Calls And Puts - The major difference between call and put options is that the former allows holders to call or purchase the underlying asset, while the latter lets the holder put or sell that asset. A call option is the right to buy a stock at a specific price by an expiration date, and a put option is the right to sell a stock at a specific price by an expiration date. Learn the differences between a put vs. Here’s what you need to know about the difference between puts and calls. Call options give the holder of the contract the right to purchase the underlying security, while put options give the holder the right to sell shares of the underlying security.

The major difference between call and put options is that the former allows holders to call or purchase the underlying asset, while the latter lets the holder put or sell that asset. A call option is the right to buy a stock at a specific price by an expiration date, and a put option is the right to sell a stock at a specific price by an expiration date. Call options give the holder of the contract the right to purchase the underlying security, while put options give the holder the right to sell shares of the underlying security. Learn the differences between a put vs. Here’s what you need to know about the difference between puts and calls.

A call option is the right to buy a stock at a specific price by an expiration date, and a put option is the right to sell a stock at a specific price by an expiration date. Learn the differences between a put vs. Call options give the holder of the contract the right to purchase the underlying security, while put options give the holder the right to sell shares of the underlying security. The major difference between call and put options is that the former allows holders to call or purchase the underlying asset, while the latter lets the holder put or sell that asset. Here’s what you need to know about the difference between puts and calls.

What’s the Difference Between Calls and Puts? Navigation Trading

The major difference between call and put options is that the former allows holders to call or purchase the underlying asset, while the latter lets the holder put or sell that asset. Here’s what you need to know about the difference between puts and calls. A call option is the right to buy a stock at a specific price by.

Option Basics Explained Calls And Puts Stock trading learning

The major difference between call and put options is that the former allows holders to call or purchase the underlying asset, while the latter lets the holder put or sell that asset. A call option is the right to buy a stock at a specific price by an expiration date, and a put option is the right to sell a.

Calls & Puts in Options Trading Explained

A call option is the right to buy a stock at a specific price by an expiration date, and a put option is the right to sell a stock at a specific price by an expiration date. Call options give the holder of the contract the right to purchase the underlying security, while put options give the holder the right.

Options Trading An Introductory Guide for Traders

The major difference between call and put options is that the former allows holders to call or purchase the underlying asset, while the latter lets the holder put or sell that asset. Here’s what you need to know about the difference between puts and calls. Learn the differences between a put vs. A call option is the right to buy.

Calls Options vs Puts Options 6 MAJOR Differences projectfinance

Here’s what you need to know about the difference between puts and calls. Learn the differences between a put vs. A call option is the right to buy a stock at a specific price by an expiration date, and a put option is the right to sell a stock at a specific price by an expiration date. Call options give.

Stock Calls and Puts Explained

Learn the differences between a put vs. Here’s what you need to know about the difference between puts and calls. The major difference between call and put options is that the former allows holders to call or purchase the underlying asset, while the latter lets the holder put or sell that asset. A call option is the right to buy.

Understanding Calls and Puts YouTube

The major difference between call and put options is that the former allows holders to call or purchase the underlying asset, while the latter lets the holder put or sell that asset. Call options give the holder of the contract the right to purchase the underlying security, while put options give the holder the right to sell shares of the.

Puts and Calls Are Two Types of This Investment

Learn the differences between a put vs. The major difference between call and put options is that the former allows holders to call or purchase the underlying asset, while the latter lets the holder put or sell that asset. Call options give the holder of the contract the right to purchase the underlying security, while put options give the holder.

