California Llc Extension Form - Information regarding our address and business hours can be found on. This form is for llcs that cannot file their tax return by the original due date and owe ncnr tax for 2022. It explains how to pay the tax, when. You must submit a request for extension no later than one month after the due date of your return or prepayment form and payment. An extension to file your tax return is not an extension to pay. Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability. Locate the form that you would like to submit and follow the instructions. Use an automatic extension form to make a payment if both of.

It explains how to pay the tax, when. Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability. An extension to file your tax return is not an extension to pay. Locate the form that you would like to submit and follow the instructions. Use an automatic extension form to make a payment if both of. This form is for llcs that cannot file their tax return by the original due date and owe ncnr tax for 2022. You must submit a request for extension no later than one month after the due date of your return or prepayment form and payment. Information regarding our address and business hours can be found on.

An extension to file your tax return is not an extension to pay. Locate the form that you would like to submit and follow the instructions. It explains how to pay the tax, when. You must submit a request for extension no later than one month after the due date of your return or prepayment form and payment. Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability. Information regarding our address and business hours can be found on. This form is for llcs that cannot file their tax return by the original due date and owe ncnr tax for 2022. Use an automatic extension form to make a payment if both of.

California Extension Court Form Fill Online, Printable, Fillable

An extension to file your tax return is not an extension to pay. You must submit a request for extension no later than one month after the due date of your return or prepayment form and payment. Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability. Information regarding our address.

Demystifying DAO LLC A New Frontier in Business Organization — Tresp

You must submit a request for extension no later than one month after the due date of your return or prepayment form and payment. It explains how to pay the tax, when. Locate the form that you would like to submit and follow the instructions. This form is for llcs that cannot file their tax return by the original due.

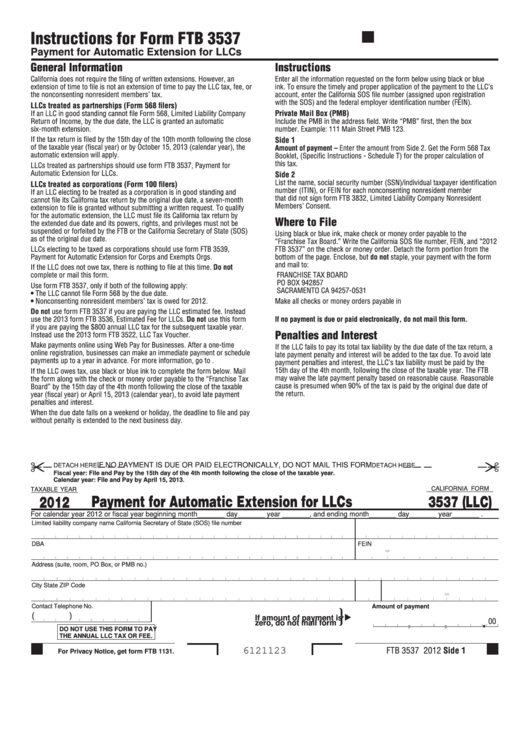

Fillable California Form 3537 (Llc) Payment For Automatic Extension

This form is for llcs that cannot file their tax return by the original due date and owe ncnr tax for 2022. Use an automatic extension form to make a payment if both of. Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability. You must submit a request for extension.

How to file tax extension KimmiKjeilan

You must submit a request for extension no later than one month after the due date of your return or prepayment form and payment. Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability. Use an automatic extension form to make a payment if both of. An extension to file your.

2010 Form CA LLC5 Fill Online, Printable, Fillable, Blank pdfFiller

Locate the form that you would like to submit and follow the instructions. This form is for llcs that cannot file their tax return by the original due date and owe ncnr tax for 2022. Information regarding our address and business hours can be found on. You must submit a request for extension no later than one month after the.

How to file tax extension KimmiKjeilan

An extension to file your tax return is not an extension to pay. Locate the form that you would like to submit and follow the instructions. This form is for llcs that cannot file their tax return by the original due date and owe ncnr tax for 2022. It explains how to pay the tax, when. You must submit a.

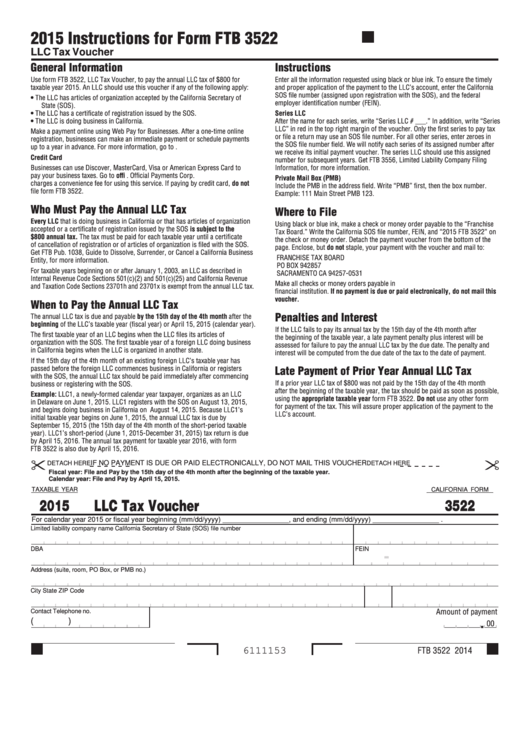

California Form 3522 Llc Tax Voucher 2015 printable pdf download

Locate the form that you would like to submit and follow the instructions. An extension to file your tax return is not an extension to pay. This form is for llcs that cannot file their tax return by the original due date and owe ncnr tax for 2022. Use an automatic extension form to make a payment if both of..

How to Form an LLC in California? (8 Steps) Guide for LLC in CA

You must submit a request for extension no later than one month after the due date of your return or prepayment form and payment. This form is for llcs that cannot file their tax return by the original due date and owe ncnr tax for 2022. Over 140 business filings, name reservations, and orders for certificates of status and certified.

How to Form an LLC in California in 6 Steps [Updated for 2023]

This form is for llcs that cannot file their tax return by the original due date and owe ncnr tax for 2022. Information regarding our address and business hours can be found on. Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability. Use an automatic extension form to make a.

Forming an LLC in California A StepbyStep Guide NerdWallet

Locate the form that you would like to submit and follow the instructions. This form is for llcs that cannot file their tax return by the original due date and owe ncnr tax for 2022. It explains how to pay the tax, when. You must submit a request for extension no later than one month after the due date of.

This Form Is For Llcs That Cannot File Their Tax Return By The Original Due Date And Owe Ncnr Tax For 2022.

Locate the form that you would like to submit and follow the instructions. You must submit a request for extension no later than one month after the due date of your return or prepayment form and payment. An extension to file your tax return is not an extension to pay. Use an automatic extension form to make a payment if both of.

It Explains How To Pay The Tax, When.

Information regarding our address and business hours can be found on. Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability.

![How to Form an LLC in California in 6 Steps [Updated for 2023]](https://assets-global.website-files.com/610922bf9b095f4969ed70fb/63d27183d187392c166adedd_California.png)