Form 1099 R Code J - Code j indicates that there was an early distribution from a roth ira. Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the recipient, not that of. Use code r for a. One of those questions will ask about. Taxable amount is blank and it is. If any other code, such as 8 or p, applies, use code j. Client has a form 1099r with a code j in box 7 which states early distribution from a roth ira. Recharacterized ira contribution made for 2017. The amount may or may not be taxable depending on the. If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in.

Use code r for a. Recharacterized ira contribution made for 2017. Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the recipient, not that of. Taxable amount is blank and it is. If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in. Code j indicates that there was an early distribution from a roth ira. The amount may or may not be taxable depending on the. One of those questions will ask about. If any other code, such as 8 or p, applies, use code j. Client has a form 1099r with a code j in box 7 which states early distribution from a roth ira.

One of those questions will ask about. Recharacterized ira contribution made for 2017. Client has a form 1099r with a code j in box 7 which states early distribution from a roth ira. Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the recipient, not that of. Code j indicates that there was an early distribution from a roth ira. Taxable amount is blank and it is. Use code r for a. The amount may or may not be taxable depending on the. If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in. If any other code, such as 8 or p, applies, use code j.

Selecting the Correct IRS Form 1099R Box 7 Distribution Codes — Ascensus

If any other code, such as 8 or p, applies, use code j. Client has a form 1099r with a code j in box 7 which states early distribution from a roth ira. Code j indicates that there was an early distribution from a roth ira. Recharacterized ira contribution made for 2017. Report military retirement pay awarded as a property.

