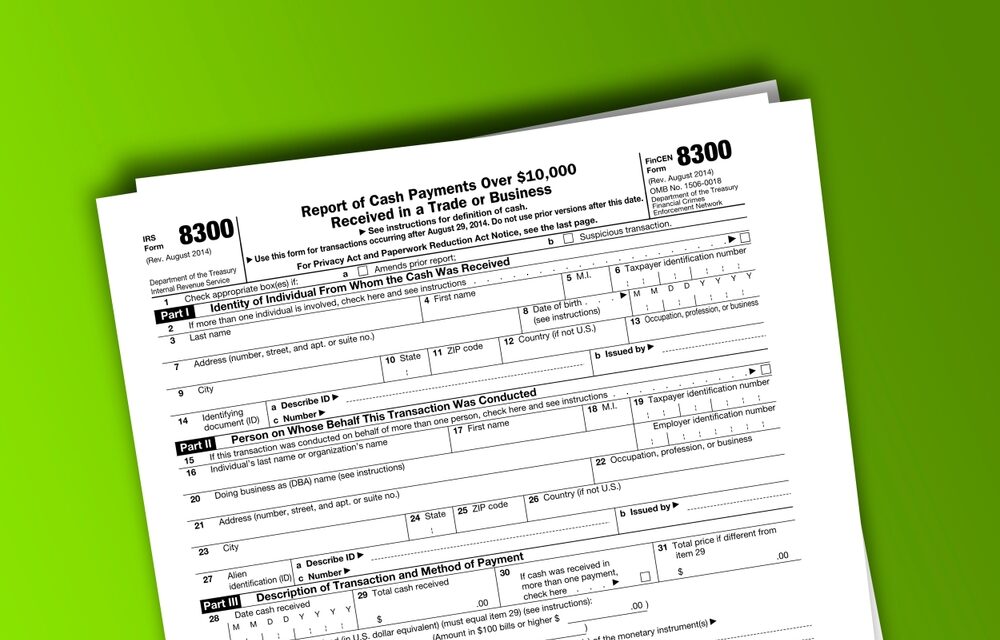

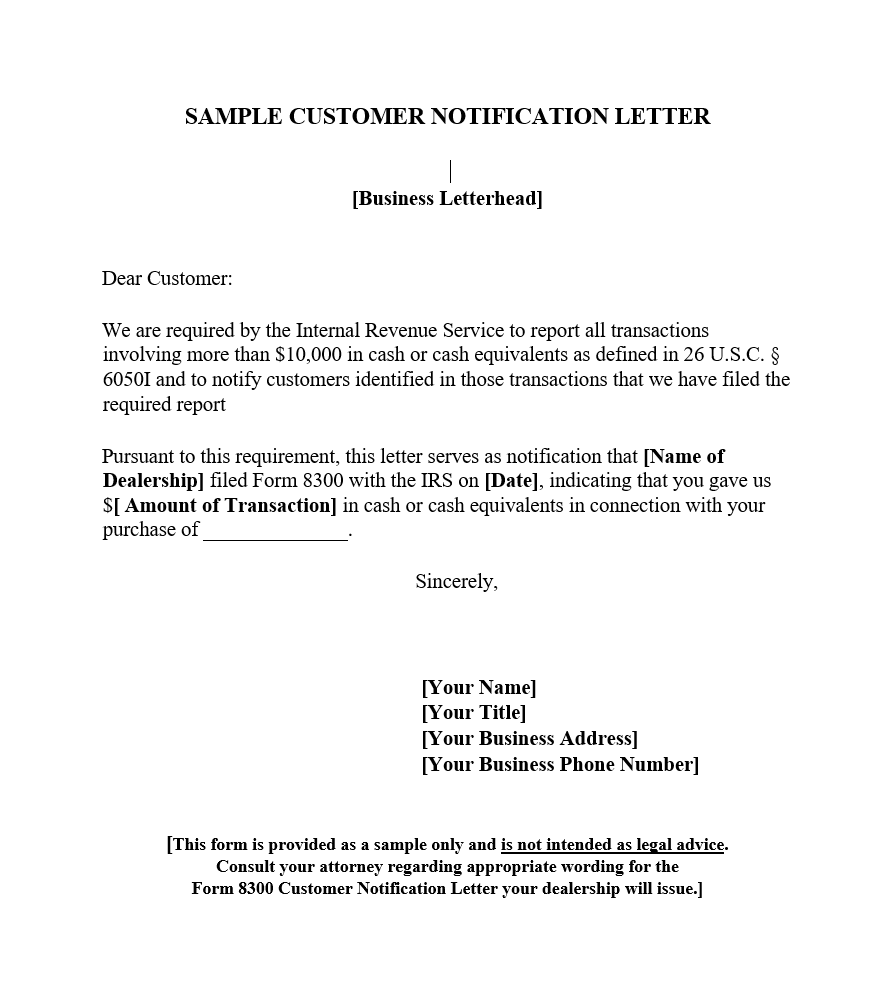

Form 8300 Letter To Customer - Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date] , indicating that you. Under the irs rules, a business must notify its customers, in writing, by january 31 of the subsequent calendar year that the. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on.

Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date] , indicating that you. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on. Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. Under the irs rules, a business must notify its customers, in writing, by january 31 of the subsequent calendar year that the.

Under the irs rules, a business must notify its customers, in writing, by january 31 of the subsequent calendar year that the. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date] , indicating that you. Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on.

Form 8300 Letter To Customer Sample Letter Hub

Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. Under the irs rules, a business must notify its customers, in writing, by january 31 of the subsequent calendar year that the. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form.

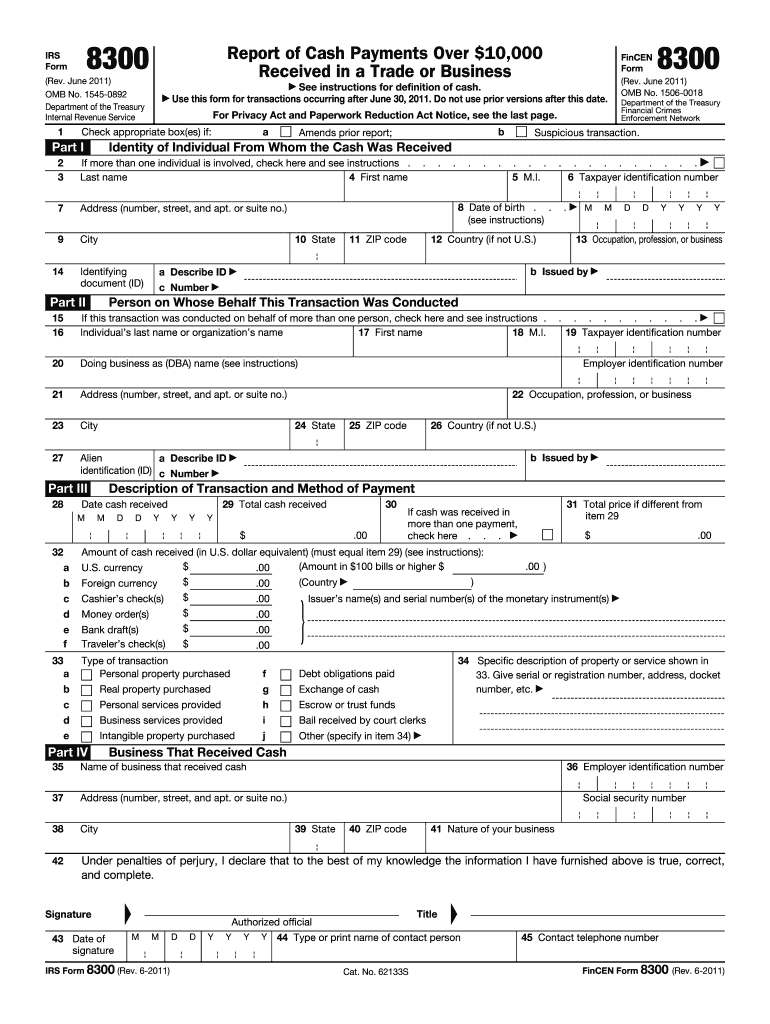

Form 8300 Reporting Cash Payments over 10,000 HM&M

Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with.

What Is Form 8300 and How Do You File It? Hourly, Inc.

Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on. Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. Under the irs rules, a business must notify its customers, in writing, by january 31 of the.

Customer Notification Letter form 8300 Forms Docs 2023

Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date] , indicating that you. Under the irs rules, a business must notify its customers, in writing,.

Fillable Form 8300 Report Of Cash Payments Over 10,000 Received In A

Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on. Under the irs rules, a business must notify its customers, in writing, by january 31 of the.

8300 form pdf Fill out & sign online DocHub

Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on. Under the irs rules, a business must notify its customers, in writing, by january 31 of the subsequent calendar year that the. Each person engaged in a trade or business who, in the course of that trade or business, receives.

Form 8300 Letter to Customer Letter Draft

Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on. Under the irs rules, a business must notify its customers, in writing, by january 31 of the subsequent calendar year that the. Each person engaged in a trade or business who, in the course of that trade or business, receives.

What Is Form 8300 and How Do You File It? Hourly, Inc.

Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date] , indicating that you. Under the irs rules, a business must notify its customers, in writing, by january 31 of the subsequent calendar year that the. Pursuant to this requirement, this letter serves as notification that [name of dealership].

What Is Form 8300 and How Do You File It? Hourly, Inc.

Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date] , indicating that you. Under the irs rules, a business must notify its customers, in writing, by january 31 of the subsequent calendar year that the. Pursuant to this requirement, this letter serves as notification that [name of dealership].

Form 8300 Letter to Customer Letter Draft

Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. Under the irs rules, a business must notify its customers, in writing, by january 31 of the subsequent calendar year that the. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form.

Pursuant To This Requirement, This Letter Serves As Notification That [Name Of Dealership] Filed Form 8300 With The Irs On [Date] , Indicating That You.

Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. Under the irs rules, a business must notify its customers, in writing, by january 31 of the subsequent calendar year that the. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on.