Federal Tax Refund Calendar - Here’s how to make sure you get your tax refund as quickly as possible. If you file your income tax return for a fiscal year rather than the calendar year, you must change some of the dates in this calendar. Tool provides taxpayers with three key pieces of information: Irs confirmation of receiving a. See your personalized refund date as soon as the irs processes your tax return and approves your refund. The irs says if you file early and electronically, you’ll typically receive your tax refund within 21 days after filing. Taxes 2024 — everything you need to.

If you file your income tax return for a fiscal year rather than the calendar year, you must change some of the dates in this calendar. Here’s how to make sure you get your tax refund as quickly as possible. Irs confirmation of receiving a. Tool provides taxpayers with three key pieces of information: Taxes 2024 — everything you need to. The irs says if you file early and electronically, you’ll typically receive your tax refund within 21 days after filing. See your personalized refund date as soon as the irs processes your tax return and approves your refund.

If you file your income tax return for a fiscal year rather than the calendar year, you must change some of the dates in this calendar. See your personalized refund date as soon as the irs processes your tax return and approves your refund. Irs confirmation of receiving a. Here’s how to make sure you get your tax refund as quickly as possible. Tool provides taxpayers with three key pieces of information: Taxes 2024 — everything you need to. The irs says if you file early and electronically, you’ll typically receive your tax refund within 21 days after filing.

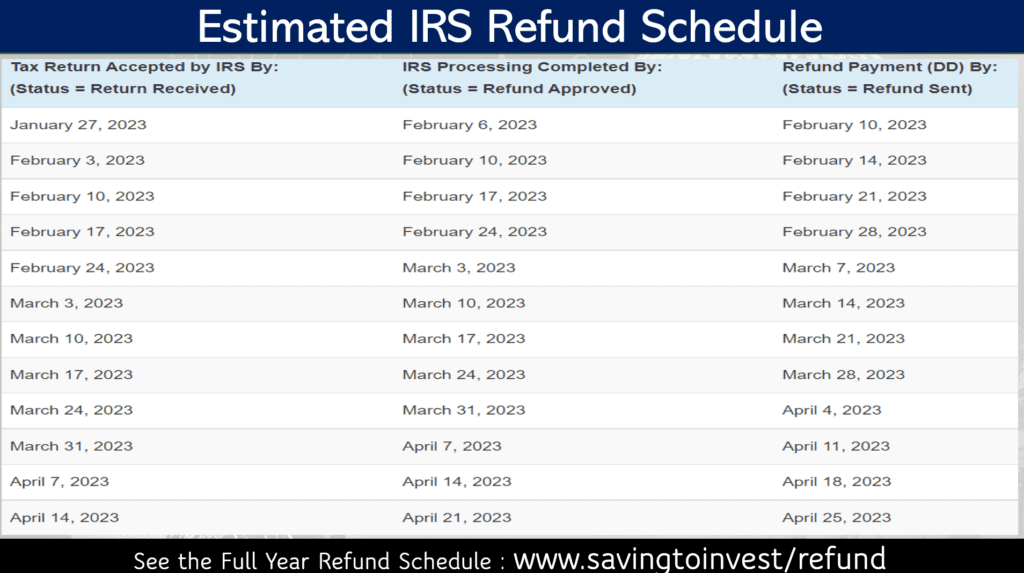

2023 Irs Tax Chart Printable Forms Free Online

See your personalized refund date as soon as the irs processes your tax return and approves your refund. The irs says if you file early and electronically, you’ll typically receive your tax refund within 21 days after filing. Taxes 2024 — everything you need to. If you file your income tax return for a fiscal year rather than the calendar.

