Form 8832 Deadline - The updated mailing addresses are shown below. There’s no “deadline” to file form 8832 — you can file it either right when you start your business or at any point during your business’s lifetime. However, the filing date is. Information about form 8832, entity classification election, including. There is also a deadline for filing, which is 75 days prior to the date that the election is filed, or 12 months after the date the election is filed. Taxpayers in the states below send your form to. Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. The address for mailing form 8832 has changed since the form was last published.

Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. There’s no “deadline” to file form 8832 — you can file it either right when you start your business or at any point during your business’s lifetime. The updated mailing addresses are shown below. There is also a deadline for filing, which is 75 days prior to the date that the election is filed, or 12 months after the date the election is filed. The address for mailing form 8832 has changed since the form was last published. Information about form 8832, entity classification election, including. However, the filing date is. Taxpayers in the states below send your form to.

Taxpayers in the states below send your form to. However, the filing date is. There is also a deadline for filing, which is 75 days prior to the date that the election is filed, or 12 months after the date the election is filed. The updated mailing addresses are shown below. Information about form 8832, entity classification election, including. There’s no “deadline” to file form 8832 — you can file it either right when you start your business or at any point during your business’s lifetime. The address for mailing form 8832 has changed since the form was last published. Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes.

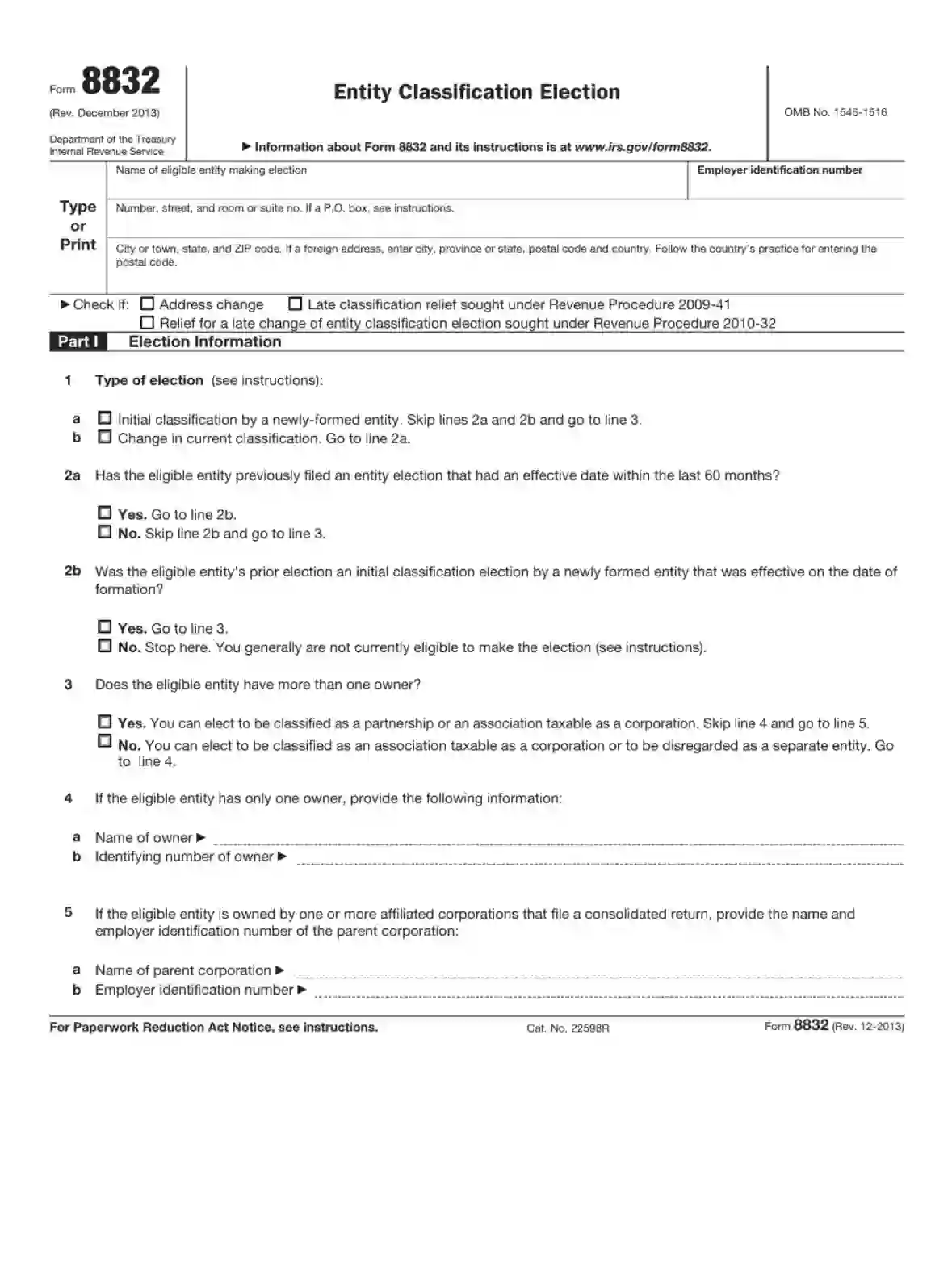

Form 8832 Fillable Pdf Printable Forms Free Online

There’s no “deadline” to file form 8832 — you can file it either right when you start your business or at any point during your business’s lifetime. However, the filing date is. There is also a deadline for filing, which is 75 days prior to the date that the election is filed, or 12 months after the date the election.

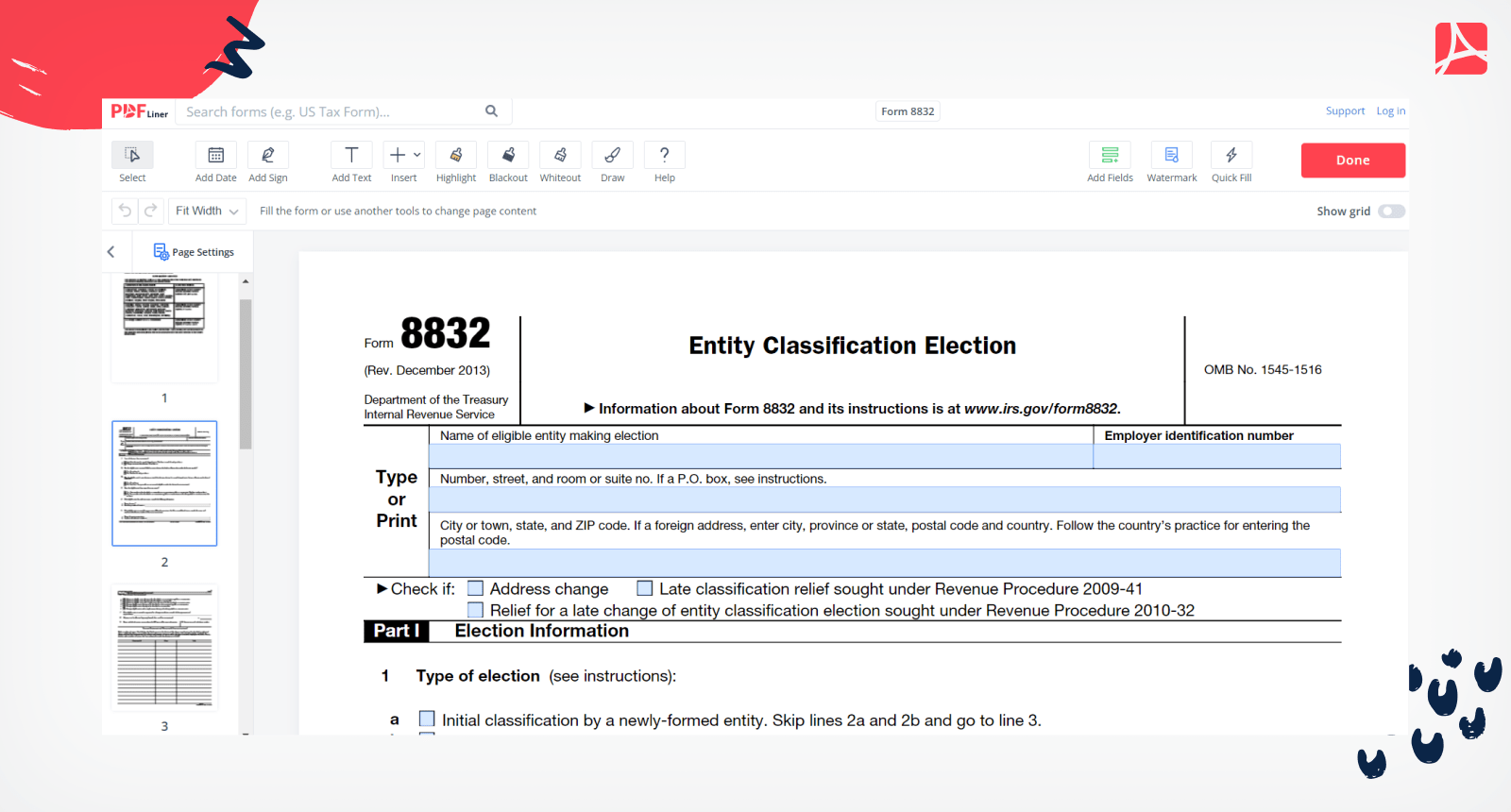

Form 8832 Fillable and Printable blank PDFline

Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. Information about form 8832, entity classification election, including. Taxpayers in the states below send your form to. The updated mailing addresses are shown below. However, the filing date is.

