Goodwill Tax Deduction Form - Not all donations to goodwill automatically qualify for tax deductions. When you drop off your donations at goodwill, you’ll receive a receipt from a donation attendant. To claim such a deduction, the donations must be made. When you fill out your tax return, you will need to be able to get your appraiser to. Download a donation valuation guide, find a location to donate, and. Learn how to value and deduct your donations to goodwill on your taxes. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations.

Not all donations to goodwill automatically qualify for tax deductions. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. Learn how to value and deduct your donations to goodwill on your taxes. When you drop off your donations at goodwill, you’ll receive a receipt from a donation attendant. Download a donation valuation guide, find a location to donate, and. When you fill out your tax return, you will need to be able to get your appraiser to. To claim such a deduction, the donations must be made.

Download a donation valuation guide, find a location to donate, and. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. Learn how to value and deduct your donations to goodwill on your taxes. When you drop off your donations at goodwill, you’ll receive a receipt from a donation attendant. Not all donations to goodwill automatically qualify for tax deductions. To claim such a deduction, the donations must be made. When you fill out your tax return, you will need to be able to get your appraiser to.

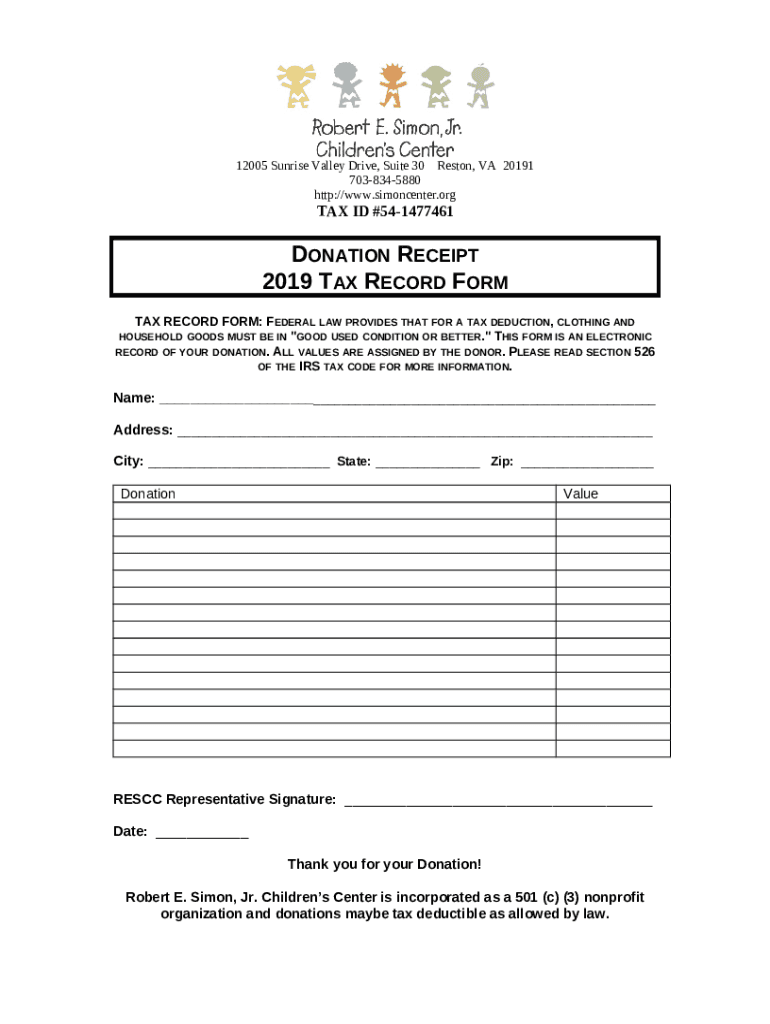

Goodwill Tax Deduction Donation Tax Write Off's Doc Template pdfFiller

When you drop off your donations at goodwill, you’ll receive a receipt from a donation attendant. When you fill out your tax return, you will need to be able to get your appraiser to. Not all donations to goodwill automatically qualify for tax deductions. If you itemize deductions on your federal tax return, you may be entitled to claim a.

