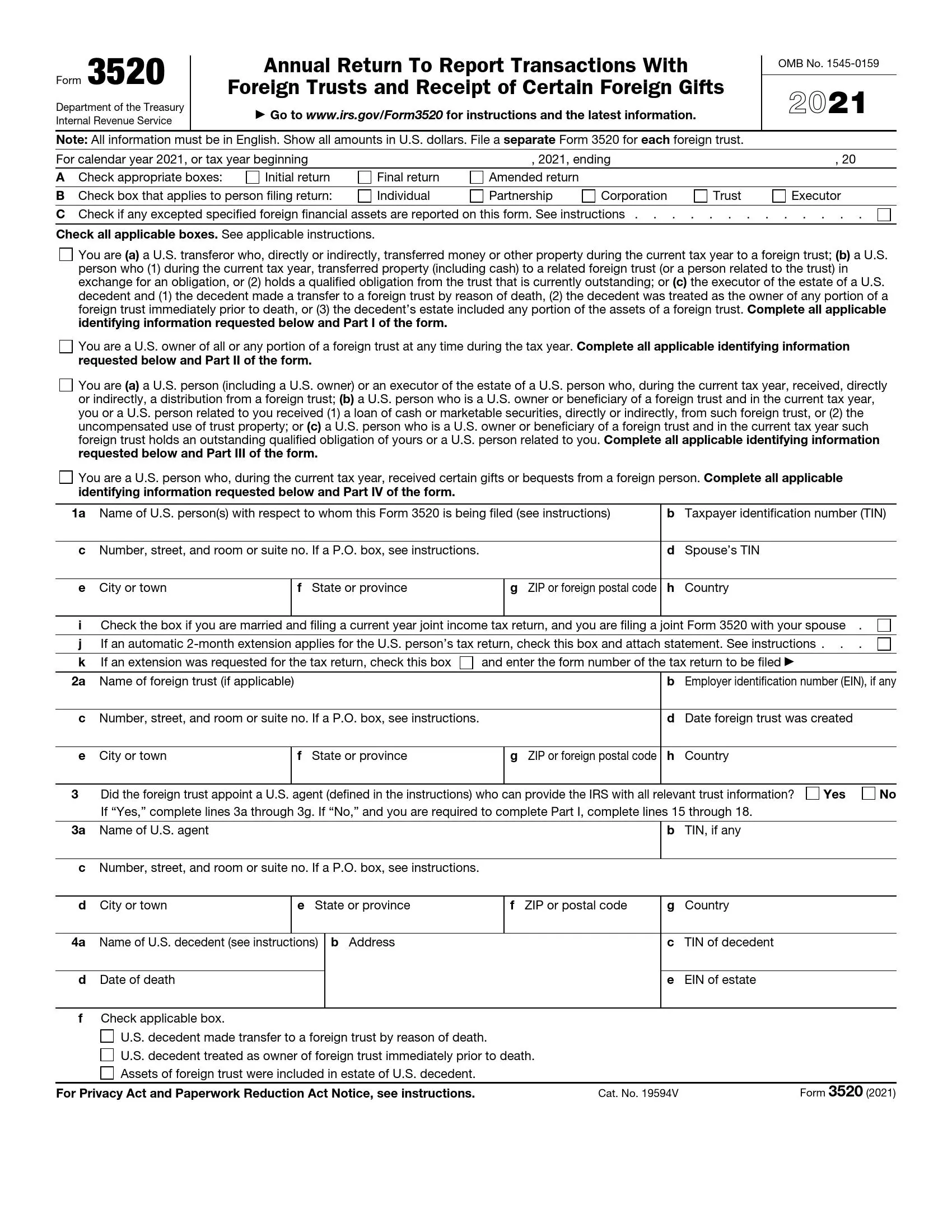

Form 3520 Foreign Gift - Specifically, the receipt of a foreign gift of over $100,000 triggers a requirement to file a form 3520, annual return to report. Decedents) file form 3520 to report: Certain transactions with foreign trusts. Person who, during the current tax year, received certain gifts or bequests from a foreign person. For purposes of form 3520, the irs takes the position that an inheritance is a type of gift and therefore if the. Persons (and executors of estates of u.s.

Specifically, the receipt of a foreign gift of over $100,000 triggers a requirement to file a form 3520, annual return to report. For purposes of form 3520, the irs takes the position that an inheritance is a type of gift and therefore if the. Persons (and executors of estates of u.s. Decedents) file form 3520 to report: Person who, during the current tax year, received certain gifts or bequests from a foreign person. Certain transactions with foreign trusts.

Specifically, the receipt of a foreign gift of over $100,000 triggers a requirement to file a form 3520, annual return to report. Certain transactions with foreign trusts. For purposes of form 3520, the irs takes the position that an inheritance is a type of gift and therefore if the. Person who, during the current tax year, received certain gifts or bequests from a foreign person. Decedents) file form 3520 to report: Persons (and executors of estates of u.s.