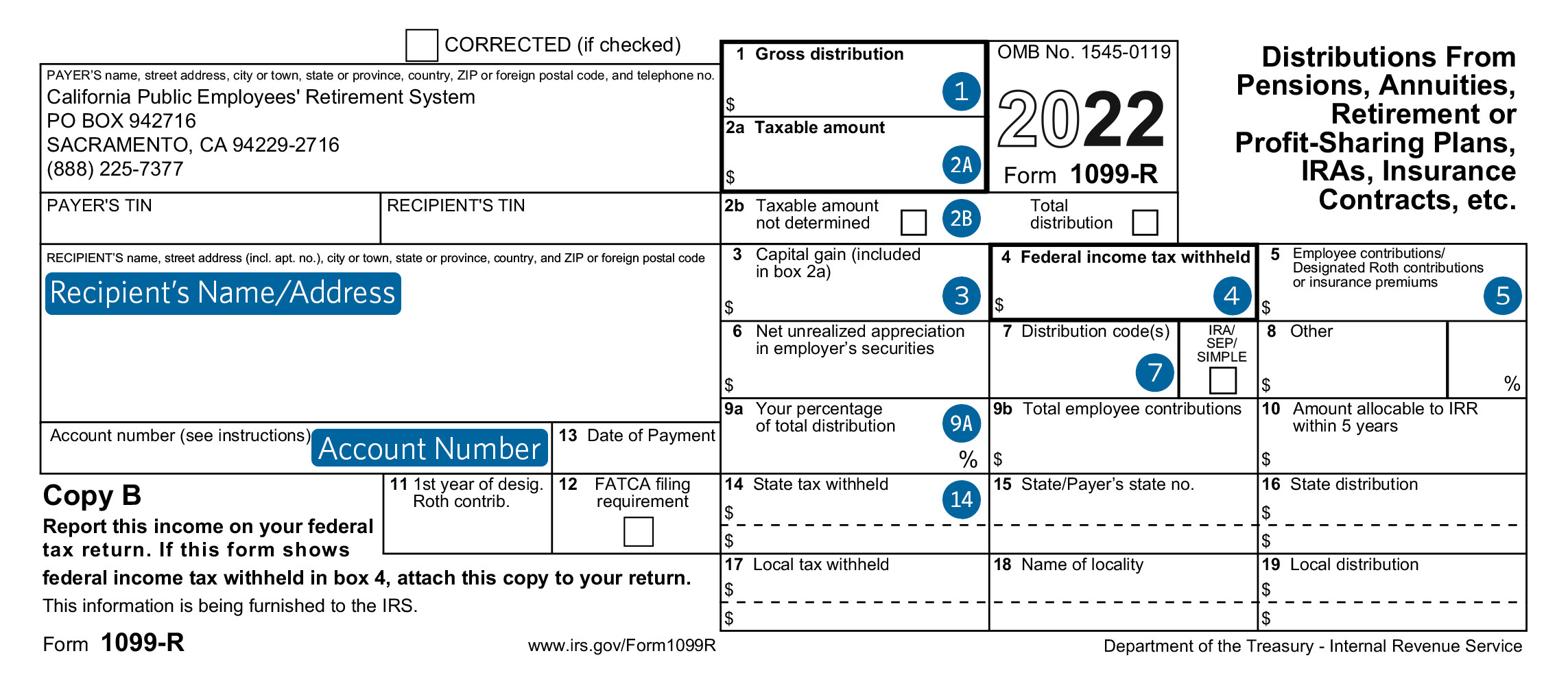

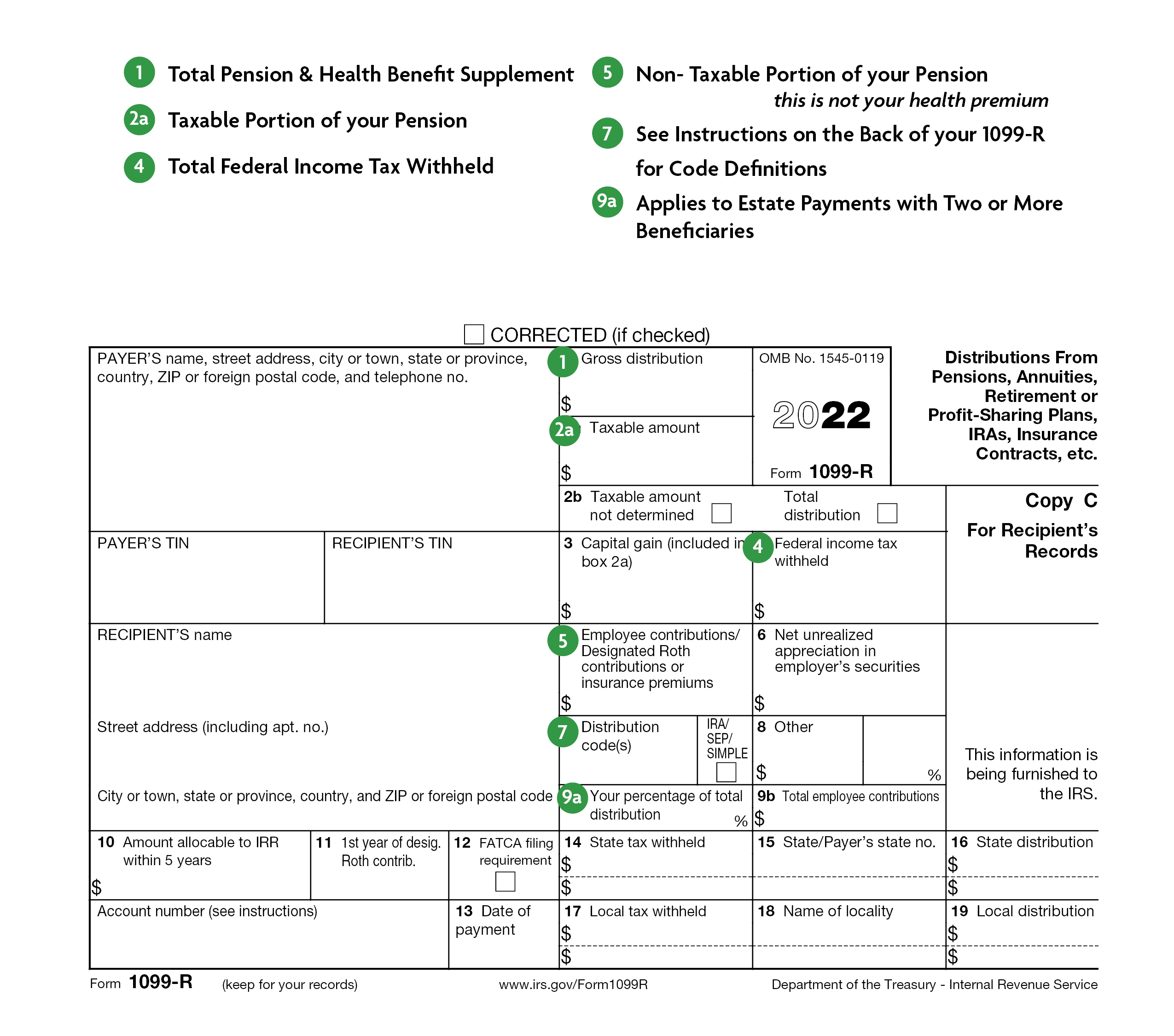

1099 Pension

Code j indicates that there was an early distribution from a roth ira. If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in. Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the.

1099 Pension

Client has a form 1099r with a code j in box 7 which states early distribution from a roth ira. Taxable amount is blank and it is. Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the recipient, not that of. One of those questions will ask about. Code j.

Neat What Is Non Standard 1099r A Chronological Report About Tigers

Recharacterized ira contribution made for 2017. One of those questions will ask about. If any other code, such as 8 or p, applies, use code j. Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the recipient, not that of. Client has a form 1099r with a code j in.

