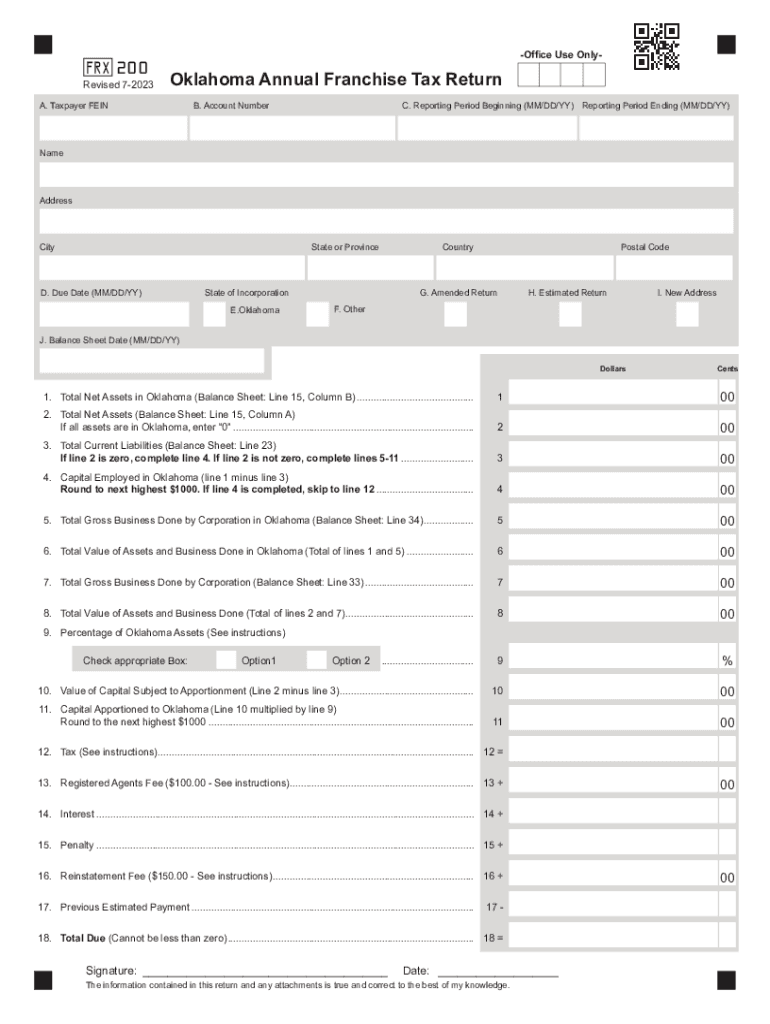

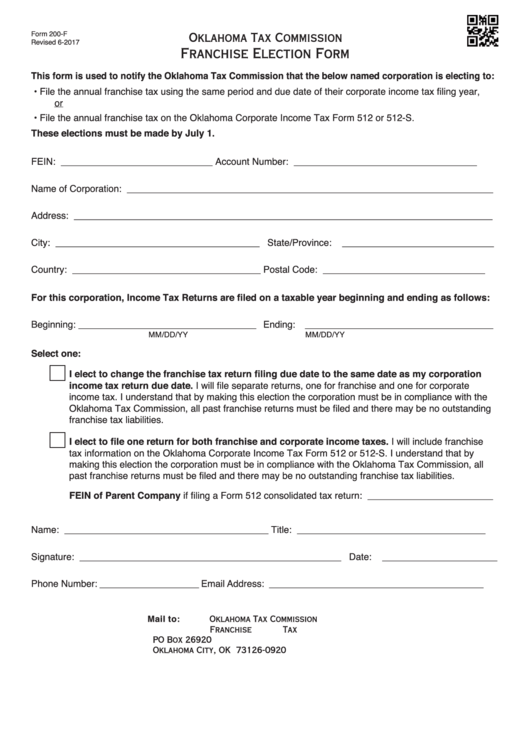

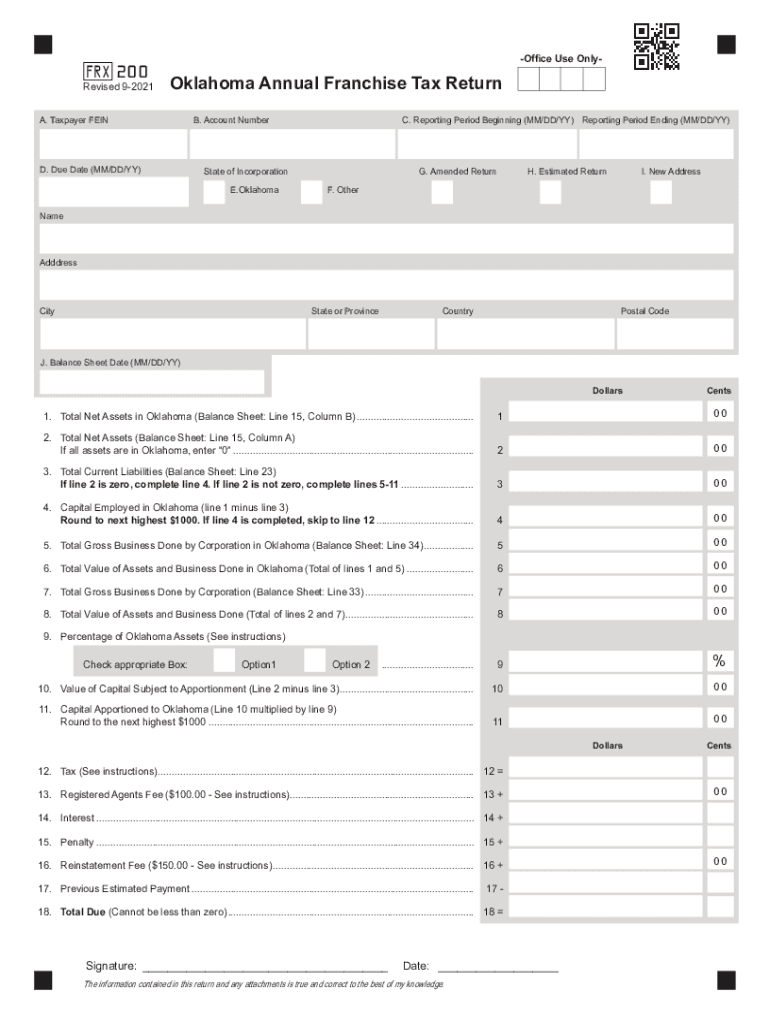

Form 200 F Oklahoma - This form is used to notify the oklahoma tax commission that the below named corporation is electing to: Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. • file the annual franchise tax using. Oklahoma annual franchise tax return. This page contains schedules b, c, and d for the completion of form 200:

• file the annual franchise tax using. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. This form is used to notify the oklahoma tax commission that the below named corporation is electing to: Oklahoma annual franchise tax return. This page contains schedules b, c, and d for the completion of form 200:

This page contains schedules b, c, and d for the completion of form 200: Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. Oklahoma annual franchise tax return. This form is used to notify the oklahoma tax commission that the below named corporation is electing to: • file the annual franchise tax using.

Form 200 f oklahoma Fill out & sign online DocHub

