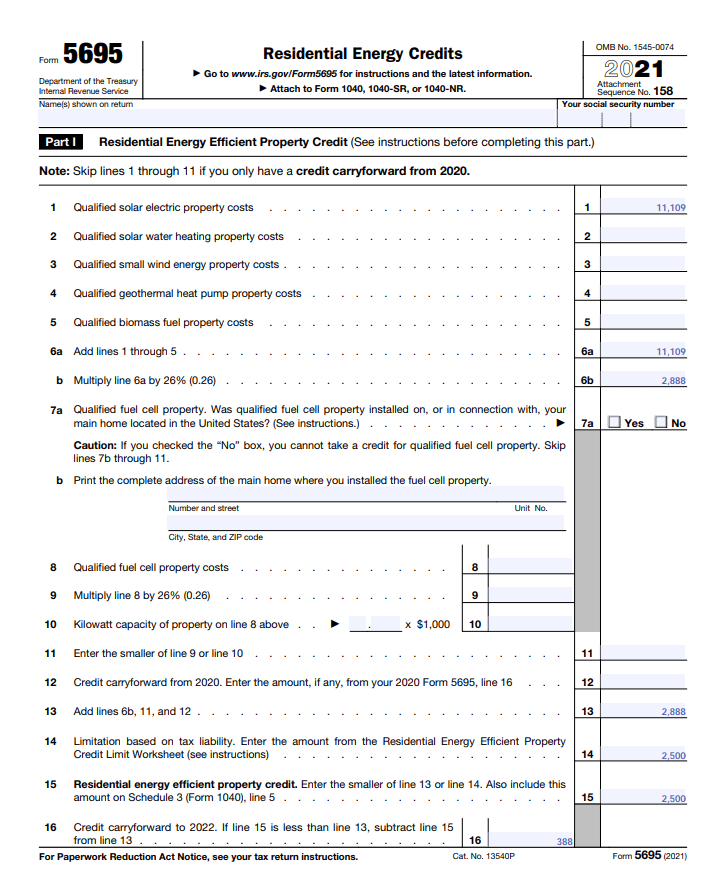

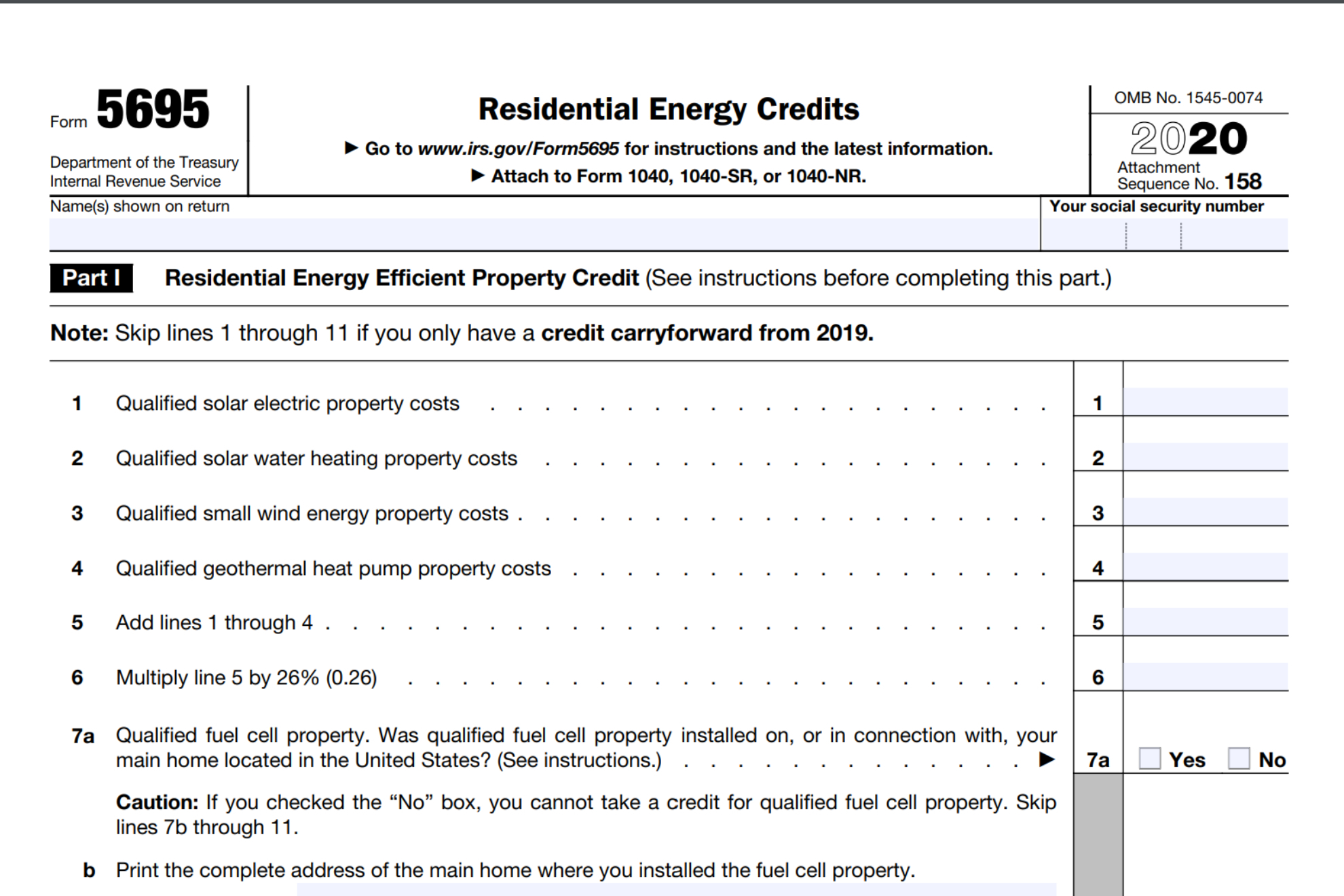

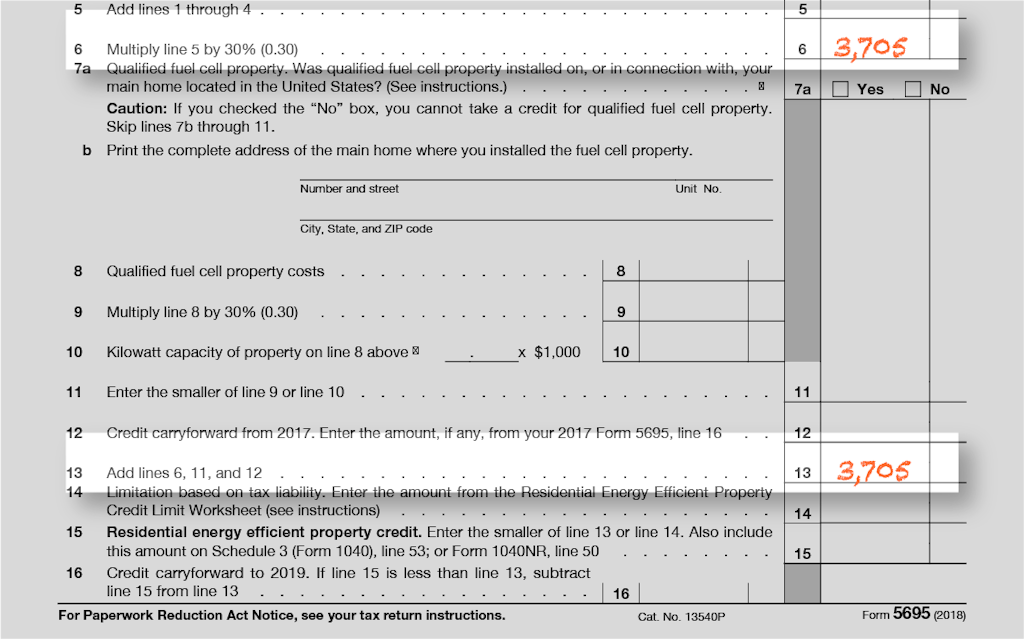

How Do I Fill Out Form 5695 For Solar Panels - Once you’ve installed your solar system, collected all the receipts and. How to fill out irs form 5695 for solar panel tax credit. You may be able to take a credit of 30% of your costs of qualified solar electric property, solar water heating property, small wind energy. Here’s a simple checklist for filling out form 5695 for solar panels: We'll also address common questions and. Collect all receipts and invoices for solar panel purchases. The energy efficient home improvement credit. The residential energy credits are: We'll walk you through the process of completing form 5695 for solar panels, step by step. Use form 5695 to figure and take your residential energy credits.

The energy efficient home improvement credit. We'll also address common questions and. The residential energy credits are: We'll walk you through the process of completing form 5695 for solar panels, step by step. Once you’ve installed your solar system, collected all the receipts and. Collect all receipts and invoices for solar panel purchases. How to fill out irs form 5695 for solar panel tax credit. You may be able to take a credit of 30% of your costs of qualified solar electric property, solar water heating property, small wind energy. Here’s a simple checklist for filling out form 5695 for solar panels: Use form 5695 to figure and take your residential energy credits.

Use form 5695 to figure and take your residential energy credits. The energy efficient home improvement credit. We'll also address common questions and. The residential energy credits are: Here’s a simple checklist for filling out form 5695 for solar panels: Collect all receipts and invoices for solar panel purchases. We'll walk you through the process of completing form 5695 for solar panels, step by step. Once you’ve installed your solar system, collected all the receipts and. You may be able to take a credit of 30% of your costs of qualified solar electric property, solar water heating property, small wind energy. How to fill out irs form 5695 for solar panel tax credit.

Irs Form 5695 Instructions 2023 Printable Forms Free Online

The residential energy credits are: You may be able to take a credit of 30% of your costs of qualified solar electric property, solar water heating property, small wind energy. We'll also address common questions and. Collect all receipts and invoices for solar panel purchases. How to fill out irs form 5695 for solar panel tax credit.

Cómo reclamar el crédito fiscal federal por energía solar

We'll also address common questions and. Collect all receipts and invoices for solar panel purchases. How to fill out irs form 5695 for solar panel tax credit. You may be able to take a credit of 30% of your costs of qualified solar electric property, solar water heating property, small wind energy. Here’s a simple checklist for filling out form.

Form 5695 Fillable Printable Forms Free Online

Here’s a simple checklist for filling out form 5695 for solar panels: You may be able to take a credit of 30% of your costs of qualified solar electric property, solar water heating property, small wind energy. Collect all receipts and invoices for solar panel purchases. Use form 5695 to figure and take your residential energy credits. Once you’ve installed.

Form 5695 For 2024 Norma Annmaria

Once you’ve installed your solar system, collected all the receipts and. How to fill out irs form 5695 for solar panel tax credit. You may be able to take a credit of 30% of your costs of qualified solar electric property, solar water heating property, small wind energy. Here’s a simple checklist for filling out form 5695 for solar panels:.

5695 Form 2025 Poppy Livvie

We'll walk you through the process of completing form 5695 for solar panels, step by step. You may be able to take a credit of 30% of your costs of qualified solar electric property, solar water heating property, small wind energy. Once you’ve installed your solar system, collected all the receipts and. We'll also address common questions and. Use form.

A Quick Guide To IRS Form 5695

Once you’ve installed your solar system, collected all the receipts and. We'll walk you through the process of completing form 5695 for solar panels, step by step. You may be able to take a credit of 30% of your costs of qualified solar electric property, solar water heating property, small wind energy. How to fill out irs form 5695 for.

How To Properly Claim The Solar Tax Credit (ITC)? Form 5695 Solar

We'll walk you through the process of completing form 5695 for solar panels, step by step. Collect all receipts and invoices for solar panel purchases. Here’s a simple checklist for filling out form 5695 for solar panels: Use form 5695 to figure and take your residential energy credits. The energy efficient home improvement credit.

What is the Residential energy credit form 5695? Leia aqui Who fills

Use form 5695 to figure and take your residential energy credits. Here’s a simple checklist for filling out form 5695 for solar panels: Collect all receipts and invoices for solar panel purchases. How to fill out irs form 5695 for solar panel tax credit. The energy efficient home improvement credit.

How To Save Money On Taxes By Filing IRS Form 5695

Collect all receipts and invoices for solar panel purchases. The energy efficient home improvement credit. You may be able to take a credit of 30% of your costs of qualified solar electric property, solar water heating property, small wind energy. Here’s a simple checklist for filling out form 5695 for solar panels: We'll also address common questions and.

How To Claim The Solar Tax Credit Using Form 5695 Solar Tax Pros

Use form 5695 to figure and take your residential energy credits. Here’s a simple checklist for filling out form 5695 for solar panels: We'll walk you through the process of completing form 5695 for solar panels, step by step. Once you’ve installed your solar system, collected all the receipts and. We'll also address common questions and.

Use Form 5695 To Figure And Take Your Residential Energy Credits.

Here’s a simple checklist for filling out form 5695 for solar panels: The energy efficient home improvement credit. We'll walk you through the process of completing form 5695 for solar panels, step by step. Once you’ve installed your solar system, collected all the receipts and.

Collect All Receipts And Invoices For Solar Panel Purchases.

How to fill out irs form 5695 for solar panel tax credit. We'll also address common questions and. The residential energy credits are: You may be able to take a credit of 30% of your costs of qualified solar electric property, solar water heating property, small wind energy.