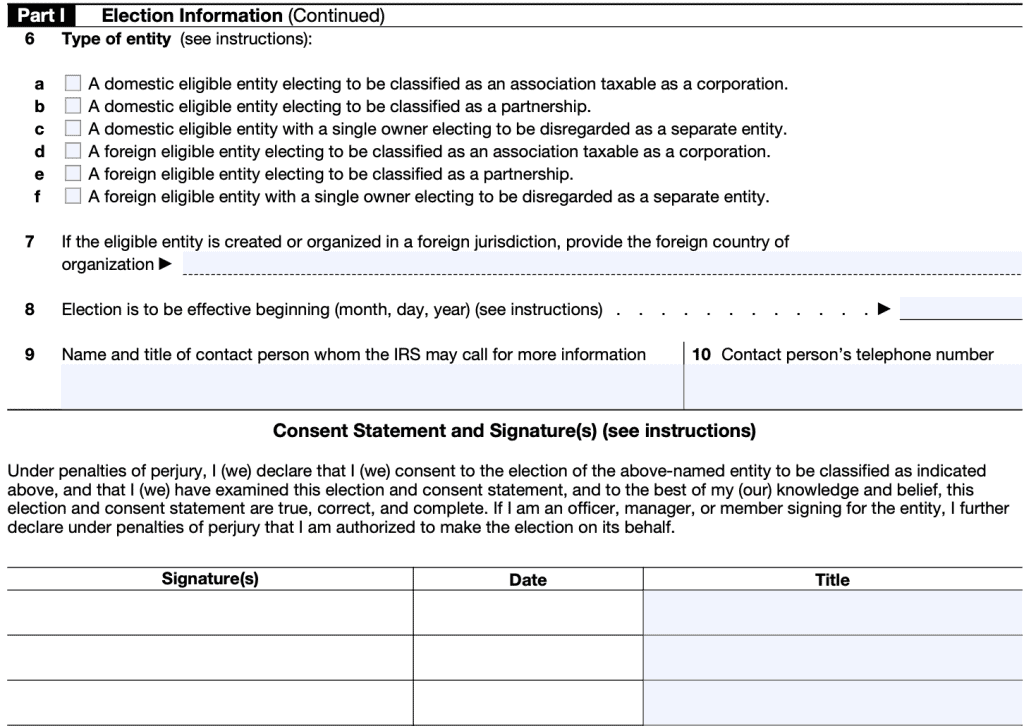

What is Form 8832? An Essential Guide for Small Business Owners The

Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. The address for mailing form 8832 has changed since the form was last published. However, the filing date is. There’s no “deadline” to file form 8832 — you can file it either right when you start your business or at any point during.

Form 8832 Instruction 2024 2025

Information about form 8832, entity classification election, including. There’s no “deadline” to file form 8832 — you can file it either right when you start your business or at any point during your business’s lifetime. However, the filing date is. There is also a deadline for filing, which is 75 days prior to the date that the election is filed,.

What Is Form 8832 Entity Classification Election Design Talk

However, the filing date is. There is also a deadline for filing, which is 75 days prior to the date that the election is filed, or 12 months after the date the election is filed. Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. Information about form 8832, entity classification election, including..

IRS Form 8832 Instructions Entity Classification Election

Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. However, the filing date is. There’s no “deadline” to file form 8832 — you can file it either right when you start your business or at any point during your business’s lifetime. Taxpayers in the states below send your form to. The address.

IRS Form 8832 ≡ Fill Out Printable PDF Forms Online

The updated mailing addresses are shown below. Taxpayers in the states below send your form to. There’s no “deadline” to file form 8832 — you can file it either right when you start your business or at any point during your business’s lifetime. The address for mailing form 8832 has changed since the form was last published. Form 8832 is.

IRS Form 8832 Instructions Entity Classification Election

The updated mailing addresses are shown below. The address for mailing form 8832 has changed since the form was last published. Taxpayers in the states below send your form to. There is also a deadline for filing, which is 75 days prior to the date that the election is filed, or 12 months after the date the election is filed..

Form 8832 All About It and How to File It?

Taxpayers in the states below send your form to. Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. There’s no “deadline” to file form 8832 — you can file it either right when you start your business or at any point during your business’s lifetime. Information about form 8832, entity classification election,.

What is Form 8832?

Taxpayers in the states below send your form to. The updated mailing addresses are shown below. Information about form 8832, entity classification election, including. However, the filing date is. There’s no “deadline” to file form 8832 — you can file it either right when you start your business or at any point during your business’s lifetime.

The Address For Mailing Form 8832 Has Changed Since The Form Was Last Published.

Information about form 8832, entity classification election, including. Taxpayers in the states below send your form to. However, the filing date is. The updated mailing addresses are shown below.

There Is Also A Deadline For Filing, Which Is 75 Days Prior To The Date That The Election Is Filed, Or 12 Months After The Date The Election Is Filed.

There’s no “deadline” to file form 8832 — you can file it either right when you start your business or at any point during your business’s lifetime. Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes.