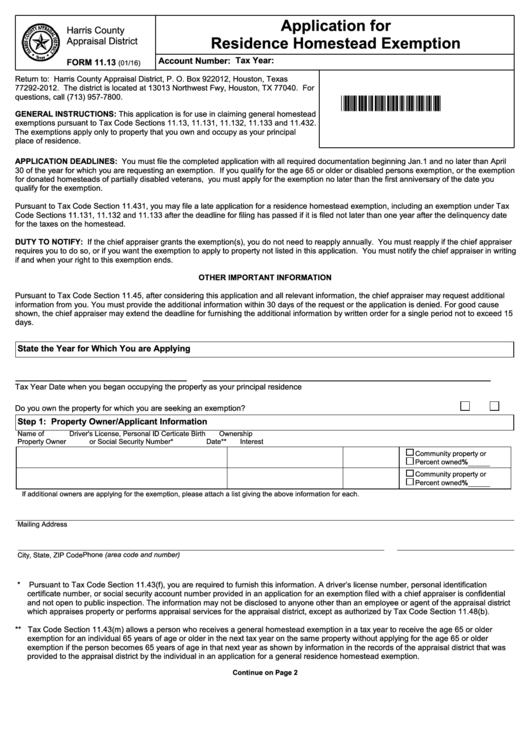

Dallas Appraisal District Homestead Exemption Form - A homeowner may receive the over 65 exemption immediately upon qualification of the exemption by filing an application with the county. To qualify, you must own and reside in your home on january 1 of the year application is made and cannot claim a. This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131, and §11.432. What if my exemptions are wrong? File this form and all supporting documentation with the appraisal district office in each county in which the property is located generally between. To file a homestead exemption, the residence homestead exemption application form is available from the details page of your account. How can i find out what my listed exemptions are? Contact your local appraisal district. A qualified texas homeowner can file for the homestead exemption by filing the form that can be downloaded below.

How can i find out what my listed exemptions are? This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131, and §11.432. What if my exemptions are wrong? Contact your local appraisal district. To file a homestead exemption, the residence homestead exemption application form is available from the details page of your account. To qualify, you must own and reside in your home on january 1 of the year application is made and cannot claim a. A qualified texas homeowner can file for the homestead exemption by filing the form that can be downloaded below. A homeowner may receive the over 65 exemption immediately upon qualification of the exemption by filing an application with the county. File this form and all supporting documentation with the appraisal district office in each county in which the property is located generally between.

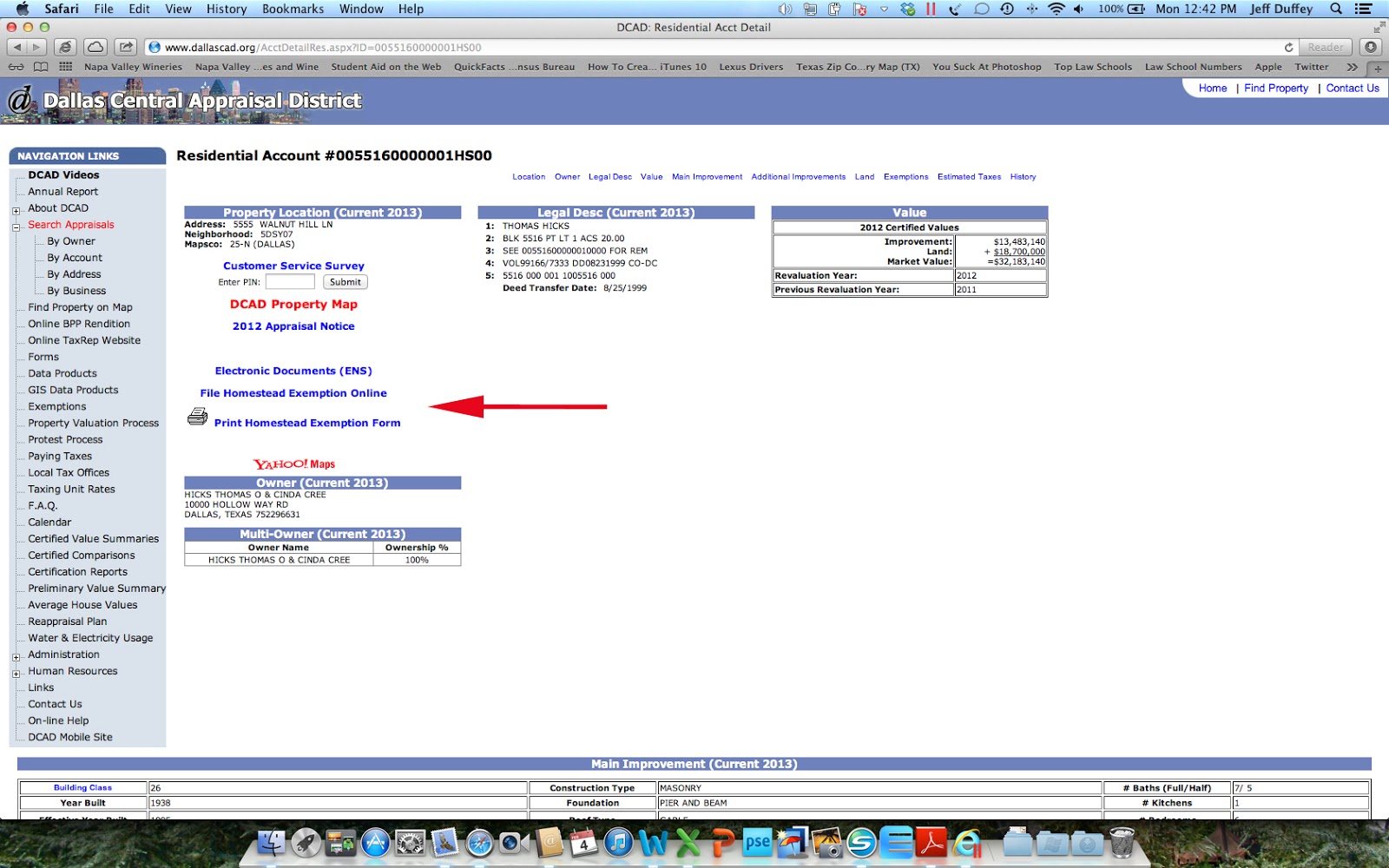

To file a homestead exemption, the residence homestead exemption application form is available from the details page of your account. Contact your local appraisal district. To qualify, you must own and reside in your home on january 1 of the year application is made and cannot claim a. A homeowner may receive the over 65 exemption immediately upon qualification of the exemption by filing an application with the county. What if my exemptions are wrong? How can i find out what my listed exemptions are? A qualified texas homeowner can file for the homestead exemption by filing the form that can be downloaded below. File this form and all supporting documentation with the appraisal district office in each county in which the property is located generally between. This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131, and §11.432.

Fillable Online Dallas central appraisal district homestead exemption

Contact your local appraisal district. A homeowner may receive the over 65 exemption immediately upon qualification of the exemption by filing an application with the county. File this form and all supporting documentation with the appraisal district office in each county in which the property is located generally between. How can i find out what my listed exemptions are? To.

Dallas County Homestead Exemption Form 2023 Printable Forms Free Online

File this form and all supporting documentation with the appraisal district office in each county in which the property is located generally between. A qualified texas homeowner can file for the homestead exemption by filing the form that can be downloaded below. How can i find out what my listed exemptions are? To qualify, you must own and reside in.

HECHO! How to Fill out Texas Homestead Exemption 2022 YouTube

To qualify, you must own and reside in your home on january 1 of the year application is made and cannot claim a. This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131, and §11.432. How can i find out what my listed exemptions are? A qualified texas homeowner can file for the.

Texas Homestead Exemption Changes 2012

A qualified texas homeowner can file for the homestead exemption by filing the form that can be downloaded below. To qualify, you must own and reside in your home on january 1 of the year application is made and cannot claim a. Contact your local appraisal district. This application is for use in claiming general homestead exemptions pursuant to tax.

How To File Homestead Exemption 🏠 Dallas County YouTube

What if my exemptions are wrong? File this form and all supporting documentation with the appraisal district office in each county in which the property is located generally between. How can i find out what my listed exemptions are? Contact your local appraisal district. A qualified texas homeowner can file for the homestead exemption by filing the form that can.

Dallas Homestead Exemption Explained FAQs + How to File

What if my exemptions are wrong? File this form and all supporting documentation with the appraisal district office in each county in which the property is located generally between. A homeowner may receive the over 65 exemption immediately upon qualification of the exemption by filing an application with the county. To qualify, you must own and reside in your home.

Dallas Real Estate Blog How To File Your Homestead Exemption

What if my exemptions are wrong? A homeowner may receive the over 65 exemption immediately upon qualification of the exemption by filing an application with the county. To file a homestead exemption, the residence homestead exemption application form is available from the details page of your account. File this form and all supporting documentation with the appraisal district office in.

Dallas Homestead Exemption Explained FAQs + How to File

How can i find out what my listed exemptions are? Contact your local appraisal district. What if my exemptions are wrong? File this form and all supporting documentation with the appraisal district office in each county in which the property is located generally between. A qualified texas homeowner can file for the homestead exemption by filing the form that can.

Fillable Homestead Exemption Harris County Appraisal District

A qualified texas homeowner can file for the homestead exemption by filing the form that can be downloaded below. Contact your local appraisal district. This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131, and §11.432. To qualify, you must own and reside in your home on january 1 of the year application.

Fillable Online Dallas county appraisal district homestead exemption

Contact your local appraisal district. To file a homestead exemption, the residence homestead exemption application form is available from the details page of your account. A homeowner may receive the over 65 exemption immediately upon qualification of the exemption by filing an application with the county. To qualify, you must own and reside in your home on january 1 of.

To File A Homestead Exemption, The Residence Homestead Exemption Application Form Is Available From The Details Page Of Your Account.

To qualify, you must own and reside in your home on january 1 of the year application is made and cannot claim a. File this form and all supporting documentation with the appraisal district office in each county in which the property is located generally between. What if my exemptions are wrong? This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131, and §11.432.

Contact Your Local Appraisal District.

A homeowner may receive the over 65 exemption immediately upon qualification of the exemption by filing an application with the county. How can i find out what my listed exemptions are? A qualified texas homeowner can file for the homestead exemption by filing the form that can be downloaded below.