Commercial Letters Of Credit - It represents a promise to pay the holder if he fulfills his obligation. Here’s how letters of credit work. A commercial letter of credit, also known as a documentary credit, is an aspect of business banking. What is a letter of credit? It’s a document issued by a bank to guarantee payment for goods or services for a. A letter of credit (lc) can be thought of as a guarantee that is backstopped by the financial institution that issues it. Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit. Other types of letters of credit are irrevocable. One party is required to guarantee something to another party;. A commercial letter of credit is a legal document from a bank or a financial institution.

It represents a promise to pay the holder if he fulfills his obligation. What is a letter of credit? A commercial letter of credit is a legal document from a bank or a financial institution. Other types of letters of credit are irrevocable. A letter of credit is a letter from a bank guaranteeing that a buyer’s payment will be received on time and for the correct amount. A commercial letter of credit, also known as a documentary credit, is an aspect of business banking. Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit. One party is required to guarantee something to another party;. Here’s how letters of credit work. It’s a document issued by a bank to guarantee payment for goods or services for a.

A letter of credit is a letter from a bank guaranteeing that a buyer’s payment will be received on time and for the correct amount. Other types of letters of credit are irrevocable. What is a letter of credit? A commercial letter of credit is a legal document from a bank or a financial institution. A commercial letter of credit, also known as a documentary credit, is an aspect of business banking. It’s a document issued by a bank to guarantee payment for goods or services for a. Here’s how letters of credit work. One party is required to guarantee something to another party;. It represents a promise to pay the holder if he fulfills his obligation. A letter of credit (lc) can be thought of as a guarantee that is backstopped by the financial institution that issues it.

Presentation Types of Letters of Credit LC L/C

A commercial letter of credit is a legal document from a bank or a financial institution. It represents a promise to pay the holder if he fulfills his obligation. Other types of letters of credit are irrevocable. A letter of credit is a letter from a bank guaranteeing that a buyer’s payment will be received on time and for the.

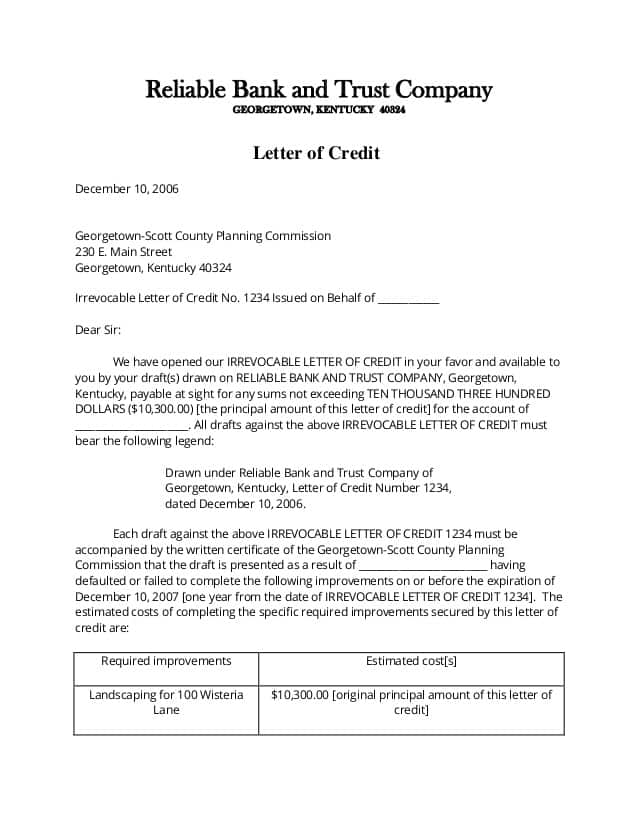

10+ Sample Letter Of Credit Writing Letters Formats & Examples

Other types of letters of credit are irrevocable. Here’s how letters of credit work. A letter of credit is a letter from a bank guaranteeing that a buyer’s payment will be received on time and for the correct amount. A commercial letter of credit, also known as a documentary credit, is an aspect of business banking. One party is required.

Understanding Letters of Credit A Commercial Leasing Guide Occupier

A letter of credit (lc) can be thought of as a guarantee that is backstopped by the financial institution that issues it. A commercial letter of credit is a legal document from a bank or a financial institution. Other types of letters of credit are irrevocable. It’s a document issued by a bank to guarantee payment for goods or services.

Commercial Letters of Credit SouthState Commercial Lending

It represents a promise to pay the holder if he fulfills his obligation. Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit. One party is required to guarantee something to another party;. Here’s how letters of credit work. A commercial letter of credit, also known as a documentary credit, is.

commercial credit application Doc Template pdfFiller

It’s a document issued by a bank to guarantee payment for goods or services for a. A commercial letter of credit, also known as a documentary credit, is an aspect of business banking. A letter of credit is a letter from a bank guaranteeing that a buyer’s payment will be received on time and for the correct amount. It represents.

What is Letter of Credit? Explained

A commercial letter of credit, also known as a documentary credit, is an aspect of business banking. It represents a promise to pay the holder if he fulfills his obligation. Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit. Other types of letters of credit are irrevocable. One party is.

Letter of Credit Basics L/C Transaction Export

Here’s how letters of credit work. A commercial letter of credit, also known as a documentary credit, is an aspect of business banking. Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit. It’s a document issued by a bank to guarantee payment for goods or services for a. It represents.

What Is Commercial Credit? And How it Can Work for You

What is a letter of credit? It represents a promise to pay the holder if he fulfills his obligation. Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit. It’s a document issued by a bank to guarantee payment for goods or services for a. Other types of letters of credit.

123. Commercial Letters Of Credit

Here’s how letters of credit work. A commercial letter of credit is a legal document from a bank or a financial institution. One party is required to guarantee something to another party;. It represents a promise to pay the holder if he fulfills his obligation. Types of letters of credit include commercial letters of credit, standby letters of credit, and.

Letter of Credit Basics Definition and Types

It’s a document issued by a bank to guarantee payment for goods or services for a. A commercial letter of credit, also known as a documentary credit, is an aspect of business banking. What is a letter of credit? Other types of letters of credit are irrevocable. Here’s how letters of credit work.

Types Of Letters Of Credit Include Commercial Letters Of Credit, Standby Letters Of Credit, And Revocable Letters Of Credit.

One party is required to guarantee something to another party;. What is a letter of credit? Other types of letters of credit are irrevocable. It’s a document issued by a bank to guarantee payment for goods or services for a.

Here’s How Letters Of Credit Work.

A letter of credit is a letter from a bank guaranteeing that a buyer’s payment will be received on time and for the correct amount. A commercial letter of credit is a legal document from a bank or a financial institution. A letter of credit (lc) can be thought of as a guarantee that is backstopped by the financial institution that issues it. A commercial letter of credit, also known as a documentary credit, is an aspect of business banking.