Printable 1099 R Form Printable Forms Free Online

One of those questions will ask about. The amount may or may not be taxable depending on the. Client has a form 1099r with a code j in box 7 which states early distribution from a roth ira. Use code r for a. Report military retirement pay awarded as a property settlement to a former spouse under the name and.

1099 r form Fill out & sign online DocHub

One of those questions will ask about. If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in. Client has a form 1099r with a code j in box 7 which states early distribution from a roth ira. Taxable amount is blank and it.

1099 Reporting Threshold 2024 Twila Ingeberg

Use code r for a. Client has a form 1099r with a code j in box 7 which states early distribution from a roth ira. The amount may or may not be taxable depending on the. One of those questions will ask about. Taxable amount is blank and it is.

2023 Form 1099 R Printable Forms Free Online

Taxable amount is blank and it is. One of those questions will ask about. Use code r for a. The amount may or may not be taxable depending on the. Code j indicates that there was an early distribution from a roth ira.

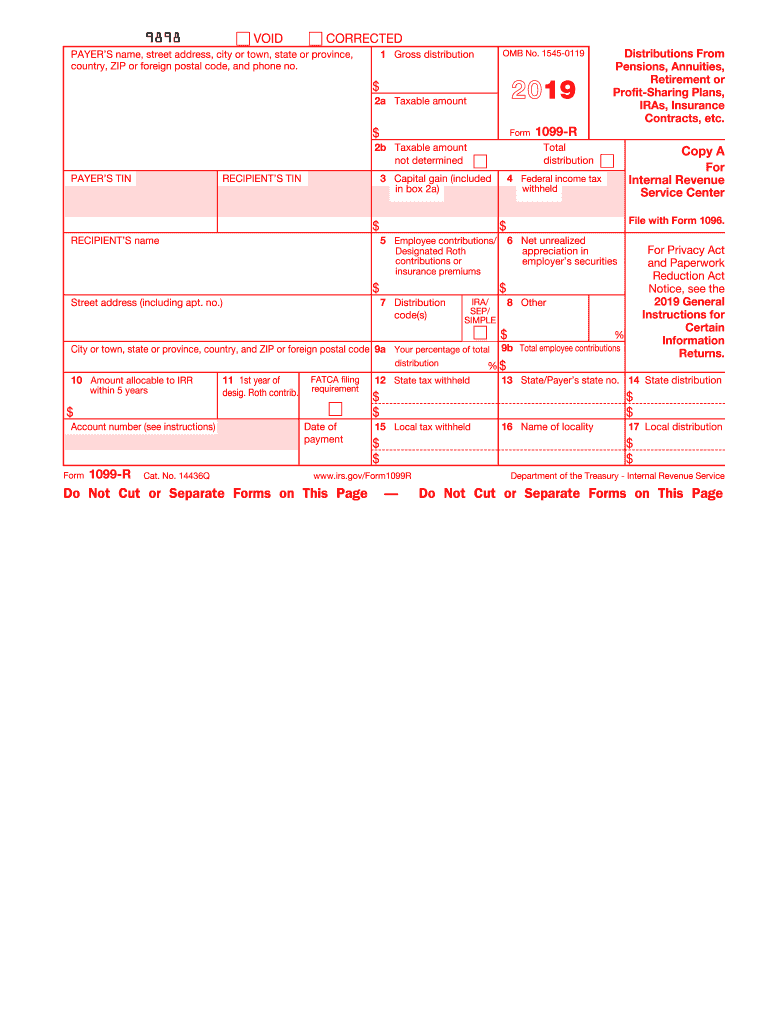

2019 1099 Form Complete with ease airSlate SignNow

Taxable amount is blank and it is. If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in. Code j indicates that there was an early distribution from a roth ira. Client has a form 1099r with a code j in box 7 which.

Does a 1099R hurt your taxes?

If any other code, such as 8 or p, applies, use code j. Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the recipient, not that of. Use code r for a. Code j indicates that there was an early distribution from a roth ira. Recharacterized ira contribution made for.

Use Code R For A.

Recharacterized ira contribution made for 2017. Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the recipient, not that of. Client has a form 1099r with a code j in box 7 which states early distribution from a roth ira. If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in.

Code J Indicates That There Was An Early Distribution From A Roth Ira.

The amount may or may not be taxable depending on the. One of those questions will ask about. If any other code, such as 8 or p, applies, use code j. Taxable amount is blank and it is.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.31.57PM-22f2d44f32ac447aa561bd652c2c11e4.png)

:max_bytes(150000):strip_icc()/1099-Rpdf1-b1fa4454f3af489aa717304e4667e415.jpg)