stays and lodging, on. You can find out if the state where you are traveling is tax exempt on the per diem screen in the defense travel system (dts). The integrated lodging program ensures that travelers are staying in quality lodging.

California Hotel Occupancy Tax Exemption Certificate

You can find out if the state where you are traveling is tax exempt on the per diem screen in the defense travel system (dts). The integrated lodging program ensures that travelers are staying in quality lodging facilities that are close to tdy. Mission tax exemption cards are used by foreign missions to obtain exemption from certain taxes, including taxes.

California Hotel Tax Exempt Form Pdf

The integrated lodging program ensures that travelers are staying in quality lodging facilities that are close to tdy. Mission tax exemption cards are used by foreign missions to obtain exemption from certain taxes, including taxes on hotel stays and lodging, on. You can find out if the state where you are traveling is tax exempt on the per diem screen.

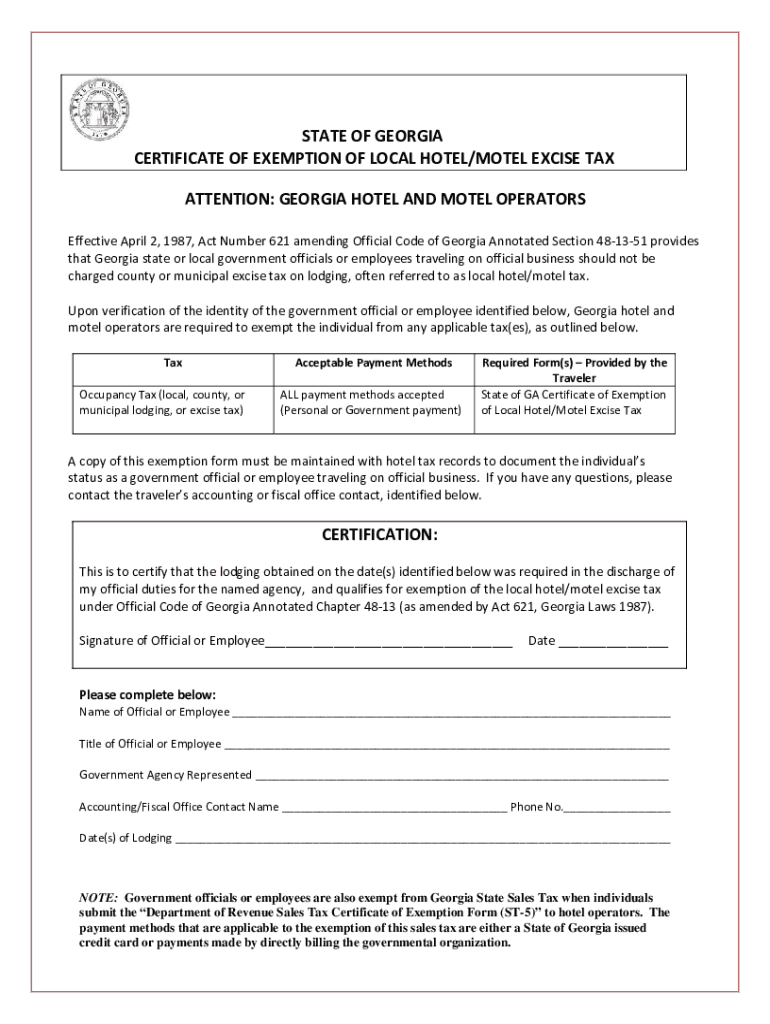

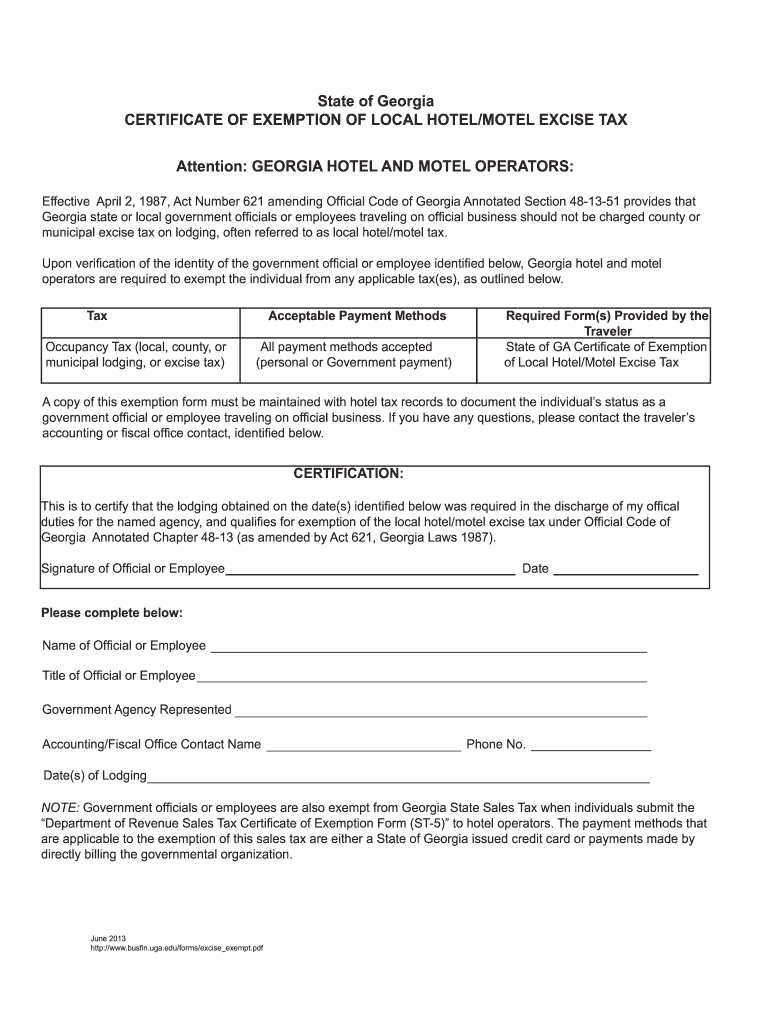

State Of Certificate Of Exemption Of Local Hotel Motel Excise

The integrated lodging program ensures that travelers are staying in quality lodging facilities that are close to tdy. Mission tax exemption cards are used by foreign missions to obtain exemption from certain taxes, including taxes on hotel stays and lodging, on. You can find out if the state where you are traveling is tax exempt on the per diem screen.