This form is used to notify the oklahoma tax commission that the below named corporation is electing to: Oklahoma annual franchise tax return. • file the annual franchise tax using. This page contains schedules b, c, and d for the completion of form 200: Corporations required to file a franchise tax return may elect to file a combined corporate income.

Fillable Form 200F Franchise Election Oklahoma Tax Commission

This form is used to notify the oklahoma tax commission that the below named corporation is electing to: Oklahoma annual franchise tax return. This page contains schedules b, c, and d for the completion of form 200: • file the annual franchise tax using. Corporations required to file a franchise tax return may elect to file a combined corporate income.

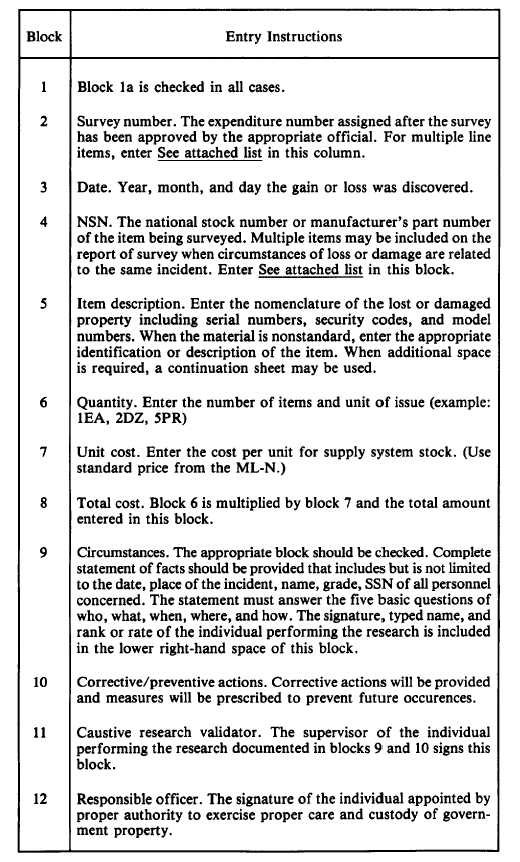

Instructions for Preparation of DD Form 200 12655_69

This form is used to notify the oklahoma tax commission that the below named corporation is electing to: This page contains schedules b, c, and d for the completion of form 200: Oklahoma annual franchise tax return. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. • file the.

