Instructions For Form 8936 - This article explains how to claim the maximum credit amount for business/investment use of an electric vehicle on form 8936. Use parts i and v of schedule a (form 8936) to figure the clean vehicle credit amount for each qualified commercial clean vehicle you placed.

Use parts i and v of schedule a (form 8936) to figure the clean vehicle credit amount for each qualified commercial clean vehicle you placed. This article explains how to claim the maximum credit amount for business/investment use of an electric vehicle on form 8936.

Use parts i and v of schedule a (form 8936) to figure the clean vehicle credit amount for each qualified commercial clean vehicle you placed. This article explains how to claim the maximum credit amount for business/investment use of an electric vehicle on form 8936.

IRS Form 8936 Instructions Qualifying Electric Vehicle Tax Credits

This article explains how to claim the maximum credit amount for business/investment use of an electric vehicle on form 8936. Use parts i and v of schedule a (form 8936) to figure the clean vehicle credit amount for each qualified commercial clean vehicle you placed.

Form 8936 Instructions 2023 Printable Forms Free Online

Use parts i and v of schedule a (form 8936) to figure the clean vehicle credit amount for each qualified commercial clean vehicle you placed. This article explains how to claim the maximum credit amount for business/investment use of an electric vehicle on form 8936.

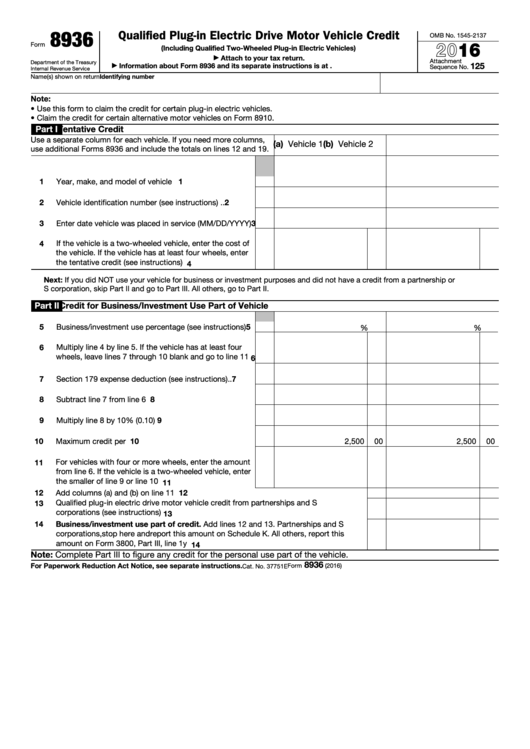

Fillable Form 8936 Qualified PlugIn Electric Drive Motor Vehicle

This article explains how to claim the maximum credit amount for business/investment use of an electric vehicle on form 8936. Use parts i and v of schedule a (form 8936) to figure the clean vehicle credit amount for each qualified commercial clean vehicle you placed.