Tax exempt form florida Fill out & sign online DocHub

The integrated lodging program ensures that travelers are staying in quality lodging facilities that are close to tdy. Mission tax exemption cards are used by foreign missions to obtain exemption from certain taxes, including taxes on hotel stays and lodging, on. You can find out if the state where you are traveling is tax exempt on the per diem screen.

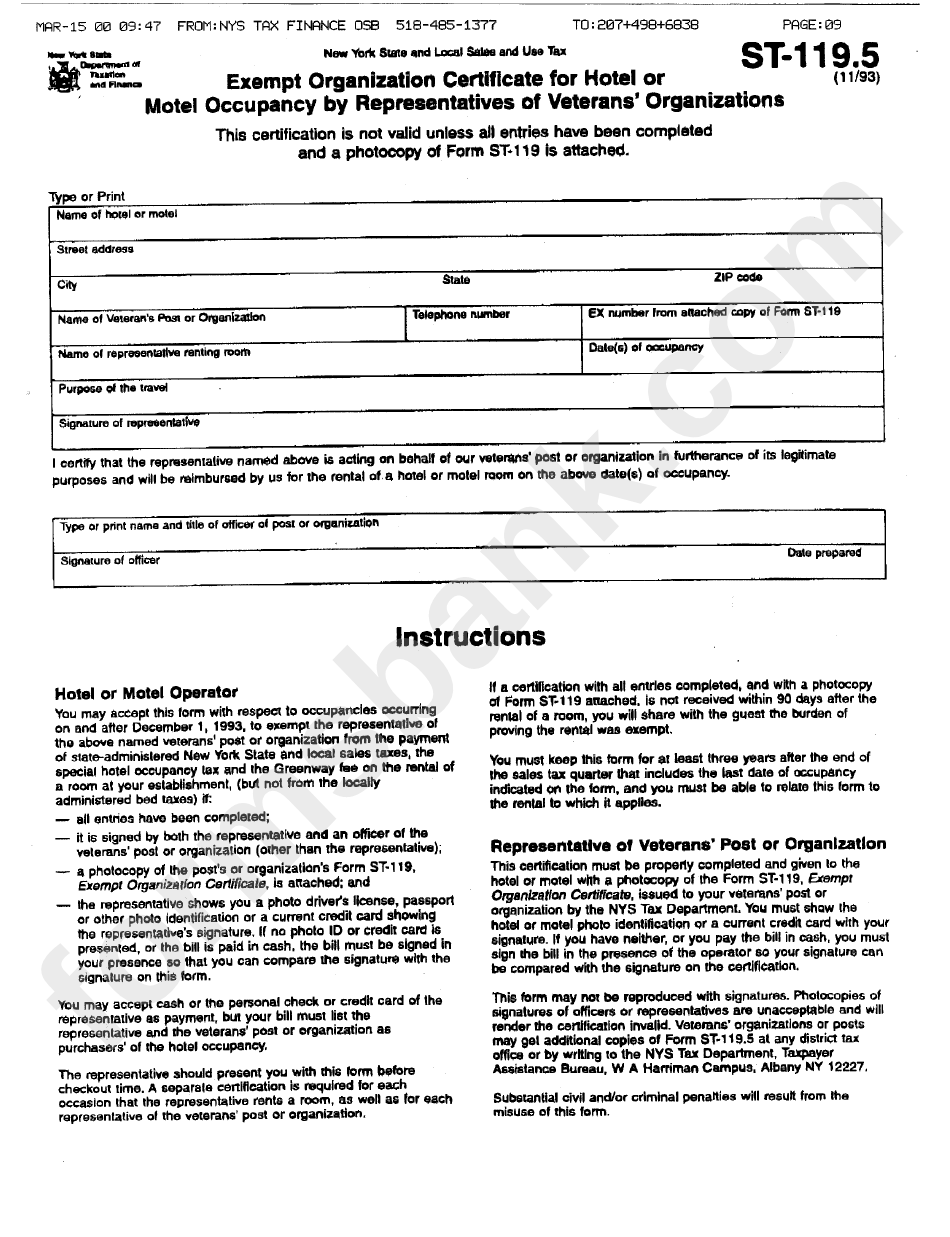

FREE 10+ Sample Tax Exemption Forms in PDF

Mission tax exemption cards are used by foreign missions to obtain exemption from certain taxes, including taxes on hotel stays and lodging, on. You can find out if the state where you are traveling is tax exempt on the per diem screen in the defense travel system (dts). The integrated lodging program ensures that travelers are staying in quality lodging.

The Integrated Lodging Program Ensures That Travelers Are Staying In Quality Lodging Facilities That Are Close To Tdy.

Mission tax exemption cards are used by foreign missions to obtain exemption from certain taxes, including taxes on hotel stays and lodging, on. You can find out if the state where you are traveling is tax exempt on the per diem screen in the defense travel system (dts).