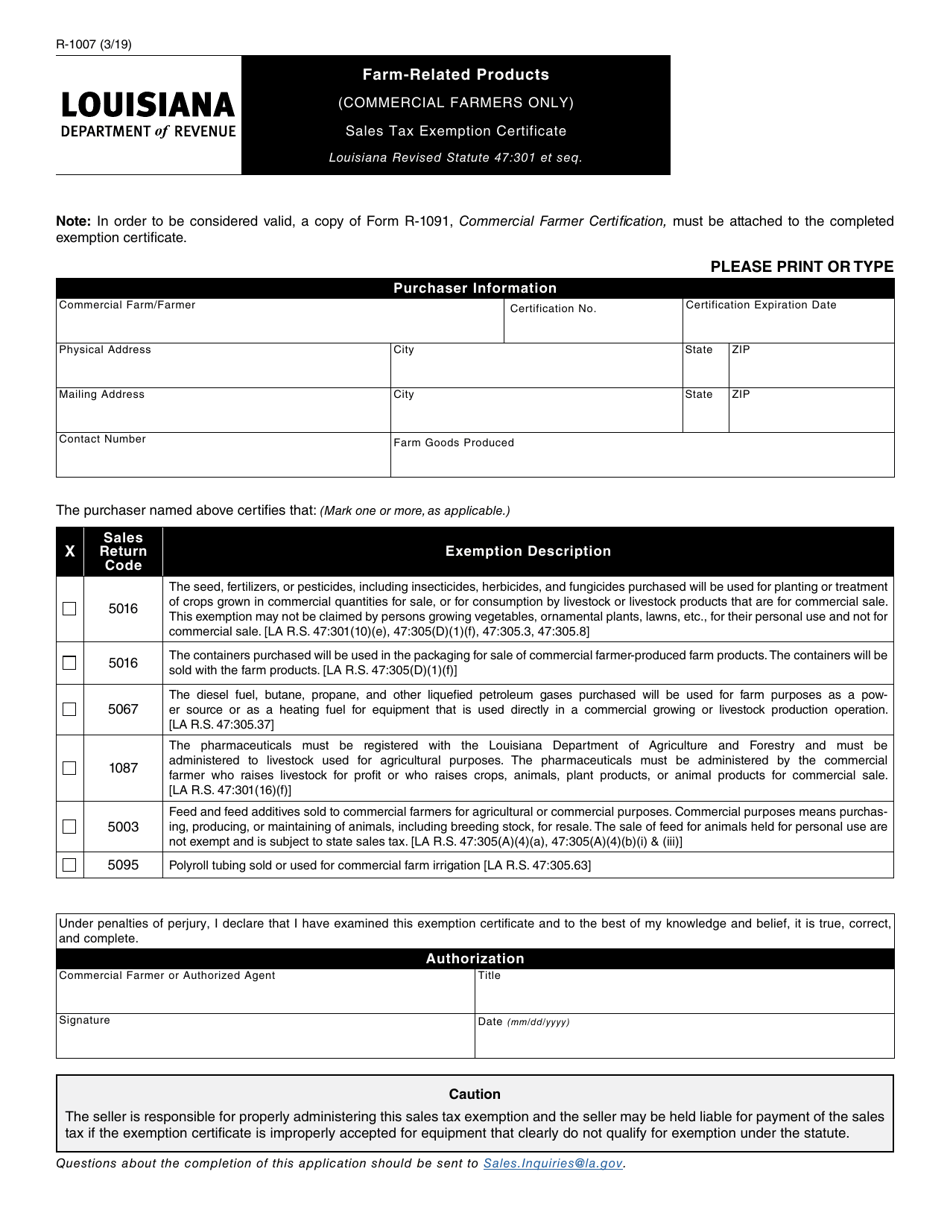

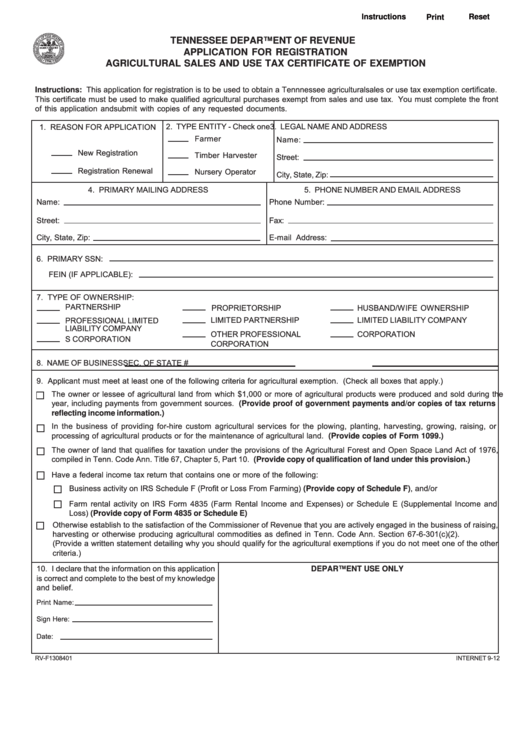

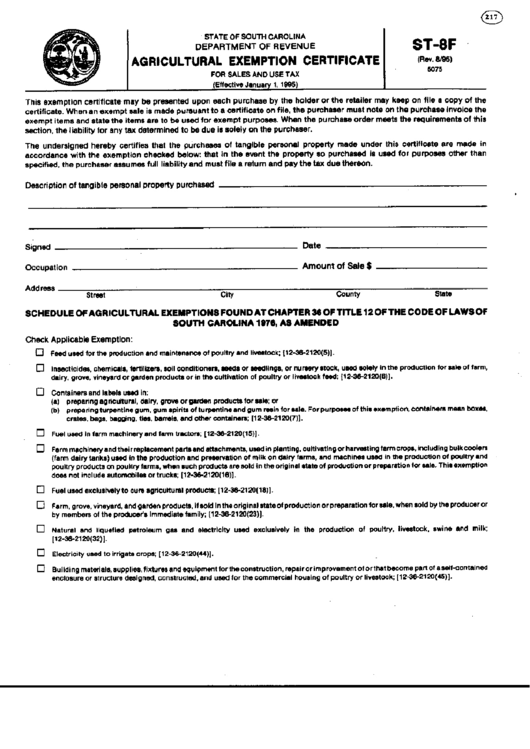

Farm Sales Tax Exemption Form - This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. (to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming,. Certificates are valid for up to three years. I certify that the purchase(s) is (are) exempt from payment of sales and use taxes on the property or service(s) indicated below. A qualified farmer, timber harvester, or nursery operator must apply for and receive an agricultural sales and use tax certificate of exemption.

This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. I certify that the purchase(s) is (are) exempt from payment of sales and use taxes on the property or service(s) indicated below. A qualified farmer, timber harvester, or nursery operator must apply for and receive an agricultural sales and use tax certificate of exemption. Certificates are valid for up to three years. (to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming,.

I certify that the purchase(s) is (are) exempt from payment of sales and use taxes on the property or service(s) indicated below. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. A qualified farmer, timber harvester, or nursery operator must apply for and receive an agricultural sales and use tax certificate of exemption. Certificates are valid for up to three years. (to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming,.

Virginia Sales Tax Exemption Form St 11 Fill Out And Sign Printable

A qualified farmer, timber harvester, or nursery operator must apply for and receive an agricultural sales and use tax certificate of exemption. (to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming,. Certificates are valid for up to three years. This document is to be completed by a purchaser.