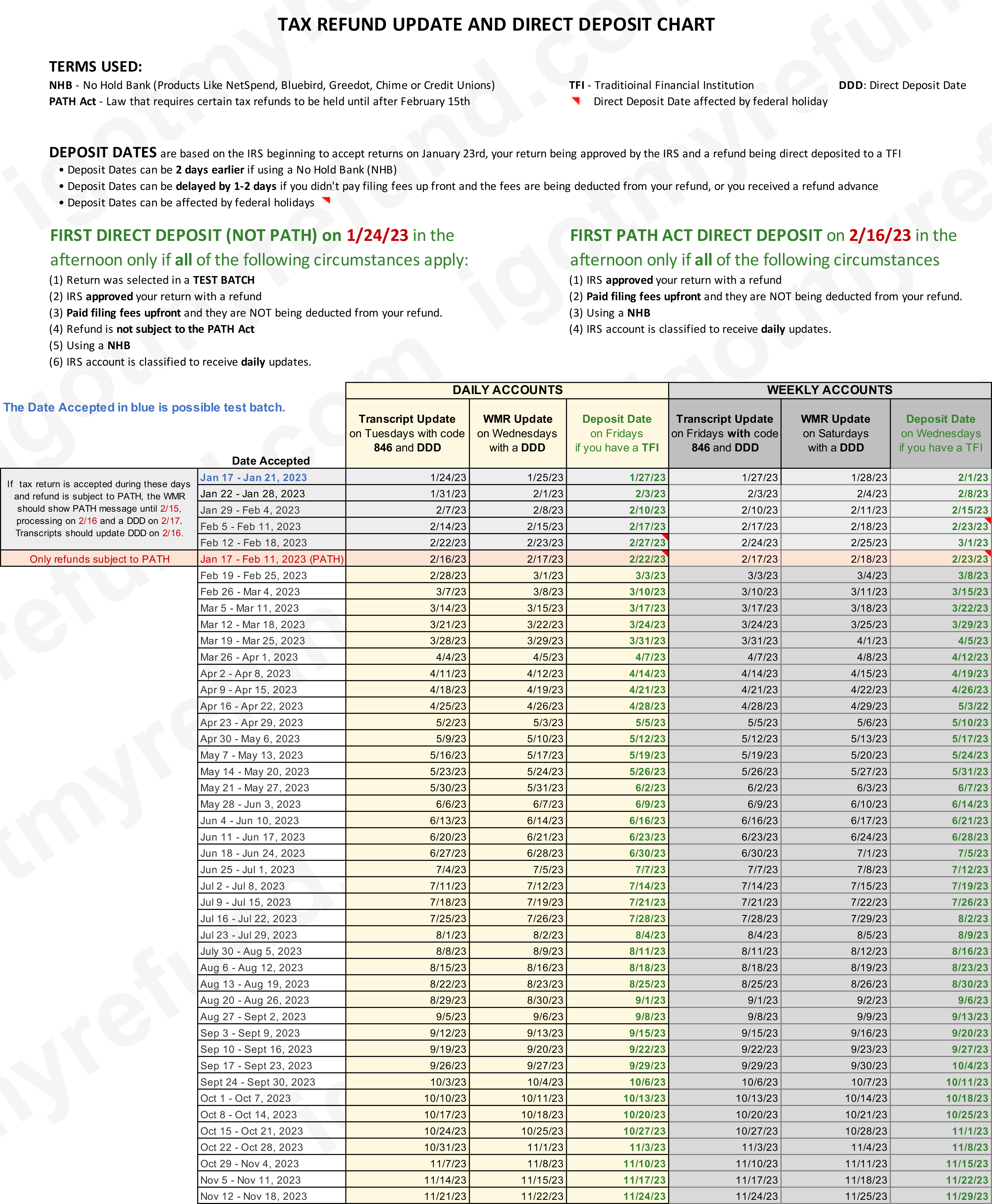

What Time Does The Irs Update Refund Status 2024 Olga Tiffie

Here’s how to make sure you get your tax refund as quickly as possible. Tool provides taxpayers with three key pieces of information: If you file your income tax return for a fiscal year rather than the calendar year, you must change some of the dates in this calendar. Irs confirmation of receiving a. See your personalized refund date as.

Tax Refund Calendar 2024 Lyssa Devonne

Tool provides taxpayers with three key pieces of information: Taxes 2024 — everything you need to. Here’s how to make sure you get your tax refund as quickly as possible. Irs confirmation of receiving a. If you file your income tax return for a fiscal year rather than the calendar year, you must change some of the dates in this.

Refund schedule 2023 r/IRS

Irs confirmation of receiving a. If you file your income tax return for a fiscal year rather than the calendar year, you must change some of the dates in this calendar. Taxes 2024 — everything you need to. The irs says if you file early and electronically, you’ll typically receive your tax refund within 21 days after filing. Here’s how.

Irs Refund Calendar Dates Devan Stafani

The irs says if you file early and electronically, you’ll typically receive your tax refund within 21 days after filing. Here’s how to make sure you get your tax refund as quickly as possible. Irs confirmation of receiving a. See your personalized refund date as soon as the irs processes your tax return and approves your refund. Tool provides taxpayers.

Tax Refund Calendar 2024 Irs Corine Kaycee

The irs says if you file early and electronically, you’ll typically receive your tax refund within 21 days after filing. See your personalized refund date as soon as the irs processes your tax return and approves your refund. Tool provides taxpayers with three key pieces of information: Here’s how to make sure you get your tax refund as quickly as.

2023 Tax Refund Schedule Chart Printable Forms Free Online

The irs says if you file early and electronically, you’ll typically receive your tax refund within 21 days after filing. Tool provides taxpayers with three key pieces of information: If you file your income tax return for a fiscal year rather than the calendar year, you must change some of the dates in this calendar. Irs confirmation of receiving a..

Where'S My Refund Calendar 2024 Madel Roselin

See your personalized refund date as soon as the irs processes your tax return and approves your refund. The irs says if you file early and electronically, you’ll typically receive your tax refund within 21 days after filing. Tool provides taxpayers with three key pieces of information: Here’s how to make sure you get your tax refund as quickly as.

Refund schedule 2023 r/IRS

If you file your income tax return for a fiscal year rather than the calendar year, you must change some of the dates in this calendar. Here’s how to make sure you get your tax refund as quickly as possible. The irs says if you file early and electronically, you’ll typically receive your tax refund within 21 days after filing..

Federal Tax Return Delays 2024 Bibi Marita

The irs says if you file early and electronically, you’ll typically receive your tax refund within 21 days after filing. If you file your income tax return for a fiscal year rather than the calendar year, you must change some of the dates in this calendar. Here’s how to make sure you get your tax refund as quickly as possible..

Tool Provides Taxpayers With Three Key Pieces Of Information:

Here’s how to make sure you get your tax refund as quickly as possible. The irs says if you file early and electronically, you’ll typically receive your tax refund within 21 days after filing. If you file your income tax return for a fiscal year rather than the calendar year, you must change some of the dates in this calendar. See your personalized refund date as soon as the irs processes your tax return and approves your refund.

Irs Confirmation Of Receiving A.

Taxes 2024 — everything you need to.