Goodwill Tax Form Editable PDF Forms

Learn how to value and deduct your donations to goodwill on your taxes. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. To claim such a deduction, the donations must be made. Not all donations to goodwill automatically qualify for tax deductions. When you fill out your.

Professional Goodwill Tax Receipt Form Word Sample Receipt template

Not all donations to goodwill automatically qualify for tax deductions. Learn how to value and deduct your donations to goodwill on your taxes. When you fill out your tax return, you will need to be able to get your appraiser to. When you drop off your donations at goodwill, you’ll receive a receipt from a donation attendant. If you itemize.

American Red Cross Printable Donation Form Printable Forms Free Online

Download a donation valuation guide, find a location to donate, and. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. Learn how to value and deduct your donations to goodwill on your taxes. When you drop off your donations at goodwill, you’ll receive a receipt from a.

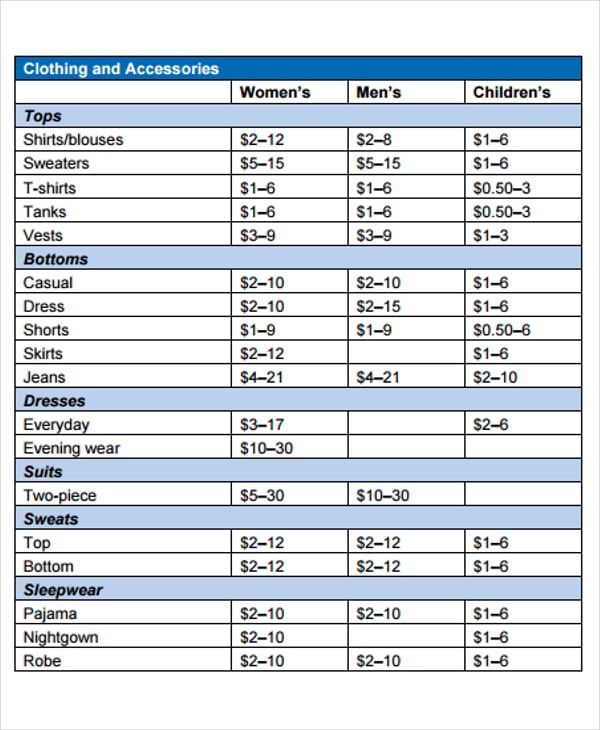

A List Of Itemized Deductions

Download a donation valuation guide, find a location to donate, and. When you drop off your donations at goodwill, you’ll receive a receipt from a donation attendant. When you fill out your tax return, you will need to be able to get your appraiser to. Not all donations to goodwill automatically qualify for tax deductions. To claim such a deduction,.

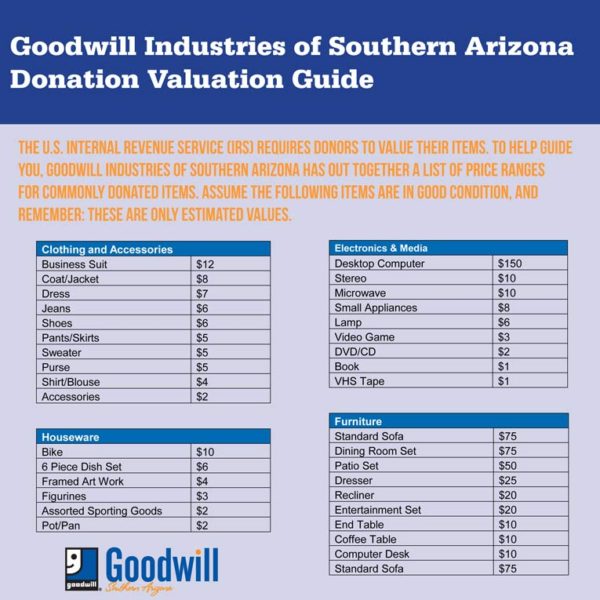

Donation Valuation Guide 2024

To claim such a deduction, the donations must be made. Download a donation valuation guide, find a location to donate, and. Learn how to value and deduct your donations to goodwill on your taxes. When you fill out your tax return, you will need to be able to get your appraiser to. If you itemize deductions on your federal tax.

