Form 8801 Instructions 2022 - Use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in. Instructions for form 8801, credit for prior year minimum tax. Use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in. This document offers comprehensive guidance on completing form 8801 for the year 2023, including eligibility, form. Form 8801 is used to calculate the minimum tax credit, if any, for. As discussed below, a taxpayer who was subject to the amt in a previous year may be entitled to a credit against his or her regular tax called the.

This document offers comprehensive guidance on completing form 8801 for the year 2023, including eligibility, form. As discussed below, a taxpayer who was subject to the amt in a previous year may be entitled to a credit against his or her regular tax called the. Form 8801 is used to calculate the minimum tax credit, if any, for. Use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in. Instructions for form 8801, credit for prior year minimum tax. Use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in.

This document offers comprehensive guidance on completing form 8801 for the year 2023, including eligibility, form. Form 8801 is used to calculate the minimum tax credit, if any, for. Use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in. Instructions for form 8801, credit for prior year minimum tax. Use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in. As discussed below, a taxpayer who was subject to the amt in a previous year may be entitled to a credit against his or her regular tax called the.

Irs 8801 Printable Form Printable Forms Free Online

This document offers comprehensive guidance on completing form 8801 for the year 2023, including eligibility, form. Use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in. Form 8801 is used to calculate the minimum tax credit, if any, for. Instructions for form 8801,.

The Amazing Disappearing AMT CreditMichael Gray CPA, Stock Option Advisors

As discussed below, a taxpayer who was subject to the amt in a previous year may be entitled to a credit against his or her regular tax called the. Use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in. Use form 8801 if.

Form 8801 Blank PDF Form to Download PDFLiner

Use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in. Instructions for form 8801, credit for prior year minimum tax. As discussed below, a taxpayer who was subject to the amt in a previous year may be entitled to a credit against his.

