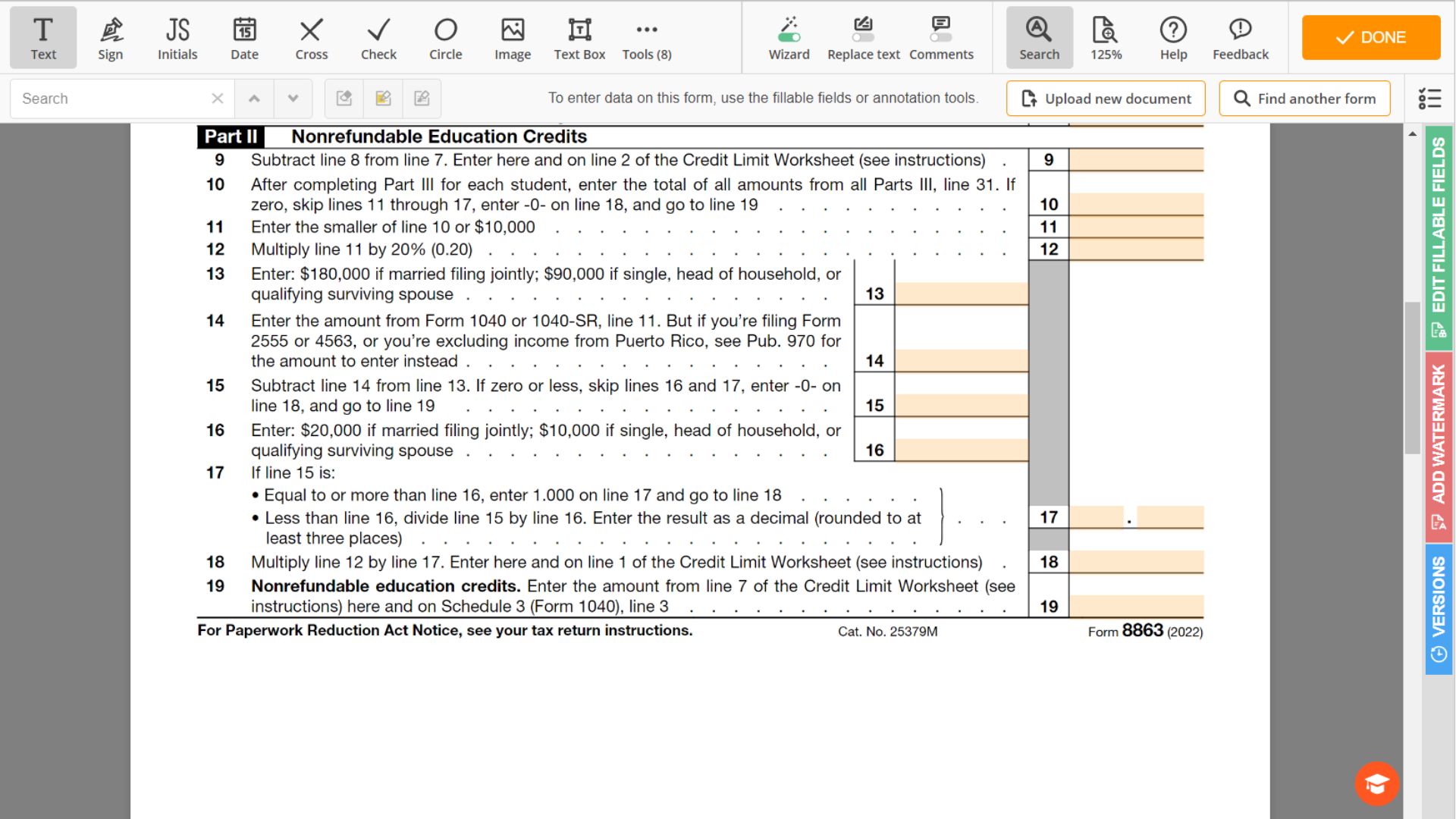

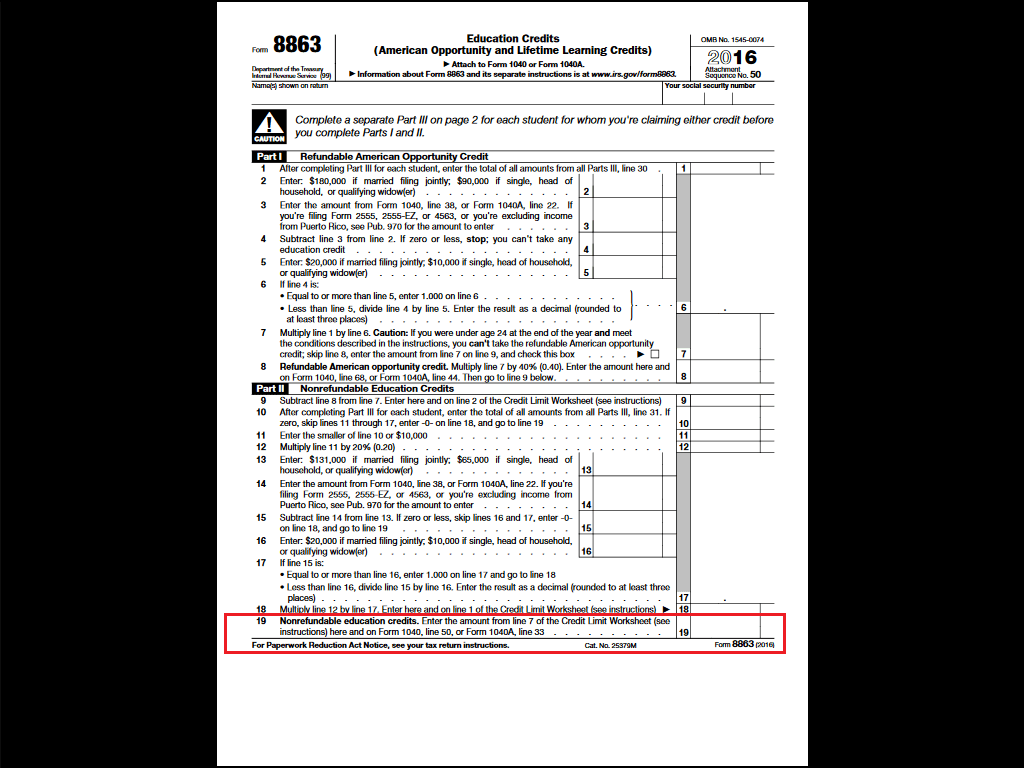

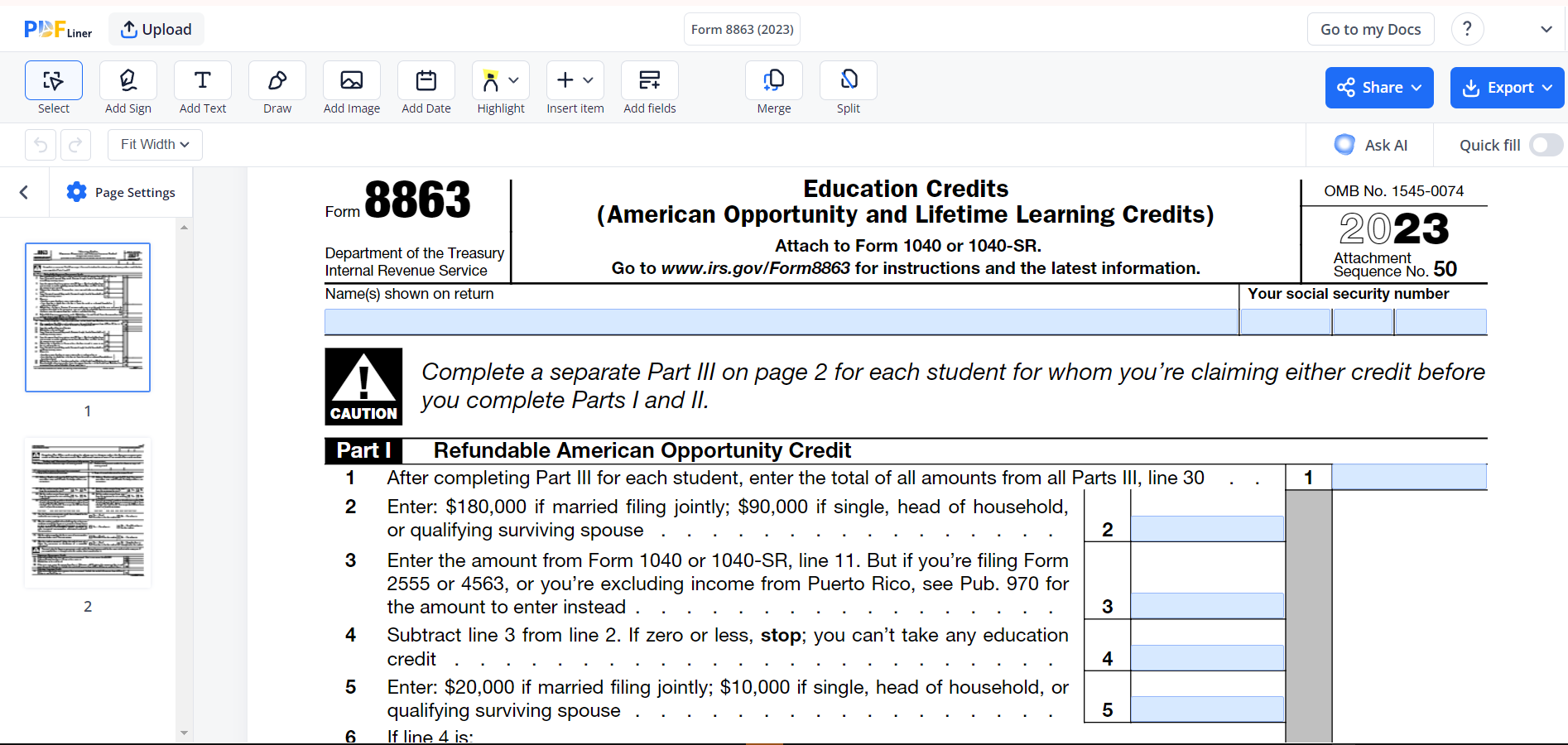

Form 8863 Line 19 - Add lines 1 and 2 3. Information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms. Complete the credit limit worksheet using the amount from line 18, on line 1 of the worksheet. The amount you get on line. Irs form 8863, education credits, is the tax form that a taxpayer may use to take a tax credit for qualified education expenses they. Enter the amount from form 8863, line 9 2. I'm trying to file online, but am stuck here on what. Complete a separate part iii on page 2 for each student for whom you’re claiming either credit before you complete parts i and ii.

Irs form 8863, education credits, is the tax form that a taxpayer may use to take a tax credit for qualified education expenses they. Add lines 1 and 2 3. Enter the amount from form 8863, line 9 2. Complete the credit limit worksheet using the amount from line 18, on line 1 of the worksheet. The amount you get on line. Information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms. Complete a separate part iii on page 2 for each student for whom you’re claiming either credit before you complete parts i and ii. I'm trying to file online, but am stuck here on what.

Complete a separate part iii on page 2 for each student for whom you’re claiming either credit before you complete parts i and ii. Complete the credit limit worksheet using the amount from line 18, on line 1 of the worksheet. Add lines 1 and 2 3. The amount you get on line. Irs form 8863, education credits, is the tax form that a taxpayer may use to take a tax credit for qualified education expenses they. Information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms. Enter the amount from form 8863, line 9 2. I'm trying to file online, but am stuck here on what.