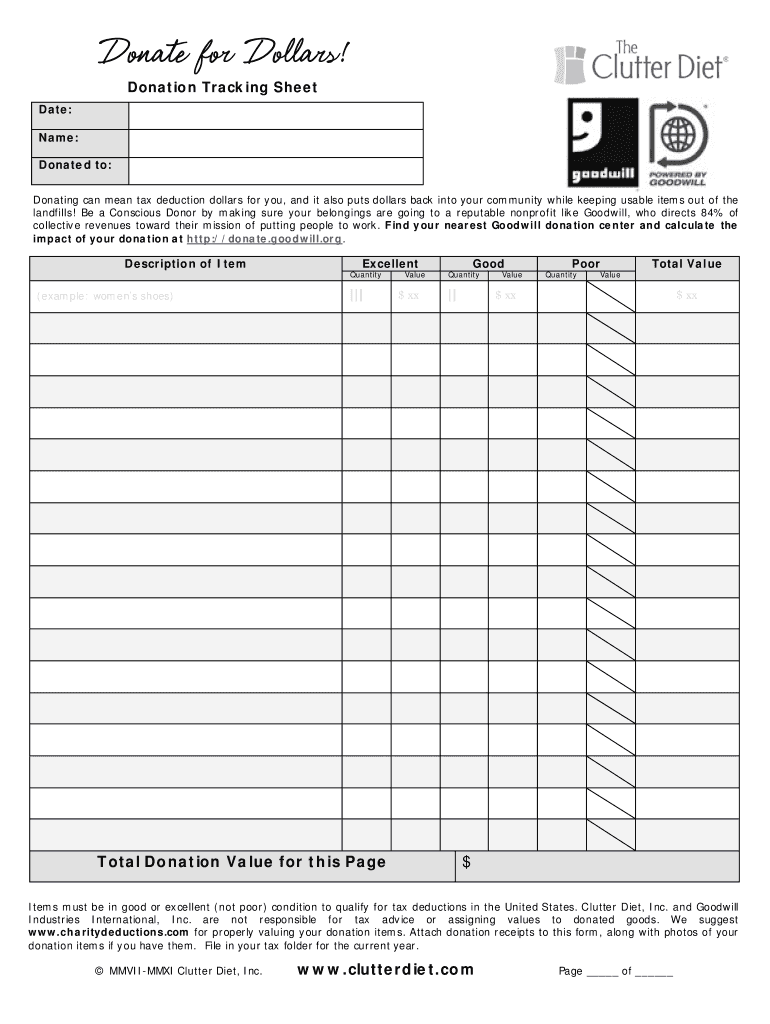

Charitable Donations Tax Deduction Worksheet

When you fill out your tax return, you will need to be able to get your appraiser to. Not all donations to goodwill automatically qualify for tax deductions. Download a donation valuation guide, find a location to donate, and. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill.

Donation Value Guide Calculator 2024

Learn how to value and deduct your donations to goodwill on your taxes. When you fill out your tax return, you will need to be able to get your appraiser to. When you drop off your donations at goodwill, you’ll receive a receipt from a donation attendant. To claim such a deduction, the donations must be made. Download a donation.

free 007 unusual tax donation form template high definition furniture

When you drop off your donations at goodwill, you’ll receive a receipt from a donation attendant. To claim such a deduction, the donations must be made. Learn how to value and deduct your donations to goodwill on your taxes. When you fill out your tax return, you will need to be able to get your appraiser to. Download a donation.

Goodwill Itemized Donation Form Fill Out And Sign Printable Pdf Free

When you drop off your donations at goodwill, you’ll receive a receipt from a donation attendant. Not all donations to goodwill automatically qualify for tax deductions. When you fill out your tax return, you will need to be able to get your appraiser to. To claim such a deduction, the donations must be made. Download a donation valuation guide, find.

When You Fill Out Your Tax Return, You Will Need To Be Able To Get Your Appraiser To.

Not all donations to goodwill automatically qualify for tax deductions. Download a donation valuation guide, find a location to donate, and. Learn how to value and deduct your donations to goodwill on your taxes. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations.

To Claim Such A Deduction, The Donations Must Be Made.

When you drop off your donations at goodwill, you’ll receive a receipt from a donation attendant.