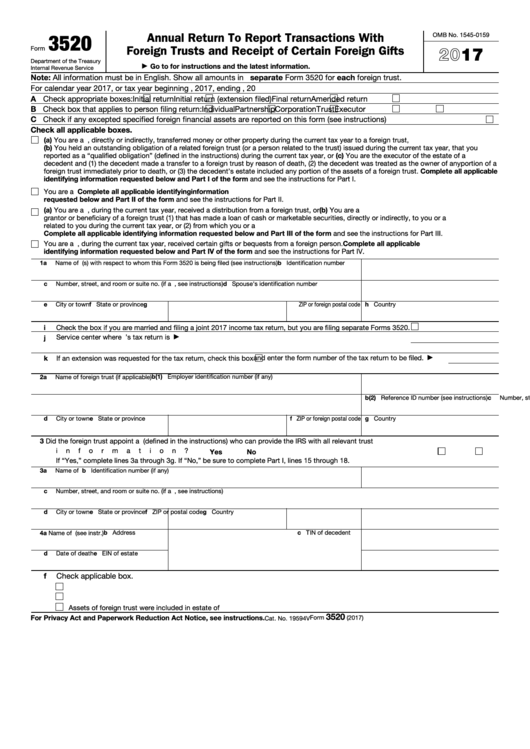

Form 3520 (2020) Instructions for Foreign Gifts & Inheritance

Person who, during the current tax year, received certain gifts or bequests from a foreign person. For purposes of form 3520, the irs takes the position that an inheritance is a type of gift and therefore if the. Decedents) file form 3520 to report: Certain transactions with foreign trusts. Persons (and executors of estates of u.s.

Foreign Trust System Internal Revenue Service, 59 OFF

Decedents) file form 3520 to report: Certain transactions with foreign trusts. Specifically, the receipt of a foreign gift of over $100,000 triggers a requirement to file a form 3520, annual return to report. Persons (and executors of estates of u.s. For purposes of form 3520, the irs takes the position that an inheritance is a type of gift and therefore.

Foreign Gifts Do You Need to File Form 3520 & What If You Don't?

Certain transactions with foreign trusts. Persons (and executors of estates of u.s. Person who, during the current tax year, received certain gifts or bequests from a foreign person. Decedents) file form 3520 to report: Specifically, the receipt of a foreign gift of over $100,000 triggers a requirement to file a form 3520, annual return to report.

Form 3520 Fillable Printable Forms Free Online

Decedents) file form 3520 to report: Person who, during the current tax year, received certain gifts or bequests from a foreign person. Certain transactions with foreign trusts. Persons (and executors of estates of u.s. Specifically, the receipt of a foreign gift of over $100,000 triggers a requirement to file a form 3520, annual return to report.

IRS Form 3520Reporting Transactions With Foreign Trusts

Decedents) file form 3520 to report: Person who, during the current tax year, received certain gifts or bequests from a foreign person. Certain transactions with foreign trusts. Specifically, the receipt of a foreign gift of over $100,000 triggers a requirement to file a form 3520, annual return to report. For purposes of form 3520, the irs takes the position that.

IRS Form 3520 Why You Must Report Foreign 100,000+ Gifts

Decedents) file form 3520 to report: Certain transactions with foreign trusts. Person who, during the current tax year, received certain gifts or bequests from a foreign person. For purposes of form 3520, the irs takes the position that an inheritance is a type of gift and therefore if the. Persons (and executors of estates of u.s.

Form 3520 2023 Printable Forms Free Online

Decedents) file form 3520 to report: Person who, during the current tax year, received certain gifts or bequests from a foreign person. For purposes of form 3520, the irs takes the position that an inheritance is a type of gift and therefore if the. Persons (and executors of estates of u.s. Specifically, the receipt of a foreign gift of over.

Filing Form 3520 A Guide to Foreign Gift Tax

Person who, during the current tax year, received certain gifts or bequests from a foreign person. For purposes of form 3520, the irs takes the position that an inheritance is a type of gift and therefore if the. Specifically, the receipt of a foreign gift of over $100,000 triggers a requirement to file a form 3520, annual return to report..

IRS Form 3520 Annual Return To Report Transactions With Foreign Trust

Specifically, the receipt of a foreign gift of over $100,000 triggers a requirement to file a form 3520, annual return to report. Decedents) file form 3520 to report: Person who, during the current tax year, received certain gifts or bequests from a foreign person. Persons (and executors of estates of u.s. Certain transactions with foreign trusts.

Form 3520 Due Date 2023 Printable Forms Free Online

Specifically, the receipt of a foreign gift of over $100,000 triggers a requirement to file a form 3520, annual return to report. Persons (and executors of estates of u.s. Decedents) file form 3520 to report: For purposes of form 3520, the irs takes the position that an inheritance is a type of gift and therefore if the. Certain transactions with.

Persons (And Executors Of Estates Of U.s.

Specifically, the receipt of a foreign gift of over $100,000 triggers a requirement to file a form 3520, annual return to report. Person who, during the current tax year, received certain gifts or bequests from a foreign person. Certain transactions with foreign trusts. For purposes of form 3520, the irs takes the position that an inheritance is a type of gift and therefore if the.