Maryland Form 202 - For form 202, withholding reconciliation, you need to. Businesses in maryland are required to collect and file sut202 on maryland's 6 percent sales and use tax and or 9 percent alcoholic beverage. Bfile is an online portal for business taxpayers to file and pay various taxes in maryland. Senate bill 516 of 2023 establishes that the sales and use tax applies at a rate of 9% to the retail sales of cannabis and cannabis products.

Senate bill 516 of 2023 establishes that the sales and use tax applies at a rate of 9% to the retail sales of cannabis and cannabis products. For form 202, withholding reconciliation, you need to. Bfile is an online portal for business taxpayers to file and pay various taxes in maryland. Businesses in maryland are required to collect and file sut202 on maryland's 6 percent sales and use tax and or 9 percent alcoholic beverage.

For form 202, withholding reconciliation, you need to. Businesses in maryland are required to collect and file sut202 on maryland's 6 percent sales and use tax and or 9 percent alcoholic beverage. Senate bill 516 of 2023 establishes that the sales and use tax applies at a rate of 9% to the retail sales of cannabis and cannabis products. Bfile is an online portal for business taxpayers to file and pay various taxes in maryland.

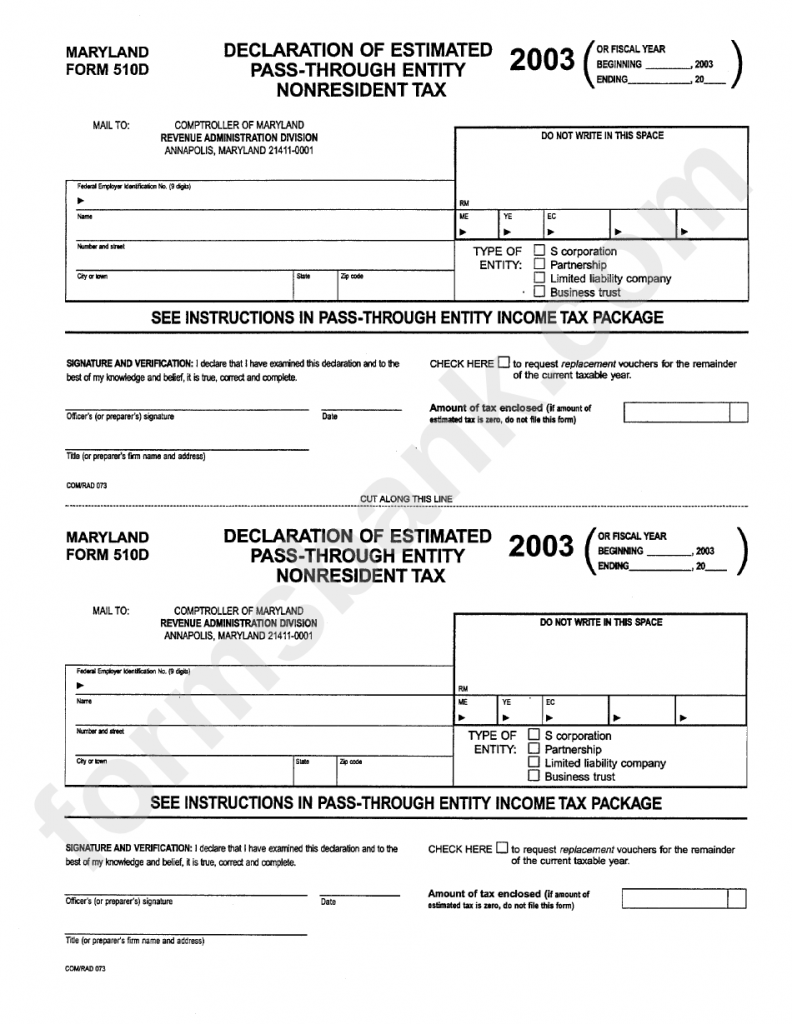

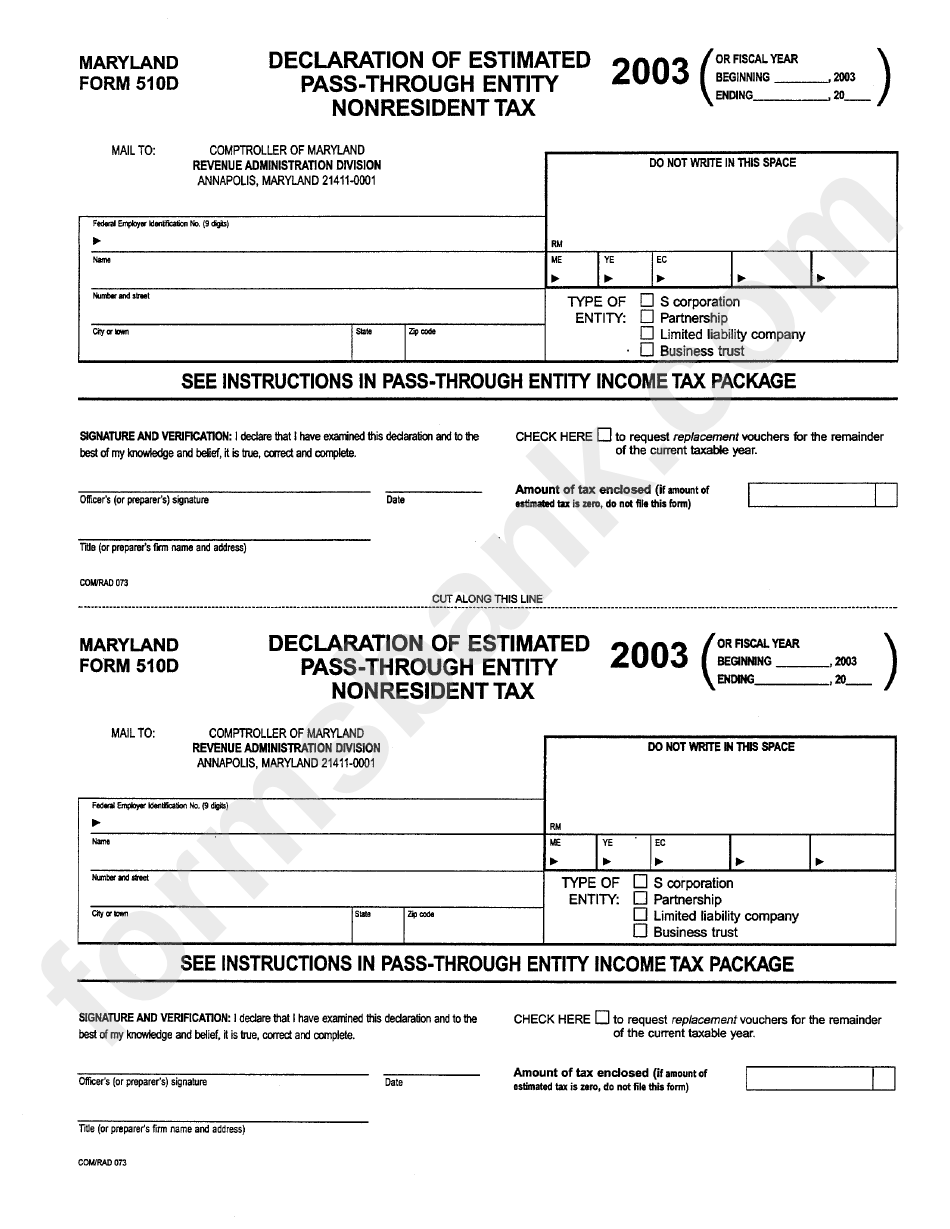

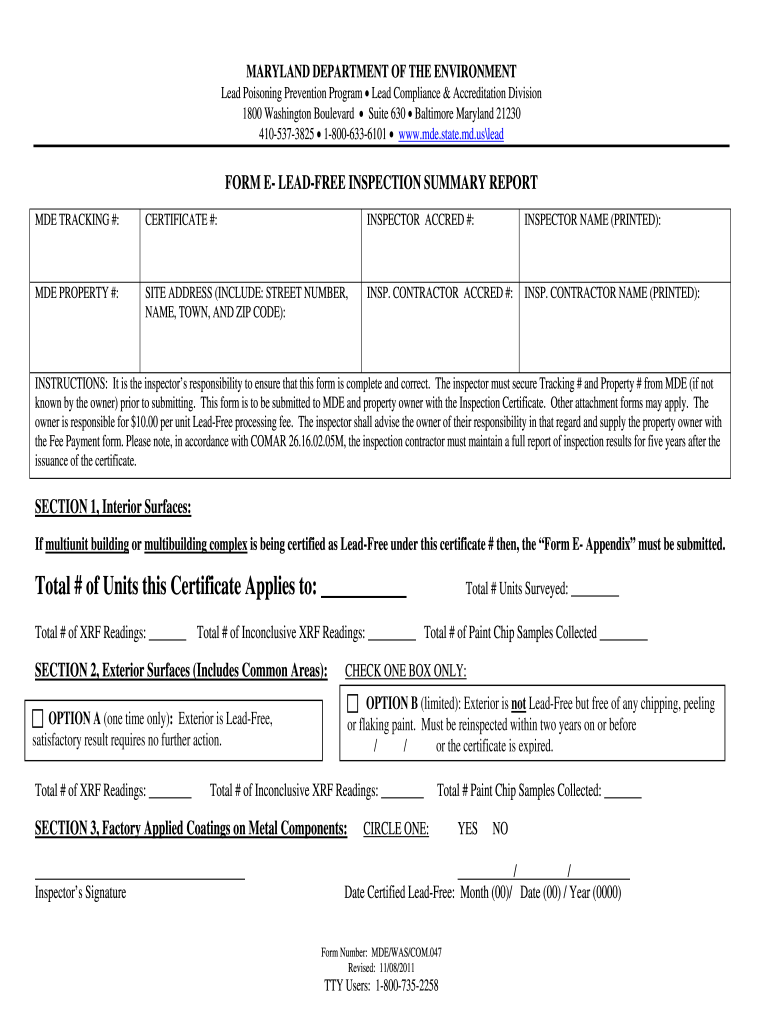

Maryland form 202 Fill out & sign online DocHub

Businesses in maryland are required to collect and file sut202 on maryland's 6 percent sales and use tax and or 9 percent alcoholic beverage. For form 202, withholding reconciliation, you need to. Bfile is an online portal for business taxpayers to file and pay various taxes in maryland. Senate bill 516 of 2023 establishes that the sales and use tax.

Maryland 2022 Form 1

Businesses in maryland are required to collect and file sut202 on maryland's 6 percent sales and use tax and or 9 percent alcoholic beverage. Bfile is an online portal for business taxpayers to file and pay various taxes in maryland. For form 202, withholding reconciliation, you need to. Senate bill 516 of 2023 establishes that the sales and use tax.

Maryland Tax Form 2024 Cornie Krystyna

For form 202, withholding reconciliation, you need to. Bfile is an online portal for business taxpayers to file and pay various taxes in maryland. Businesses in maryland are required to collect and file sut202 on maryland's 6 percent sales and use tax and or 9 percent alcoholic beverage. Senate bill 516 of 2023 establishes that the sales and use tax.

Metaplan corregido 1 METAPLAN (ASCAMTA) Pic 1 Fase 2 Discusión

Bfile is an online portal for business taxpayers to file and pay various taxes in maryland. For form 202, withholding reconciliation, you need to. Senate bill 516 of 2023 establishes that the sales and use tax applies at a rate of 9% to the retail sales of cannabis and cannabis products. Businesses in maryland are required to collect and file.

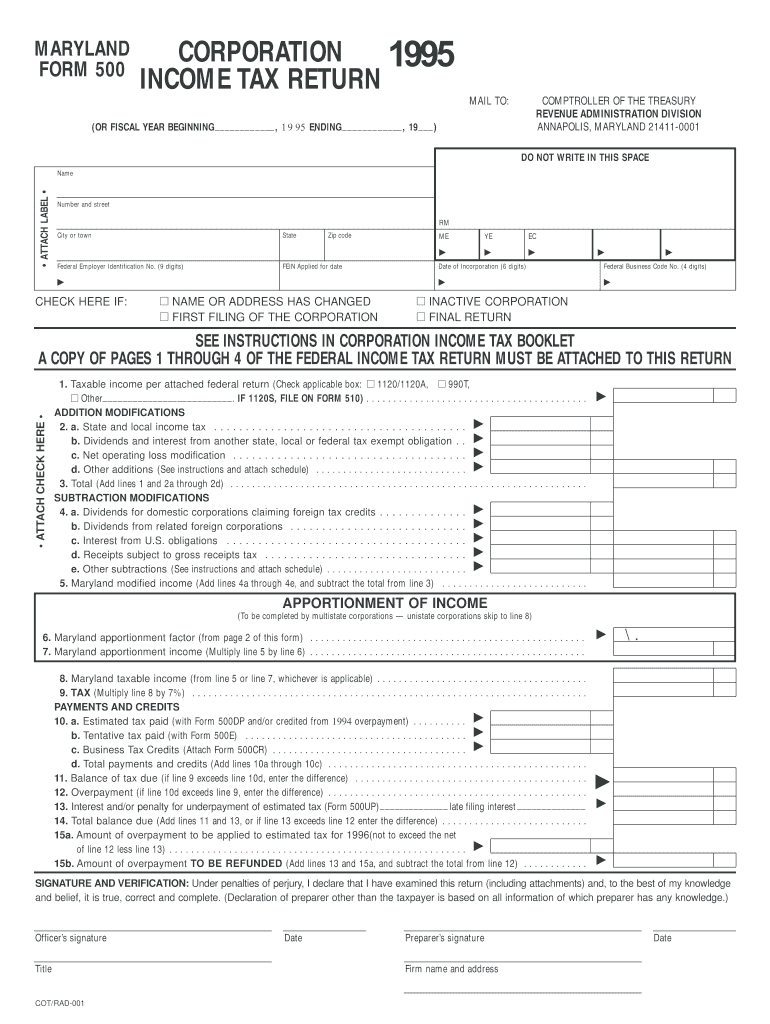

Maryland form 500 instructions Fill out & sign online DocHub

Senate bill 516 of 2023 establishes that the sales and use tax applies at a rate of 9% to the retail sales of cannabis and cannabis products. Bfile is an online portal for business taxpayers to file and pay various taxes in maryland. For form 202, withholding reconciliation, you need to. Businesses in maryland are required to collect and file.

MD SBE 032021 20162021 Fill and Sign Printable Template Online

Bfile is an online portal for business taxpayers to file and pay various taxes in maryland. For form 202, withholding reconciliation, you need to. Businesses in maryland are required to collect and file sut202 on maryland's 6 percent sales and use tax and or 9 percent alcoholic beverage. Senate bill 516 of 2023 establishes that the sales and use tax.

Fill Free fillable Form 2. 202FR FINAL RETURN FORM Maryland Sales

Senate bill 516 of 2023 establishes that the sales and use tax applies at a rate of 9% to the retail sales of cannabis and cannabis products. Bfile is an online portal for business taxpayers to file and pay various taxes in maryland. Businesses in maryland are required to collect and file sut202 on maryland's 6 percent sales and use.

Blank Maryland Sales Use Tax Form 202 Fill Out and Print PDFs

For form 202, withholding reconciliation, you need to. Businesses in maryland are required to collect and file sut202 on maryland's 6 percent sales and use tax and or 9 percent alcoholic beverage. Senate bill 516 of 2023 establishes that the sales and use tax applies at a rate of 9% to the retail sales of cannabis and cannabis products. Bfile.

Maryland sales and use tax form Fill out & sign online DocHub

Senate bill 516 of 2023 establishes that the sales and use tax applies at a rate of 9% to the retail sales of cannabis and cannabis products. Bfile is an online portal for business taxpayers to file and pay various taxes in maryland. Businesses in maryland are required to collect and file sut202 on maryland's 6 percent sales and use.

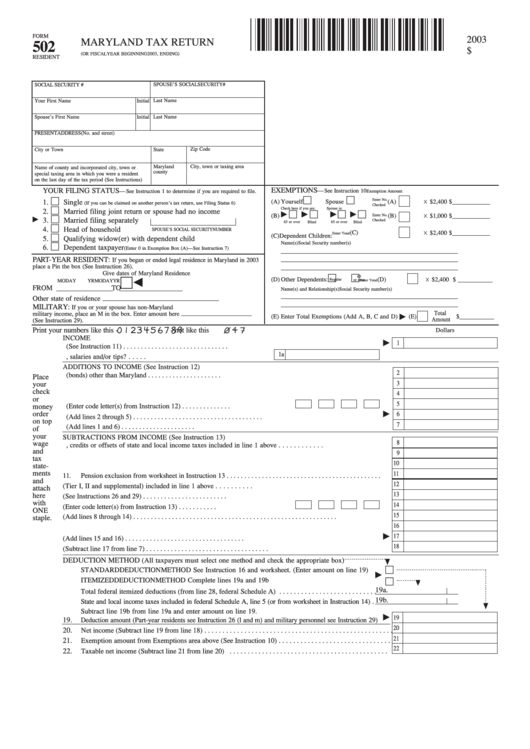

Blank Fillable Maryland Tax Return 502 Fillable Form 2024

Businesses in maryland are required to collect and file sut202 on maryland's 6 percent sales and use tax and or 9 percent alcoholic beverage. Bfile is an online portal for business taxpayers to file and pay various taxes in maryland. For form 202, withholding reconciliation, you need to. Senate bill 516 of 2023 establishes that the sales and use tax.

Senate Bill 516 Of 2023 Establishes That The Sales And Use Tax Applies At A Rate Of 9% To The Retail Sales Of Cannabis And Cannabis Products.

For form 202, withholding reconciliation, you need to. Businesses in maryland are required to collect and file sut202 on maryland's 6 percent sales and use tax and or 9 percent alcoholic beverage. Bfile is an online portal for business taxpayers to file and pay various taxes in maryland.