Depreciation Expense Income Statement Or Balance Sheet - Depreciation on the income statement is an expense, while it is a contra account on the balance sheet. The nature of depreciation is a 'contra account' on the balance sheet, while it is an expense on the income statement. This means that it is a deduction.

This means that it is a deduction. Depreciation on the income statement is an expense, while it is a contra account on the balance sheet. The nature of depreciation is a 'contra account' on the balance sheet, while it is an expense on the income statement.

This means that it is a deduction. Depreciation on the income statement is an expense, while it is a contra account on the balance sheet. The nature of depreciation is a 'contra account' on the balance sheet, while it is an expense on the income statement.

Why does accumulated depreciation have a credit balance on the balance

This means that it is a deduction. Depreciation on the income statement is an expense, while it is a contra account on the balance sheet. The nature of depreciation is a 'contra account' on the balance sheet, while it is an expense on the income statement.

Amortization vs. Depreciation What's the Difference? (2024)

This means that it is a deduction. The nature of depreciation is a 'contra account' on the balance sheet, while it is an expense on the income statement. Depreciation on the income statement is an expense, while it is a contra account on the balance sheet.

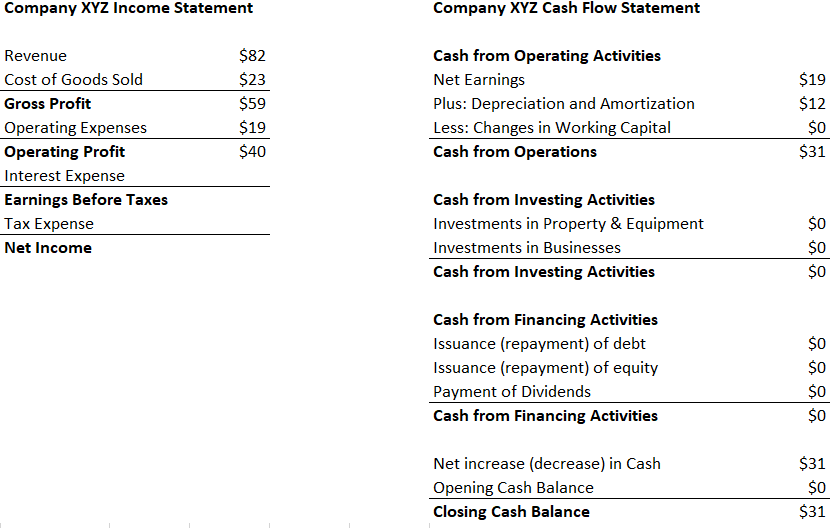

Cash Flow Statement Depreciation Expense AccountingCoach

Depreciation on the income statement is an expense, while it is a contra account on the balance sheet. This means that it is a deduction. The nature of depreciation is a 'contra account' on the balance sheet, while it is an expense on the income statement.

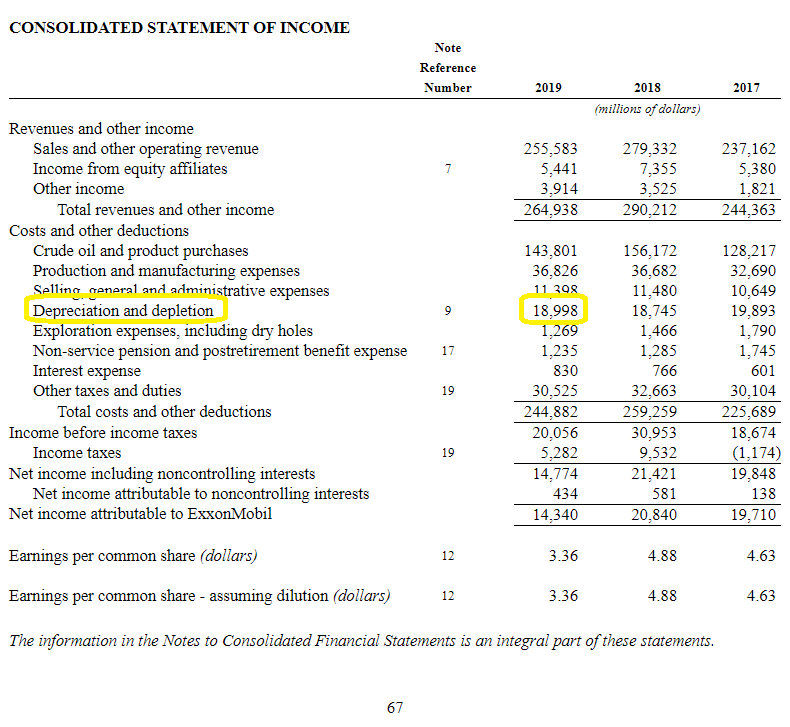

Is Depreciation an Expense? Is EBITDA Deceitful? Well, it Depends

Depreciation on the income statement is an expense, while it is a contra account on the balance sheet. This means that it is a deduction. The nature of depreciation is a 'contra account' on the balance sheet, while it is an expense on the income statement.

Ace Treatment Of Depreciation In Cash Flow Statement Trial Balance

The nature of depreciation is a 'contra account' on the balance sheet, while it is an expense on the income statement. Depreciation on the income statement is an expense, while it is a contra account on the balance sheet. This means that it is a deduction.

Solved STATEMENT Sales Cost of goods sold

This means that it is a deduction. The nature of depreciation is a 'contra account' on the balance sheet, while it is an expense on the income statement. Depreciation on the income statement is an expense, while it is a contra account on the balance sheet.

Profit Loss Statements A Guide for Managers Yeow's Website

This means that it is a deduction. Depreciation on the income statement is an expense, while it is a contra account on the balance sheet. The nature of depreciation is a 'contra account' on the balance sheet, while it is an expense on the income statement.

Statement Example Depreciation

Depreciation on the income statement is an expense, while it is a contra account on the balance sheet. This means that it is a deduction. The nature of depreciation is a 'contra account' on the balance sheet, while it is an expense on the income statement.

Are depreciation and amortization included in gross profit?

The nature of depreciation is a 'contra account' on the balance sheet, while it is an expense on the income statement. This means that it is a deduction. Depreciation on the income statement is an expense, while it is a contra account on the balance sheet.

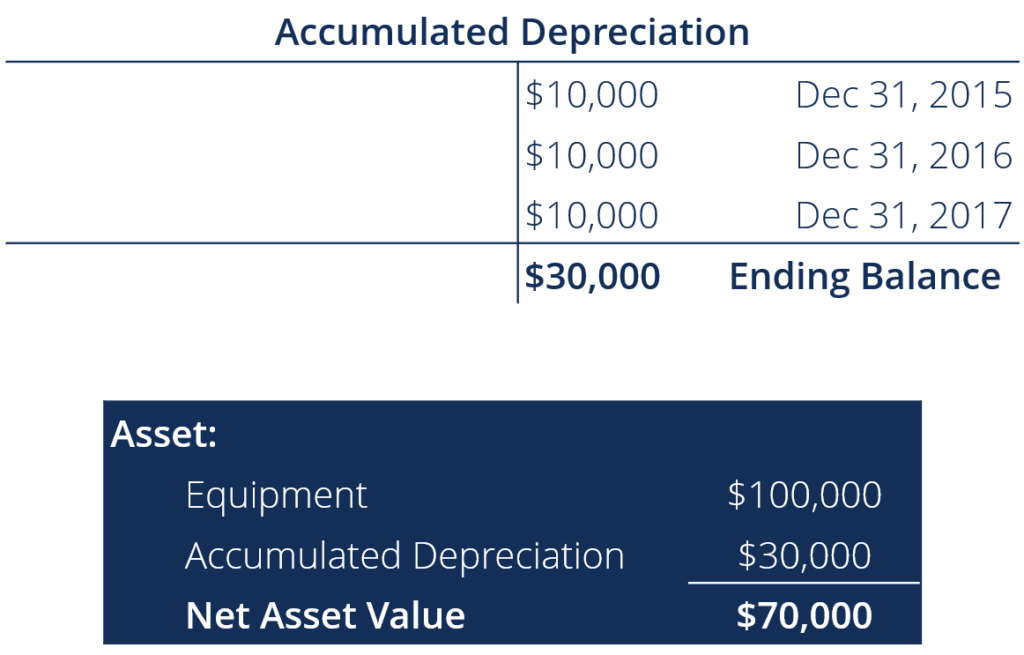

Accumulated Depreciation Definition, Example, Sample

The nature of depreciation is a 'contra account' on the balance sheet, while it is an expense on the income statement. Depreciation on the income statement is an expense, while it is a contra account on the balance sheet. This means that it is a deduction.

This Means That It Is A Deduction.

Depreciation on the income statement is an expense, while it is a contra account on the balance sheet. The nature of depreciation is a 'contra account' on the balance sheet, while it is an expense on the income statement.

:max_bytes(150000):strip_icc()/Amazon1-44e7bd8e358a4b8688093664825b23cd.JPG)

:max_bytes(150000):strip_icc()/Walmart202010KIncomestatement-365d4a49671b4579a2e102762ada8029.jpg)

:max_bytes(150000):strip_icc()/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)