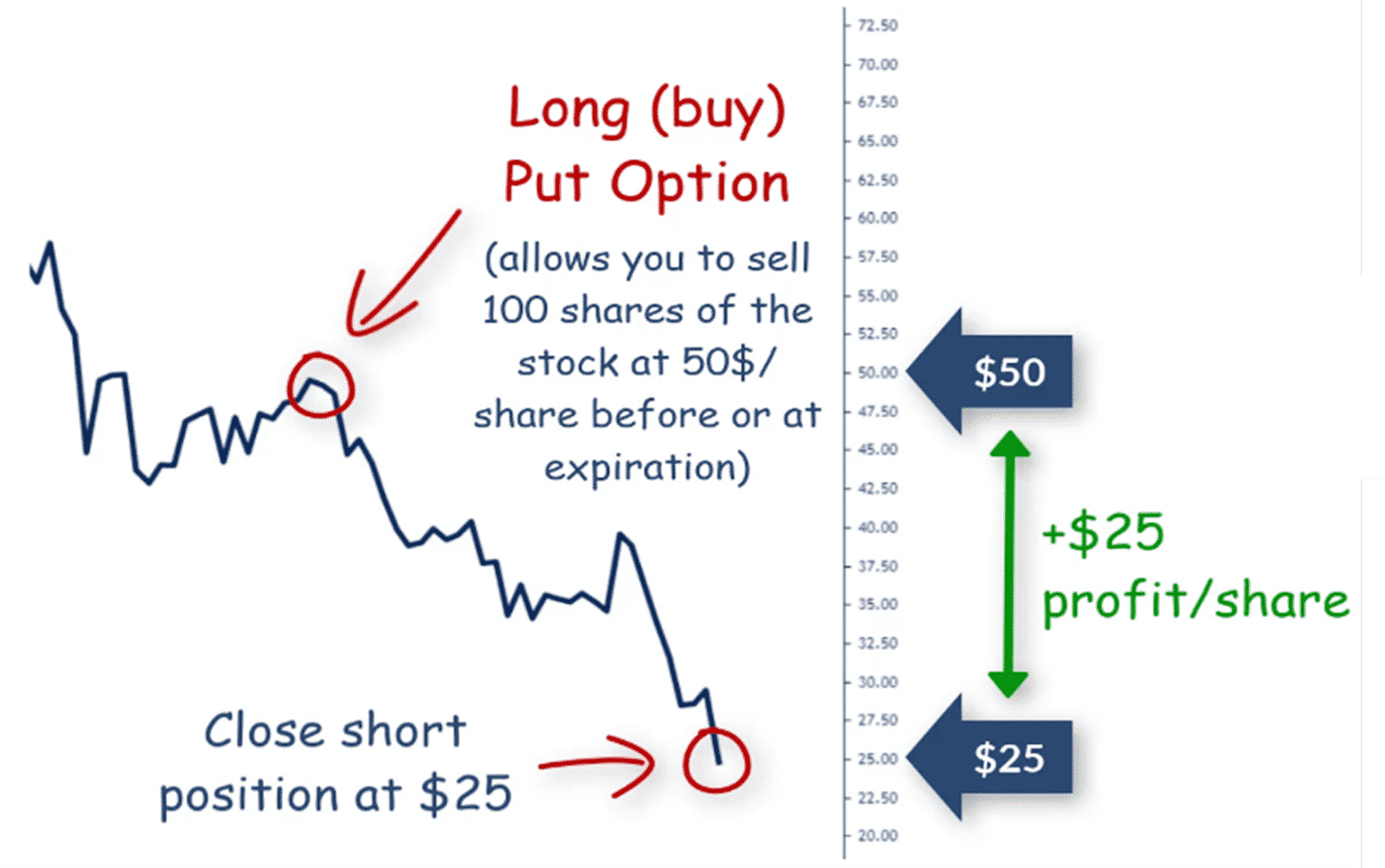

How To Buy Put Options Phaseisland17

Here’s what you need to know about the difference between puts and calls. Learn the differences between a put vs. Call options give the holder of the contract the right to purchase the underlying security, while put options give the holder the right to sell shares of the underlying security. The major difference between call and put options is that.

Opciones desmitificadoras una guía completa para comprender cómo

A call option is the right to buy a stock at a specific price by an expiration date, and a put option is the right to sell a stock at a specific price by an expiration date. The major difference between call and put options is that the former allows holders to call or purchase the underlying asset, while the.

Here’s What You Need To Know About The Difference Between Puts And Calls.

Learn the differences between a put vs. Call options give the holder of the contract the right to purchase the underlying security, while put options give the holder the right to sell shares of the underlying security. The major difference between call and put options is that the former allows holders to call or purchase the underlying asset, while the latter lets the holder put or sell that asset. A call option is the right to buy a stock at a specific price by an expiration date, and a put option is the right to sell a stock at a specific price by an expiration date.