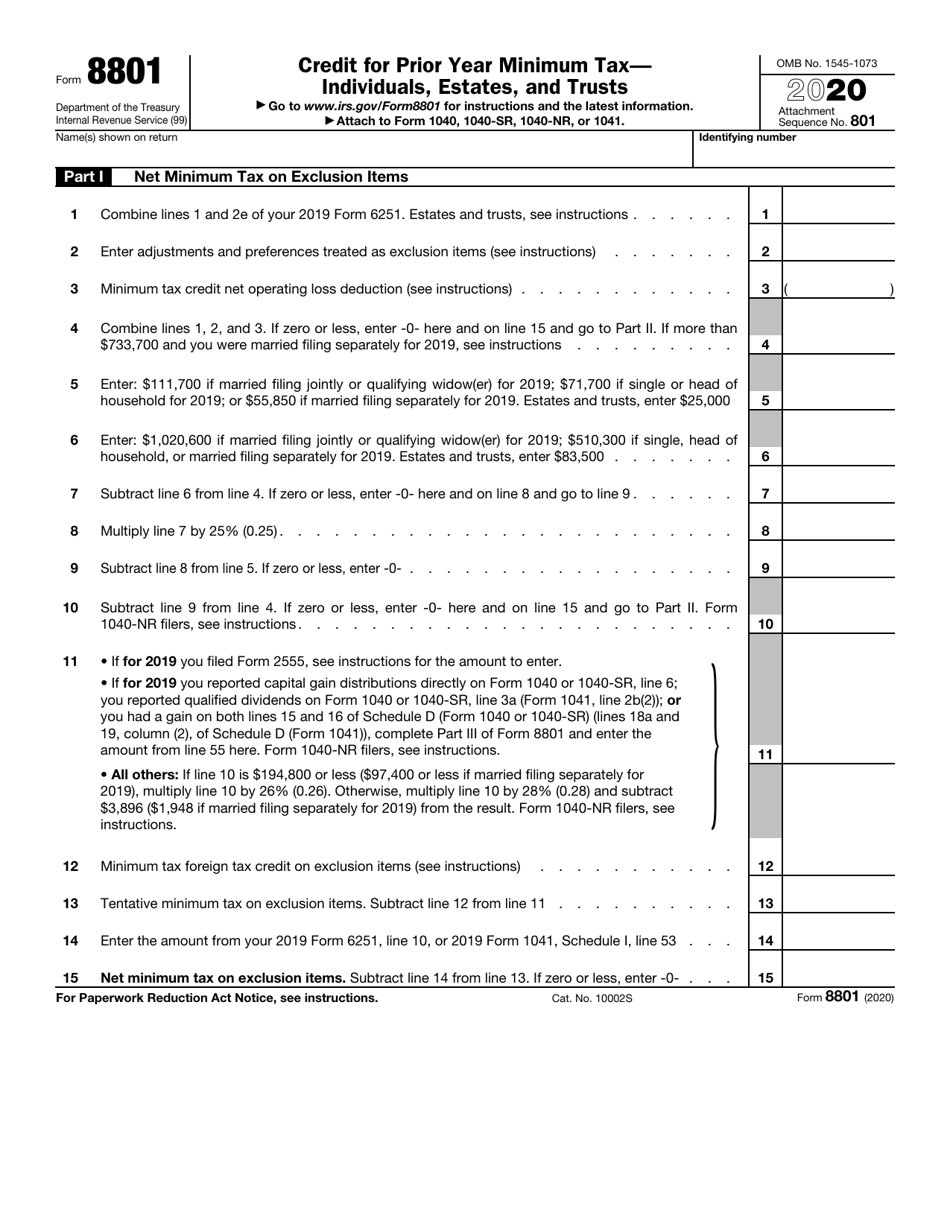

Form 8801 Credit for Prior Year Minimum Tax Individuals, Estates

As discussed below, a taxpayer who was subject to the amt in a previous year may be entitled to a credit against his or her regular tax called the. This document offers comprehensive guidance on completing form 8801 for the year 2023, including eligibility, form. Use form 8801 if you are an individual, estate, or trust to figure the minimum.

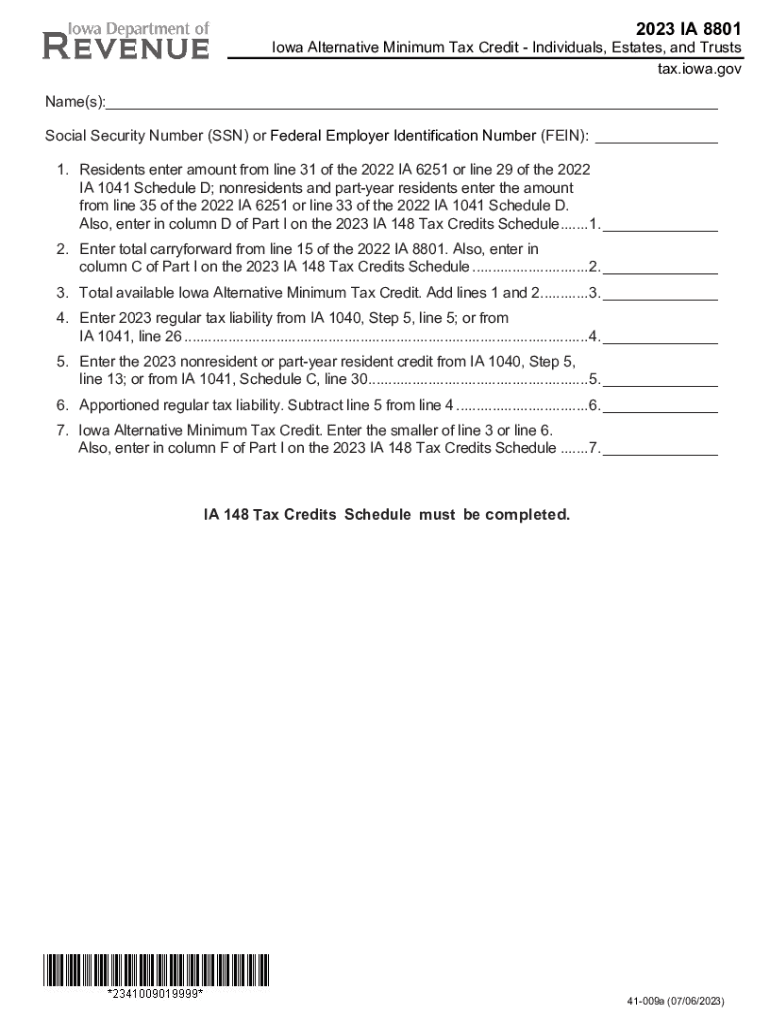

Irs 8801 Printable Form Printable Forms Free Online

This document offers comprehensive guidance on completing form 8801 for the year 2023, including eligibility, form. Use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in. Instructions for form 8801, credit for prior year minimum tax. As discussed below, a taxpayer who was.

IRS Form 8801 2020 Fill Out, Sign Online and Download Fillable PDF

Form 8801 is used to calculate the minimum tax credit, if any, for. Use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in. This document offers comprehensive guidance on completing form 8801 for the year 2023, including eligibility, form. As discussed below, a.

2021 Form IRS 8801 Instructions Fill Online, Printable, Fillable, Blank

Instructions for form 8801, credit for prior year minimum tax. Form 8801 is used to calculate the minimum tax credit, if any, for. Use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in. This document offers comprehensive guidance on completing form 8801 for.