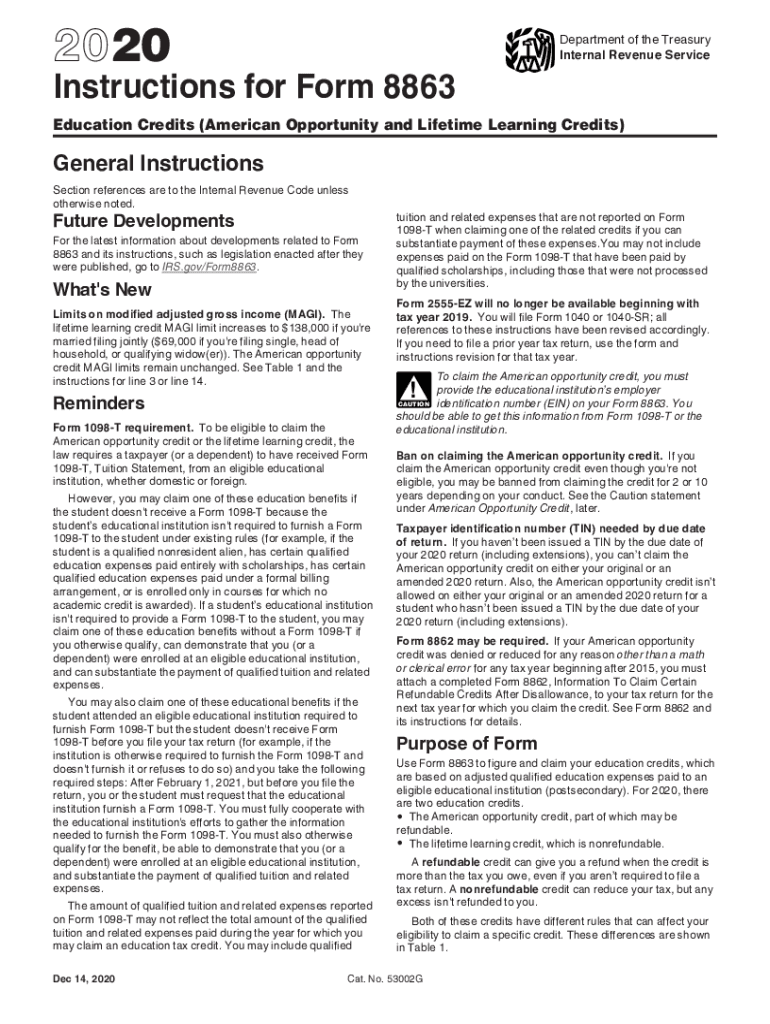

2020 Form IRS Instruction 8863 Fill Online, Printable, Fillable, Blank

Irs form 8863, education credits, is the tax form that a taxpayer may use to take a tax credit for qualified education expenses they. Enter the amount from form 8863, line 9 2. I'm trying to file online, but am stuck here on what. Add lines 1 and 2 3. Information about form 8863, education credits (american opportunity and lifetime.

IRS Form 8863 Instructions

The amount you get on line. Add lines 1 and 2 3. Enter the amount from form 8863, line 9 2. Complete a separate part iii on page 2 for each student for whom you’re claiming either credit before you complete parts i and ii. I'm trying to file online, but am stuck here on what.

Printable Form 8863 Printable Forms Free Online

Complete the credit limit worksheet using the amount from line 18, on line 1 of the worksheet. Add lines 1 and 2 3. I'm trying to file online, but am stuck here on what. The amount you get on line. Information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms.

