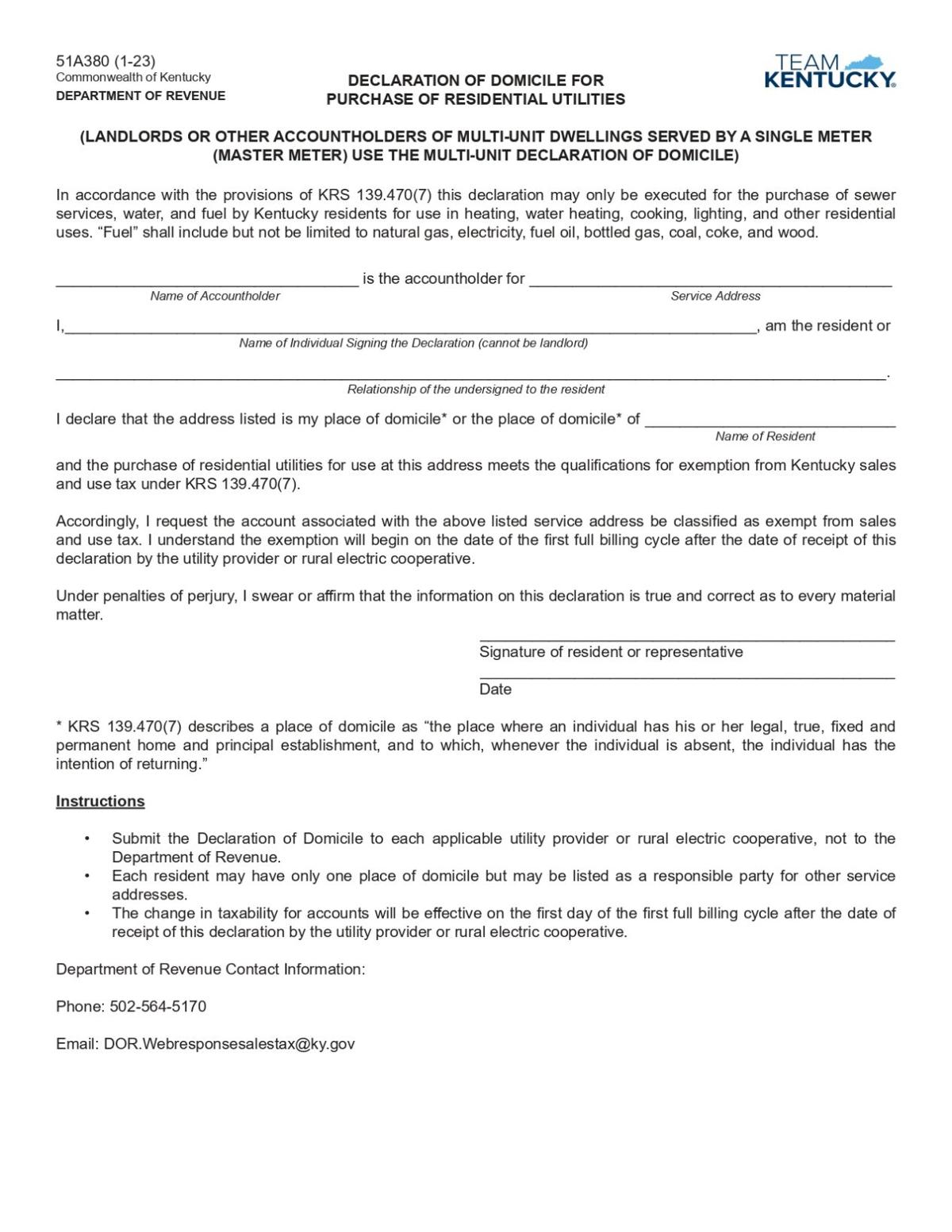

Kentucky Utility Tax Exemption Form - Yes, the new form for use by residents to declare their eligibility for the residential exemption is the declaration of domicile for purchase of. To claim an exemption from this tax a customer must provide the required tax exemption form or forms: Use form 51a380 to certify your. Starting january 1, 2023, a new law in kentucky places limits on the existing sales tax exemption for residential utility accounts. • submit the declaration of domicile to each applicable utility provider or rural electric cooperative, not to the department of revenue. Available at kenergy or at www.kyelectric.coop/taxanswers, a kentucky department of revenue form allows utility.