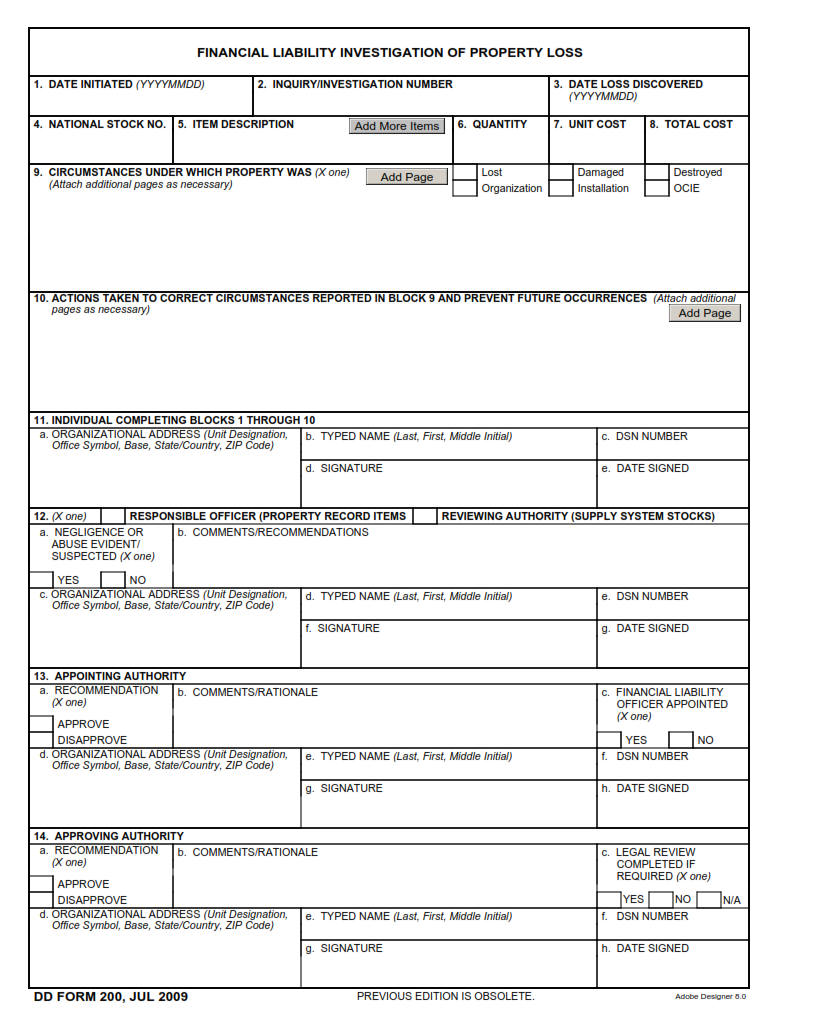

DD Form 200 Financial Liability Investigation of Property Loss

• file the annual franchise tax using. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. This form is used to notify the oklahoma tax commission that the below named corporation is electing to: This page contains schedules b, c, and d for the completion of form 200: Oklahoma.

+GF+ AGIECHARMILLES FORM 200 2017 Die Sinking EDM machine REMIswiss

Oklahoma annual franchise tax return. This page contains schedules b, c, and d for the completion of form 200: This form is used to notify the oklahoma tax commission that the below named corporation is electing to: • file the annual franchise tax using. Corporations required to file a franchise tax return may elect to file a combined corporate income.

