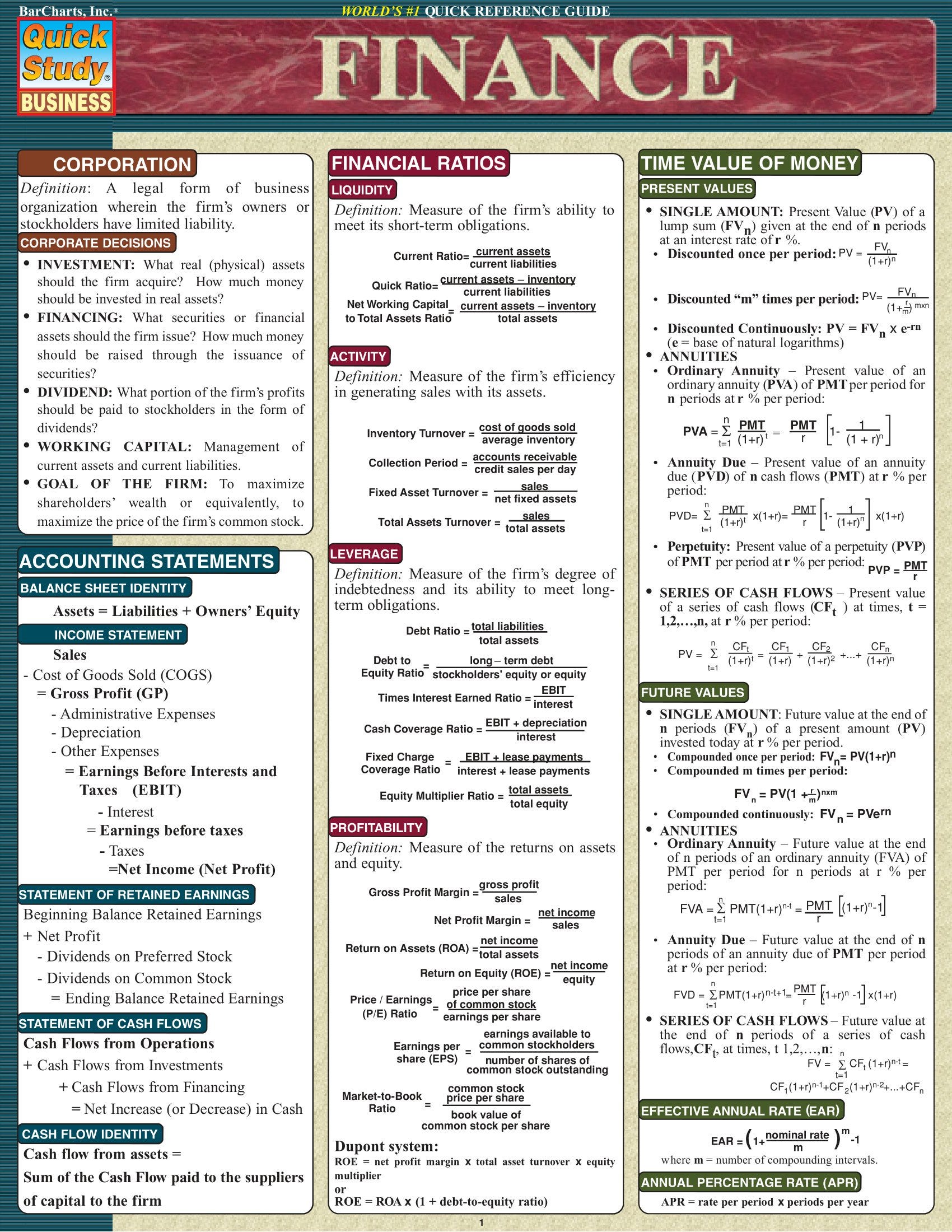

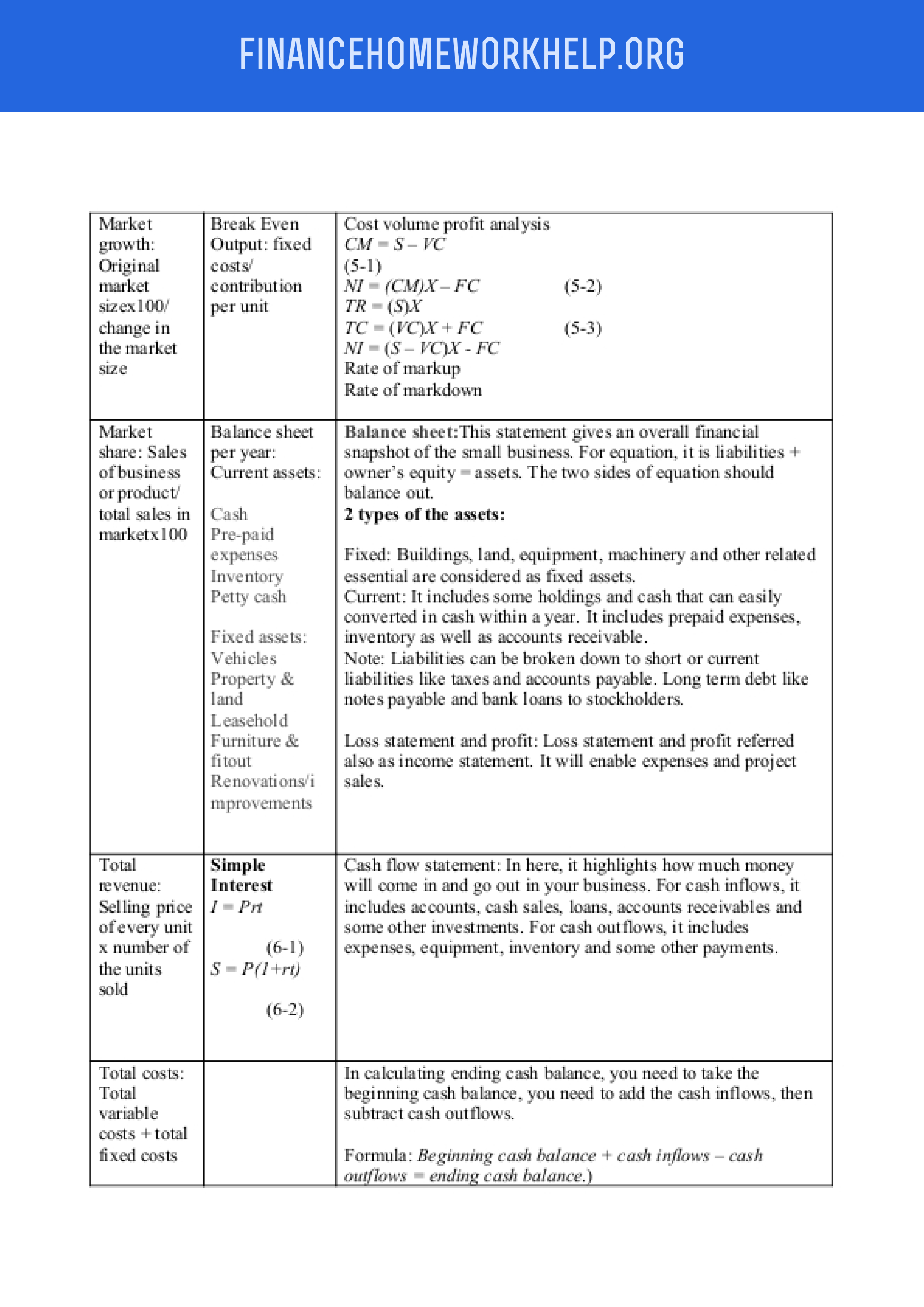

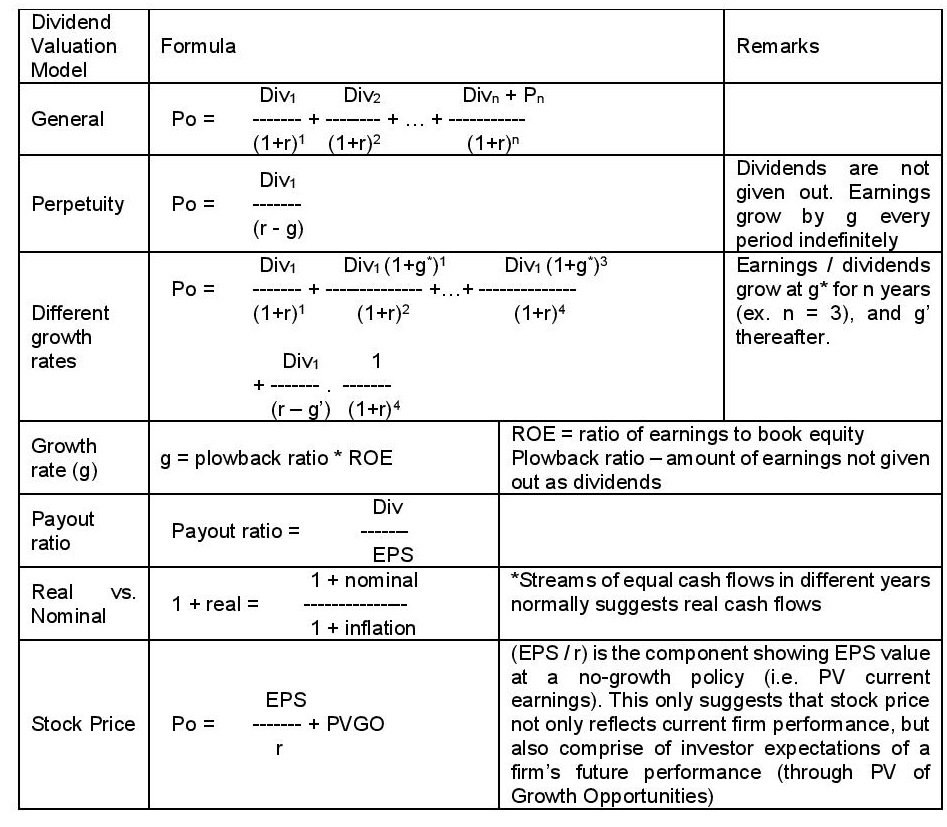

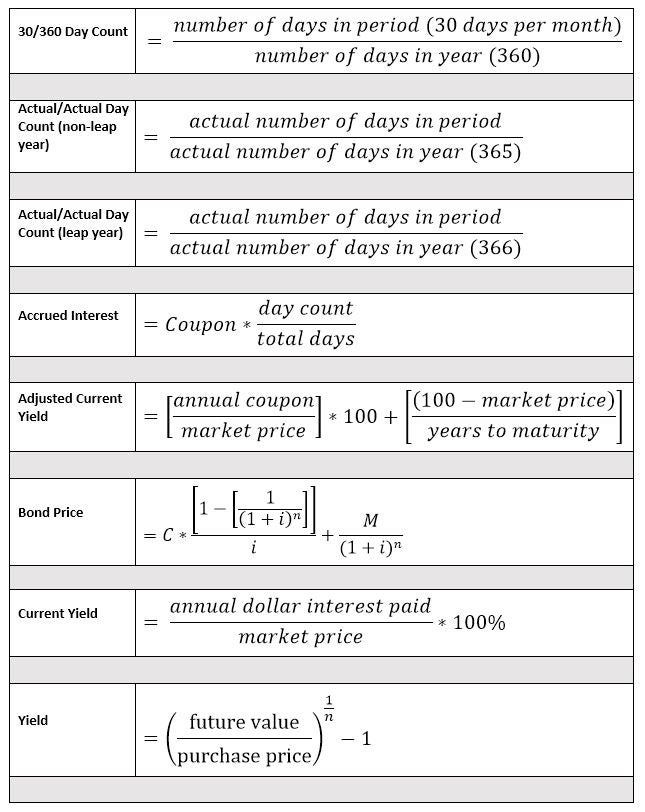

Finance Formulas Cheat Sheet - Financial ratios at a glance cheat sheets. Our finance cheat sheet provides essential formulas for calculating earnings per share (eps) and understanding balance sheet components. From determining the future value of an investment using the fv function to analyze the net present value with the npv function, these excel formulas for finance help financial professionals, analysts, and even individual. Cfi's excel formulas cheat sheet will give you all the most important formulas to perform financial analysis and modeling in excel spreadsheets. Mastering financial ratios is crucial for evaluating a company’s financial health. S is the future value (or maturity value). Receivables turnover = annual sales average receivables the efficiency of a company in collecting its trade receivables days of sales outstanding = 365 receivables turnover the. It is equal to the principal plus the interest earned.

Financial ratios at a glance cheat sheets. It is equal to the principal plus the interest earned. Cfi's excel formulas cheat sheet will give you all the most important formulas to perform financial analysis and modeling in excel spreadsheets. From determining the future value of an investment using the fv function to analyze the net present value with the npv function, these excel formulas for finance help financial professionals, analysts, and even individual. S is the future value (or maturity value). Our finance cheat sheet provides essential formulas for calculating earnings per share (eps) and understanding balance sheet components. Mastering financial ratios is crucial for evaluating a company’s financial health. Receivables turnover = annual sales average receivables the efficiency of a company in collecting its trade receivables days of sales outstanding = 365 receivables turnover the.

Financial ratios at a glance cheat sheets. S is the future value (or maturity value). Our finance cheat sheet provides essential formulas for calculating earnings per share (eps) and understanding balance sheet components. From determining the future value of an investment using the fv function to analyze the net present value with the npv function, these excel formulas for finance help financial professionals, analysts, and even individual. Receivables turnover = annual sales average receivables the efficiency of a company in collecting its trade receivables days of sales outstanding = 365 receivables turnover the. Cfi's excel formulas cheat sheet will give you all the most important formulas to perform financial analysis and modeling in excel spreadsheets. Mastering financial ratios is crucial for evaluating a company’s financial health. It is equal to the principal plus the interest earned.

🏰 Finance cheat sheet Compounding Quality

Our finance cheat sheet provides essential formulas for calculating earnings per share (eps) and understanding balance sheet components. Mastering financial ratios is crucial for evaluating a company’s financial health. Cfi's excel formulas cheat sheet will give you all the most important formulas to perform financial analysis and modeling in excel spreadsheets. Receivables turnover = annual sales average receivables the efficiency.

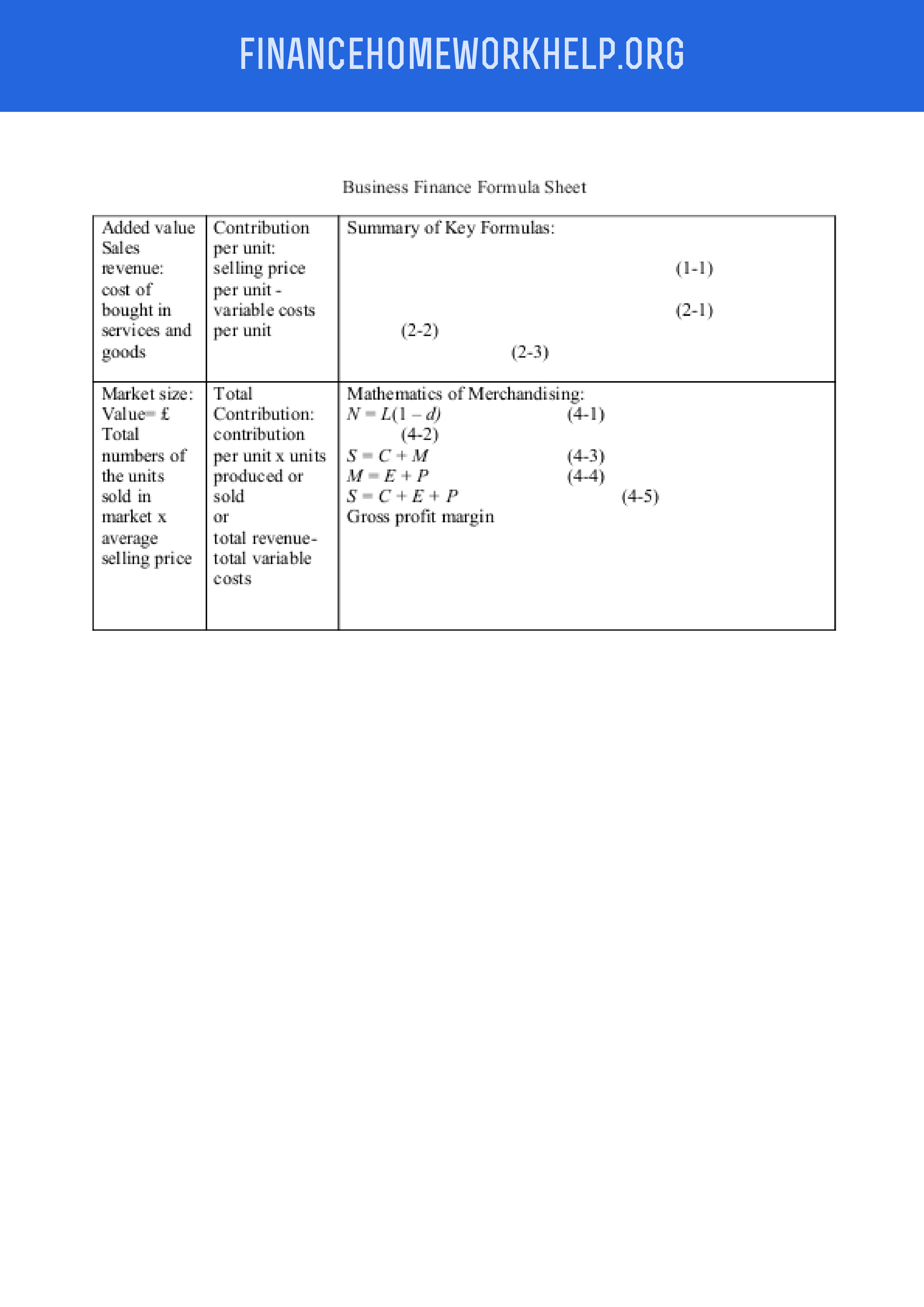

Our Handy Finance Formula Sheet Finance Homework Help

From determining the future value of an investment using the fv function to analyze the net present value with the npv function, these excel formulas for finance help financial professionals, analysts, and even individual. Financial ratios at a glance cheat sheets. S is the future value (or maturity value). Cfi's excel formulas cheat sheet will give you all the most.

Finance Formulas Cheat Sheet

Receivables turnover = annual sales average receivables the efficiency of a company in collecting its trade receivables days of sales outstanding = 365 receivables turnover the. Our finance cheat sheet provides essential formulas for calculating earnings per share (eps) and understanding balance sheet components. Financial ratios at a glance cheat sheets. Mastering financial ratios is crucial for evaluating a company’s.

Perfect Pmp formula Cheat Sheet Financial ratio, Accounting classes

Cfi's excel formulas cheat sheet will give you all the most important formulas to perform financial analysis and modeling in excel spreadsheets. From determining the future value of an investment using the fv function to analyze the net present value with the npv function, these excel formulas for finance help financial professionals, analysts, and even individual. Receivables turnover = annual.

102 Useful Excel Formulas Cheat Sheet PDF (Free Download Sheet) in 2022

Financial ratios at a glance cheat sheets. Receivables turnover = annual sales average receivables the efficiency of a company in collecting its trade receivables days of sales outstanding = 365 receivables turnover the. S is the future value (or maturity value). Our finance cheat sheet provides essential formulas for calculating earnings per share (eps) and understanding balance sheet components. From.

