K 9 Tax Form - This is a statement for tax paid by the partnership or sub. Corporations which elect under subchapter s of the internal revenue code not to be taxed as a corporation must file a kansas small business.

This is a statement for tax paid by the partnership or sub. Corporations which elect under subchapter s of the internal revenue code not to be taxed as a corporation must file a kansas small business.

This is a statement for tax paid by the partnership or sub. Corporations which elect under subchapter s of the internal revenue code not to be taxed as a corporation must file a kansas small business.

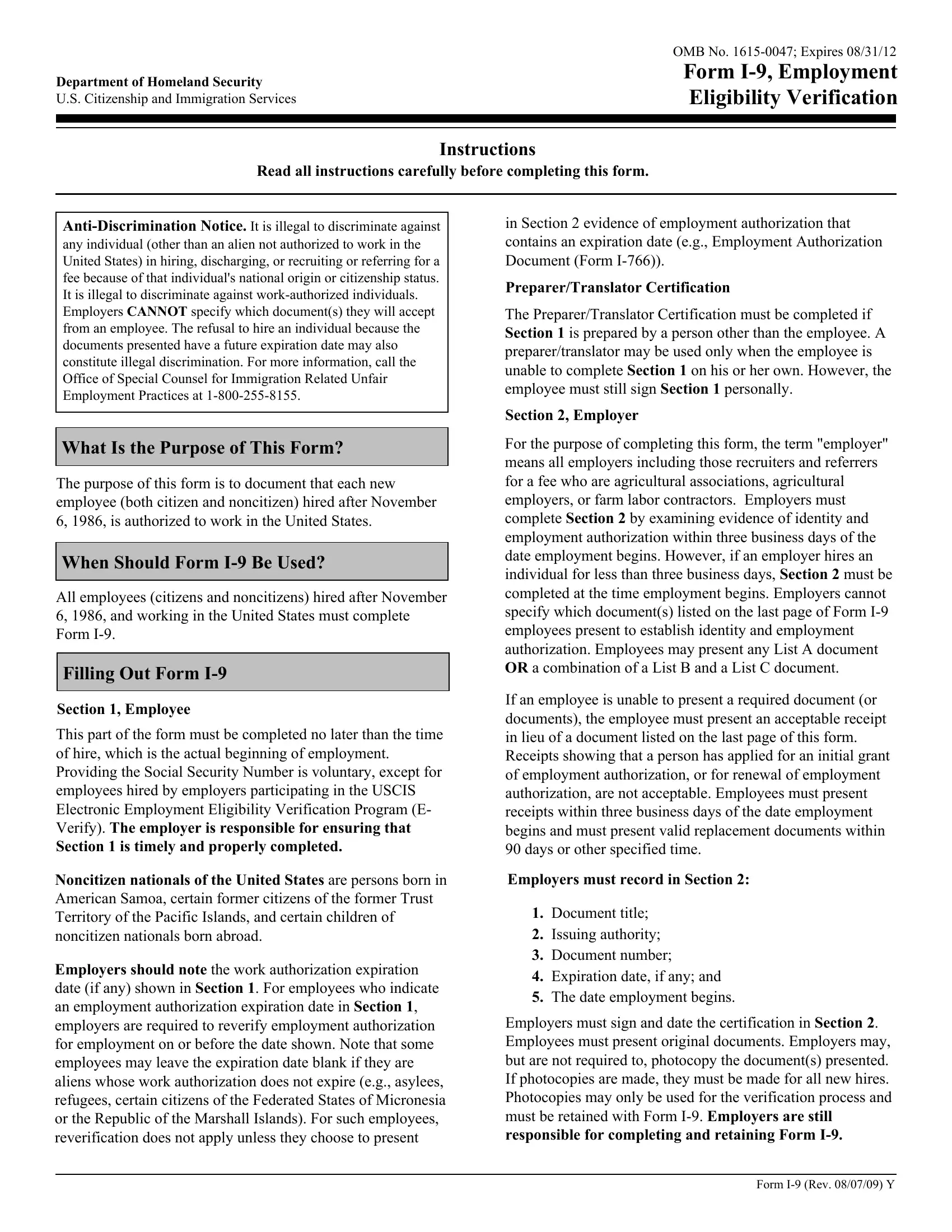

Online I9 Tax Form ≡ Fill Out Printable PDF Forms Online

Corporations which elect under subchapter s of the internal revenue code not to be taxed as a corporation must file a kansas small business. This is a statement for tax paid by the partnership or sub.

Food Startup Help How does an employer know whether an applicant for

Corporations which elect under subchapter s of the internal revenue code not to be taxed as a corporation must file a kansas small business. This is a statement for tax paid by the partnership or sub.

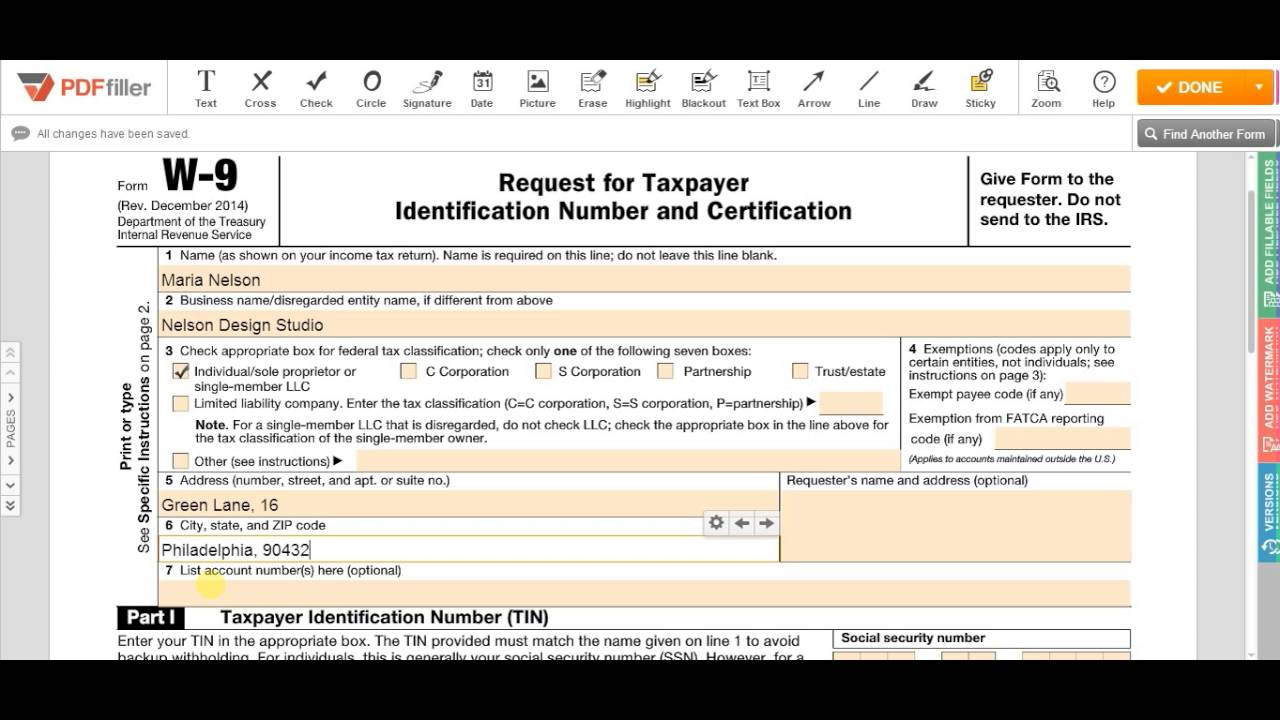

Get W9 Form 2020 Print Calendar Printables Free Blank

Corporations which elect under subchapter s of the internal revenue code not to be taxed as a corporation must file a kansas small business. This is a statement for tax paid by the partnership or sub.

[Solved] Unable to submit W9 tax form

Corporations which elect under subchapter s of the internal revenue code not to be taxed as a corporation must file a kansas small business. This is a statement for tax paid by the partnership or sub.

Prime Video K9

This is a statement for tax paid by the partnership or sub. Corporations which elect under subchapter s of the internal revenue code not to be taxed as a corporation must file a kansas small business.

Tripawds » K9 Canine Tax Form

This is a statement for tax paid by the partnership or sub. Corporations which elect under subchapter s of the internal revenue code not to be taxed as a corporation must file a kansas small business.

WK9TaxForm hosted at ImgBB — ImgBB

Corporations which elect under subchapter s of the internal revenue code not to be taxed as a corporation must file a kansas small business. This is a statement for tax paid by the partnership or sub.

W 9 Form 2024 Pdf Download Online Maye Stephi

Corporations which elect under subchapter s of the internal revenue code not to be taxed as a corporation must file a kansas small business. This is a statement for tax paid by the partnership or sub.

Barbara Johnson Blog Schedule K1 Tax Form What Is It and Who Needs

Corporations which elect under subchapter s of the internal revenue code not to be taxed as a corporation must file a kansas small business. This is a statement for tax paid by the partnership or sub.

Corporations Which Elect Under Subchapter S Of The Internal Revenue Code Not To Be Taxed As A Corporation Must File A Kansas Small Business.

This is a statement for tax paid by the partnership or sub.

![[Solved] Unable to submit W9 tax form](https://airbnbase.com/content/images/size/w1600/2022/07/unable-submit-w-9-tax-form.png)