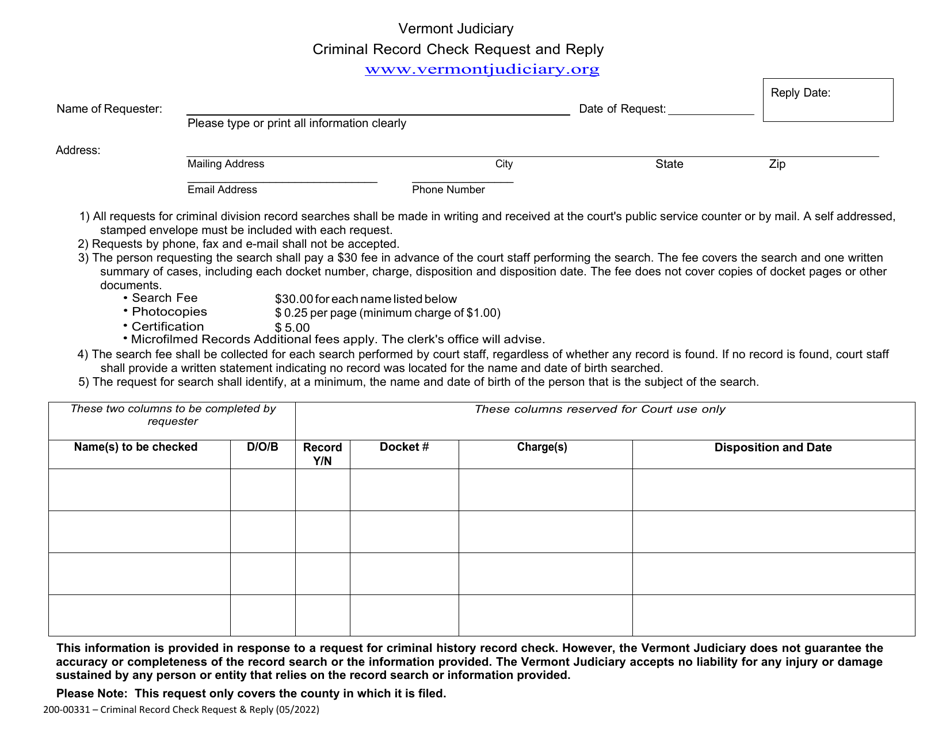

Form 20000331 Download Fillable PDF or Fill Online Criminal Record

Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. Oklahoma annual franchise tax return. • file the annual franchise tax using. This page contains schedules b, c, and d for the completion of form 200: This form is used to notify the oklahoma tax commission that the below named.