• submit the declaration of domicile to each applicable utility provider or rural electric cooperative, not to the department of revenue. Yes, the new form for use by residents to declare their eligibility for the residential exemption is the declaration of domicile for purchase of. Starting january 1, 2023, a new law in kentucky places limits on the existing sales tax exemption for residential utility accounts. To claim an exemption from this tax a customer must provide the required tax exemption form or forms: Available at kenergy or at www.kyelectric.coop/taxanswers, a kentucky department of revenue form allows utility. Use form 51a380 to certify your.

Yes, the new form for use by residents to declare their eligibility for the residential exemption is the declaration of domicile for purchase of. To claim an exemption from this tax a customer must provide the required tax exemption form or forms: Available at kenergy or at www.kyelectric.coop/taxanswers, a kentucky department of revenue form allows utility. • submit the declaration of domicile to each applicable utility provider or rural electric cooperative, not to the department of revenue. Starting january 1, 2023, a new law in kentucky places limits on the existing sales tax exemption for residential utility accounts. Use form 51a380 to certify your.

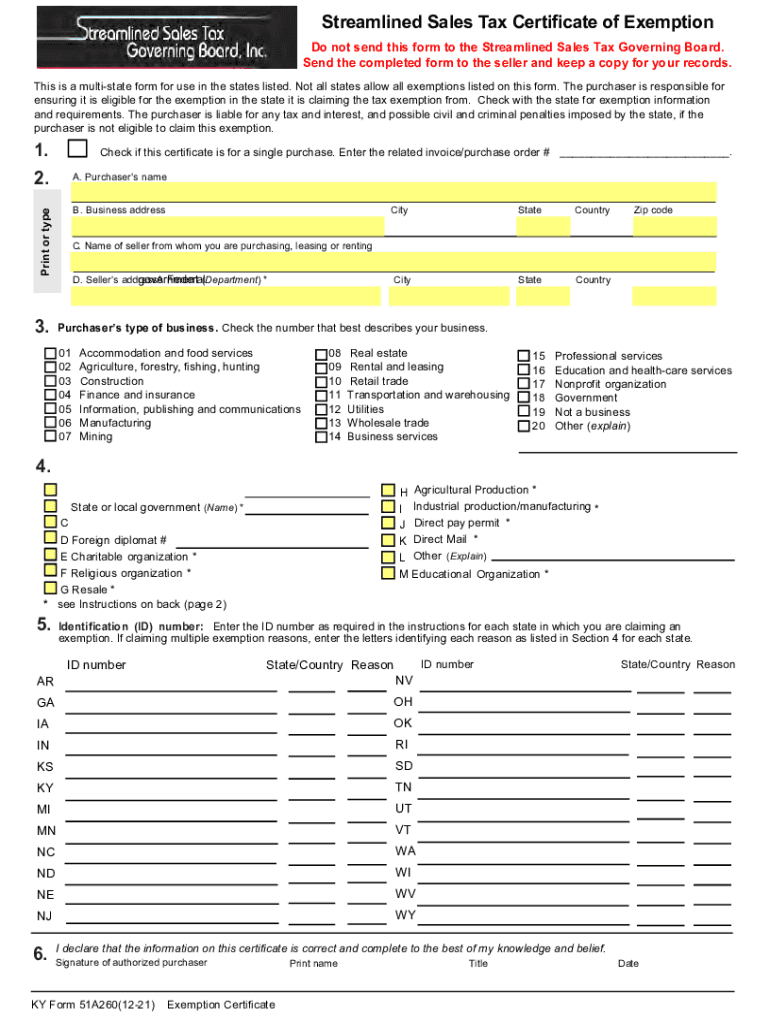

Tax Exempt Form 20202021 Fill and Sign Printable Template Online

Use form 51a380 to certify your. Available at kenergy or at www.kyelectric.coop/taxanswers, a kentucky department of revenue form allows utility. Yes, the new form for use by residents to declare their eligibility for the residential exemption is the declaration of domicile for purchase of. • submit the declaration of domicile to each applicable utility provider or rural electric cooperative, not.

Novat ‑ Tax Exempt Shopify Tax Exempt App Remove VAT from Checkout

• submit the declaration of domicile to each applicable utility provider or rural electric cooperative, not to the department of revenue. Available at kenergy or at www.kyelectric.coop/taxanswers, a kentucky department of revenue form allows utility. Starting january 1, 2023, a new law in kentucky places limits on the existing sales tax exemption for residential utility accounts. Yes, the new form.

Utility companies ask Kentucky customers to fill out exemption form to

• submit the declaration of domicile to each applicable utility provider or rural electric cooperative, not to the department of revenue. Available at kenergy or at www.kyelectric.coop/taxanswers, a kentucky department of revenue form allows utility. To claim an exemption from this tax a customer must provide the required tax exemption form or forms: Use form 51a380 to certify your. Starting.

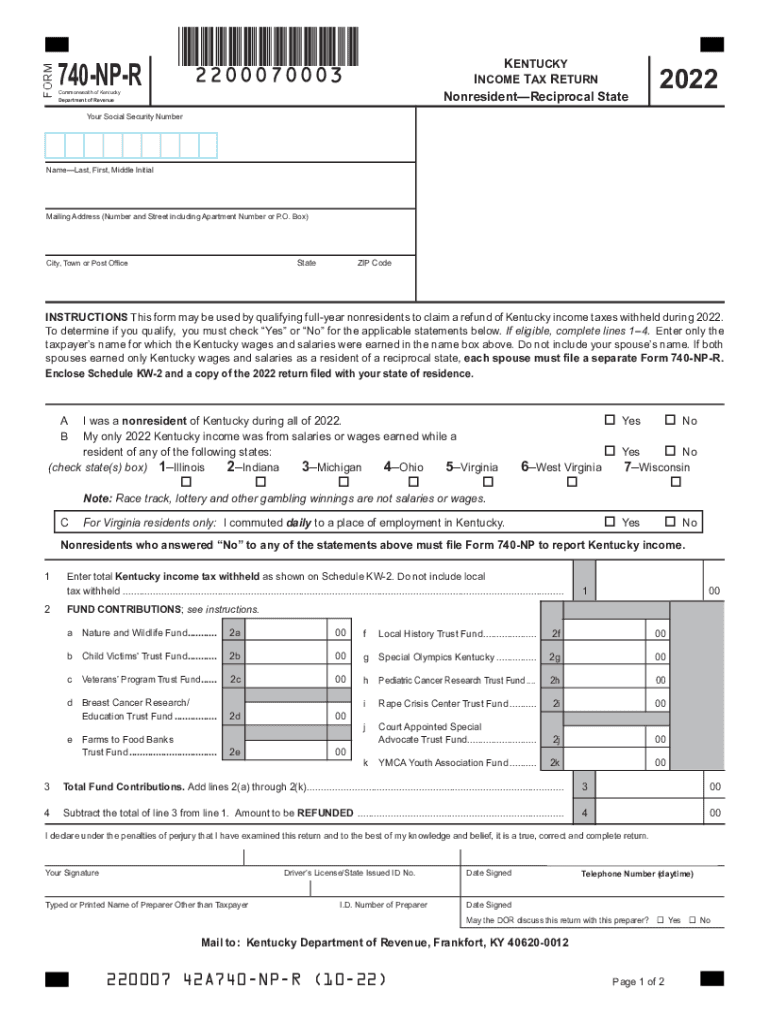

2023 Ky State Tax Form Printable Forms Free Online

To claim an exemption from this tax a customer must provide the required tax exemption form or forms: Use form 51a380 to certify your. • submit the declaration of domicile to each applicable utility provider or rural electric cooperative, not to the department of revenue. Starting january 1, 2023, a new law in kentucky places limits on the existing sales.

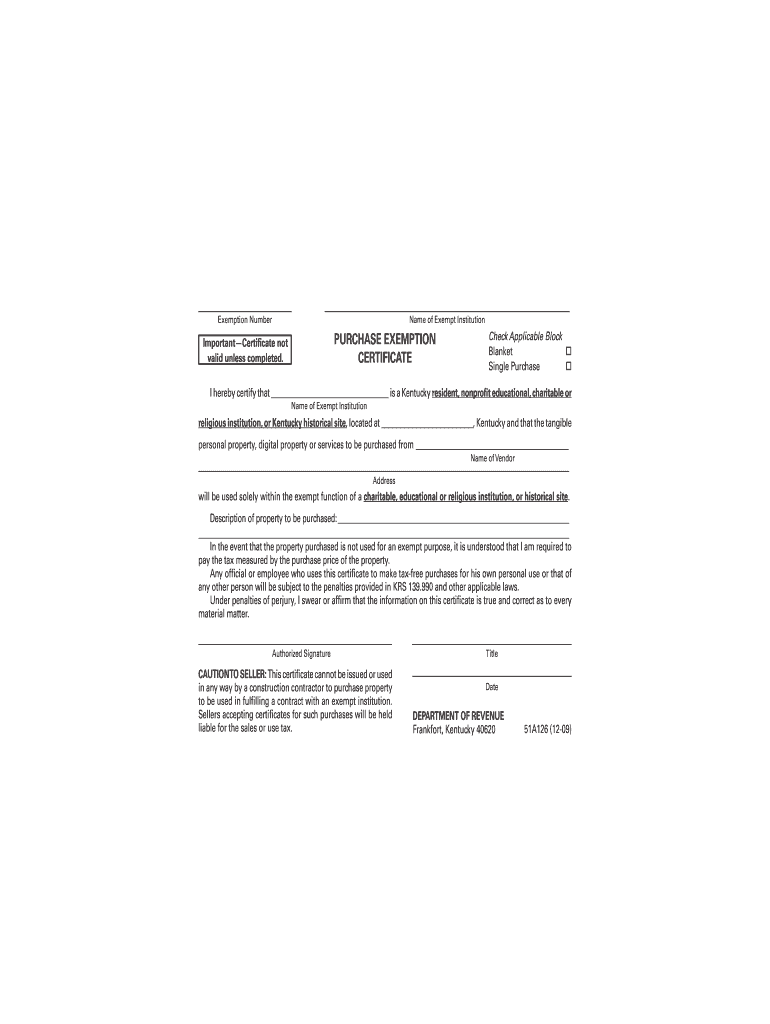

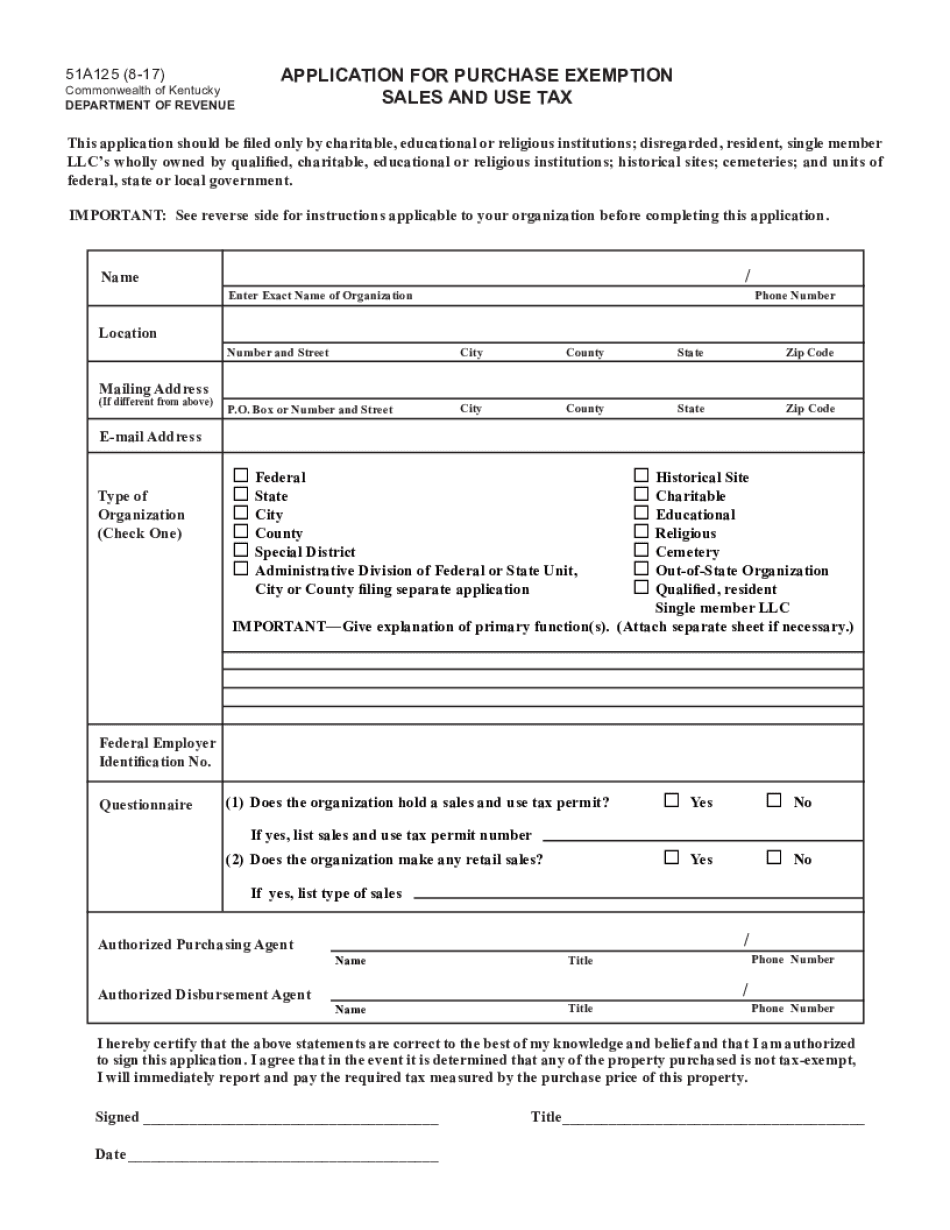

Kentucky Farm Tax Exempt 20092024 Form Fill Out and Sign Printable

Use form 51a380 to certify your. Starting january 1, 2023, a new law in kentucky places limits on the existing sales tax exemption for residential utility accounts. Yes, the new form for use by residents to declare their eligibility for the residential exemption is the declaration of domicile for purchase of. Available at kenergy or at www.kyelectric.coop/taxanswers, a kentucky department.

Kentucky Tax Exemption Form Complete with ease airSlate SignNow

Starting january 1, 2023, a new law in kentucky places limits on the existing sales tax exemption for residential utility accounts. Use form 51a380 to certify your. Yes, the new form for use by residents to declare their eligibility for the residential exemption is the declaration of domicile for purchase of. Available at kenergy or at www.kyelectric.coop/taxanswers, a kentucky department.

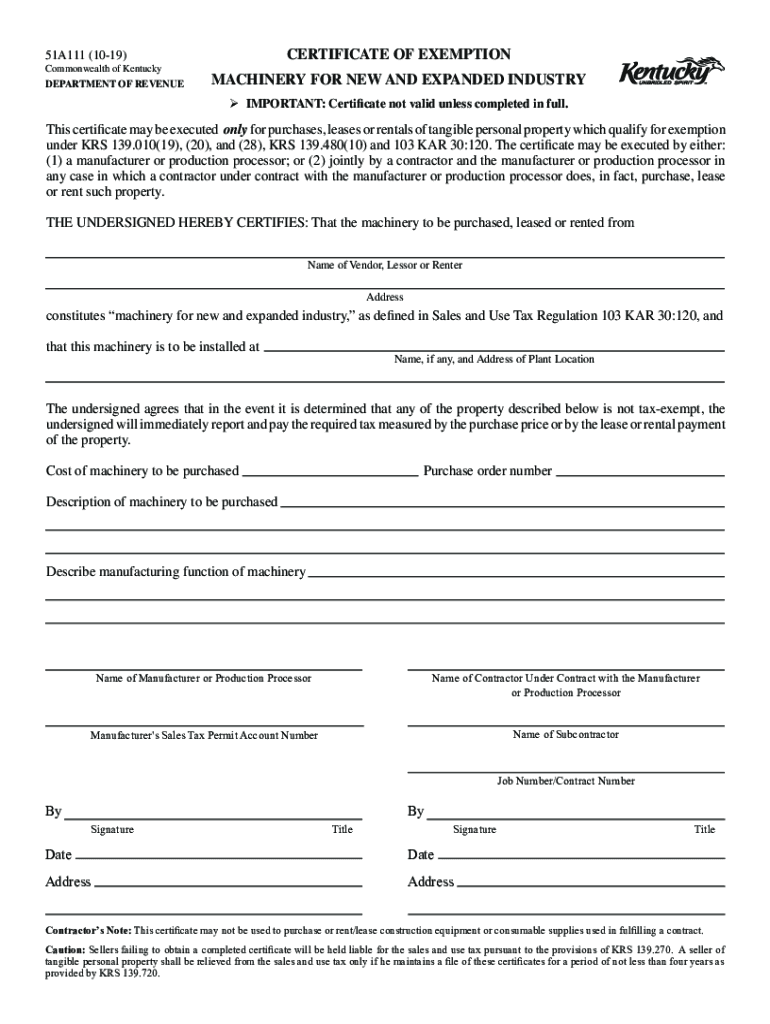

Ky 51a111 Exemption 20192024 Form Fill Out and Sign Printable PDF

To claim an exemption from this tax a customer must provide the required tax exemption form or forms: Starting january 1, 2023, a new law in kentucky places limits on the existing sales tax exemption for residential utility accounts. Available at kenergy or at www.kyelectric.coop/taxanswers, a kentucky department of revenue form allows utility. • submit the declaration of domicile to.

Kentucky residents have questions about utility tax bill

Yes, the new form for use by residents to declare their eligibility for the residential exemption is the declaration of domicile for purchase of. To claim an exemption from this tax a customer must provide the required tax exemption form or forms: Use form 51a380 to certify your. Available at kenergy or at www.kyelectric.coop/taxanswers, a kentucky department of revenue form.

Kentucky Exemption Sales Tax PDF 20172024 Form Fill Out and Sign

Available at kenergy or at www.kyelectric.coop/taxanswers, a kentucky department of revenue form allows utility. Use form 51a380 to certify your. • submit the declaration of domicile to each applicable utility provider or rural electric cooperative, not to the department of revenue. Yes, the new form for use by residents to declare their eligibility for the residential exemption is the declaration.

Fillable Original Application For Homestead And Related Tax Exemptions

Use form 51a380 to certify your. Starting january 1, 2023, a new law in kentucky places limits on the existing sales tax exemption for residential utility accounts. Yes, the new form for use by residents to declare their eligibility for the residential exemption is the declaration of domicile for purchase of. • submit the declaration of domicile to each applicable.

To Claim An Exemption From This Tax A Customer Must Provide The Required Tax Exemption Form Or Forms:

Yes, the new form for use by residents to declare their eligibility for the residential exemption is the declaration of domicile for purchase of. • submit the declaration of domicile to each applicable utility provider or rural electric cooperative, not to the department of revenue. Available at kenergy or at www.kyelectric.coop/taxanswers, a kentucky department of revenue form allows utility. Use form 51a380 to certify your.