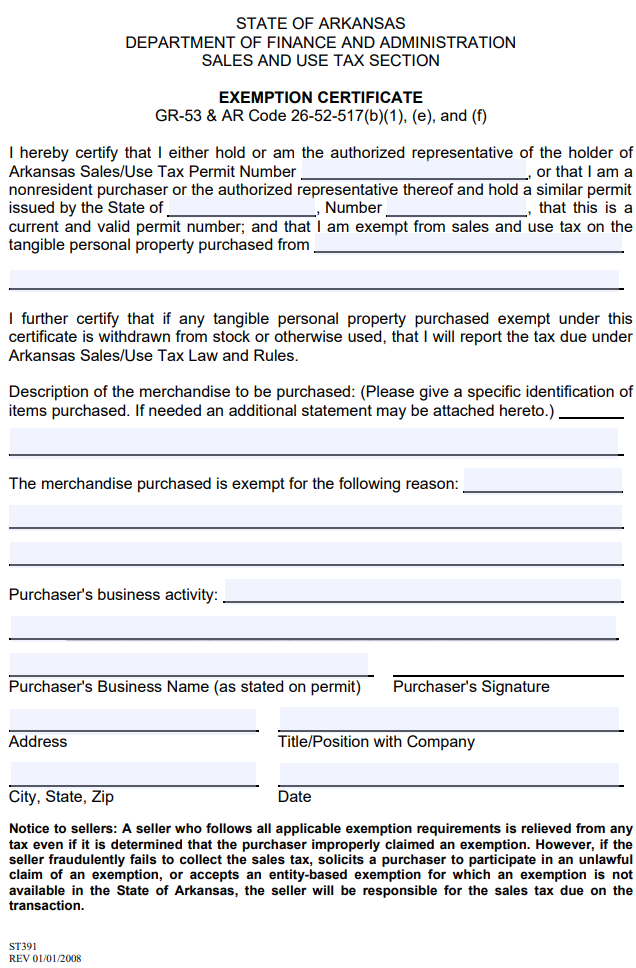

Arkansas Sales And Use Tax Exemption

A qualified farmer, timber harvester, or nursery operator must apply for and receive an agricultural sales and use tax certificate of exemption. Certificates are valid for up to three years. (to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming,. This document is to be completed by a purchaser.

Fillable Form Farm Tax Exempt Printable Forms Free Online

Certificates are valid for up to three years. I certify that the purchase(s) is (are) exempt from payment of sales and use taxes on the property or service(s) indicated below. (to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming,. This document is to be completed by a purchaser.

Kentucky Sales Tax Farm Exemption Form Fill Online, Printable

(to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming,. Certificates are valid for up to three years. A qualified farmer, timber harvester, or nursery operator must apply for and receive an agricultural sales and use tax certificate of exemption. This document is to be completed by a purchaser.

Arkansas Farm Use Sales Tax Exemption

(to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming,. I certify that the purchase(s) is (are) exempt from payment of sales and use taxes on the property or service(s) indicated below. Certificates are valid for up to three years. This document is to be completed by a purchaser.

Sales Tax Exemptions Arkansas Public Schools

A qualified farmer, timber harvester, or nursery operator must apply for and receive an agricultural sales and use tax certificate of exemption. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. I certify that the purchase(s) is (are) exempt from payment of sales and use taxes on the property or service(s) indicated below. Certificates.

Tax Exempt Form Fill Online, Printable, Fillable, Blank pdfFiller

I certify that the purchase(s) is (are) exempt from payment of sales and use taxes on the property or service(s) indicated below. (to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming,. A qualified farmer, timber harvester, or nursery operator must apply for and receive an agricultural sales and.

Arkansas Agriculture Tax Exemption

I certify that the purchase(s) is (are) exempt from payment of sales and use taxes on the property or service(s) indicated below. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. Certificates are valid for up to three years. A qualified farmer, timber harvester, or nursery operator must apply for and receive an agricultural.

Farm Tax Exemption Form Oklahoma

This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. Certificates are valid for up to three years. (to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming,. A qualified farmer, timber harvester, or nursery operator must apply for and receive an agricultural sales.

Arkansas Sales Tax Exemption Form Farm

A qualified farmer, timber harvester, or nursery operator must apply for and receive an agricultural sales and use tax certificate of exemption. (to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming,. Certificates are valid for up to three years. This document is to be completed by a purchaser.

(To Qualify For This Exemption, The Purchaser Must Use Item(S) Exclusively And Directly In The Business Of Farming, Including Dairy Farming,.

This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. Certificates are valid for up to three years. I certify that the purchase(s) is (are) exempt from payment of sales and use taxes on the property or service(s) indicated below. A qualified farmer, timber harvester, or nursery operator must apply for and receive an agricultural sales and use tax certificate of exemption.