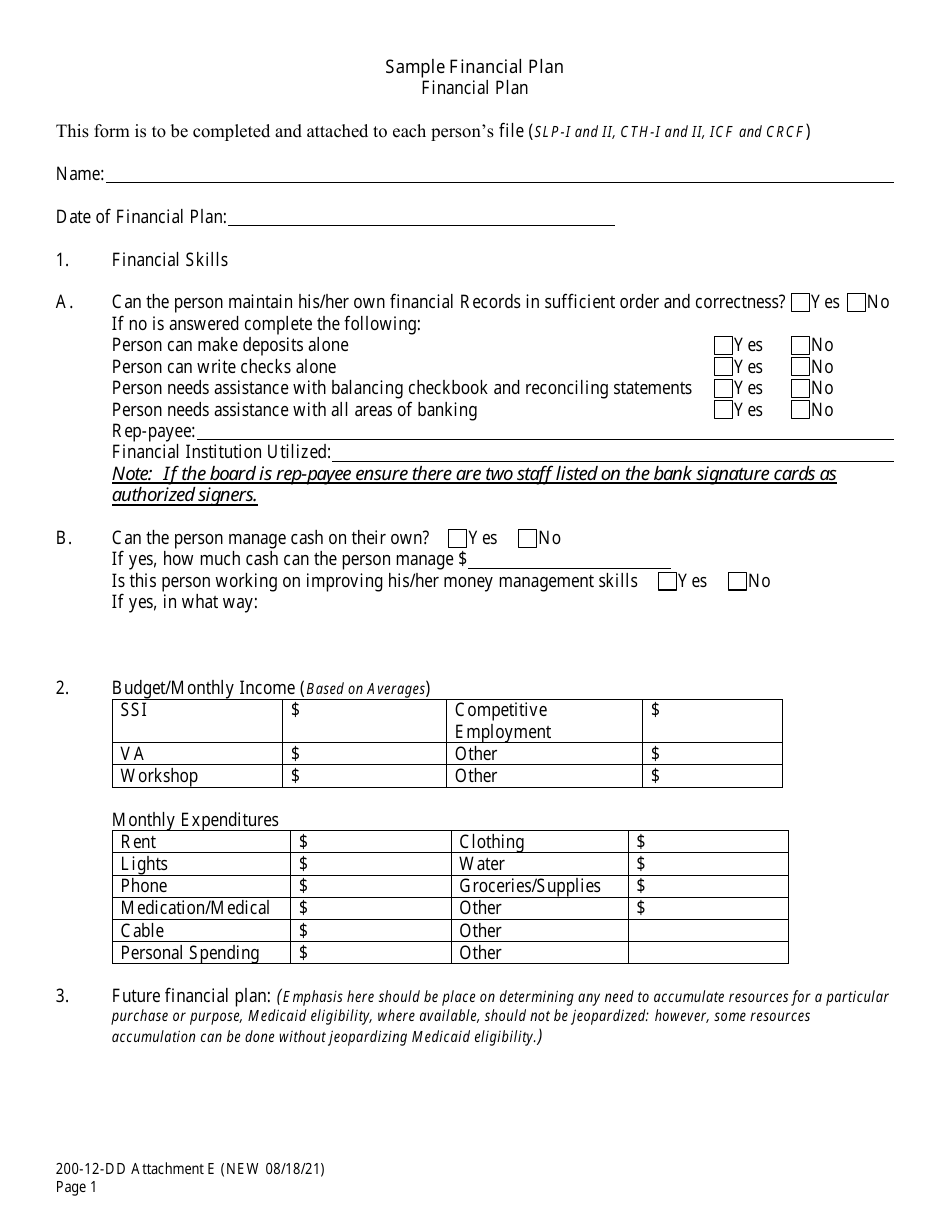

Form 20012DD Attachment E Fill Out, Sign Online and Download

Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. This form is used to notify the oklahoma tax commission that the below named corporation is electing to: • file the annual franchise tax using. Oklahoma annual franchise tax return. This page contains schedules b, c, and d for the.

Ce 200 Printable Form

Oklahoma annual franchise tax return. This form is used to notify the oklahoma tax commission that the below named corporation is electing to: Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. • file the annual franchise tax using. This page contains schedules b, c, and d for the.

Fillable Online Form 200F Franchise Election Form Fax Email Print

Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. This page contains schedules b, c, and d for the completion of form 200: • file the annual franchise tax using. This form is used to notify the oklahoma tax commission that the below named corporation is electing to: Oklahoma.

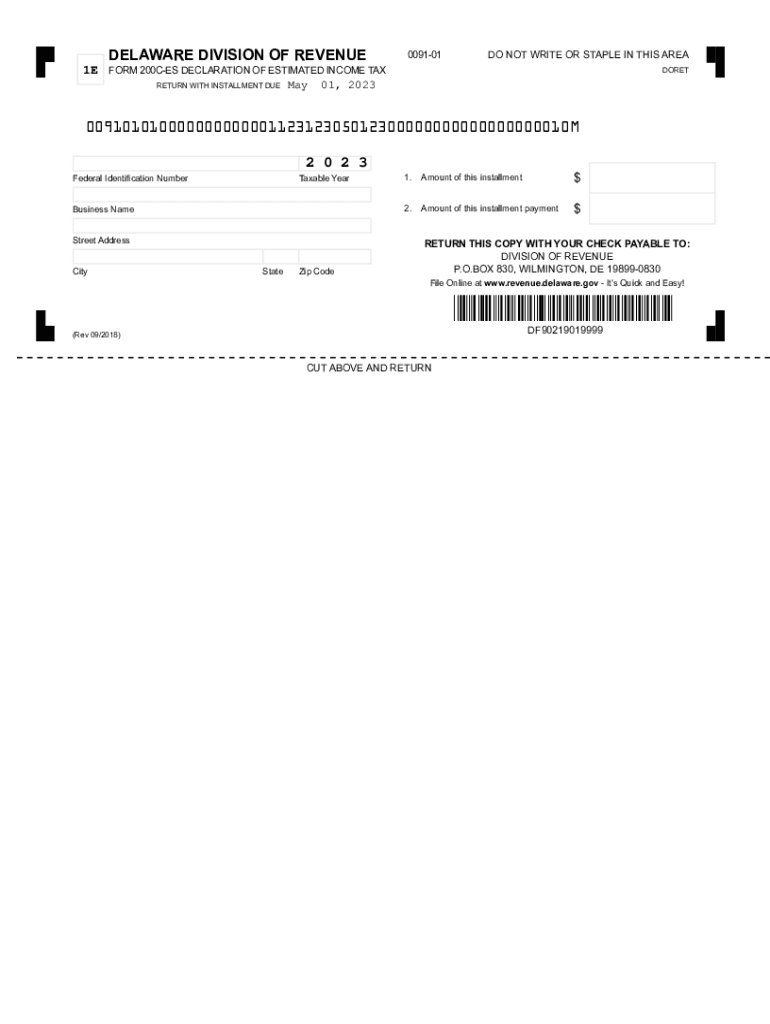

Delaware Form 200ES Declaration of Estimated Tax for Fill out & sign

Oklahoma annual franchise tax return. This form is used to notify the oklahoma tax commission that the below named corporation is electing to: This page contains schedules b, c, and d for the completion of form 200: Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. • file the.

Oklahoma Annual Franchise Tax Return.

This page contains schedules b, c, and d for the completion of form 200: Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. • file the annual franchise tax using. This form is used to notify the oklahoma tax commission that the below named corporation is electing to: