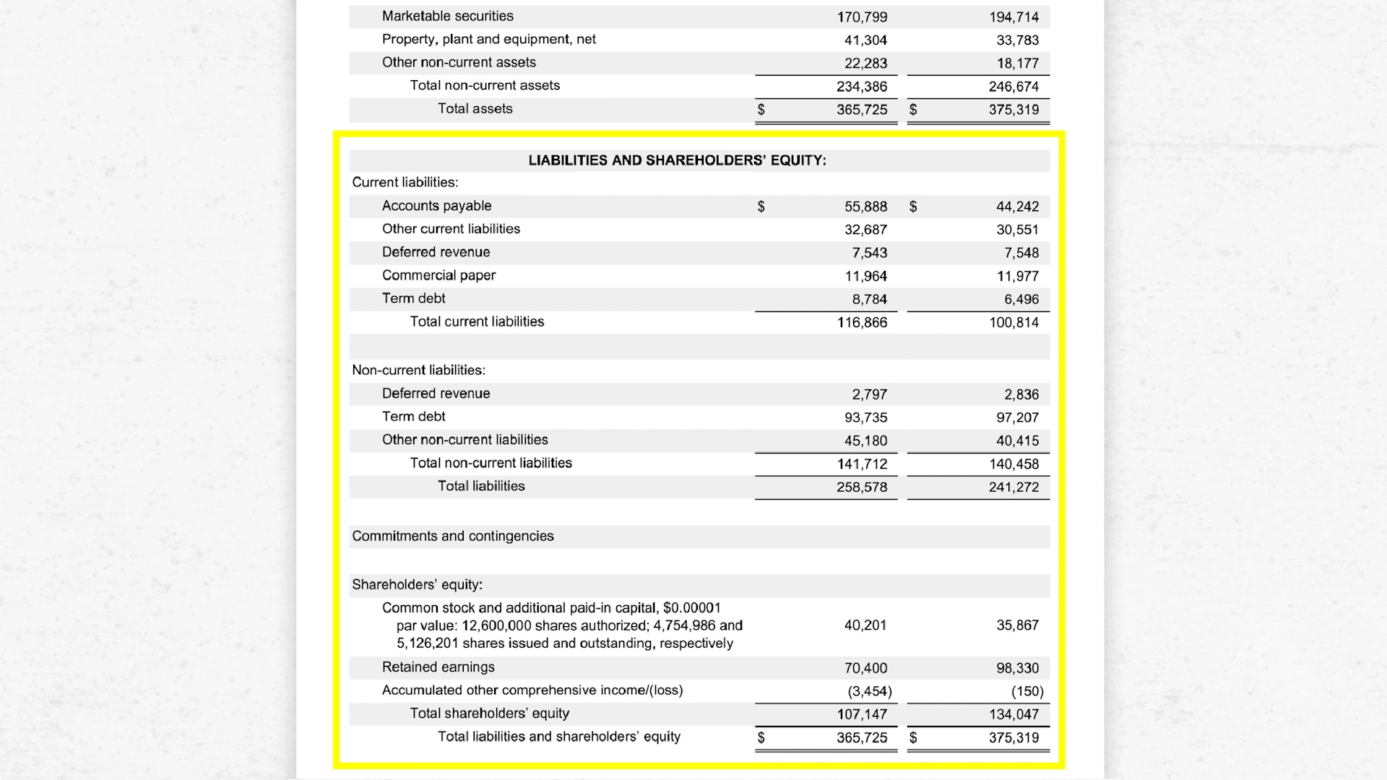

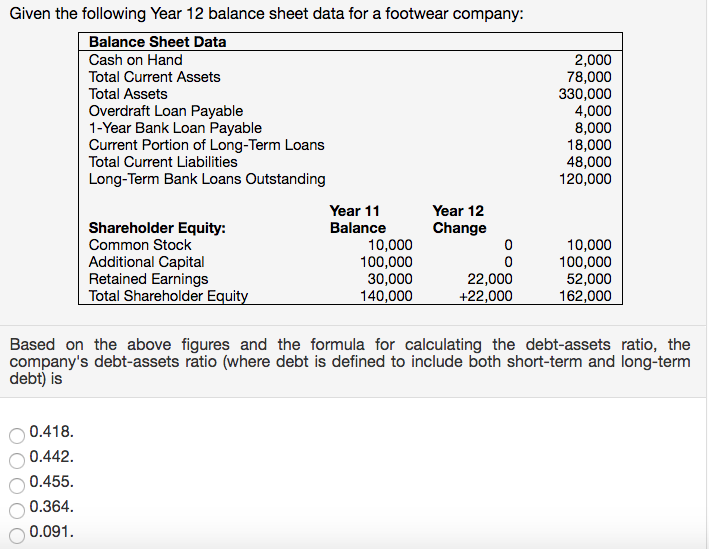

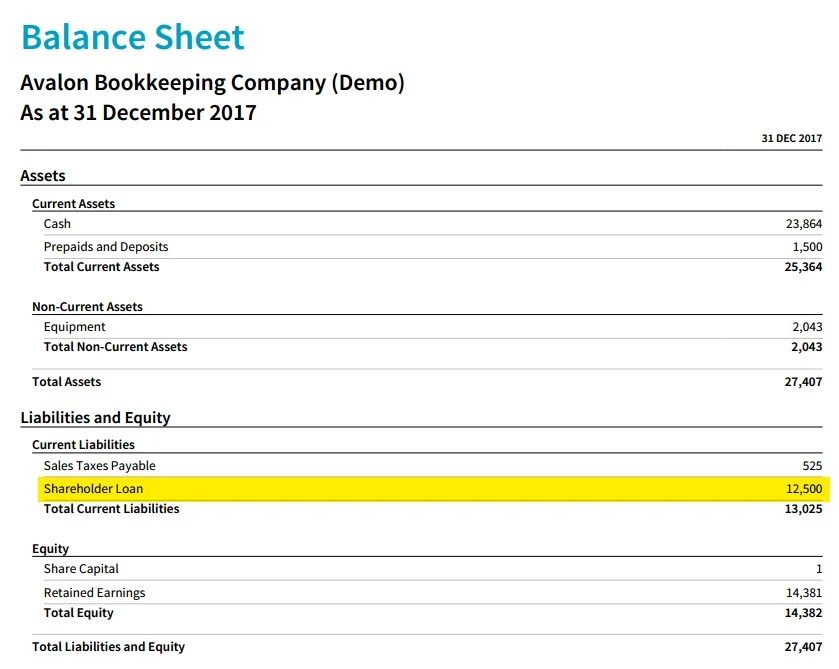

Loan To Shareholder On Balance Sheet - In general, the balance of your shareholder loan represents the total owner cash draws from your company minus funds you have. When you are dealing with shareholder loans, they should appear in the liability section of the balance sheet. When a corporation loans money to a shareholder at what the tax law considers an inadequate interest rate — meaning below the. Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent.

When a corporation loans money to a shareholder at what the tax law considers an inadequate interest rate — meaning below the. In general, the balance of your shareholder loan represents the total owner cash draws from your company minus funds you have. Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent. When you are dealing with shareholder loans, they should appear in the liability section of the balance sheet.

When a corporation loans money to a shareholder at what the tax law considers an inadequate interest rate — meaning below the. In general, the balance of your shareholder loan represents the total owner cash draws from your company minus funds you have. When you are dealing with shareholder loans, they should appear in the liability section of the balance sheet. Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent.

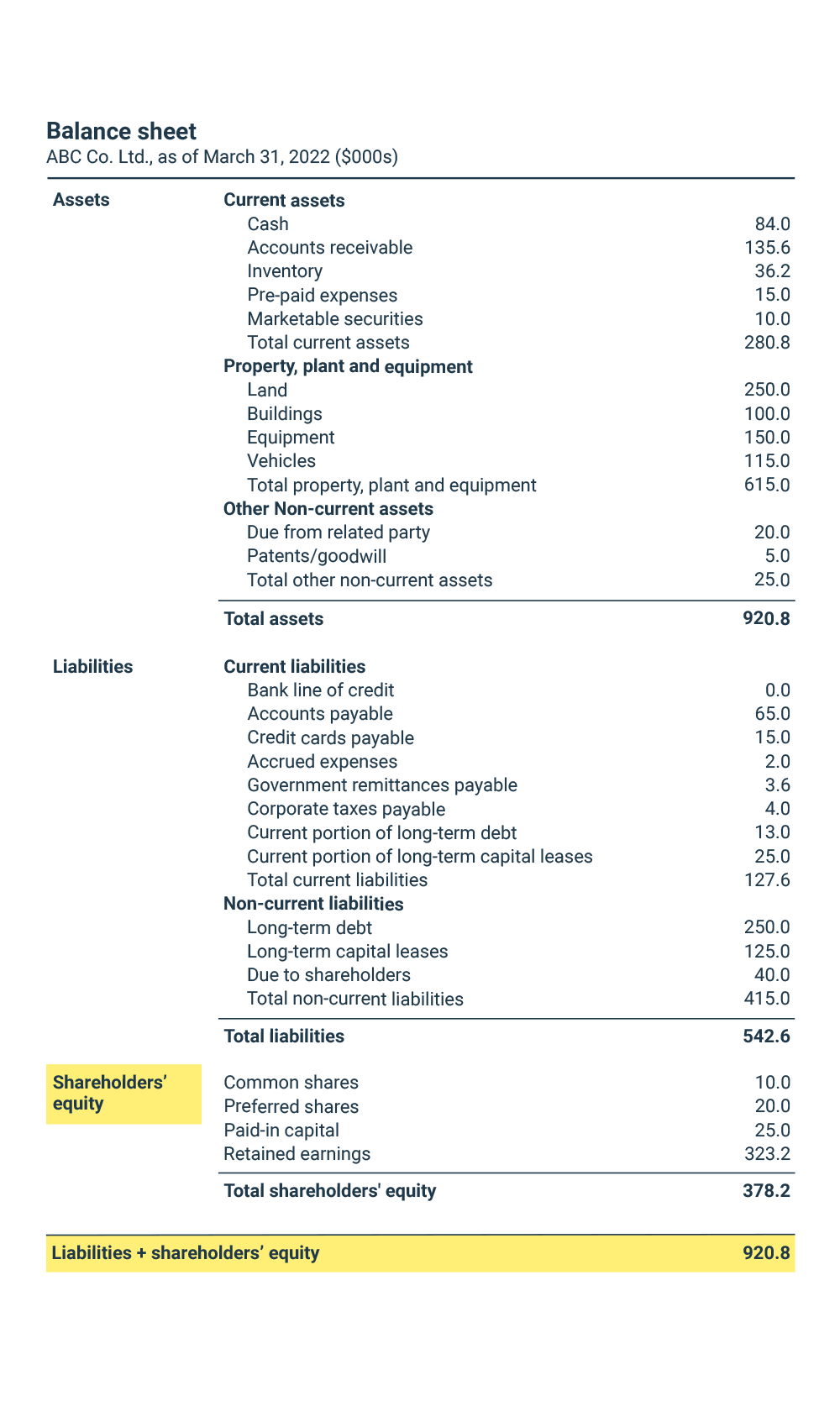

Balance Sheet Categories

When you are dealing with shareholder loans, they should appear in the liability section of the balance sheet. In general, the balance of your shareholder loan represents the total owner cash draws from your company minus funds you have. When a corporation loans money to a shareholder at what the tax law considers an inadequate interest rate — meaning below.

Loan To Shareholder On Balance Sheet Empowering Your Financial Journey

When you are dealing with shareholder loans, they should appear in the liability section of the balance sheet. In general, the balance of your shareholder loan represents the total owner cash draws from your company minus funds you have. Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent. When.

What is a Shareholder Loan? Vertical CPA

When a corporation loans money to a shareholder at what the tax law considers an inadequate interest rate — meaning below the. In general, the balance of your shareholder loan represents the total owner cash draws from your company minus funds you have. When you are dealing with shareholder loans, they should appear in the liability section of the balance.

What Is a Balance Sheet? Complete Guide Pareto Labs

In general, the balance of your shareholder loan represents the total owner cash draws from your company minus funds you have. When a corporation loans money to a shareholder at what the tax law considers an inadequate interest rate — meaning below the. Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income.

How To Prepare Projected Financial Statements For Bank Loan

Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent. In general, the balance of your shareholder loan represents the total owner cash draws from your company minus funds you have. When a corporation loans money to a shareholder at what the tax law considers an inadequate interest rate —.

Project Finance Funding with Shareholder Loan and Capitalised Interest

When a corporation loans money to a shareholder at what the tax law considers an inadequate interest rate — meaning below the. In general, the balance of your shareholder loan represents the total owner cash draws from your company minus funds you have. When you are dealing with shareholder loans, they should appear in the liability section of the balance.

Shareholder Loan The Benefits, Risks, and What You Need to Know

In general, the balance of your shareholder loan represents the total owner cash draws from your company minus funds you have. When you are dealing with shareholder loans, they should appear in the liability section of the balance sheet. When a corporation loans money to a shareholder at what the tax law considers an inadequate interest rate — meaning below.

Shareholder Loan Understand it and Avoid Trouble with the CRA Blog

When you are dealing with shareholder loans, they should appear in the liability section of the balance sheet. Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent. In general, the balance of your shareholder loan represents the total owner cash draws from your company minus funds you have. When.

How Are Shareholder Loans Shown on the Balance Sheet? Bizfluent

In general, the balance of your shareholder loan represents the total owner cash draws from your company minus funds you have. When a corporation loans money to a shareholder at what the tax law considers an inadequate interest rate — meaning below the. Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income.

Irs Loans From Shareholders

Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent. When you are dealing with shareholder loans, they should appear in the liability section of the balance sheet. When a corporation loans money to a shareholder at what the tax law considers an inadequate interest rate — meaning below the..

Loans To Shareholders Are Not Deductible For The Corporation And, In Fact, The Corporation Will Recognize Income To The Extent.

When a corporation loans money to a shareholder at what the tax law considers an inadequate interest rate — meaning below the. In general, the balance of your shareholder loan represents the total owner cash draws from your company minus funds you have. When you are dealing with shareholder loans, they should appear in the liability section of the balance sheet.