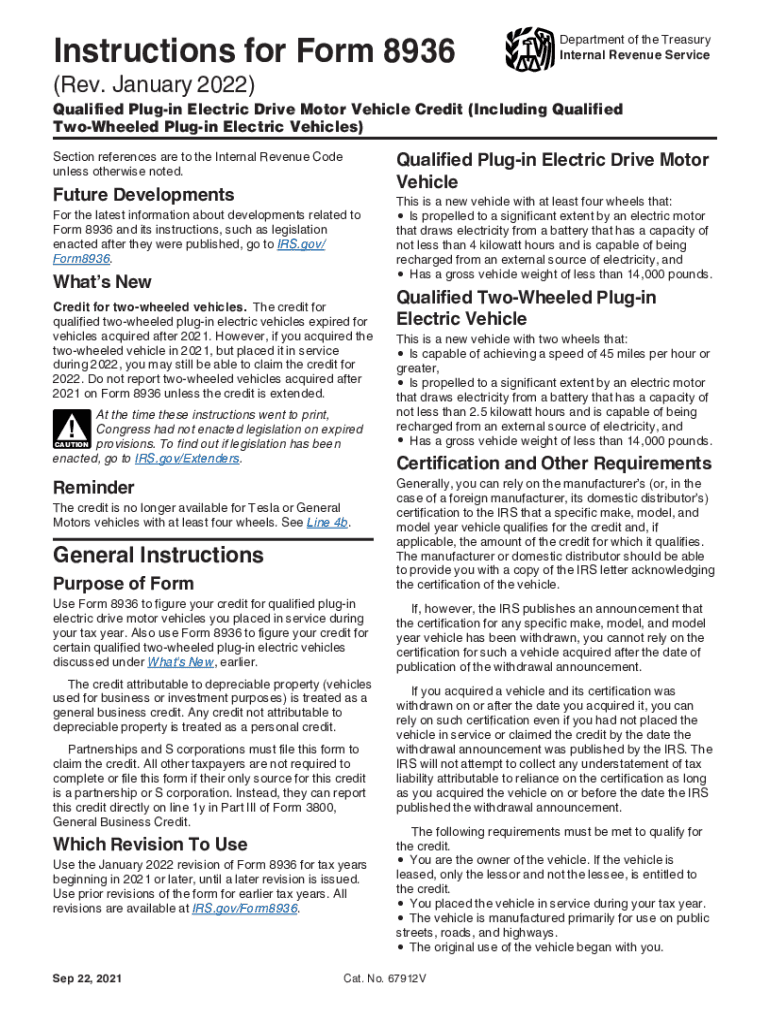

Fillable Online Instructions for Form 8936 (Rev. January 2022

Use parts i and v of schedule a (form 8936) to figure the clean vehicle credit amount for each qualified commercial clean vehicle you placed. This article explains how to claim the maximum credit amount for business/investment use of an electric vehicle on form 8936.

Form 8936 Edit, Fill, Sign Online Handypdf

This article explains how to claim the maximum credit amount for business/investment use of an electric vehicle on form 8936. Use parts i and v of schedule a (form 8936) to figure the clean vehicle credit amount for each qualified commercial clean vehicle you placed.

Fillable Online 8936 Instructions for Form 8936. Instructions for Form

Use parts i and v of schedule a (form 8936) to figure the clean vehicle credit amount for each qualified commercial clean vehicle you placed. This article explains how to claim the maximum credit amount for business/investment use of an electric vehicle on form 8936.

Form 8936

Use parts i and v of schedule a (form 8936) to figure the clean vehicle credit amount for each qualified commercial clean vehicle you placed. This article explains how to claim the maximum credit amount for business/investment use of an electric vehicle on form 8936.