Finance Formulas Cheat Sheet One Stop Accounting Formulas Cheat Sheet

Financial ratios at a glance cheat sheets. Mastering financial ratios is crucial for evaluating a company’s financial health. Receivables turnover = annual sales average receivables the efficiency of a company in collecting its trade receivables days of sales outstanding = 365 receivables turnover the. Cfi's excel formulas cheat sheet will give you all the most important formulas to perform financial.

Accounting Equation Cheat Sheet Tessshebaylo

From determining the future value of an investment using the fv function to analyze the net present value with the npv function, these excel formulas for finance help financial professionals, analysts, and even individual. Financial ratios at a glance cheat sheets. It is equal to the principal plus the interest earned. S is the future value (or maturity value). Mastering.

seretnow.me

It is equal to the principal plus the interest earned. Our finance cheat sheet provides essential formulas for calculating earnings per share (eps) and understanding balance sheet components. S is the future value (or maturity value). Receivables turnover = annual sales average receivables the efficiency of a company in collecting its trade receivables days of sales outstanding = 365 receivables.

Finance Formulas Cheat Sheet

It is equal to the principal plus the interest earned. Receivables turnover = annual sales average receivables the efficiency of a company in collecting its trade receivables days of sales outstanding = 365 receivables turnover the. Financial ratios at a glance cheat sheets. Cfi's excel formulas cheat sheet will give you all the most important formulas to perform financial analysis.

Finance Formulas Sheet

S is the future value (or maturity value). Receivables turnover = annual sales average receivables the efficiency of a company in collecting its trade receivables days of sales outstanding = 365 receivables turnover the. It is equal to the principal plus the interest earned. Our finance cheat sheet provides essential formulas for calculating earnings per share (eps) and understanding balance.

It Is Equal To The Principal Plus The Interest Earned.

Financial ratios at a glance cheat sheets. S is the future value (or maturity value). From determining the future value of an investment using the fv function to analyze the net present value with the npv function, these excel formulas for finance help financial professionals, analysts, and even individual. Our finance cheat sheet provides essential formulas for calculating earnings per share (eps) and understanding balance sheet components.

Receivables Turnover = Annual Sales Average Receivables The Efficiency Of A Company In Collecting Its Trade Receivables Days Of Sales Outstanding = 365 Receivables Turnover The.

Cfi's excel formulas cheat sheet will give you all the most important formulas to perform financial analysis and modeling in excel spreadsheets. Mastering financial ratios is crucial for evaluating a company’s financial health.