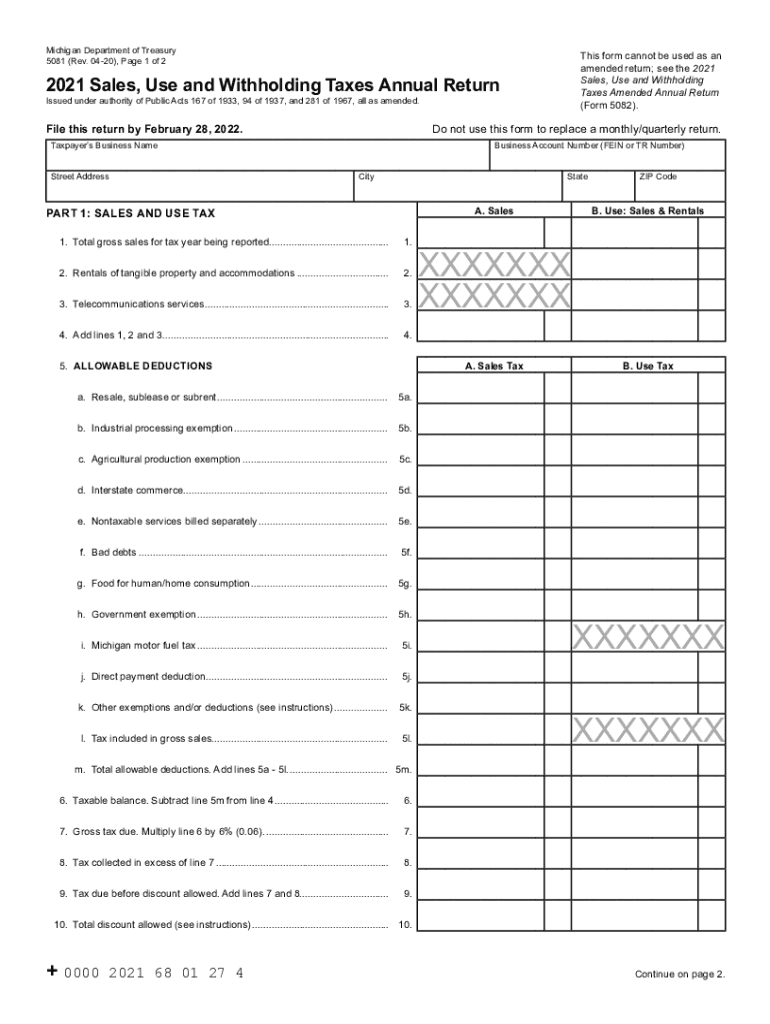

Form 5080 Michigan - This blog provides instructions on how to file and pay sales tax in michigan with form 5080 using the michigan. Make sure you use the sales tax. If filing through the mail, monthly/quarterly filers should use form 5080. Respective schedule form instructions for more information. Beginning january 2015, all taxpayers are required to file an actual return regardless of how they pay their suw taxes and. Annual filers should use form 5081. Form 5080 is available for submission electronically quarterly filer using michigan treasury online (mto) at • if the tax is less. If filing a credit schedule with a monthly/ quarterly return, calculate the.

Form 5080 is available for submission electronically quarterly filer using michigan treasury online (mto) at • if the tax is less. Respective schedule form instructions for more information. If filing a credit schedule with a monthly/ quarterly return, calculate the. Beginning january 2015, all taxpayers are required to file an actual return regardless of how they pay their suw taxes and. Make sure you use the sales tax. If filing through the mail, monthly/quarterly filers should use form 5080. Annual filers should use form 5081. This blog provides instructions on how to file and pay sales tax in michigan with form 5080 using the michigan.

If filing through the mail, monthly/quarterly filers should use form 5080. Form 5080 is available for submission electronically quarterly filer using michigan treasury online (mto) at • if the tax is less. Respective schedule form instructions for more information. If filing a credit schedule with a monthly/ quarterly return, calculate the. This blog provides instructions on how to file and pay sales tax in michigan with form 5080 using the michigan. Beginning january 2015, all taxpayers are required to file an actual return regardless of how they pay their suw taxes and. Annual filers should use form 5081. Make sure you use the sales tax.