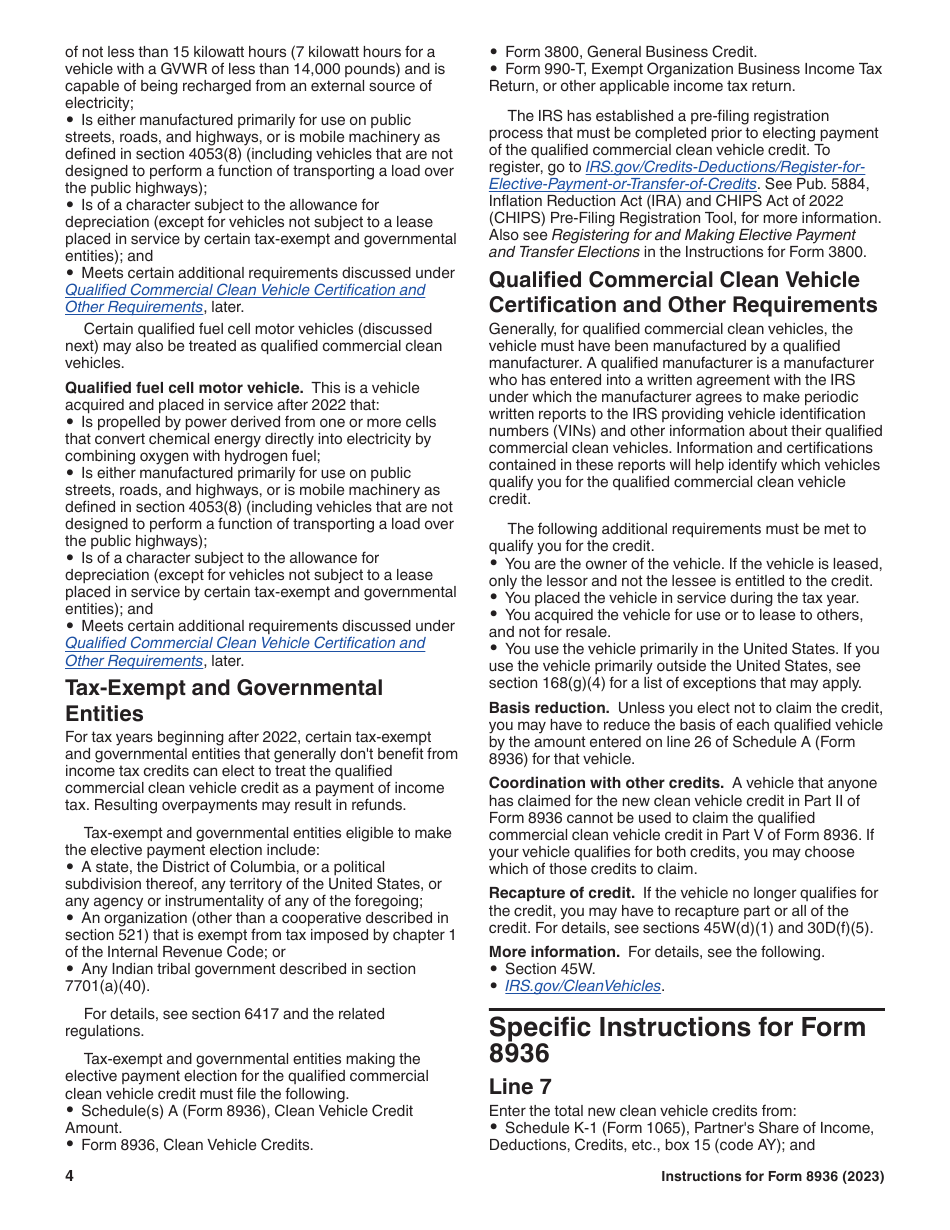

Download Instructions for IRS Form 8936 Clean Vehicle Credits PDF, 2023

Use parts i and v of schedule a (form 8936) to figure the clean vehicle credit amount for each qualified commercial clean vehicle you placed. This article explains how to claim the maximum credit amount for business/investment use of an electric vehicle on form 8936.

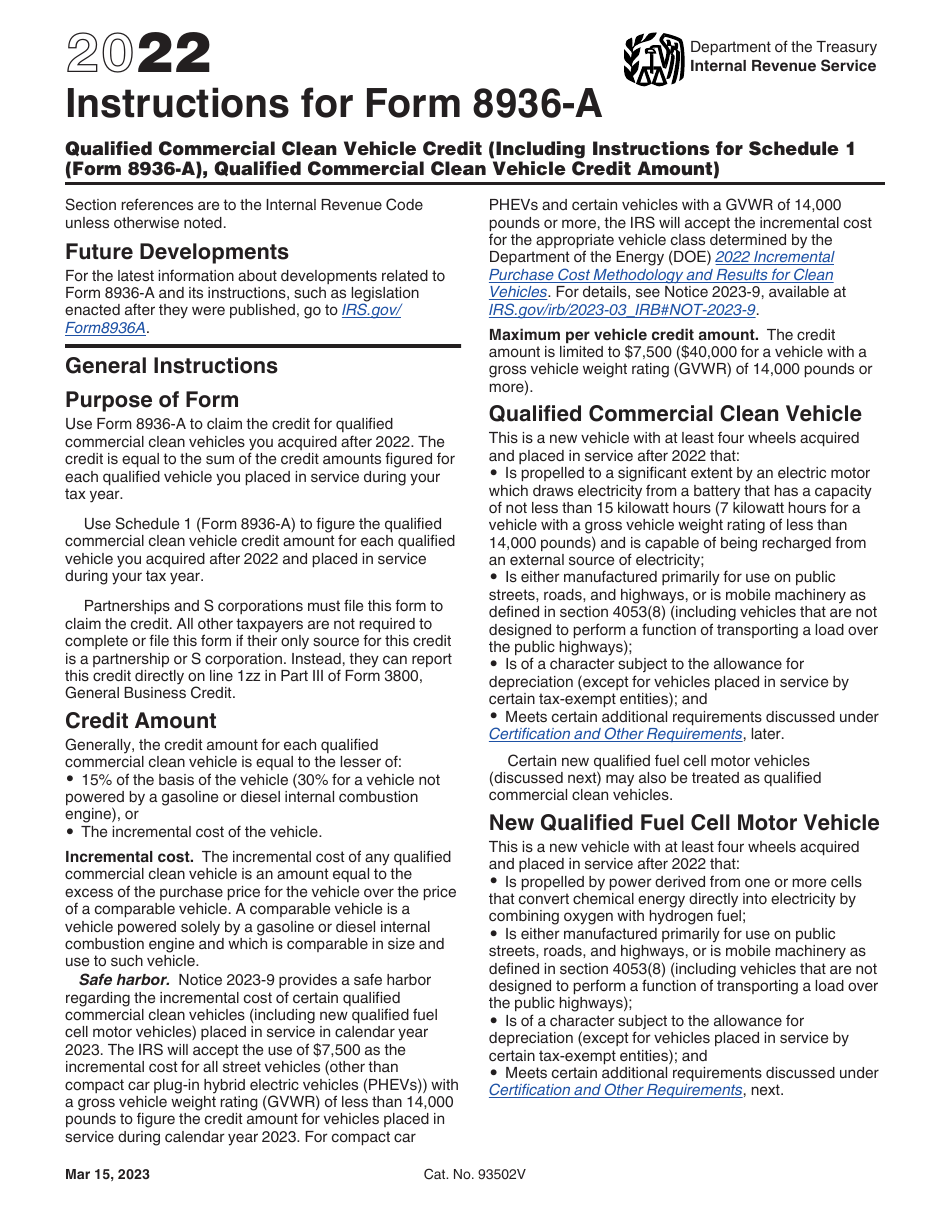

Download Instructions for IRS Form 8936A Schedule 1 PDF, 2022

Use parts i and v of schedule a (form 8936) to figure the clean vehicle credit amount for each qualified commercial clean vehicle you placed. This article explains how to claim the maximum credit amount for business/investment use of an electric vehicle on form 8936.