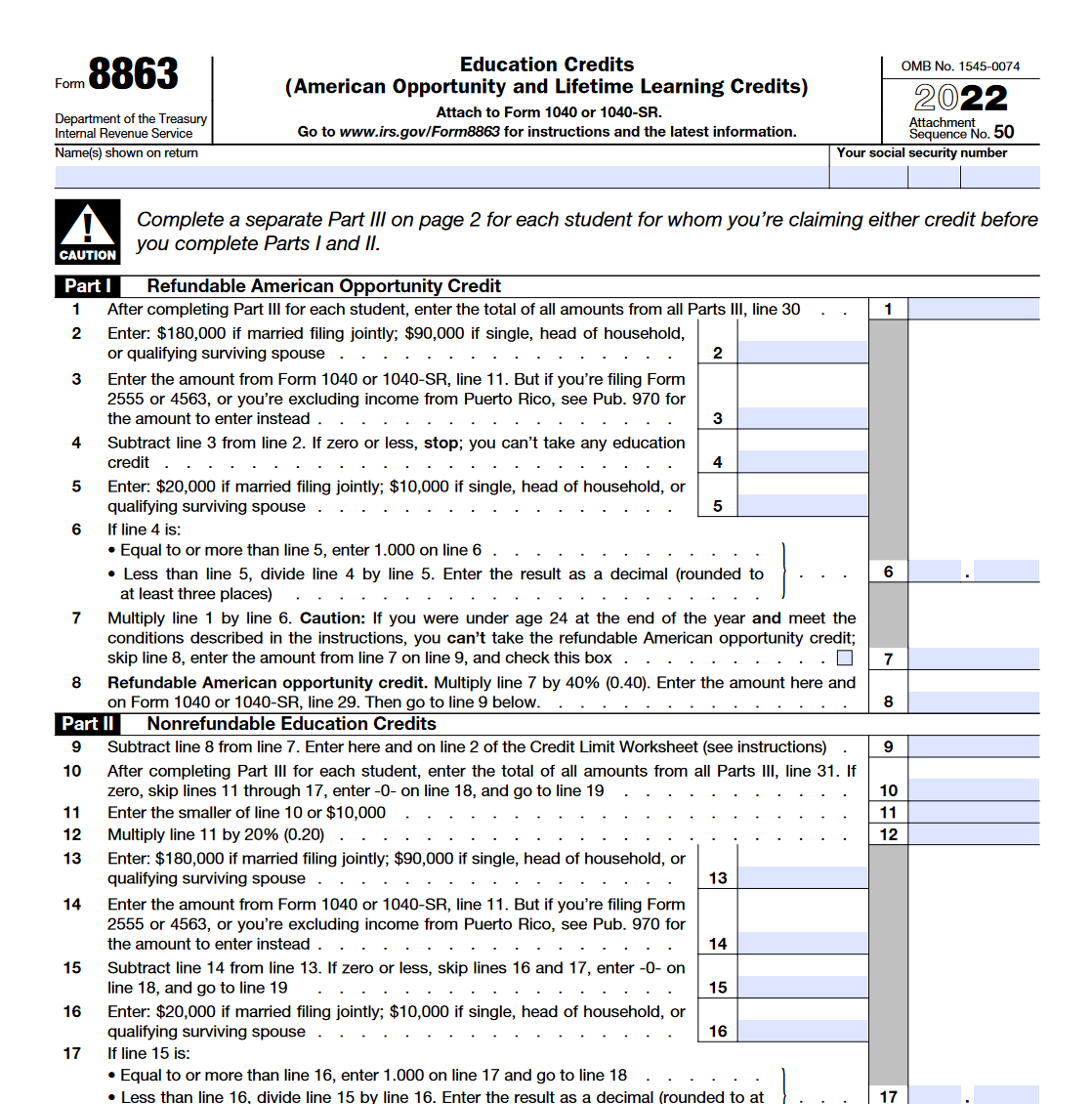

IRS Form 8863 📝 Get Federal Tax Form 8863 for 2022 Instructions

Add lines 1 and 2 3. I'm trying to file online, but am stuck here on what. The amount you get on line. Information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms. Irs form 8863, education credits, is the tax form that a taxpayer may use to take a tax credit for.

Form 8863 Fillable Pdf Printable Forms Free Online

Irs form 8863, education credits, is the tax form that a taxpayer may use to take a tax credit for qualified education expenses they. Add lines 1 and 2 3. Complete a separate part iii on page 2 for each student for whom you’re claiming either credit before you complete parts i and ii. I'm trying to file online, but.