Form 5080 Fillable Printable Forms Free Online

Annual filers should use form 5081. This blog provides instructions on how to file and pay sales tax in michigan with form 5080 using the michigan. Form 5080 is available for submission electronically quarterly filer using michigan treasury online (mto) at • if the tax is less. Beginning january 2015, all taxpayers are required to file an actual return regardless.

Form 5080 Fill out & sign online DocHub

Make sure you use the sales tax. Annual filers should use form 5081. Beginning january 2015, all taxpayers are required to file an actual return regardless of how they pay their suw taxes and. This blog provides instructions on how to file and pay sales tax in michigan with form 5080 using the michigan. If filing through the mail, monthly/quarterly.

Free Michigan Sales Use Withholding Tax Form 5080 PrintFriendly

Form 5080 is available for submission electronically quarterly filer using michigan treasury online (mto) at • if the tax is less. If filing through the mail, monthly/quarterly filers should use form 5080. This blog provides instructions on how to file and pay sales tax in michigan with form 5080 using the michigan. Annual filers should use form 5081. Make sure.

Nvidia RTX 5080 might get speedier video RAM than we expected but

Respective schedule form instructions for more information. If filing through the mail, monthly/quarterly filers should use form 5080. Make sure you use the sales tax. Form 5080 is available for submission electronically quarterly filer using michigan treasury online (mto) at • if the tax is less. If filing a credit schedule with a monthly/ quarterly return, calculate the.

MI 5081 20212022 Fill out Tax Template Online US Legal Forms

If filing through the mail, monthly/quarterly filers should use form 5080. Annual filers should use form 5081. If filing a credit schedule with a monthly/ quarterly return, calculate the. This blog provides instructions on how to file and pay sales tax in michigan with form 5080 using the michigan. Respective schedule form instructions for more information.

Form 5080 Michigan ≡ Fill Out Printable PDF Forms Online

This blog provides instructions on how to file and pay sales tax in michigan with form 5080 using the michigan. Respective schedule form instructions for more information. If filing through the mail, monthly/quarterly filers should use form 5080. If filing a credit schedule with a monthly/ quarterly return, calculate the. Form 5080 is available for submission electronically quarterly filer using.

Form 5080 Download Fillable PDF or Fill Online Sales, Use and

Form 5080 is available for submission electronically quarterly filer using michigan treasury online (mto) at • if the tax is less. If filing through the mail, monthly/quarterly filers should use form 5080. Beginning january 2015, all taxpayers are required to file an actual return regardless of how they pay their suw taxes and. This blog provides instructions on how to.

How Michigan Taxes Retirees YouTube

Beginning january 2015, all taxpayers are required to file an actual return regardless of how they pay their suw taxes and. Annual filers should use form 5081. Respective schedule form instructions for more information. Make sure you use the sales tax. If filing a credit schedule with a monthly/ quarterly return, calculate the.

Form 5080 michigan 2024 Fill out & sign online DocHub

Annual filers should use form 5081. Make sure you use the sales tax. If filing a credit schedule with a monthly/ quarterly return, calculate the. If filing through the mail, monthly/quarterly filers should use form 5080. This blog provides instructions on how to file and pay sales tax in michigan with form 5080 using the michigan.

Michigan Secretary of State PDF Forms Fillable and Printable

If filing through the mail, monthly/quarterly filers should use form 5080. This blog provides instructions on how to file and pay sales tax in michigan with form 5080 using the michigan. Make sure you use the sales tax. Annual filers should use form 5081. Form 5080 is available for submission electronically quarterly filer using michigan treasury online (mto) at •.

Beginning January 2015, All Taxpayers Are Required To File An Actual Return Regardless Of How They Pay Their Suw Taxes And.

Respective schedule form instructions for more information. Make sure you use the sales tax. If filing a credit schedule with a monthly/ quarterly return, calculate the. If filing through the mail, monthly/quarterly filers should use form 5080.

Form 5080 Is Available For Submission Electronically Quarterly Filer Using Michigan Treasury Online (Mto) At • If The Tax Is Less.

This blog provides instructions on how to file and pay sales tax in michigan with form 5080 using the michigan. Annual filers should use form 5081.