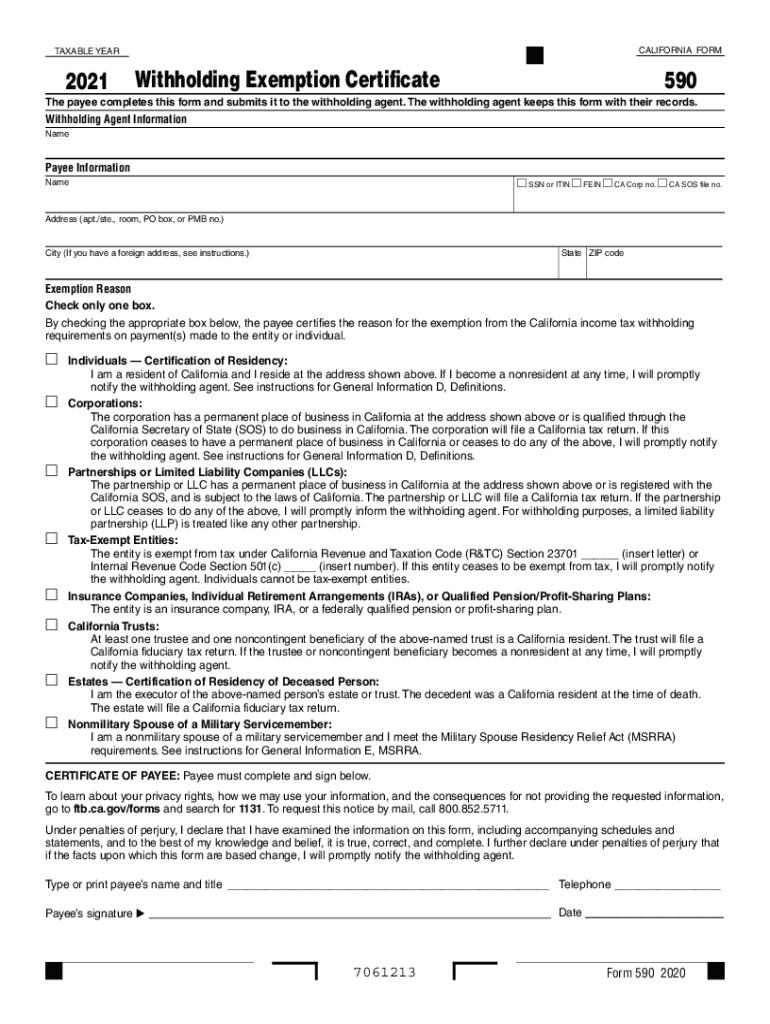

Form 590 2023 - Use form 590 to certify an exemption from nonresident withholding. Complete and present form 590 to the withholding agent. Use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Claim for family tax relief credit. Download or print the 2023 california form 590 (withholding exemption certificate) for free from the california franchise tax board. For 2023, if you are covered by a retirement plan at work, your deduction for contributions to a traditional ira is reduced (phased out) if your.

Download or print the 2023 california form 590 (withholding exemption certificate) for free from the california franchise tax board. Use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Use form 590 to certify an exemption from nonresident withholding. For 2023, if you are covered by a retirement plan at work, your deduction for contributions to a traditional ira is reduced (phased out) if your. Claim for family tax relief credit. Complete and present form 590 to the withholding agent.

Use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. For 2023, if you are covered by a retirement plan at work, your deduction for contributions to a traditional ira is reduced (phased out) if your. Use form 590 to certify an exemption from nonresident withholding. Download or print the 2023 california form 590 (withholding exemption certificate) for free from the california franchise tax board. Claim for family tax relief credit. Complete and present form 590 to the withholding agent.

Tax Right For 2024 Software Waly Amalita

For 2023, if you are covered by a retirement plan at work, your deduction for contributions to a traditional ira is reduced (phased out) if your. Use form 590 to certify an exemption from nonresident withholding. Use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Complete and present form 590 to the withholding agent. Download or.

590 Form 2023 Pdf Printable Forms Free Online

Complete and present form 590 to the withholding agent. For 2023, if you are covered by a retirement plan at work, your deduction for contributions to a traditional ira is reduced (phased out) if your. Use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Download or print the 2023 california form 590 (withholding exemption certificate) for.

Rmd Worksheets

Use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Complete and present form 590 to the withholding agent. For 2023, if you are covered by a retirement plan at work, your deduction for contributions to a traditional ira is reduced (phased out) if your. Download or print the 2023 california form 590 (withholding exemption certificate) for.

2023 Form 590 Printable Forms Free Online

Complete and present form 590 to the withholding agent. For 2023, if you are covered by a retirement plan at work, your deduction for contributions to a traditional ira is reduced (phased out) if your. Use form 590 to certify an exemption from nonresident withholding. Claim for family tax relief credit. Use form 590, withholding exemption certificate, to certify an.

Publication 590A (2023), Contributions to Individual Retirement

For 2023, if you are covered by a retirement plan at work, your deduction for contributions to a traditional ira is reduced (phased out) if your. Use form 590 to certify an exemption from nonresident withholding. Download or print the 2023 california form 590 (withholding exemption certificate) for free from the california franchise tax board. Use form 590, withholding exemption.

CA FTB 590P 20202021 Fill out Tax Template Online US Legal Forms

Use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Download or print the 2023 california form 590 (withholding exemption certificate) for free from the california franchise tax board. Claim for family tax relief credit. For 2023, if you are covered by a retirement plan at work, your deduction for contributions to a traditional ira is reduced.

Publication 590B (2023), Distributions from Individual Retirement

Use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Complete and present form 590 to the withholding agent. Use form 590 to certify an exemption from nonresident withholding. Download or print the 2023 california form 590 (withholding exemption certificate) for free from the california franchise tax board. Claim for family tax relief credit.

Ca 590 form 2023 Fill out & sign online DocHub

Use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. For 2023, if you are covered by a retirement plan at work, your deduction for contributions to a traditional ira is reduced (phased out) if your. Download or print the 2023 california form 590 (withholding exemption certificate) for free from the california franchise tax board. Use form.

Qualified Business Deduction Worksheets

Complete and present form 590 to the withholding agent. Claim for family tax relief credit. For 2023, if you are covered by a retirement plan at work, your deduction for contributions to a traditional ira is reduced (phased out) if your. Use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Use form 590 to certify an.

Figuring the Taxable Part of Your IRA Distribution (IRS Pub. 590B

Complete and present form 590 to the withholding agent. Download or print the 2023 california form 590 (withholding exemption certificate) for free from the california franchise tax board. Use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Claim for family tax relief credit. Use form 590 to certify an exemption from nonresident withholding.

For 2023, If You Are Covered By A Retirement Plan At Work, Your Deduction For Contributions To A Traditional Ira Is Reduced (Phased Out) If Your.

Download or print the 2023 california form 590 (withholding exemption certificate) for free from the california franchise tax board. Claim for family tax relief credit. Use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Complete and present form 590 to the withholding agent.