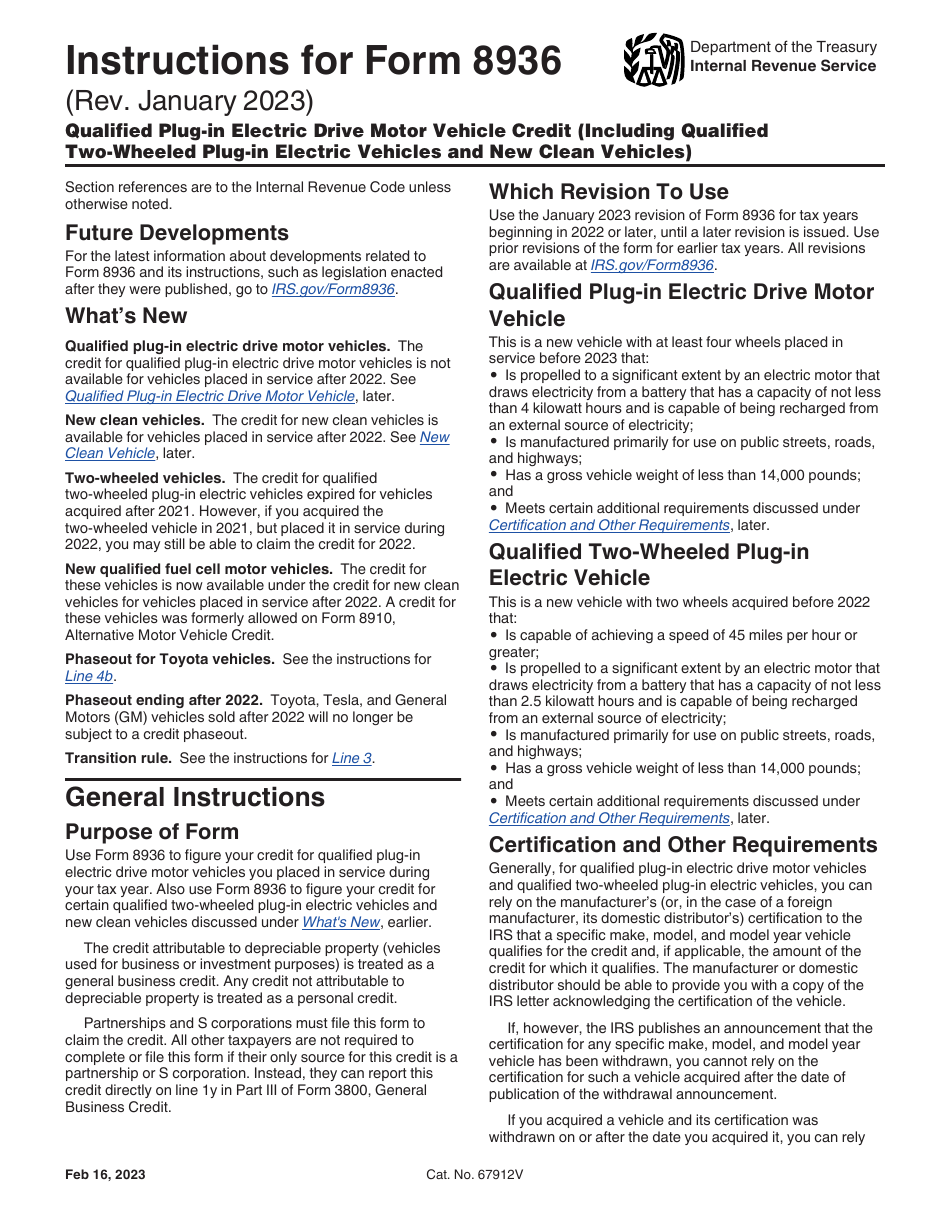

Download Instructions for IRS Form 8936 Qualified PlugIn Electric

This article explains how to claim the maximum credit amount for business/investment use of an electric vehicle on form 8936. Use parts i and v of schedule a (form 8936) to figure the clean vehicle credit amount for each qualified commercial clean vehicle you placed.

This Article Explains How To Claim The Maximum Credit Amount For Business/Investment Use Of An Electric Vehicle On Form 8936.

Use parts i and v of schedule a (form 8936) to figure the clean vehicle credit amount for each qualified commercial clean vehicle you placed.

:max_bytes(150000):strip_icc()/IRSForm8936-e08cdbaf8ff74a2eab7cd0c1e19b93ef.png)