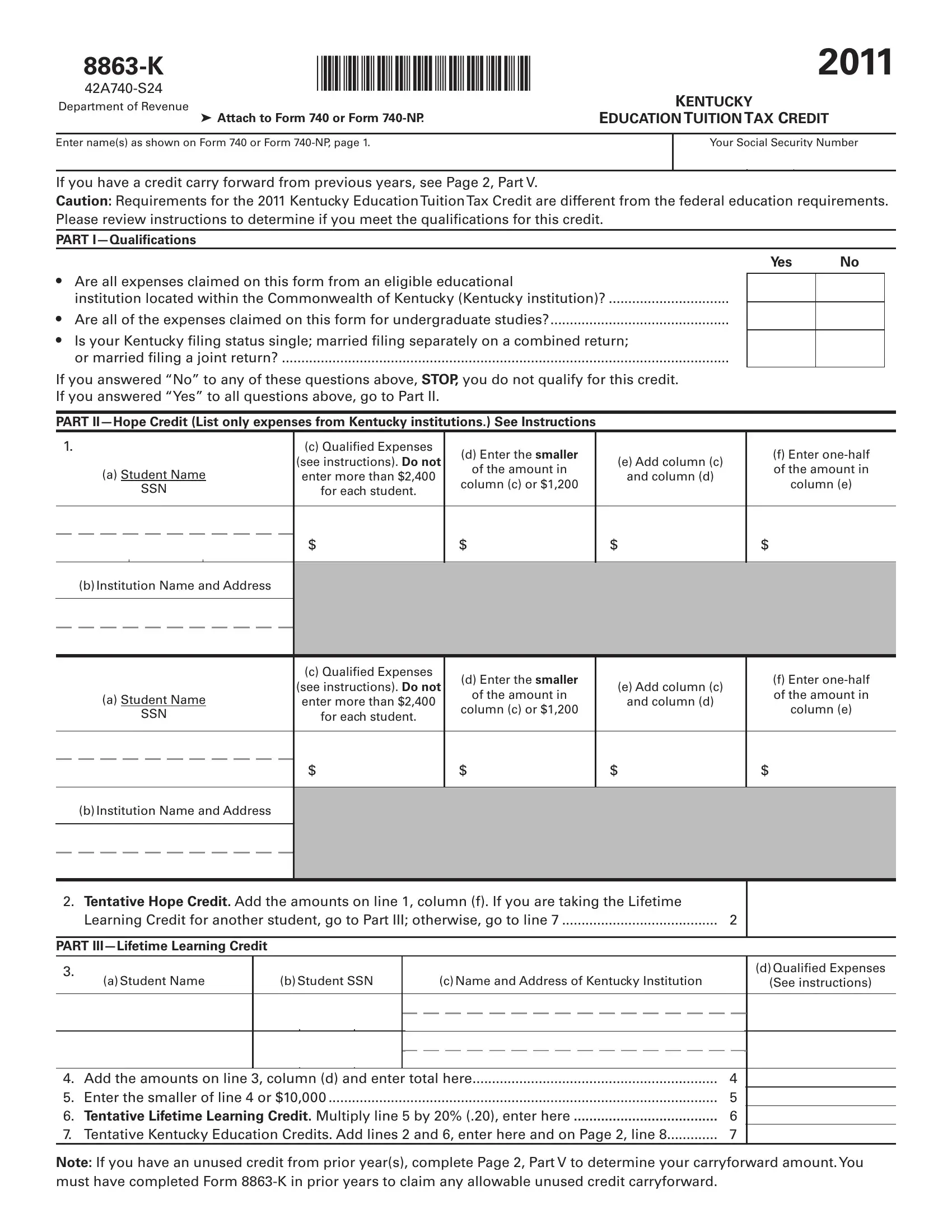

Form 8863 K ≡ Fill Out Printable PDF Forms Online

Complete the credit limit worksheet using the amount from line 18, on line 1 of the worksheet. Enter the amount from form 8863, line 9 2. I'm trying to file online, but am stuck here on what. Information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms. Complete a separate part iii on.

Printable Form 8863

Irs form 8863, education credits, is the tax form that a taxpayer may use to take a tax credit for qualified education expenses they. I'm trying to file online, but am stuck here on what. Complete the credit limit worksheet using the amount from line 18, on line 1 of the worksheet. Information about form 8863, education credits (american opportunity.

AOTC & LLC Two Higher Education Tax Benefits For US Taxpayers The

Complete a separate part iii on page 2 for each student for whom you’re claiming either credit before you complete parts i and ii. The amount you get on line. Add lines 1 and 2 3. Complete the credit limit worksheet using the amount from line 18, on line 1 of the worksheet. Enter the amount from form 8863, line.

Form 8863 YouTube

I'm trying to file online, but am stuck here on what. Complete a separate part iii on page 2 for each student for whom you’re claiming either credit before you complete parts i and ii. Complete the credit limit worksheet using the amount from line 18, on line 1 of the worksheet. Irs form 8863, education credits, is the tax.

Form 8863 Fillable and Printable blank PDFline

Add lines 1 and 2 3. Enter the amount from form 8863, line 9 2. Complete the credit limit worksheet using the amount from line 18, on line 1 of the worksheet. I'm trying to file online, but am stuck here on what. Complete a separate part iii on page 2 for each student for whom you’re claiming either credit.

Complete The Credit Limit Worksheet Using The Amount From Line 18, On Line 1 Of The Worksheet.

Add lines 1 and 2 3. Complete a separate part iii on page 2 for each student for whom you’re claiming either credit before you complete parts i and ii. I'm trying to file online, but am stuck here on what. Enter the amount from form 8863, line 9 2.

The Amount You Get On Line.

Information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms. Irs form 8863, education credits, is the tax form that a taxpayer may use to take a tax credit for qualified education expenses they.