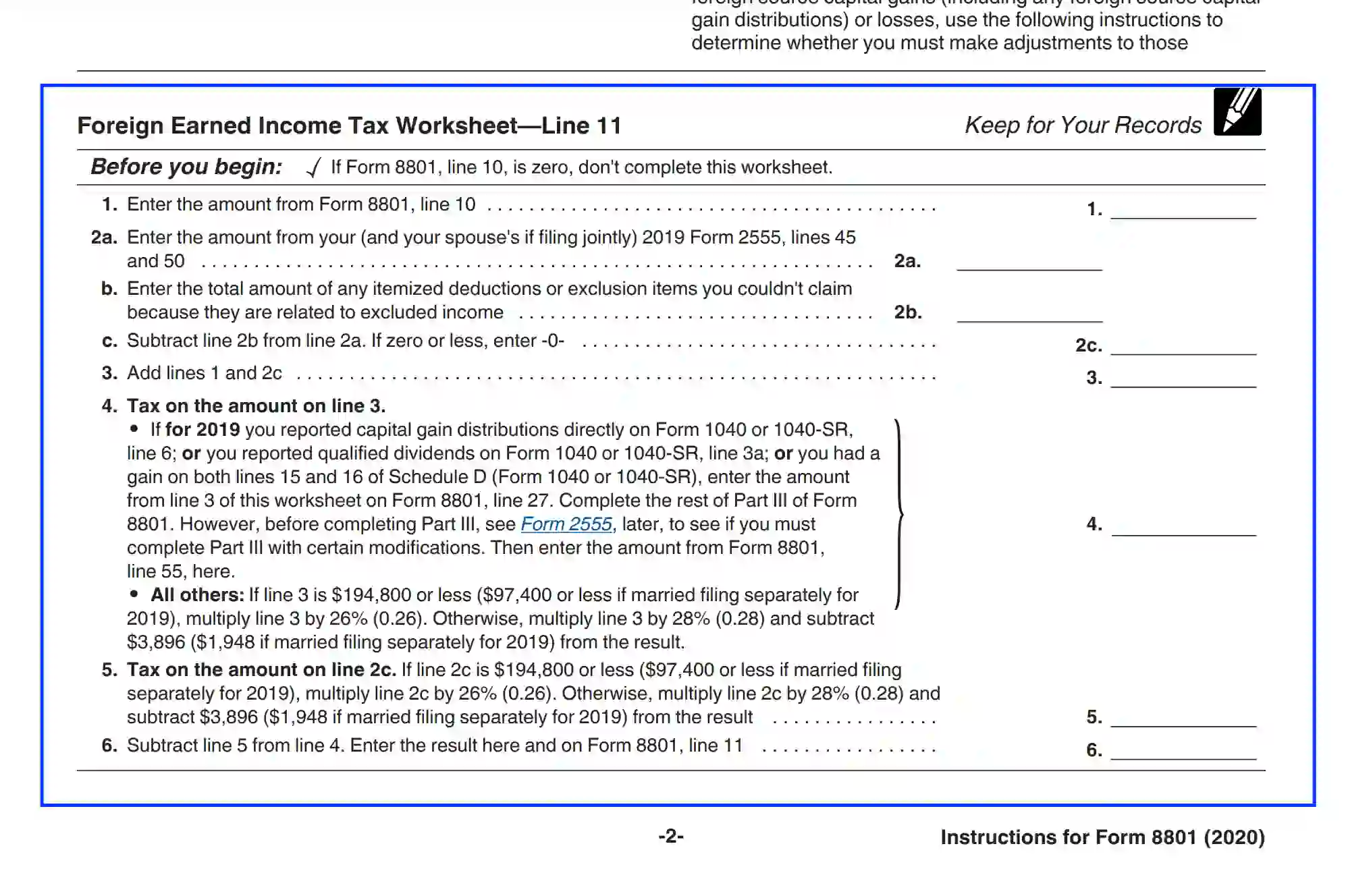

IRS Form 8801 Instructions Credit for Prior Year Minimum Tax

Instructions for form 8801, credit for prior year minimum tax. Use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in. As discussed below, a taxpayer who was subject to the amt in a previous year may be entitled to a credit against his.

IRS Form 8801 Instructions Credit for Prior Year Minimum Tax

Form 8801 is used to calculate the minimum tax credit, if any, for. This document offers comprehensive guidance on completing form 8801 for the year 2023, including eligibility, form. As discussed below, a taxpayer who was subject to the amt in a previous year may be entitled to a credit against his or her regular tax called the. Use form.

Fillable Online Instructions for Form 8801 (2023)Internal Revenue

Instructions for form 8801, credit for prior year minimum tax. Form 8801 is used to calculate the minimum tax credit, if any, for. This document offers comprehensive guidance on completing form 8801 for the year 2023, including eligibility, form. Use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative.

Instructions For Form 8801, Credit For Prior Year Minimum Tax.

As discussed below, a taxpayer who was subject to the amt in a previous year may be entitled to a credit against his or her regular tax called the. This document offers comprehensive guidance on completing form 8801 for the year 2023, including eligibility, form. Use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in. Use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in.